Approval Granted For Rights Issue! Onboard for the NEXT ROCKET!

swimwithsharkss

Publish date: Wed, 08 Dec 2021, 04:14 AM

Approval Granted For Rights Issue! Onboard for the NEXT ROCKET!

After my days of observation in the market, people had been doubting the company on the ability to raise fund. And just few days ago - ironically and timely, the company announced that they got the approval from bursa on the fund raising exercise.

As the company current valuation is extremely low and undervalued is an understatement, people are trying to scare away retail investors in order to collect the shares at a lower price. But being a true investor, let me recap on why they are undergoing a fund raising exercise for you to not miss out the company on your watchlist.

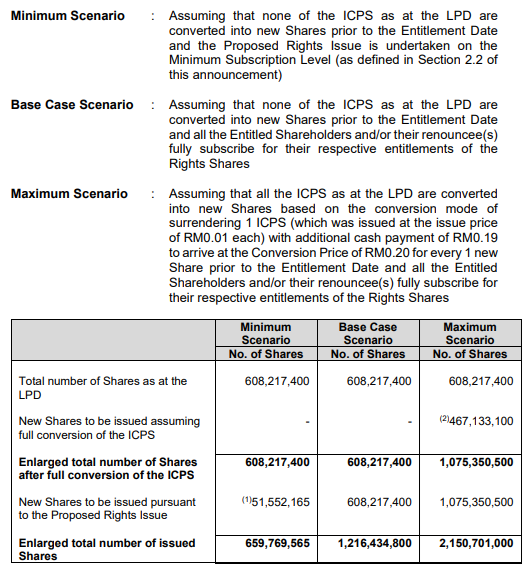

To whom it may concern, I’ve attached the table below on the different scenarios of the rights issue.

And to sweeten the deal itself, the key management and major shareholder of the company, Dato’ Sri Liew Kok Leong will be undertaking 51.55 million shares on the minimum scenario basis. Of course, it is very likely for him to oversubscribe the rights.

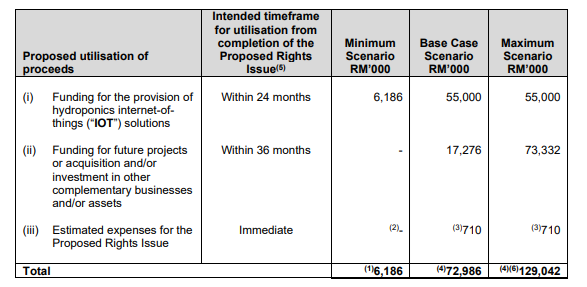

But what, and where are the funds being used?

To add on more details, I would also like to attach an excerpt of the company comment on the hydroponics IOT business:

This provision of Hydroponics IOT Solutions would involve the following:-

(i) design of the layout of the smart hydroponic farm for the application and integration of IOT in hydroponics, which includes the procurement of sensors and surveillance cameras as well as other relevant hardware that are essential in a hydroponics farm e.g. nutrient controllers, seedling tray, water tank and piping system;

(ii) design of software to enable transfer of data from the smart hydroponic farm to a cloud server, which can then be accessed remotely via smart devices;

(iii) installation, testing and commissioning of the hardware and software to ensure that the smart hydroponic farm operates as intended; and

(iv) after-sales services such as data analytics and periodic maintenance services. For the provision of Hydroponics IOT Solutions, the Group will be required to incur upfront cost to purchase the necessary software and hardware to set up the hydroponic systems for the farm operators. Once the smart hydroponic farm is set up and operational, the Group can start receiving recurring payment from the farm operators over a specified tenure.

Given the above, the Group intends to utilise proceeds of up to RM55.00 million from the Proposed Rights Issue to fund the purchasing costs of hardware and software for the provision of Hydroponics IOT Solutions. As at the LPD, the Group is in the midst of finalising an agreement with a farm operatorfor the provision of Hydroponics IOT Solutions on 50 acres of land in Gua Musang, Kelantan. For this project, the Group estimates that it would be able to install up to 4 greenhouses for every acre of land.

For now, they are aiming to install up to 200 greenhouses, and although the management did not mention the potential revenue stream generated from the exercise, we could easily tell that if the execution was successful, it will overpower the impact of dilution from the rights issue.

Will they be successful?

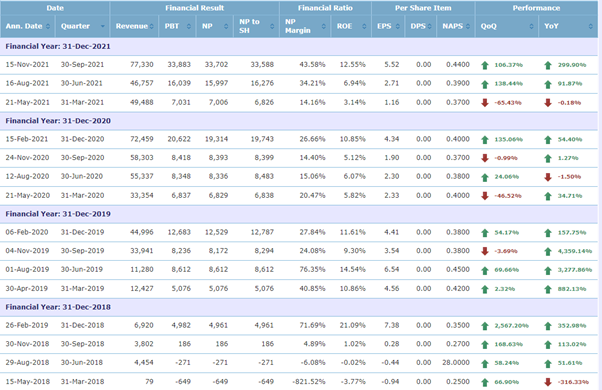

This is the best representation I could show you based on their track record. History does not guarantee future and that’s for sure, but it also gives us some guidance on how well the management had managed the company before.

What say you?

More articles on Swim With Sharks

Created by swimwithsharkss | Feb 22, 2022

Created by swimwithsharkss | Jan 23, 2022

Created by swimwithsharkss | Dec 30, 2021

.png)

.png)