(RICHE HO) 利兴工业LIIHEN – 与众不同的家私股?

RicheHo

Publish date: Tue, 19 Jul 2016, 07:01 PM

利兴工业LIIHEN – 与众不同的家私股?

LIIHEN是一家设于柔佛麻坡的一家控股公司,主要业务是家具制造,属于一家综合性木制家具制造商。它在2000年4月上市于大马交易所创业板,之后于2002年8月转至主要板。

翻看近几个季度表现,LIIHEN的营业额自FY14Q2起,已连续提升了11个季度。此外,和FY14相比,它的FY15净利翻了将近100%,进步幅度非常大!当中它FY15业绩还包括了一笔RM4.25m的无形资产减值亏损,要不然LIIHEN的业绩肯定不止这数目。到底什么因素导致LIIHEN成长幅度如此的大?

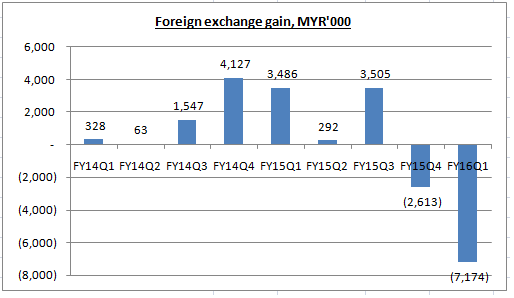

LIIHEN在FY15里有高达92%的销售主要是来自出口,而本地只占了8%。据FY15年报,LIIHEN有92%的销售是以美金交易,意味着全部出口都是运用美金交易。因此,美金的走势对LIIHEN的业绩表现有直接的影响。USD/MYR在FY14的汇率平均在3.50左右,在FY15里最高曾去到4.40左右,目前FY16里则滑落至4.00。理论上,LIIHEN肯定受惠于外汇净利。LIIHEN在近3个季度的外汇表现,如下:

FY15Q3 – RM3.5m 盈利

FY15Q4 – RM2.6m 亏损

FY16Q1 – RM7.2m 亏损

抛开FY15Q3外汇盈利不谈,LIIHEN竟然能在近2个季度累积外汇亏损高达RM9.8m的情况下,业绩表现创下新高!这也意味着外汇盈利对于LIIHEN来说只是个Bonus,生意不断地成长才是重点。它在今年2月新租了一间位于柔佛麻坡的单层厂房,来充当新的仓库。这也证明了LIIHEN的生产产能在增加,旧的仓库已不足够容纳了。

从生意角度来看,LIIHEN的订单持续在增长,而它在FY15每个季度营业额的平均成长率是15%。基于美国占了总营业额的78%,美国的经济和走势将间接影响LIIHEN的生意。美国在4月份和5月份的新屋销售量是58.6万幢和55.1万幢,自2009年9月以来新高。目前,虽说美国经济复苏之路并不平坦,但美国新屋销售的整体趋势是在上涨中。这对LIIHEN来说,是个利好因素。

接下来的几个季度,LIIHEN都会面对不少的挑战。从7月起,最低薪金制从每月RM900提升至RM1000,也间接提升了LIIHEN的生产成本。此外,LIIHEN长期以来都缺乏劳工。为了应对这问题,LIIHEN将一些家私零件生产外包给次级承包商。这的确是个明智之举,为LIIHEN节省了不少劳力和时间。

对于未来展望,LIIHEN的业务确实有能力继续成长,外汇亏损预计会缩小,今年的业绩不出意外应可超越去年的表现。值得一提的是,LIIHEN有一点是和同行的LATITUD、HOMERIZ和POHUAT不一样。非常意外的,它的业务表现竟然不受季节影响。例如每年的1月至3月,家私行业的生产和销售都会比较低,但LIIHEN似乎不受一点影响。到底是怎么一回事,笔者也不清楚。

目前LIIHEN握有RM82m的净现金在手,相等于每股RM0.45现金。只要业绩可以维持,继续派高息肯定不是问题。基于去年10月LIIHEN曾经派红股及股票分拆,股息必须调整而不能作准。因此,笔者以21cent股息和今日闭市价RM3.06股价来计算,股息率也有6.86%。保守估计,假设LIIHEN在 FY16的业绩和FY15的业绩一样,每股净利是37.50cent。以10倍PE来推算,LIIHEN的潜在价值是每股RM3.75,大约还有22%的上涨空间。

从技术走势上,经历了1个月半的小调整后,LIIHEN今天再次放量从支撑点2.85处反弹。或许,LIIHEN即将开启另一波涨潮。

纯属分享!

