KLCI waves

KLCI waves 15 - 5th waves update

hotstock1975

Publish date: Mon, 13 Jul 2020, 01:44 AM

Weekly Time Frame

KLCI was able to sustain above DT line and moved higher after the gap of 1556 - 1568 was filled successfully and 1575 was breached. These might build up some strenght to test next major resistance at 1610. To recap, the prior Double Top Range effect would be written off if 1610 is breached.

The higher degree of 5th wave is still underway which will be elaborated further in daily time frame.

-DMI (red line) is still heading down and made new low indicates bearish sentiment is continuing decrease. +DMI (blue line) continued curve up with breakout to new high indicates bull strenght is in control. Besides that, ADX (pink line) is starting to be flatthen from downward which implying the volatility of the current bull trend is gradually returned. Eventhough both DMI indicator is starting to widen up, stronger magnitude of bull is required to be developed before it can move higher in order for ADX to curve up again.

Prevailing trend could be emerged if levels listed below was broken:

Resistance - 1610

Immediate Resistance - 1600

Immediate Support - 1575

Support - 1556

Daily Time Frame

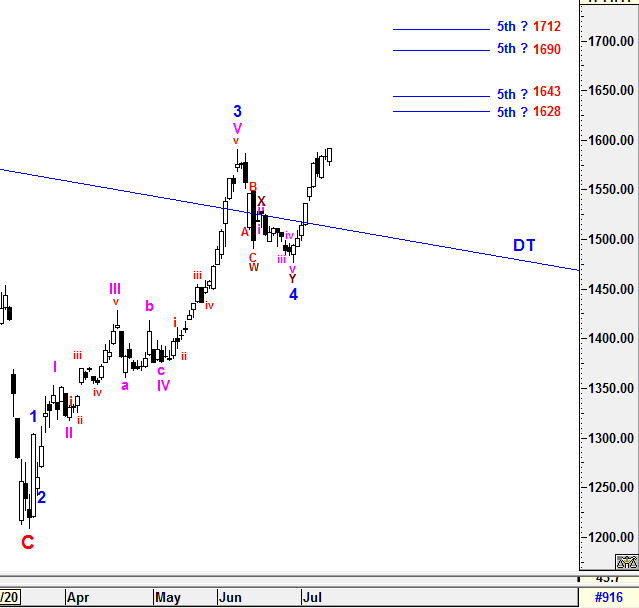

After 1575 was breached, KLCI was able to close slightly above 1590.83 which was the high of higher degree of 3rd wave. These indicated higher tendency of higher degree of 5th wave to be realized at higher level.

Currently, There are 5 sub minutte wave structure is being formed to complete higher degree of 5th wave and 4th sub minutte wave correction is underway which would be monitored closely to anticipate any possible complex wave form structure being emerged.

The potential projected targets of higher degree of 5th wave which are 1628, 1643, 1690 and 1712. The validity of these projection target would be high once the resistance of 1610 to be breached.

All waves' count and projected target are generated based on past/current price level and it may be subjected to vary if degree of momentum movement change.

Prevailing trend could be emerged if levels listed below was broken:

3rd resistance - 1610

2nd resistance - 1600

Immediate resistance - 1595

Immediate support - 1575

2nd support - 1556

Let's Mr Market pave the waves.

Trade safely

Wave Believer

More articles on KLCI waves

KLCI waves 94 - WILL THE DOWNWARD PRESSURE TO BE IMPULSIVE TOWARDS WAVE E?

Created by hotstock1975 | Jan 24, 2022

KLCI waves 93 - EXTENSION UPWARD ENDED AND IT'S TIME TO THE DOWNSIDE?

Created by hotstock1975 | Jan 17, 2022

KLCI waves 89 - KLCI WILL EXTEND AND HIT LOWER TARGETS GRADUALLY

Created by hotstock1975 | Dec 20, 2021

Discussions

Be the first to like this. Showing 0 of 0 comments