What you should know about Annum Berhad’s (KLSE: 5082) financial report

swimwithsharkss

Publish date: Sat, 20 Nov 2021, 01:10 AM

What you should know about Annum Berhad’s (KLSE: 5082) financial report

As we are filtering for deeply undervalued companies, we had stumbled across this gem with ridiculously low valuation of 1.40 times PER. And when we are talking about 1.40 times PER, we are talking about actual core profit and without any one-off profit for the company. And with only RM74 million of value in market capitalization, I can say that you could easily double your money when the market realizes its value.

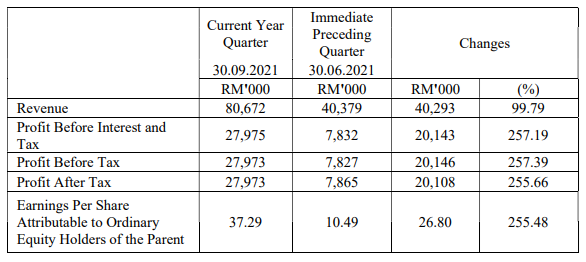

For the current quarter ended 30th September 2021, ANNUM had recorded RM80.67 million in revenue and RM27.97 million in profit after tax, or in other words, an EPS of 37.29 in a single quarter.

We know that while ANNUM is expanding into construction and property development segment, they had also striked an agreement via their indirectly wholly-owned subsidiary Annum Technology Sdn Bhd to acquire the entire equity interest for Annum Softcodes Sdn Bhd.

In short, we shall see a more diversified ANNUM in the near future.

But even without the additional contribution from the construction, property development and technology segment, the company had still achieved historical high results in this quarter. Bear in mind that in financial year 2020, the total profit after tax of the company only amounts to RM3.95 million, and this quarter alone, the company had achieved close to 7 times in terms of earnings.

So what had contributed to the increase in earnings for the company?

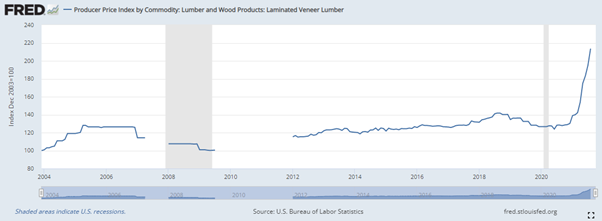

The increase of profit after tax for the company was mainly due to increase in sales for polyester wood in this quarter.

And as you can see from the graph above, veneer lumber prices had been skyrocketing, and this is likely to be the key profit contributor for the company.

As a matter of fact, the share price of ANNUM had not really increase in the recent times. Based on the trading volume of the company, this is likely to be caused by the lack of exposure of this company to the general publics eyeball. And for the readers who actually reads this post, kudos to you and hopefully you could profit from ANNUM too.

Cheers.

More articles on Swim With Sharks

Created by swimwithsharkss | Feb 22, 2022

Created by swimwithsharkss | Jan 23, 2022

Created by swimwithsharkss | Dec 30, 2021

.png)

.png)