AirAsia Group Bhd: A relook into AirAisa Group from Profitability, Volume Spread Analysis and what’s Insiders Report are telling they are doing Now ?

TradeVSA

Publish date: Sat, 12 Oct 2019, 10:01 AM

Comment what stock you like us to cover below for the next article....

AirAsia Group Bhd (5099.KL) listed in the Bursa Malaysia

Background of AirAsia Group Bhd (5099.KL)

AirAsia Group Bhd (AirAsia), listed on the Main Market of Bursa Malaysia on November 2004, commenced operations in 1996 as a full-service domestic airline with two aircrafts and became Malaysia’s second national carrier then. However, following the acquisition of the Company by Tune Air Sdn Bhd in December 2001, AirAsia was re-launched as a low-cost carrier (LCC) and commenced operations in January 2002.

The Group is principally engaged in the operation of AirAsia, a low-cost airline with major business in Malaysia, Thailand, Indonesia, the Philippines, India and Japan, among others. Currently, AirAsia is the leading LCC in Southeast Asia. The Group focuses on providing high-frequency services on short-haul, point-to-point domestic and international routes on a single-class, no frills and ticketless concept. From an airline with two aircraft flying six routes in Malaysia in January 2002, AirAsia has soared in the last seventeen years to cover over 152 destinations in 22 countries.

AirAsia is one of the largest and most successful LCCs in Southeast Asia, with a fleet of 226 Airbus 320 (A320) aircrafts, which include AirAsia Malaysia, Thai AirAsia, Indonesia AirAsia, AirAsia Philippines, AirAsia India & AirAsia Japan.

For the six months ended 30 June 2019, Airasia Group BHD revenues increased 12% to RM5.81B. Net income decreased 93% to RM111.8M. Revenues reflect Load Factor, Total -% increase of 1% to 86.5%. Net income was offset by Remeasurement gain on former subsidiary decrease from RM534.7M (income) to RM0K, Share of results of associates decrease from RM6M (income) to RM194.1M (expense).

For the six months ended 30 June 2019, AirAsia Group Bhd revenues increased 12% to RM5.81B. The net income of AirAsia decreased by almost 93% to RM111.8M. The increase in revenues mainly attributed by increase in total passengers carried coupled with higher load factor.

A Quick Fundamental View for AirAsia:

- PE = 8.84 **

- ROE = 8.37 %

- DIY = 83.99 % (due to large dividend payout of RM0.90 per share in Aug 2019)

- Mkt Cap: 5,614.5M (RM) in Large Cap, Consumer Products & Services, Main Market.

- Trading at Fair Price (relative).

Recent Insider Report for AirAsia Group Bhd (Bursa Malaysia)

In the Insider Report of AirAsia, we did not see major disposal of shareholder from BlackRock Institutional Trust Company, EPF, Tune Live S.B, Tune Air S.B. These big-time insiders of AirAsia are confident of AirAsia in the overall long term. It is no secret that the public knows the founders of AirAsia Tan Sri Anthony Fernandes and Datuk Kamarudin Meranun are the major shareholders for Tune Live S.B and Tune Air S.B. Within the Insider Report AirAsia, as long as Tan Sri Tony Fernandes and Datuk Kamarudin remained the largest shareholder, the support @ TradeVSA chart of Insider Report AirAsia will remained strong at RM1.75. From the many of the institutional shareholders, they will view AirAsia as a longer term growth share due to the exposure of the its passenger in the new millennials and mixed group of family and retirees.

With Tan Sri Tony Fernandes and Datuk Kamarudin owning both combined 31% of out floating shares, they will have a good command of its share price. The outlook AirAsia may not be as rosy as the fuel prices will edge toward higher figure, ie USD 55-USD60 putting pressure margin to the over profitability. Recent attacks on Saudi oil field and the tit-for-tat conflict between Saudi/US Troop allied vs. Iran will provide support of crude oil prices hovering above USD55.

Known Major Shareholder(s) As at 27th Mar 2019

5.59 % Employees Provident Fund Board (EPF)

15.45 % Tune Air Sdn Bhd +

16.73 % Tune Live Sdn Bhd

+Note: Tan Sri (Dr) Anthony Francis Fernandes is deemed interest in this.

Insider Report AirAsia : Market Cap: 5,713 Million, Number of Shares: 3341 Million, Float: 60.78%.

Profitability Analysis of AirAsia Outlook

The profitability of AirAsia Outlook in Return of Equity (ROE) is somewhat below average of 10-12%. In a layman person, ROE is calculated as (Shareholders’ Earnings / Shareholders’ Equity) x 100% . It is the measure on the return from the shareholder equity. What you paid for, and what you are getting from a earning standpoint. It is also the measure of capital efficiency utilisation eg can AirAsia outlook of its profitability deliver profits to their shareholders ? Do you want more than 6.68% for the latest of AirAsia Outlook Profitability ?

