KLCI waves

KLCI waves 6

hotstock1975

Publish date: Mon, 11 May 2020, 12:31 PM

Continue from KLCI waves 5 : https://klse.i3investor.com/blogs/E_Wave/2020-05-04-story-h1506878621-KLCI_waves_5.jsp

Weekly Time Frame

From the last 2 candles, Bearish Harami formation has been formed which indicates bearish sentiment is still persist. These was the second set of bearish formation after Dark Cloud Cover from prior 2 weeks. -DMI and +DMI are still implying consolidaton is taken place.

An continuous short term trend could emerge if levels listed below was broken:

Immediate Resistance - 1407

Immediate Support - 1369

Daily Time Frame

KLCI has consolidated and traded in tight range to form a bullish triangle. To recap, our bearish view on the downside is still hold since KLCI has yet to breach above the high of minuette sub wave ii at 1418. Therefore, a trend channel (CT) and few trend lines (DT, UT) has been constructed to capture more signals. For the past fews days, it was resisted under DT line which is one of the important level to watch in coming days.

Since there are new signals prompted, we have prepared 2 possible outcomes which either bearish or bullish setiment might take place if certain critical levels is breached respectively. You may see the wave counts for bullish look has been revised.

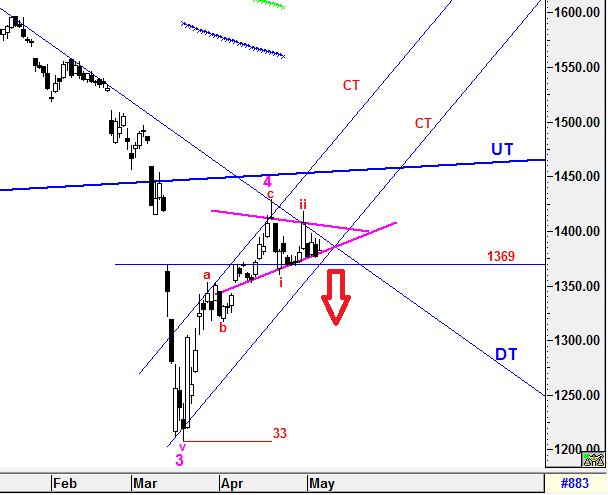

a) Bearish view

Since our prior bearish view is still hold, minuette sub 3rd wave would take place if the triangle break down and the support 1369 broken.

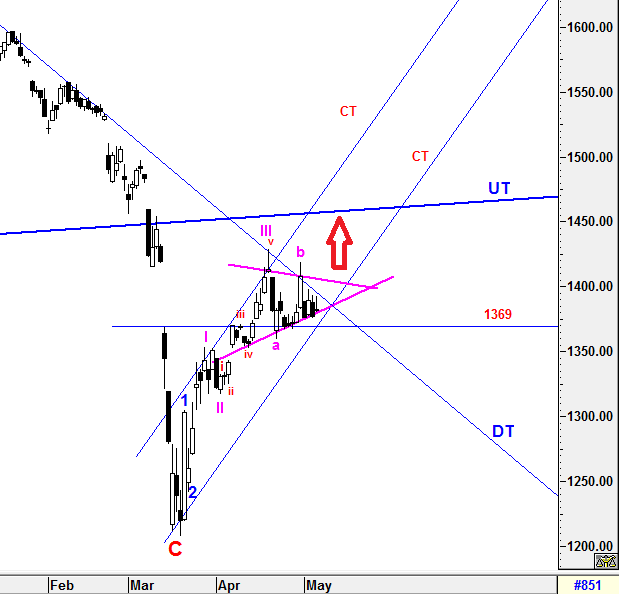

b) Bullish view

From the chart below, a possible new wave counts would be realized if there was a breakout from triangle and closed above 1418. Besides that, Wave C could be ended at 1207 low. Thereafter, UT line level to be watched closely when KLCI is trending higher.

All analysis above are based on past and current price levels setup. It could be vary at some point in time.

Stay healthly and safely.

Wave Believer

More articles on KLCI waves

KLCI waves 94 - WILL THE DOWNWARD PRESSURE TO BE IMPULSIVE TOWARDS WAVE E?

Created by hotstock1975 | Jan 24, 2022

KLCI waves 93 - EXTENSION UPWARD ENDED AND IT'S TIME TO THE DOWNSIDE?

Created by hotstock1975 | Jan 17, 2022

KLCI waves 89 - KLCI WILL EXTEND AND HIT LOWER TARGETS GRADUALLY

Created by hotstock1975 | Dec 20, 2021

Discussions

Be the first to like this. Showing 0 of 0 comments