IPO - Go Hub Capital Bhd (Part 1)

MQTrader Jesse

Publish date: Tue, 18 Jun 2024, 09:41 AM

Company Background

The Company was incorporated in Malaysia on 3 June 2022 under the Act as a private limited company under the name of Go Hub Capital Sdn Bhd. On 15 September 2023, the Company was converted into a public limited company and assumed its present name.

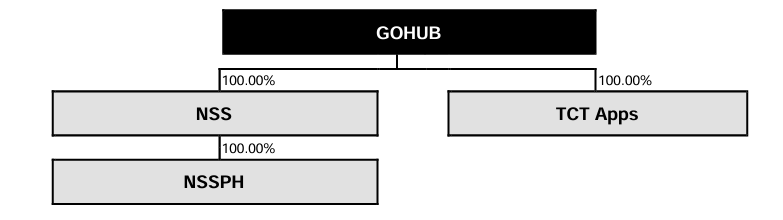

The Group structure as at the LPD is set out below:

The principal activity is an investment holding while its subsidiaries are principally involved in the provision of enterprise IT services, focusing on providing transportation IT solutions (including customised software development systems and integration of hardware and software systems) in the bus and rail segments. The offerings also extend to include maintenance and support services as well as terminal management services for the IT solutions delivered.

Use of proceeds

- Business expansion - 65.88% (Within 6 months to 36 months)

- Expansion of the workforce - 26.92% (Within 24 months)

- Capital expenditure on equipment and tools - 17.33% (Within 36 months)

- Acquisition of Star Central Office Tower - 9.9% (Within 6 months)

- D&D - 5.06% (Within 36 months)

- Set-up of new integrated centre - 4.00% (Within 36 months)

- Business development and marketing - 2.67% (Within 24 months)

- Repayment of bank borrowings - 10.66% (within 6 months)

- Working capital - 12.80% (within 12 months)

- Estimated listing expenses - 10.66% (within 1 month)

Business expansion - 65.88% (Within 6 months to 36 months)

The company intends to scale up its operations to support its business expansion plans in the next 3 years, which include the following:

- leveraging on the market presence and established track record to expand the Group’s footprint in the bus and rail segments to locations where the company currently does not have any presence in;

- widening the Group’s transportation IT solutions to include the ferry segment; and

- strengthening the operational capabilities, which includes expansion of the workforce, the Acquisition of Star Central Office Tower, setting up a D&D department and enhancing the customer support and maintenance services,

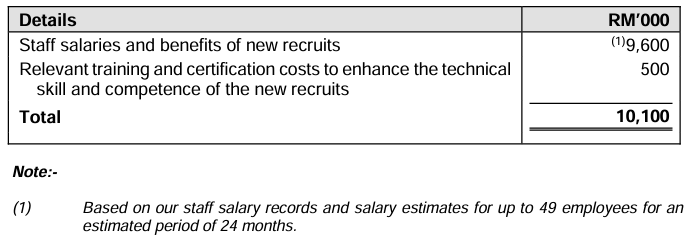

(i) Expansion of the workforce

The company intends to strengthen its human resources capabilities through the recruitment of the right professionals with the relevant technical skill set and/or know-how in the next 2 years.

The company has therefore earmarked RM10.10 million or 26.92% of the total Public Issue proceeds towards the expansion of its workforce, which stood at 18 employees as at the LPD. The company believes that the new recruits will enhance its capacity to service the growing number of new contracts.

The breakdown of utilisation is envisaged as follows: -

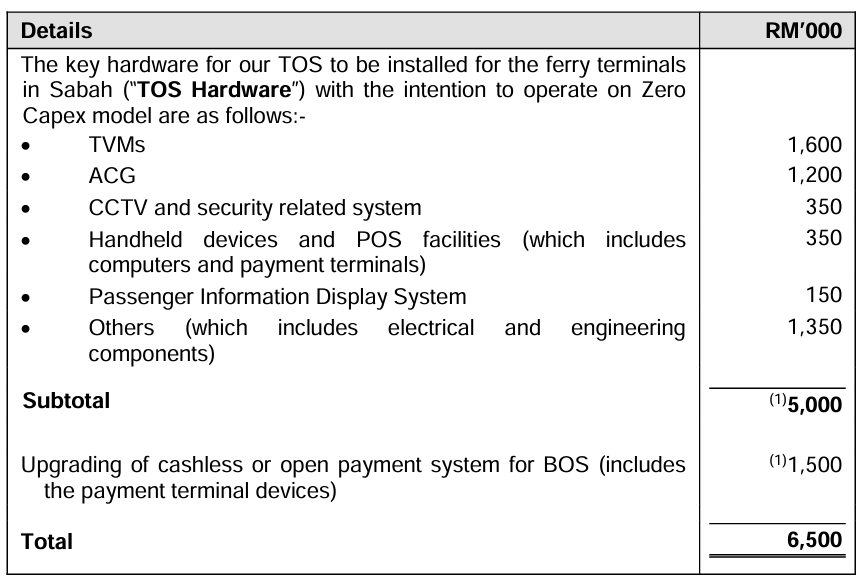

(ii) Capital expenditure on equipment and tools

The company intends to utilise RM6.50 million or 17.33% of the total Public Issue proceeds to purchase new IT equipment, tools and software tools for the following ventures with the aim to expand its presence within the transportation IT solutions provider sector.

