HENGYUAN - WORST IS OVER FOR THIS COMPANY !!! RENEWED BUYING INTEREST EMERGES !!

BURSAMASTER

Publish date: Sat, 22 Feb 2020, 03:29 PM

HENGYUAN - WORST IS OVER FOR THIS COMPANY !!!

RENEWED BUYING INTEREST EMERGES !!!

(INVESTMENT GRADE COUNTER)

I would like to highlight about this big cap company; which I believe has seen its worst days, and might see bright future ahead -HENGYUAN REFINING COMPANY (Stock Code 4234, listed on MAIN MARKET, ENERGY Sector, market cap RM 1.227 billion as at writing)

Please do note that I am not an expert in oil & gas field, and that the terms I am using are mostly layman terms that any average person should be able to understand. Please feel free to add-on any comments that you feel could contribute to this article.

1. First Factor - Improved Refining Crack Spread

What is a crack spread?

Crack spread is a term used on the oil industry and futures trading for the differential between the price of crude oil and petroleum products extracted from it. The spread approximates the profit margin that an oil refinery can expect to make by “cracking” the long-chain hydrocarbons of crude oil into useful shorter-chain petroleum products.

Previously, one of our fellow senior investors had shared about this matter in detail in his blog write-up. I append here the article link so that you may read further as I find his write-up explains a lot more detail about this.

Please refer below weekly chart of SINGAPORE MOGAS 92 UNLEADED (PLATTS) BRENT CRACK SPREAD FUTURES (link provided).

Some observations:

i) In between December 2019 to January 2020, crack spread remained between USD 5-6 dollars

ii) Starting early February 2020, crack spread started to improve above USD 6.50, touching highest USD 9++ before retracing back to USD 7.40

iii) Coupled with factor 2, 3 and 4 below, maybe caused HENGYUAN price to pickup momentum in buying

https://www.tradingview.com/chart/?symbol=NYMEX%3AD1N1!

2. Second Factor - Stockholding Gain Increases as Crude Oil Moves Up in Q4 2019

Stockholding gain is referring to gain in the crude oil barrels being kept as inventory, as the price of crude oil moves up.

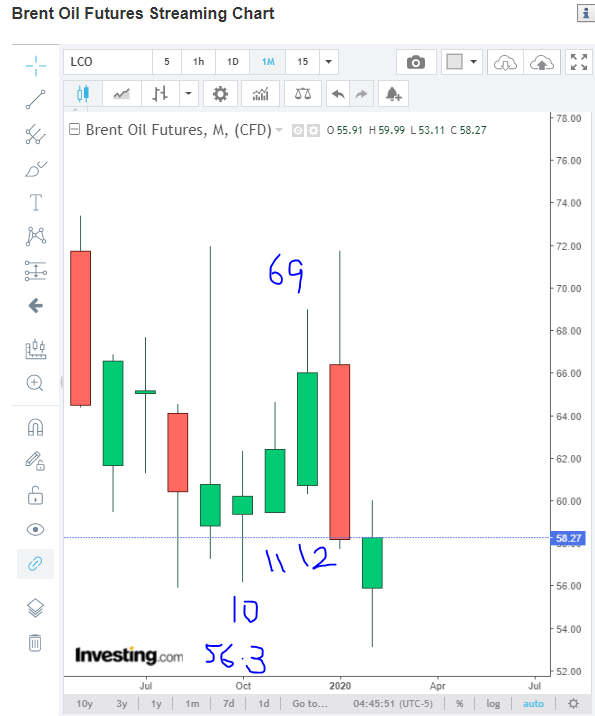

Refer below Monthly chart of Brent Oil. As we can see, the price of crude oil in Q4 2019, had jumped from USD 56.3 to USD 69 peak (a 22.6% gain in this quarter). Hence, therefore, HENGYUAN potentially should be seeing a better stockholding gain in upcoming quarter, based on the movement of crude oil prices.

Although recently, crude oil prices dropped temporarily due to coronavirus issue, however we can see that the prices are gradually recovering as the world is more aware of how to deal with the COVID-19 outbreak.

