|

| |

Overview

Financial HighlightHeadlines

Business Background Astino BHD is an investment holding company. The company operates in a single segment, namely the manufacture and sale of metal building related products. The principal activities of the company are those of investment holding and provision of management services to its subsidiaries. The organization's revenue comes from Malaysia and Indonesia. Some of its products are the Abs latch, Cylinder lock, Louver, indicator lock, spandec, AST ceiling panel.

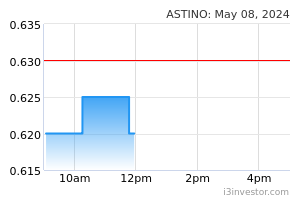

Invest_888 All steel stocks are expecting to earn more profit due to high and steady steel price. 10/09/2021 8:56 AM Zackmeiser Steel price way higher than 2020. Inflation is creeping whole world. Wait till Fed starts taper and real inflation story will be unleashed. Cant print all the money in the world and expect prices to stay the same (plus logistic and supply chain issue). 23/09/2021 6:10 PM Dakewlest Hoping for more dividend from this company because their EPS is quite high. 03/12/2021 11:00 PM Dakewlest Bila mahu announce dividen? Should announce dividend since EPS is quite high. 06/08/2022 7:30 AM Dehcomic01 Steel is a cyclical commodity. So when you look at Astino performance, you should do so over the steel price cycle. Over the past 14 years, the company achieved an average ROA of 7%. In comparison, the mean ROA of the Bursa steel companies averaged only 1%. The company outperformed the market. Visit my site for more insights on the sector performance. 14/07/2023 9:26 AM aaroiz57 https://www.thesundaily.my/local/penang-plans-10-housing-projects-to-help-people-own-house-DB8102948 https://geometrydash-lite.com . I am very happy to receive this sharing from you. This is probably the information I need, thanks 24/11/2023 12:12 PM trader808 Astino has 111m cash, 144m inventories and 93m in accounts receivable. Hence, its total liquid assets and cash is Rm349m 2The company has short term and long term debts of 14m 3 When you take 349m minus 14m, you would notice that the total net liquid asset is Rm335m 4. The company has 493m issued and paid up share capital. Hence, the liquid cash per share is 335m / 493m is 67sen 5. Considering that the share price is currently trading at only 63sen, it is an insanely and unbelievably a cheap bargain. 6 If you buy Astino at 63 sen, it is not only below its liquid cash per share of 67 sen you also get 181m of properties, plant and equipment plus 47m of investment properties or a total of 228m assets for free. 7 WOW, Is there a big fat toad jumping all over the streets?. 8 You decide. Happy trading 14/5/24 15/05/2024 12:01 PM jerret good analysis and in fact, buy good stock with low price is no harm at all 15/05/2024 3:17 PM trader808 1. Astino has been buying back its own shares regularly and persistently. When and why does a company undertake share buyback and what are the implications? 2. When the company believes that the current trading share price is far below the intrinsic value of the company, it will commence to buy back its own shares from the open market. 3 In order to undertake shares buyback, the company must have sufficient cash and cash balance. And Astino has Rm111m cash. 4. The effect of share buyback will reduce the number of shares in circulation in the market. Hence, when the number of shares in market circulation is reduced, the earning per share EPS will increase and theoretically, share price shall rise. 5. What does a company do with the buyback shares?. 6 The shares buyback shall be kept as treasury shares. The treasury shares can be canceled and thus, permanently reduced the issued and paid up capital of the company. 7. The company may chose to resale the treasury shares at a higher price to realize a substantial profit. 8. The company may also chose to reward its shareholders as in Astino to distribute dividend in species to its shareholders. 9 As for Astino, the cumulative net outstanding treasury shares as at 23/5/24 is 8,170,105 shares or 1.65%. If the buyback persist on and Astino subsequently manages to buyback 2% of its capital, than it is capable of rewarding its shareholders with a share dividend in the ratio of 1share for 50shares held. For this you must wait. Since, listing until now, Astino has rewarded its shareholders with share dividend 5 times. 10. Although there is no announcement yet, i believe it will happen slowly but surely. 10 Share buyback is good and should be undertaken as and when necessary. 11. Happy trading 24/5/24 24/05/2024 3:38 PM joseph216 Steel prices are much higher now compared to 2020. Inflation is affecting the entire world. When the Federal Reserve starts reducing its stimulus efforts, we'll see the real impact of inflation. You can't print unlimited money and expect prices to stay stable, especially with current logistics and supply chain problems. Source: https://bloxstrap.dev/ 05/08/2024 11:37 PM jerret inverted head and shoulder in the making, once break the neck line, price may go up 11/10/2024 10:53 AM Dakewlest IMHO, if Astino gives more dividend, people will start to buy this stock. Even the company buyback this share, the stock keep on falling. 05/11/2024 12:59 AM | | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||