The long term debt to Equity ratio is another concern for AirAsia outlook, it has taken new debts to finance its capital expansion on more planes and more route in Asia. Servicing these long term debts will dampen on the returns on equity. However, this is the acceptable practise in the airline industry with high financial leverage on its capital structure.

AirAsia Group's Outlook (Trading) - Weekly & Daily Chart VSA (Volume Spread Analysis) Review

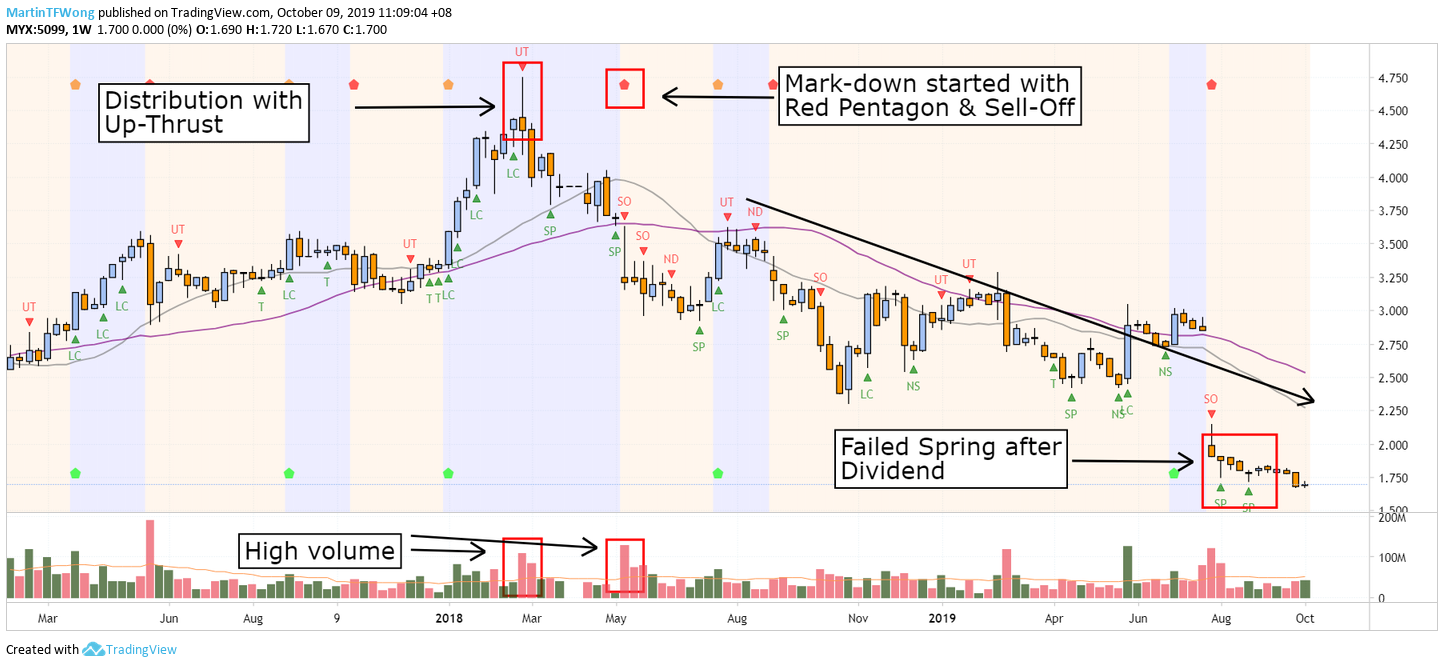

Based on the weekly TradeVSA chart, the distribution on AirAsia Group started since End of February 2018 with a huge Up-Thrust bar. Notice the Up-Thrust bar came with high volume and this is indicating the Hidden Potential Selling” by Smart Money. Price subsequently dropped further in mid of May 2018 with a Sell-Off bar and Red Pentagon signal. Again, we notice the volume increases as Smart Money distribute further.

Do take note in the Insider Report AirAsia, there was a big cash dividend payout of RM0.90 in mid Aug 2019. This explain why there’s a huge price drop in Aug 2019.

AirAsia chart continue to show weakness on recent months with 2 failed Spring bars. Price didn’t support at the Spring bars and continue to mark-down lower. Mark-down stage is likely to continue as no specific strength in the weekly chart that can change the direction of the trend.