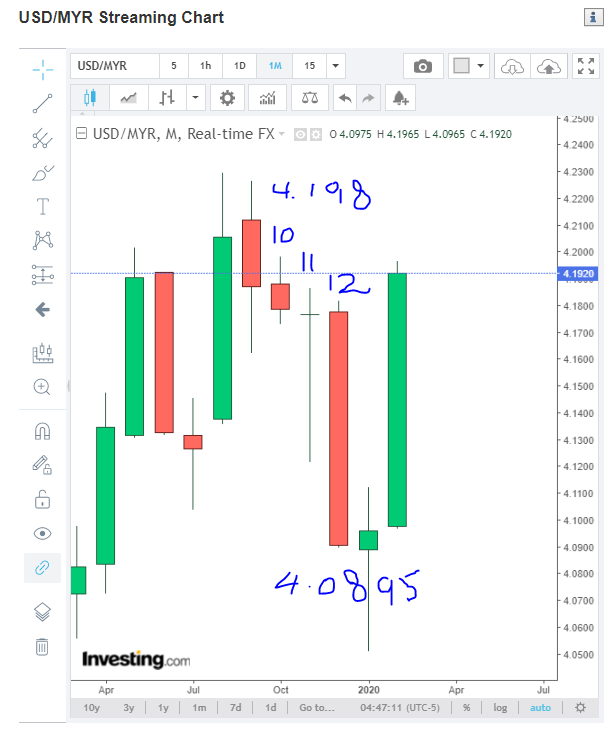

3. Third Factor - Strengthening of MYR Against USD in Q4 2019

HENGYUAN is primarily relying on MYR denominated revenues compared to USD, hence therefore any strengthening in the MYR would significantly impact overall profit margins.

As we can see, in Q4 2019, MYR had strengthened from 4.198 to 4.0895. This would mean a positive impact to the company profit margins in upcoming quarter result.

Same as previously commented, MYR had temporarily weakened again due to COVID-19 impact. This would be seen as temporary and would gradually recover over time.

4. Fourth Factor - Charts Never Lie - Surge In Volume Buying Interest With Increased Price Spread

Refer below the daily chart for HENGYUAN.

A few observations below:

i) In early February 2020, price hits recent low range of RM 3.30-3.40, and stayed at this level within 8 market days. However the traded volume remained significantly low

ii) Between 14-21 FEB 2020, the trading volume surged 7 to 10 times that of average trading volume, with the price spreading significantly on daily basis (20-50c movement per day, from top to bottom)

iii) Touched EMA200 at RM 4.60 before making retracement towards EMA43 (green line)

CONCLUSION

Considering all the above, I foresee interesting time ahead for HENGYUAN due to below:

i) Improved crack spread starting from FEBRUARY 2020

ii) Improved stockholding gains in Q4 2019

iii) Improved profit gains due to strengthening of MYR against USD in Q4 2019

iv) Chart shows market is rejecting low prices, as the price appreciates together with trading volume

LET’S SEE HOW THE SHARE PRICE MOVEMENT IN THE NEAR FUTURE FORBEARING ANY GOOD CORPORATE NEWS.

Disclaimer : The above opinion is never intended to be a BUY CALL whatsoever. I am sharing my observations ONLY based on fundamental; past history; current trading pattern; charts etc. Please make your own informed decision before buying this share or whatever share for that matter.

BURSAMASTER

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Bursa Master

Created by BURSAMASTER | Sep 22, 2023

Created by BURSAMASTER | Aug 20, 2023

DISCLAIMER: This post serves as an educational analysis and is never meant/ intended to be a buy/sell call or recomendation, whatsoever.

Investors / punters must always do their own due deligence bef

Created by BURSAMASTER | Dec 25, 2022

Created by BURSAMASTER | Oct 23, 2021

Discussions

BURSAMASTER,could you explain why your record not so encouraging ? Past 5 recommendations : mesb,scomnet,sunsuria,pos,pwroot , all went down south except 1, pwroot

2020-02-22 16:02

As you are aware, our index is at a 5 year low (the last time index hit 1503 as in August 2015)

For the time being, the safer strategy is to focus on stocks with good fundamental and business..therefore stocks like PWROOT, MASTER, UNIMECH & GUNUNG which I had written about before, have been making positive strides as compared to a few other penny stocks..

Hence therefore, the reason I am highlighting HENGYUAN as a potential alert, as HENGYUAN is a big cap counter which means minimized risk as compared to mid cap or penny stocks..

2020-02-22 21:00

@newbie911 - i really can’t stand newbs like you making empty comments without any proof..plz can you tell me how did you deduce eps down and where is the proof saying plant maintenance?

I checked the latest company announcements and never found any mention of plant downtime except for minor damage on its Single Buoy Mooring (SBM) which was repaired within 1 week and company said that they had took necessary measures to ensure no supply disruption to customers

If you really have no intellectual comment to make then plz don’t make any comments..

2020-02-22 21:38

in a market where demand is decreasing...and refinery is in excess capacity..

crack spread can only go down...

do not gamble on momentary spike in earnings...its not worth it..its not sustainable

the only time to touch this stock is when u see oil trading above 70 usd/brl

the price gives an idea on barrels consumed - demand

2020-02-23 11:09

Bursamaster/Investhor famous for recommending stocks that COLLAPSE almost immediately after they recommend see their past records on AHB, Caely, Danco, MESB etc

PUMP & DUMP!

