Fundamental Business Factors that would affect profit:

Hengyuan: How to react? (revised)

Hengyuan: How to react?

Koon Yew Yin 8 January 2018 (Revised)

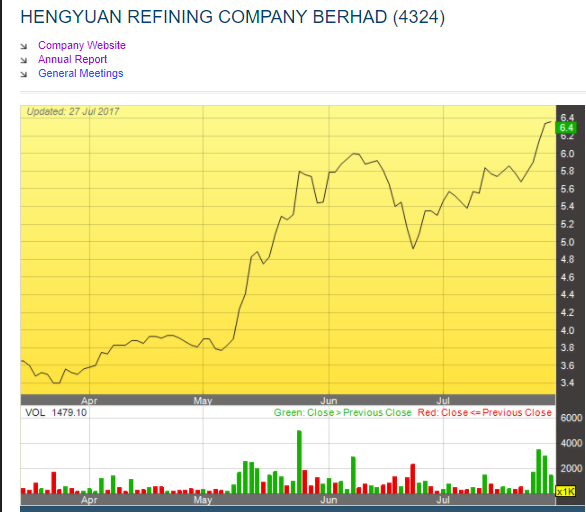

The Hengyuan price chart shows that it had gone up from about Rm 2.50 to close at above Rm 17, a rise of about 700 percent within 12 months. It has created a new record in the Malaysian stock market that no one has seen this new situation before.

How can you react, if you have seen this new situation before?

All the so called expert chartists believe that no share can go up or come down indefinitely for whatever reason. After sometime, the price must correct. As a result, many have reacted so foolishly. They have sold earlier to take profit because they believed profit is not a bad word.

What are they going to do when they see the price continues to shoot like missile?

Many egoistic investors will not eat a humble pie to buy back at a higher price than what they sold.

Only very few humble investors who can control their emotion of fear to think logically, would dare to admit their mistake and buy back at higher prices.

As I said many a time, I am not good in day trading, sell high and buy back at lower prices. To do this style, I have to watch the price movement very closely and decide quickly. Since I am not good in day trading, I have formulated my selling principle. I will only sell when I see the company reports a reduced profit.

In the case of Hengyuan, it has not reported a reduced profit yet and I have not sold any of my holdings.

Value investing:

I have read most of the investment books by famous gurus, namely Benjamin Graham, Warren Buffet, Peter Lynch and others. All of them preached value investing. Yes, if you buy really an undervalued stock, below its net tangible asset (NTA), you will not lose money. But you may have to wait a long time to make money. For example, currently there is an oversupply of properties in every town and city in Malaysia, you can buy many property companies’ shares at prices below their NTA. But you have to wait many years for property prices to rise again.

My share selection golden rule:

If you use my golden rule, you can make money faster.

Among all the selection criteria such as NTA, return of equities, good cash flow, healthy accounts with net cash in fix deposit etc, the most important is profit growth prospect which is the most powerful catalyst to move share price.

I will start to buy when I see the company reports a sudden increased profit in one quarter. I will continue to buy more shares if the company continues to report increasing profit by using margin finance.

In fact, based on the better crack spread in the 4th quarter, Hengyuan will most likely report increased profit. I will continue to buy today even at above Rm 17.00 per share because I believe the price will continue to rise until the 4th quarter result is announced before end of February 2018.

I have used the same method to buy and sell Latitude, VS Industry and Lii Hen, each of them went up a few hundred percent within a couple of years. I am proud to say that I was the 2nd largest shareholder of each of the 3 companies.

I trust this article will help investors improve their technique to make more money.

Hengyuan’s wild price fluctuation & how to react?

As you can see that the share price of Hengyuan fluctuates so wildly and also so widely that I am as puzzled as most investors. Its high and low of a day can be more than one Ringgit.

As I said before the fantastic rise of Hengyuan from about Rm 2.50 to above Rm 19, an increase of about 800% within one year, has created history in our local stock market that no one including I have not seen before.

As a result, many people asked for my advice and I told them that I also do not know how to react because I have not seen such a situation before.