注:如果你想了解某家公司的企业发展、基本面和未来前景,可以联络笔者

https://www.facebook.com/rhresearch/

richeho_92@hotmail.com

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Road to Success

Created by RicheHo | Mar 18, 2017

Created by RicheHo | Feb 19, 2017

Created by RicheHo | Feb 16, 2017

Created by RicheHo | Jan 08, 2017

Discussions

Hi moneySIFU...you must be somewhere in overseas....on the flight all the time....he he

2016-07-19 23:29

MoneySIFU

No worries after this month new financial year u will be all right

2016-07-19 23:52

To me...the ultimate reason to own this stock is because of the following:

http://www.advisorperspectives.com/dshort/updates/New-Home-Sales

Look carefully on the 'POPULATION adjusted homes sales'.

Nothing can be more obvious than this core driving factor..

we can't have future with nuclear families where 2 families or 5 or 6 people stay in one house..;)

2016-07-20 01:18

probability

Lee Hing industrial LIIHEN – unique furniture unit?

LIIHEN is a company based in Muar Johor, a holding company, its main business is furniture, is an integrated manufacturer of wooden furniture. In April 2000, it listed on the Malaysian Exchange gem, then in August 2002 and transferred to the main Board.

Look back at the past few quarters, LIIHEN turnover from FY14Q2 onwards, up to 11 consecutive quarters. Moreover, over FY14 FY15 net profit nearly doubled to 100%, progress is very large! FY15 results also include a RM4.25m intangible assets impairment losses or LIIHEN performance will surely be more than this amount. What factors cause LIIHEN grow so big?

LIIHEN FY15 has up to 92% of sales comes from exports, while local accounts for only 8%. According to FY15 annual LIIHEN 92% sales are in US dollar transactions, means that all exports be used dollar transactions. Therefore, $ LIIHEN performance has a direct effect on the trend. USD/MYR FY14 exchange rate averaged at around 3.50, FY15 Supreme had go to around 4.40, FY16 fell to 4.00. In theory, LIIHEN certainly benefited from net profit of foreign exchange. LIIHEN almost 3 quarters of foreign exchange, as follows:

FY15Q3 – RM3.5m profit

FY15Q4 – RM2.6m loss

FY16Q1 – RM7.2m loss

FY15Q3 foreign exchange earnings aside aside, LIIHEN cumulative foreign exchange loss was nearly 2 quarter up to RM9.8m of cases, record performance! It also means that foreign exchange earnings is just a Bonus for LIIHEN, business continues to grow is the point. In February this year to rent a property in Muar Johor single storey factory building, to act as the new warehouse. This would also prove LIIHEN production capacity increase, the old warehouse was not large enough.

From a business perspective, LIIHEN orders continued to grow, while its FY15 turnover per quarter average growth rate of 15%. Based on the United States accounted for 78% of the total turnover, United States economy and the movements will be indirectly affected LIIHEN business. United States in April and May new home sales is 586,000 and 551,000, since September 2009. At present, although the United States economy's road to recovery will not be smooth, but United States the overall trend of new-home sales are on the rise. For LIIHEN, this was a positive factor.

Over the next few quarters, LIIHEN will face many challenges. From July, the minimum salary from RM900 per month up to RM1000, also indirectly enhanced the LIIHEN's production costs. In addition, LIIHEN has long been a shortage of labour. In response to this problem, LIIHEN outsourcing some production of furniture parts to sub contractors. This is a smart move, LIIHEN labor and time savings.

Prospects for the future, LIIHEN business does have the capacity to continue to grow, exchange losses are expected to be reduced, this year's performance not surprisingly should surpass last year's performance. It is worth mentioning that, LIIHEN is LATITUD, HOMERIZ and POHUAT are not the same and peers. Very unexpected, its performance is not affected by seasonal effects. For example, from January to March each year, furniture industry production and sales will be lower, but LIIHEN does not seem to be affected. What is going on, I don't know.

LIIHEN currently holds RM82m of net cash in hand, equivalent to RM0.45 per share in cash. As long as performance can be maintained, and continue to be a high rate is not a problem. Last October, LIIHEN sent bonus shares and the stock splits, dividends must be adjusted not authentic. Therefore, the author calculates by the 21cent dividend and Closing Price of the day shares of RM3.06, dividend yield and 6.86%. Conservative estimates assume LIIHEN in FY16 and FY15 performance, net income per share was 37.50cent. Than PE 10 times to extrapolate, LIIHEN potential value was RM3.75 per share, about 22% up space.

From the technology trend, after 1 month and a half of small adjustments, LIIHEN volume rebounded from a support 2.85 again today. Perhaps, LIIHEN soon to open another high tide.

Is share!

Note: If you want to learn about a company's business development, fundamentals and future prospects, you can contact the author

2016-07-19 20:17