KLCI waves

KLCI waves 32 - Is Wave 1 started after WXY complex correction wave?

hotstock1975

Publish date: Mon, 09 Nov 2020, 01:04 AM

Weekly Time Frame

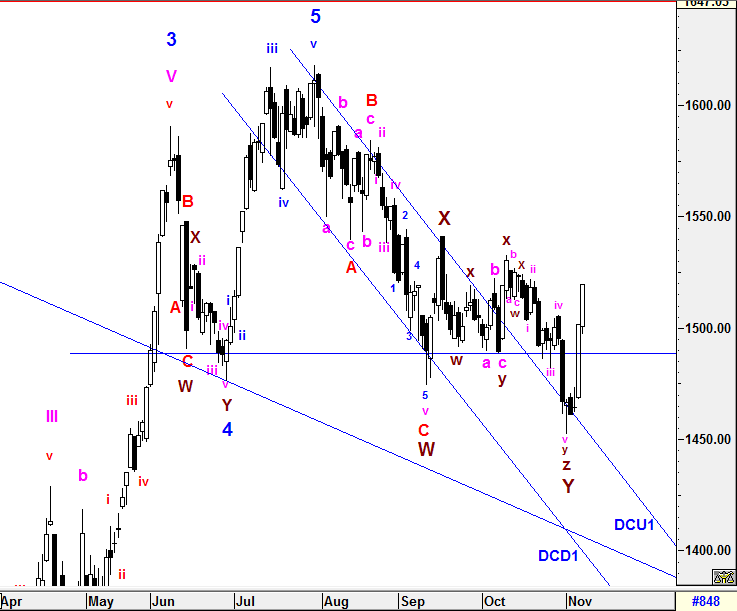

After penetrated below UT/DT line last week, KLCI traded back above these 2 lines where a false break took place. With a strong rebound and closed above 1515, the strength would spur the trend to the upside in short run before consolidation take place. Besides that, a Bullish Engulfing Candle formation had been formed and require a close above 1519.64 on coming Friday to realize the validity of the formation. However, caution is still required towards Friday before any clearer direction emerged.

On other hand, the Higher Degree of Wave counts will be elaborated further in daily time frame.

1) -DMI (red line) reversed down with greater margin indicates bearish momentum is decreasing intensively.

2) +DMI (blue line) reversed up with narrow margin indicates bull strenght is returning with caution.

3) ADX (pink line) is still heading down with greater margin which implying the volatility of the current trend is still low.

Therefore, the summations of the 3 signals above is implying uncertainty still remains and knee jerk reaction is unavoidable. From current situaton, -DMI still above +DMI indicates bear strenght is still in favor but decreasing margin. With ADX's current reading, bear strenght is weakening. However, ADX is still required to curve up in order to validate a prominent trend to be developed.

Prevailing trend could be emerged if levels listed below was broken:

Resistance - 1610

Immediate resistance - 1530, 1545

Immediate Support - 1515, 1500, 1495, 1485 (UT line), 1472 (DT line)

Support - 1465

Dailly Time Frame

To recap from prior session, we were expecting an Higher Degree of Complex Correction waves WXY has emerged and Higher Degree of Wave Y was being constructed with a possible double three formation with minutte wave w-x-y-x-z which minutte wave z consist of Expanding Diagonal formation with 5 sub minutte waves (i-ii-iii-iv-v) by archieving minimum criteria at 1461.65 unless extension minutte waves incurred which would lead to further downward.

As mentioned before, It could rebound from around DCU1 line and no doubt it realized with a false break. As expected, an 5th sub minutte wave extension (v) was formed and completed at lower level of 1452.13. These has archieved multiple complex waves formation target of wave y, wave z and Wave Y simultinously which indicated the Higher Degree of Complex Correction WXY is completed. Next, Wave 1 could have been on its way up with 5 sub minutte wave extensions are being contructed currently.

The entire wave structure will still be monitored closely if the low of Wave Y at 1452.13 is breached as more complexity wave formations could be emerged such as multiple WXY correction waves may take place before Higher Degree of 5 Waves Bull Run.

All waves' count and projected target are generated based on past/current price level and it may be subjected to vary if degree of momentum movement change.

Prevailing trend could be emerged if levels listed below was broken:

Resistance - 1610

Immediate resistance - 1530, 1545

Immediate Support - 1515, 1500, 1489

Support - 1485 (UT line), 1472 (DT line) ,1465

==========================================================================

The end of unfavorable complex waves before the SUPER CYCLE Bull Run? Looking forward.

==========================================================================

Let's Mr Market pave the waves.

Trade safely

Wave Believer

More articles on KLCI waves

KLCI waves 94 - WILL THE DOWNWARD PRESSURE TO BE IMPULSIVE TOWARDS WAVE E?

Created by hotstock1975 | Jan 24, 2022

KLCI waves 93 - EXTENSION UPWARD ENDED AND IT'S TIME TO THE DOWNSIDE?

Created by hotstock1975 | Jan 17, 2022

KLCI waves 89 - KLCI WILL EXTEND AND HIT LOWER TARGETS GRADUALLY

Created by hotstock1975 | Dec 20, 2021

Discussions

Be the first to like this. Showing 0 of 0 comments