For your information, I have not started selling seriously. My family members and I have a total of more than 20 million shares. Hengyuan is our second largest investment. JAKS is our largest investment.

I consider unfair for the few commentators to say that I have promoted the share by writing so many articles to encourage them to buy and I dumped my holdings.

I am not writing this article to encourage you to buy or sell Hengyuan. But if you do decide to buy or sell, you are doing it at your own risk as I do not have any share of your profit or loss.

You must bear in mind that when I start to sell, I am not obliged to tell you.

Hengyuan: my understanding

On the last trading day of the year, Friday morning the price of Hengyuan shot up to Rm 19.20 from Rm 17.96, the closing price of the day before. Many people believed fund managers would push the price higher for window dressing.

The price has risen from Rm 3.00 to Rm 19.20, an increase of 640% within 12 months. This phenomenal rise has created history in our local stock market.

Let us look at last Friday’s figures:

The closing price of Thursday Rm 17.96

Opening price on Friday Rm 18.42

Day’s high Rm 19.20

Day’s low Rm 15,94’

Closed at Rm 16.30.

Total volume traded 127 million shares.

Estimated value 127 million shares X say Rm17 = Rm 216 million.

Obviously, there were more sellers than buyers on Friday. As a result, the price fell.

As I said many a time, no share can go up or come down continuously for whatever reason. Sooner or later, there will be a price correction. After about 2 hours of trading, the price suddenly dropped more than Rm 3 within 30 minutes.

There are various types of shareholders. Some are day traders who buy and sell frequently. Some are short term investors who will sell when the price achieves its target. Some are serious long-term investors who would buy based on good fundamentals and hold for a long time.

Statistics shows that long term investors make more money than the other types of investors and there are more losers than winners in day trading.

On Friday, obviously there was panic selling. I think even the long term investors were also selling.

Many of my friends who have followed me to buy Hengyuan asked me for my opinion. What should they do?

It is a matter of human psychology. Sellers are fearful that the price will continue to drop and buyers believe the price will soon recover and will continue its climb.

Its fundamentals have not basically changed.

Based on the unusually high volume traded daily, I believe many institutional investors from China are buying aggressively. They are so bullish because they can see that both its revenue and profit are increasing. Its 1st half year EPS was Rm 1.20. Its 3rd quarter EPS was Rm 1.21 and they expect its 4th quarter EPS to be more than its 3rd quarter because its crack spread or profit margin has been better during the 4th quarter as shown in the Crack Spread chart below.

Hengyuan’s profit essentially depends on its margin of profit or crack spread.

Petron Refining in comparison with Hengyuan

Its half year EPS was 73.9 sen. Its 3rd quarter EPS was 39.3 sen. The total EPS for 3 quarters was 113.2 sen.

On Friday it dropped Rm 1.06 to close at Rm 13.54 per share.

Hengyuan is very much cheaper in terms of P/E ratio.

My opinion:

Looking at the huge volume of 127 million shares traded last Friday, I believe there were many institutional investors who have been buying aggressively, took advantage of the cheaper prices to buy more than usual.

I strongly believe its share price will continue to rise especially when its annual result is announced before the end of February 2018.

Hengyuan comparing with Nestle, Dutch Lady, Panasonic Manufacturing and British American Tobacco

All investors in the stock market are in a dilemma, I included, when we watch Hengyuan shooting up like a missile. It has gone up from Rm 3 to close at Rm 16.50 within 12 months, an increase of 550%. Almost all investors have not seen another stock which performs like Hengyuan except perhaps Supermax before.

This situation reminds me of Supermax during the HINI epidemic about 7 years ago.

Now we are confronting a new situation.

For example, its price went up Rm 1.10 with 4.93 million shares traded yesterday. As the daily volume traded is a few million shares, obviously there must be a lot more buyers than sellers for the price to go up almost every day.

Who is right and who is wrong?

It is most likely this article will be the useful to all investors. After reading the comparison of Hengyuan with these few counters, which are selling more than Rm 30 per share, you should know what to do.