The details of the new IT equipment, tools and software tools for the venture into the ferry segment and the upgrading of its current BOS are set out below:

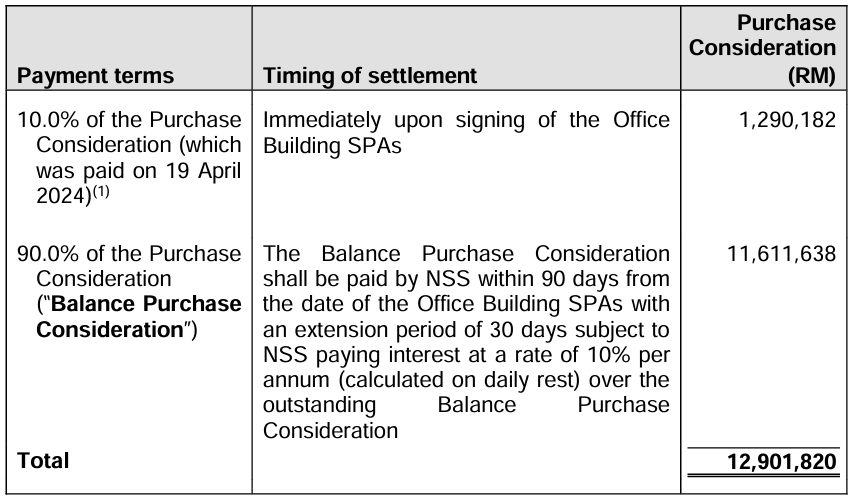

(iii) Acquisition of Star Central Office Tower

The company intends to utilise RM3.72 million or 9.90% of the total Public Issue proceeds to part fund the Acquisition of Star Central Office Tower.

The terms on the payment of the Purchase Consideration are summarised as follows:-

The New Office building will serve as its new headquarters as the company intends to relocate its operations.

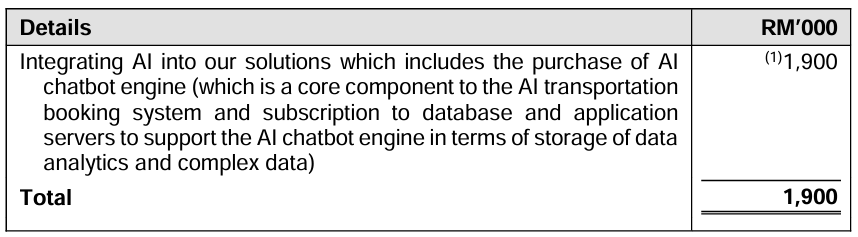

(iv) D&D

The company recognizes the increasing demand for technology application and infrastructure solutions, and the importance of D&D activities in the bid to remain competitive, and provide customers with technological applications and solutions that optimise and streamline operations process flows efficiently.

The company believes that an effective D&D shapes the features and functionality of the solutions. The company has therefore earmarked RM1.90 million or 5.06% of its total Public Issue proceeds to undertake the following D&D activities to maintain its competitiveness and market presence:

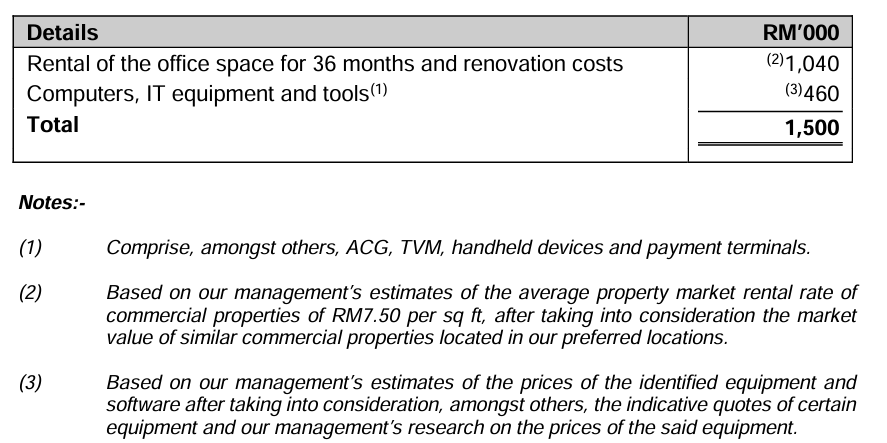

(v) Set-up of new integrated centre

The company intends to set-up a new integrated centre, which enables the Group to undertake the following:

- a sizable test laboratory and demonstration area (“Test Lab”) measuring approximately 2,000 sq ft to enable the company to enhance its testing capacity (where the Group conducts testing on the solutions or products from its suppliers) and showcase the solutions to its customers. The company currently leases an office in Kuala Lumpur with a floor space of approximately 421 sq feet and the size of the floor space has limited the ability to conduct extensive testing activities (which requires a larger floor space); and

- a training area to cater to the training requirements and needs as the centre will be equipped with a sizeable Test Lab (with a selection of the solutions for the training instructors to incorporate in the training sessions). The training area will be designed to accommodate a smaller group compared to the training area at the New Office Building, with a capacity envisioned to cater to up to 100 individuals. The company currently conducts the training at its customers’ offices or hotels function rooms.

To facilitate this strategic initiative, the company has earmarked RM1.50 million or 4.00% of the total Public issue proceeds towards the setting up of the new integrated facility centre. The company intends to lease an office area of approximately 2,000 sq ft located in the Klang Valley (envisaged to accommodate up to 35 individuals) to cater to the integrated centre requirements. The earmarked proceeds from the Public Issue will be utilised in the following manner:

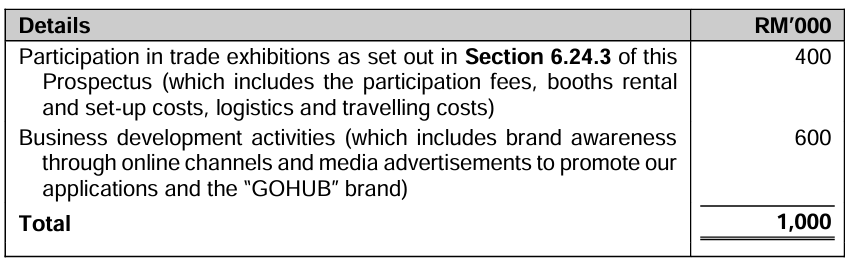

(vi) Business development and marketing

The company intends to allocate RM1.00 million or 2.67% of the total Public Issue proceeds for business development and participation in exhibitions, details of the breakdown are set out below:

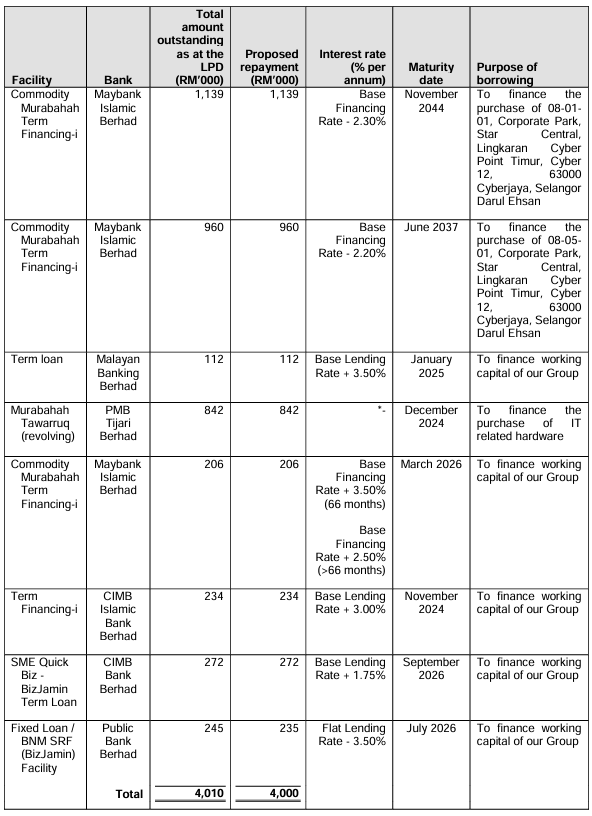

Repayment of bank borrowings - 10.66% (within 6 months)

The bank borrowings stood at approximately RM6.73 million as at the LPD, of which RM2.02 million are long term borrowings and RM4.71 million are short term borrowings. The borrowings comprise of term loans, lease liabilities under hire purchase agreement and revolving credit facilities.

The Group has earmarked approximately RM4.00 million or 10.66% of its total Public Issue proceeds for the full and/or partial repayment of our existing facilities in the manner set out below:

Working capital - 12.80% (within 12 months)

The company also expects its working capital requirements to increase in tandem with the expected growth in scale of operations.