2020-02-23 11:14

better to go for utility stocks which has 25 years recurring earnings certainty...

at such low interest rate....volatile market...certainty of earnings is the new game in stock market

2020-02-23 11:14

he is just speculating via hope...as the price appears very low to its 2017 high..

remember the 2 cents dividend

2020-02-23 11:28

i feel the need to defend myself as some newbs have mentioned my name in their comment

dompeilee is a famous do-nothing-but-diss-other-people-stock kind of person..you can see, he doesn't write anything article..the only thing he does is go around, talk bad things and talk big on certain counters as if he made big money..

i don't think people like Bursamaster will feel the need to entertain or reply to your comment..even HENGYUAN you are calling pump and dump when the market volume has been consistent for a few days..the above sharing is really beneficial to market readers compared to your worthless comment

again i reiterate, that i do know Bursamaster in real life..i respect people who are putting effort trying to share facts with the market..rather than useless people who do nothing and are toxic to others..wish you the best to you and the cave you live in, mr dompeilee

2020-02-23 12:51

@probability..i think your comments..are too speculative..the article above had provided all charts on the reasons that might support the price..eventhough there is temporary effect of coronavirus..

my question to you is..what proof do you say market demand is increasing and refinery is in excess capacity? please provide me any news link that might backup this comment..

2020-02-23 12:54

Investhor/bursamaster, how can you say you are not the same person?

https://klse.i3investor.com/blogs/InvesthorsHammer/2019-03-18-story-h1457189090-MJPERAK_BSKL_Code_8141_Time_to_Catchup_with_brother_KUB.jsp

This is an article you wrote. Notice the grammar, the colour coding, the charts, the explanations. They are both not only very similar, but exactly the same.

https://klse.i3investor.com/blogs/kcchongnz/2020-02-04-story-h1483049632-Quality_Investing_kcchongnz.jsp

This is an example of another sifu kcchongz, notice how he writes his article, his structure, his prose is so different from you?

Come on bursamaster/investhor is the same person. Not only in how he writes his articles, but also how he picks his stocks.

You both have a tendency to pick micro cap stocks, penny stocks.

Why?

Why create multiple identity? Promote those kinds of stocks which always seem to crash right after promotion?

What is your goal?

2020-02-23 13:35

@investhor, the demand for oil is decreasing as reflected by the oil price...you can see aviation and all other logistics dropped significantly due to coronavirus....

This means, the current refining capacity is in excess to the amount it has to refine...

remember, crack spread has to be way higher than 9 usd/brl.....i wont reveal much so that the market does not get smarter than me...

all i can advise is the risk is not worth it...go for the 25 years recurring earnings utility stock

2020-02-23 14:21

ha ha..confirmed Investhor is Bursamaster..but for me it does not matter..as much as the psychological trick used to make naive investors to buy...

2020-02-23 14:23

@probability..i think we shall let the market to decide..i best believe that market trades on future prospect and not past..coronavirus is temporary and wont last forever..as for Malaysia locally, our PM is announcing stimulus package on 27/2/2020 which might potentially see also oil & gas sector as a beneficiary..

2020-02-23 15:49

@ Philip & @probability..i can say 100% that me and Bursamaster are 2 different people..if you think same style writing, colour and etc are same makes us same person, then i think your imagination is way too weak..

i really got no time to waste by creating multiple identities..anyway the content shared in the article are all the facts and figures, all links provided..there are no fake news created or shared..

at the end of the day, the market shall decide which direction a stock moves..not you,,not me..

2020-02-23 15:54

@Sslee..yep Petronm and Hengyuan are in similar sector, except that Petronm also has a retail petrol section which Hengyuan does not have

I believe that with improving crack spread, crude oil prices & strengthening of MYR against USD, both Hengyuan and Petronm share prices will benefit..both will move hand in hand..

2020-02-23 16:43

Wondering why investhor answering ? Instead of bursamaster? Or use wrong ID to reply ? How about your another ID ? Grandmustah?

2020-02-23 22:13

playrobot

There is coming new government does this still applicable Calvin?

24/02/2020 11:10 AM

Calvin replies:

SINCE TUN DR MAHATHIR BRAINCHILD IS NFCP FIBERISATION

IF HE RULES LONGER MEANS ALL 5 YEARS BULL RUN FOR NFCP STOCKS LIKE OPCOM, BINACOM, REDTONE, NETX & CMSB

IN THAT DIRECTION THEN CAN SELL ALL OTHER SHARES AND JUST BUY THESE 5 CHUN CHUN

2020-02-24 11:28

ongkkh

David Lim is the expert in I3 for Hengyuan counter. Let see he is willing to comment on your article. For factor 3 is not longer good in this quarter 2020!

2020-02-22 15:47