Nestle: Its share price closed at Rm 99.9 per share yesterday. Its EPS for 3 quarters ending September 2017 was 218 sen. Assuming its 4th quarter is similar to the average EPS of the last 3 quarters its full year EPS will be Rm 2.91. Its P/E ratio will be 34.

Dutch Lady: Its share price closed at Rm 59.80 per share yesterday. Its EPS for 3 quarters was 151 sen. Assuming its 4th quarter EPS as the same as the average of the last 3 quarters, its full year EPS will be Rm 2.00. It is selling at P/E of 30.

Panasonic: Its share price closed at Rm 39 yesterday. Its first half year EPS was 104 sen. Assuming its 2nd half year is similar as its first half year, its full year EPS will be Rm 2.08. It is selling at 19.

BAT: Its share price closed at Rm 36.30 yesterday. Its 3rd quarter EPS was 144 sen. Assuming its 4th quarter EPS will be the same as its average of the last 3 quarters, its full year EPS will be Rm 2.00. It is selling P/E of 18

Hengyuan: Its price closed at Rm 16.50 yesterday. Its 3rd quarter EPS was 243 sen. Assuming its 4th quarter is the same as its average EPS of the last 3 quarters, its full year EPS will be 324 sen. It is selling at P/E of 5.

You must bear in mind that Hengyuan’s controlling shareholder is a famous China National Petroleum Chemical company called Shandong Hengyuan Petrochemical Company of China.

Can you find another counter with similar quality as Hengyuan which is selling at P/E 5?

In view of the rising prices of crude oil due to demand exceeding supply, Hengyuan should be more profitable in the near future. It should be selling at least at P/E 10. Based on its annual profit of Rm 3.24 it should be selling at Rm 32.40 per share.

Now all readers should know what to do.

|

Author: Koon Yew Yin | Latest post: Wed, 4 Apr 2018, 03:49 PM

An official blog in i3investor to publish sharing by Mr. Koon Yew Yin. |

|

Hengyuan: A Blessing in Disguise - Koon Yew Yin

Author: Koon Yew Yin | Publish date:

I have been financially supporting the opposition political parties to kick out the corrupt BN Government. About 3 months ago, 3 income tax officers came from KL to raid my house in Ipoh and suspended my current account with Maybank. I miss most is my credit card.

In view of the coming general election, the Government must be so desperate that has instructed Maybank to cut down my wife and my margin facilities from Rm 40 million to Rm 10 million.

Ever since I started doing business I always borrow large sum from the banks. I have always been able to make far more money than the interest I need to pay the banks.

For share investment, besides our margin accounts with Maybank, my wife and I have big margin accounts with T A Securities and Hong leong Investment Banks.

I have big margin accounts with Affin, Kenenga, RHB and CIMB. Our total margin finance is more than Rm 200 million. All these huge borrowings sound unbelievable. I have always been able to make far more money than the interest charges. I can easily make more money than the current interest rate of 4.8% pa from the stock market.

Talking about our Maybank margin accounts, to reduce Rm 30 million from each margin account, I have to sell about Rm 60 million worth of shares, totalling Rm120 million. Since the daily volume for Hengyuan is several million shares, I sold all our Hengyuan shares aggressively. I also sold all our Hengyuan shares we have in all the other banks.

At one time my wife and I have a total of 8 million Hengyuan shares. Now we have only a few hundred lots left.

We are now cash rich and looking for some good stocks to buy. Can you readers please recommend some shares with good profit growth?