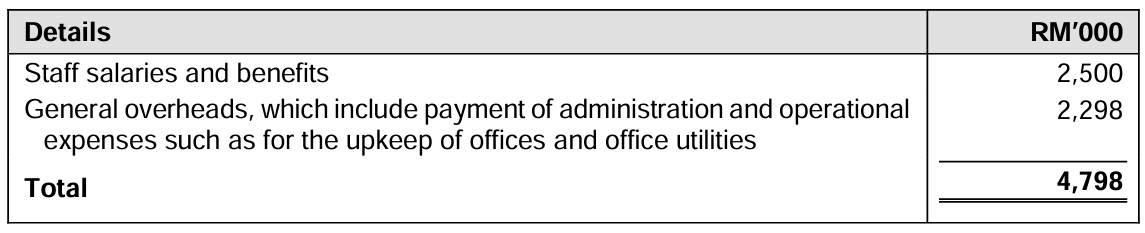

Hence, the company intends to utilise approximately RM4.80 million or 12.80% of the total Public Issue proceeds towards working capital requirements, which include the following:

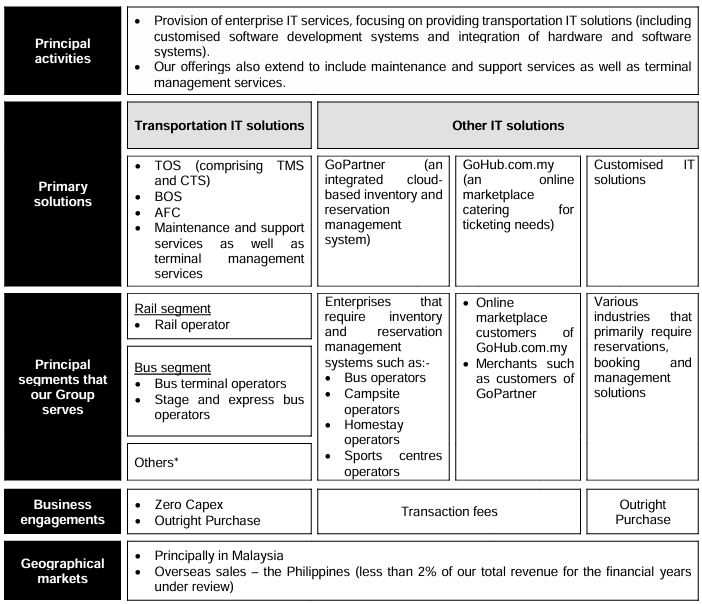

Business model

The company is principally involved in providing enterprise IT services, focusing on providing transportation IT solutions (including customised software development systems and integration of hardware and software systems) with an established track record in the bus and rail segments. The company offerings also extend to include maintenance and support services as well as terminal management services for the IT solutions that the company delivers to its customers.

The Group’s principal activities and business model are summarised in the diagram below:

The company prides itself as a key transportation IT solutions provider in Malaysia with an established track record in the bus and rail segments. The company provides customised solutions to the customers, which are catered primarily towards the optimisation and efficient management of operational process flows that are critical to the operations and requires real time monitoring, resource allocation and utilisation, automated scheduling and data analytics reporting.

The advancement of technologies and the necessity for transportation service providers and operators to adopt enterprise IT services to automate and streamline their operational process flow (resource allocation and utilisation as well as ticketing and traffic management) and elevating customer traveling experiences have led to an increase in the need and demand for the solutions. Although the solutions predominantly cater to the bus and rail segments, the solutions are adaptable and can be applied to other segments within the transportation sector (which includes sea and air transportation segments) and non-transportation sectors which require optimisation of critical process flow management functions such as warehousing and distribution centres, manufacturing facilities and healthcare.

Click here to continue the IPO - Go Hub Capital Bhd (Part 2)

Eager to explore more trading opportunities?Apply margin account now!

Community Feedback

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion into the next release of the system.

We would like to develop this system based on community feedback to cater for community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedback coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties in the Internet. We may or may not hold position in the stock covered, or initiate new position in the stock within the next 7 days.

Join us now!

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators and quantitative data to generate accurate trading signals without the interference of human's emotions and bias against any particular stock. It comprises trading strategies which are very popular among fund managers for analysing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any enquiry:

Facebook: https://www.facebook.com/mqtrader

Instagram:https://www.instagram.com/mqtrader

MQ Chat: https://messenger.i3investor.com/m/chatmq

YouTube: https://www.youtube.com/channel/UCq-26SGjlQTVQfO7DoEihlg

Email: admin@mqtrader.com

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Initial Public Offering (IPO)