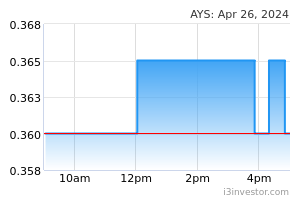

Investors can lose money if they buy shares just based on TA and FA alone and do not consider the kind of business the company is doing. For illustration, I will use AYS which has a good up trending price chart and also a good set of audited accounts.

As I said many a time before, to be successful in share investing, you do not need to be an accountant but you must have some business sense.

If you open your eyes, you can see there is an oversupply of properties in every town and city in Malaysia and currently a large amount of properties remained unsold. This oversupply situation will take a few years to resolve. As a result, the demand for building materials will also definitely slow down.

AYS

If you look at AYS’ website you can see that the company is selling building materials and hardware to property developers and building contractors.

Buying AYS is the same as buying shares of any property development company.

AYS’ Business

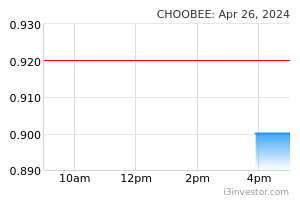

Choo Bee Metal Industries

Choo Bee Metal Industry is manufacturing small diameter water pipes, steel tubes, steel purlins etc for the building construction industry.

Many investors are impressed by its EPS of 10.60 sen for 1st quarter ending 31st March 2017, compared with 2.62 sen for corresponding period last year. Moreover, it is selling about 50% below its NTA per share of Rm 4.25.

Why should the share price shot up like a rocket?

As soon as the company announced its fantastic 1st quarter result, many ignorant investors rushed to buy the share as if there is no tomorrow, causing its price to shoot up like a rocket with exceptionally huge volume which you can see on the chart below.

Why should the share price drop like a bomb?

From Bursa announcement, you can see that the Directors and major shareholders such as Soon Cheng Boon, Yeo Seng Chong, Md Lim Mee Hwa, Lee Seng Tzi and Lambaga Tabung Haji are competing to sell their holdings.

I am obliged to tell you that I do not own AYS or Choo Bee shares. My sole purpose of writing this article is to teach investors not to buy shares based on TA and FA alone. They must look at the company’s business.

Buying AYS or Choo Bee is the same as buying shares of any property development company.

.png)

calvintaneng

Calling Probability!

2017-05-28 22:17