GOD works in mysterious ways

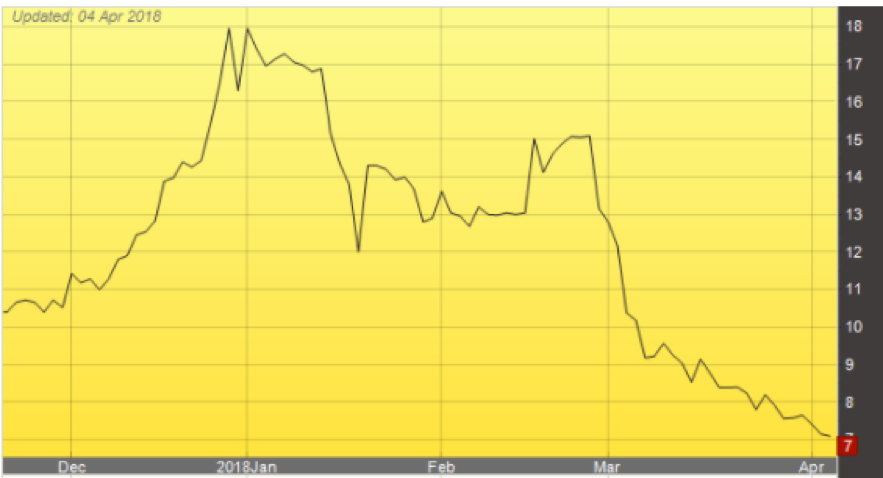

As you can see, the price has been dropping so rapidly. It has dropped Rm 1.80 today.

This let me to believe there is a supper hand helping me. The Christens believes GOD works in mysterious ways to help those kind hearted who needed help.

Why the price is plunging?

According to the company’s last profit announcement, the company will not be able to make more money this year than last year. The company has to shut down the refinery for about 2 months for upgrading. Moreover, crude oil is going up in price. These are the reasons for the price to drop so rapidly. Fortunately, we sold almost all our holdings.

My share selection principle

Among all the criteria for share selection, the most powerful catalyst to move share price is profit growth prospect. Never buy any share which does not have this quality. You must sell as soon as you see that the company cannot make more money in the current year than last year.

Rich value investors like Warren Buffet are looking to buy shares selling below NTA, net tangible asset value. Currently there are many property counters selling below their NTA. Although it is very safe to buy them, but you have to wait many years for the companies to sell all their unsold properties to show increasing profit.

EPF and some insurance companies are look for high dividend yield. All these financial institutions with a lot of cash money are buying high yield stocks to earn more money than putting their money in fix deposit with the banks.

Some investors are looking for stocks with low P/E ratio. Since most share prices often fluctuate, they believe the shares with low P/E will eventually sell at higher P/E. For example, Hengyuan which has reported reduced profit. But basing on its latest earning is still selling at single digit P/E ratio. Low P/E does not mean the price should go higher. Profit growth prospect is still the most important consideration.

Sendai P/E 8 Why Buy and Not Hengyuan P/E 2 - Koon Yew Yin

Author: Koon Yew Yin | Publish date:

I often see more criticisms than praises for my writings on I3investor forum. I also notice that my critics will perpetually find something unpleasant to say. They are egoistic. They think by running me down they want readers to think they are so clever. If they are really so clever they should write a full-length article for people to criticise.

Whenever I write about any counter, my critics would always say that it was time to sell because I wanted people to buy to push up the price for me to sell to make money. Based on what they said they would have sold all their Sendai shares at 70 sen. That is why I do not see so many critics now. They must be bleeding and leaking their wounds.

Fortunately, I often see the few who would faithfully defend me. I am sure they would have made a lot more money by believing me.

Why Should I Care About What People Say?

At one time or another I have been guilty of caring too much of what people might say or think. I hesitate to be more innovative, creative or speak up because no one wants to be told that his idea or plan is wrong.

If I cannot overcome my fear of criticisms, I would not be so successful in whatever I do. I am an entrepreneur and I am willing to accept criticisms and to take calculated risk in doing business or buying and selling shares.

Current Debate is “Why Buy Sendai P/E 8 and not Hengyuan P/E 2”

Now I can see on the i3investor forum that many people are debating on this interesting question.

Why should I bother to share my opinion?

I am willing to offer my opinion because I like to share my knowledge and I am not afraid to see criticisms

Let me tell you what I know about P/E ratio. It is an easy and quick guide for share selection. P/E ratio is largely based on investors’ willingness to take the risk to buy the share. If you buy Sendai at P/E 8, it will take 8 years to get back your money if the company gives out all its earning to shareholders. Currently many rich Funds are buying Sendai because they believe the company can increase its earning as time goes by. If the company can increase its earning, it will naturally take a shorter time to recover their cost.