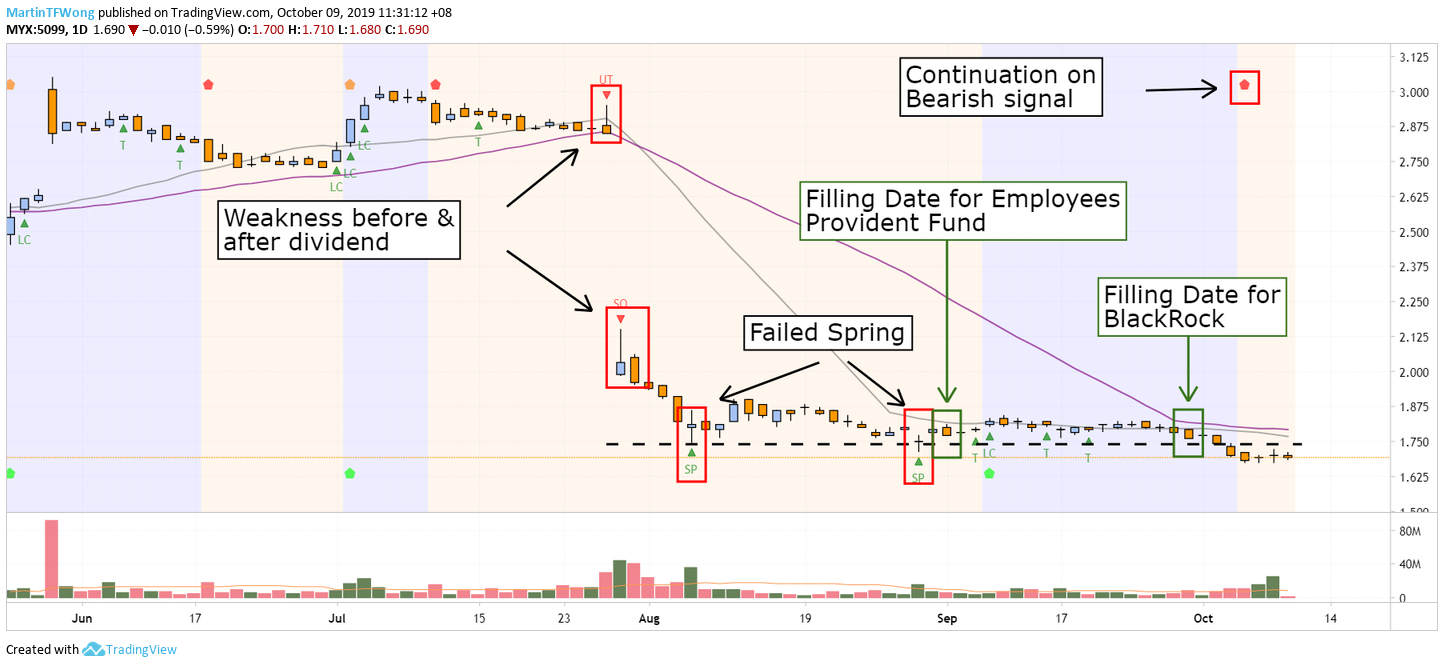

Daily chart shows the similar pattern with 2 failed Spring bars at support. The weakness of the background can be easily spotted with Up-Thrust bars before and after the dividend. Currently price is trading below support with spring, we would like to look for opportunity to trade if the price breaks back to the Spring area with a shakeout pattern.

Daily chart shows the similar pattern with 2 failed Spring bars at support. The weakness of the background can be easily spotted with Up-Thrust bars before and after the dividend. Currently price is trading below support with spring, we would like to look for opportunity to trade if the price breaks back to the Spring area with a shakeout pattern.

The filling date for both Employees Provident Fund & BlackRock appeared at the Spring area and this further show why price need to support at the area to ensure the strength in AirAsia.

*Pentagon Guider System has Buy or Sell Indicator indicated by Green Pentagon Icon and Red Pentagon Guider Icon in the field of Volume Spread Analysis. However, we advised reader that not all pentagons are buy or sell taken literally 100% of the time in Volume Spread Analysis method.

Check out our track record of our stock trade ideas of TradeVSA picked by our short term methods, here : http://bit.ly/2lUfUjY

Contact us via: email at support@tradevsa.com or Call/WhatsApp at +6010 266 9761 if you have any queries about this VS Industry Bhd outlook and its Insider Report VS industry article or opinion to clarify.

Invite all of you to Market Conference 2019, Oct 19 2019 TradeVSA for your next Event !

Improve your Financial Literacy & learn new Research/Insights of Investing and Trading from Insider Report perspective from our panel of speakers Oct 19, 2019 Market Conference 2019, co-partner with Macquarie Malaysia and media partner with TradingView. Early Bird Tickets available to 30 Sep 2019 !

https://www.eventbrite.sg/e/market-conference-2019-tickets-70882582713

Join our FREE Education via Telegram Channel: https://t.me/tradevsatradingideas

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on TradeVSA - Case Study

Created by TradeVSA | Nov 01, 2021

Created by TradeVSA | Oct 15, 2021

Created by TradeVSA | Oct 06, 2021

Discussions

Airasia rebounded on fri. (11/10) to close at 1.71

Do you see the rebound to continue ? if so, what is the resistance level ?

If not, what support level do you see for Airasia ? thank you..

13/10/2019 3:17 PM

2019-10-13 15:17

Koyee

Load of BS

2019-10-12 23:40