A good example is Nestles which is always selling at around P/E 40 and if you buy it and assuming the company gives out all its earning, you will recover your cost is 40 years.

Another good example is Public Bank which is always selling at P/E around 18 and if you buy it and assuming the Bank will give out all its earning, you will recover your cost in 18 years.

Small short-term investors will not buy these shares at such high P/E ratio. Only rich Funds, EPF and Insurance companies will buy these safe shares with long proven track record of making increasing profit.

Talking about Sendai, as you can see, the daily traded volume is so massive that no individual including I do not have so much money to buy so many shares traded daily. Rich Funds are buying aggressively because they believe the lift vessel will pass the sea trail and the buyer Tan Sri A K Nathan will be able to secure bank loan to pay the company soon. The price is moving up on auto drive and I hope it will go above the previous peak at Rm 1.40 per share soon.

The Rapid Rise in the Share Price is Proving My Critics Wrong.

If you look at Hengyuan price chart below, you can see that it has been dropping from Rm 18 to close below Rm 8 per share in the last 3 months. The company announced its earnings per share was Rm 5.90 for last year. The current price is Rm 8 which means that it is selling at P/E less than 2. Even at such low price, I will not buy it because the company will definitely make less profit this year than last year. The refinery has to shut down for about 2 months to upgrade its refinery to produce higher grade oil and the company has also to pay tax for the profit it made last year.

As I said many a time, profit growth prospect is the most important catalyst for pushing the share price up. Never buy the share of any company if the company cannot make more profit in the current year than in last year.

Generally, investors are quite smart. They will not buy as they can see that Hengyuan cannot make more profit in this year than in last year. Nevertheless, I know there are still a few stubborn investors who would not admit their mistake and cut loss.

Why Hengyuan is Falling So Rapidly? Koon Yew Yin

Author: Koon Yew Yin | Publish date:

The price chart shows that Hengyuan has been dropping from Rm 18 to around Rm 7.20 per share in the last 3 months. Many people ask me for my opinion. Some wanted to know if they should bottom fish and hope for the down trend reversal to make money. Some said that they wanted to buy because its EPS for last year which was Rm 3.03 per share and it is selling at P/E less than 3 and they could not find any other good respectable company share sell[ng at such ridiculously low P/E.

All I can say is that it does not comply with my share selection golden rule as follow:

The company must have reported increasing profit in the last 2 consecutive quarters and it must have good profit growth prospect which is the most powerful catalyst to push up share price.

Although Hengyuan has reported increasing profit in the last few quarters, it does not have good profit growth prospect. All the smart shareholders know that the company has to stop operation for 2 months to upgrade its refinery and it also has to pay the income tax for the profit it made last year. It has no profit growth prospect for the whole of this current year. That is why they are selling so aggressively. As a result, the price is falling so rapidly

Many experts based on financial report would recommend you to buy because the reported accounts for last year is so beautiful.

Remember accounts is only showing historical facts but it does not tell you anything about the future profit growth prospect of the company. Also, P/E ratio 3 is based on last year’s earnings.

After my publication of this article, I expect many will ask me if they should sell to cut loss and utilise the sale proceeds more effectively to buy stocks with better profit growth prospect.

My answer is that Hengyuan will surely report less profit for this current year and until it can report increased profit the share price will remained depressed.

If you manage to read most of KYY articles on HY you will know facts and figures don't tell a shit. Fact and figures doesn't speak, it has to be presented by the person in the way that align with his own interest.

Half a year ago, when HY was roaring, KYY and many others will present you with positive facts i.e high crack spread, low P/E, high growth, earnings growing, and even comparing it to Nestle to emphasis the case.

Half a year later, with HY in a dramatically 'opposite' situation, KYY present you with the facts that earnings this year will not be as good, no growth prospect, low P/E is the past not future etc. So much for the facts that change in 6 months.

Get this. The facts (objective truth) rarely change in the span of 6 months. It is how the person choose to sing the tune. All of these facts are correct, there is no contradiction, future is inherently uncertain, it is just a matter which facts get presented. What has changed is the subjective confidence, not the objective truth. 6 months ago, everyone is hyped up by the share price, hence rosy stories are the way to justify it (human seek certainty). Today, it's the opposite. People sing different tune base on the movement of the share price. Therefore, breaking the rule: When calculating value to challenge the stock price, beware of using price in the calculation (by Stephen Penman). Share price can be a source of influence or a source of information. It has been a source of influence back then as it is right now.

Has the fundamental changed in 6 months? Perhaps, but I would say barely. But the sentiment certainly does, in 180 degrees. This goes back to something I stress about - you can have the all the facts and figures at the back of your hand, but it won't matter if you can't use what's between your ears. Learn how to think well will help you filter out many useless things and focus on what really matters.

UNCLE KYY IS EXPERT

WHEN HE WANTS HENGYUAN (HANG JOHN LU) UP HE WRITES GOOD STUFF. ALL GREEDY SORCHAI CHASED HIGH HIGH!!

AFTER UP AND MADE A KILLING ON HENGYUAN (John Lu hanged) HE THEN WRITES BAD STUFF. ALL GREEDY SORCHAI TRAPPED!!!

SAME APPLIES TO JAYATIASA. WHEN JTIASA WAS RM2.60 - SING ITS PRAISE

AFTER SELLING TO GREEDY SORCHAI & JTIASA CRASHED 60%? NO MORE PRAISE BUT WRITE BAD STUFF ON JTIASA. ALL DIE IN JTIASA KAW KAW

SO LISTEN! LISTEN! LISTEN!!!

UNCLE KYY COMMANDS FEAR & RESPECT LIKE ROBINHOOD OF OLD WHO ROB THE RICH TO HELP THE POOR!) . HE IS OUR HERO ROBBER KOON (ROB ALL GREEDY SORCHAI IN JAKS & SENDAI & HELP POOR POOR STUDENTS!!!)

WELL DONE UNCLE KYY!!!

LONG LIVE UNCLE KYY

SORCHAI DIE!!!

Based on the unusually high volume traded daily, I believe many institutional investors from China are buying aggressively.

Hengyuan is very much cheaper in terms of P/E ratio.

Can you find another counter with similar quality as Hengyuan which is selling at P/E 5?

Based on its annual profit of Rm 3.24 it should be selling at Rm 32.40 per share.

About 3 months ago, 3 income tax officers came from KL to raid my house in Ipoh and suspended my current account with Maybank. I miss most is my credit card.

I sold all our Hengyuan shares aggressively. I also sold all our Hengyuan shares we have in all the other banks.

Sendai P/E 8 Why Buy and Not Hengyuan P/E 2 - Koon Yew Yin

Why Should I Care About What People Say?

Even at such low price, I will not buy it

All I can say is that it does not comply with my share selection golden rule as follow:

The company must have reported increasing profit in the last 2 consecutive quarters and it must have good profit growth prospect which is the most powerful catalyst to push up share price.

Remember accounts is only showing historical facts but it does not tell you anything about the future profit growth prospect of the company. Also, P/E ratio 3 is based on last year’s earnings.

Calvin comments"

FROM THE ABOVE IS UNCLE KYY A SUPER INVESTOR OR A SUPER SORCHAI CATCHER?

HAVE YOU BEEN THE GREADY SUCKER SORCHAI?

CAUGHT IN JTIASA AT RM2.60?

CAUGHT IN MUDAJAYA AT RM2.70?

CAUGHT IN LATITUDE ABOVE RM7.00

CAUGHT IN FOCUS LUMBER AT RM3.00?

CAUGHT IN XINQUAN ABOVE RM1.00?

CAUGHT IN HENGYUAN ABOVE RM17.00?

SERVE GREEDY SORCHAI RIGHT!!!

LOVE LIVE UNCLE KYY!!! THE SUPER ROBINHOOD OF TODAY.

LONG LIVE GREEDY SORCHAI CATCHER IN KLSE CASINO!!!