KLCI waves 43 - 2nd Waves Outcome Realized and 2 BEST Glove Waves (HARTA & TOPGLOVE) Update 1

hotstock1975

Publish date: Sun, 31 Jan 2021, 01:31 PM

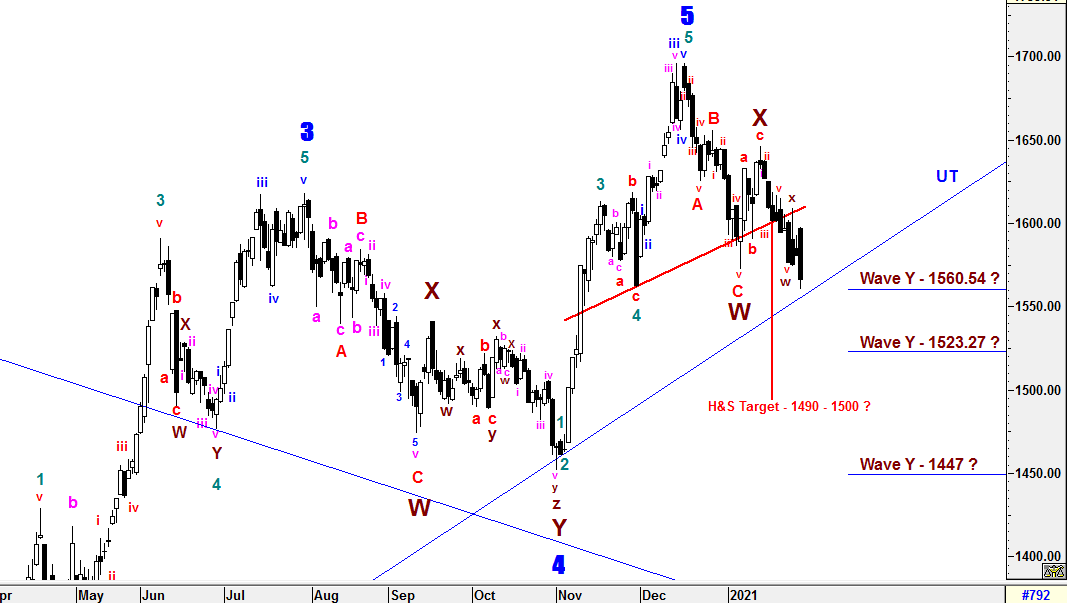

Weekly Time Frame

To recap, downward pressure would continue in coming days to test and breach the immediate support level of 1590-1593. Once this level breached, we would see longer correction or consolidation phase to be emerged. No doubt that the breaching of immediate support had initiated a strong momentum to the downside. Due to the current momentum, downward pressure would continue in coming weeks.

More articles on KLCI waves

Created by hotstock1975 | Jan 24, 2022

Created by hotstock1975 | Jan 17, 2022

Created by hotstock1975 | Dec 20, 2021

Discussions

Hi Bro, Fully agree that it is better off if we can apply regular TA with EWave analysis where regular TA is an must or good starting point before embarking into Ewave.

Based on my 2 possible counts from prior session 42, the initial Wave 1 assumption (outcome 1) was Invalidated after Wave C (1572.62) had been breached last Friday and so there would be no Wave 2 construction as the Primary/Higher Degree of Correction is not ended yet.

As aware, Complex WXY wave formation may consist of different combination forms like regular ABC, 5 regulars implusive wave and etc. From the current counts labelled, you may be correct to quote these sub minuette wave 1-2-3-4-5(w)-x-y could form as Wave A as soon as now with an expectation of rebound from 200EMA. However, i will be very caution and leave more room for these sub minuette wave y to take place where it may form in different complex formation to end wave y. Even i have mentioned it had met minimum criteria of WXY completion, i need more incoming wave counts justification to validate these criteria due to current momentum and same goes to the other 2 lower Wave Y targets projections if incurred.

I am watching the UT line as immediate support where it could lead to an impulsive waves to the downside if UT line breached. Correction complex waves are always the most challenging phase which we need more patient to wrack the code one at a time. Kindly continue to share your thought if i have missed something.

i am also appreciating your sharing and opinion. Hopefully, i can receive more sharing and opinion on going forward.

Wave believer.

My tribute to Robert Prechter & Alfred John Frost.

2021-01-31 21:58

I guess I missed out your enquiries whether Primary/Highest Degree of Wave 2 is on it's way. Yes, Indeed. Since the Higher Degree of Impulsive Bull Waves from March 2020 to Dec 2020 had realized, it would quote as Primary Wave 1 and Primary Wave 2 is on its way. Let's see how these prolong complex correction waves to end before Super Bull Cycle in long run.

2021-02-01 10:42

Yup currently that all important UT line on daily chart that would be at 1553 tomorrow is super critical. But just looking at how last Fri's candle did not breach the 200ema to touch the very near UT line kinda give a good feel.

In any case, after studying the daily chart again & again & comparing with your count (which i could've missed some of your pointers), I was of the opinion that instead of being in Primary Wave 2 now, we could be in Primary Wave 3 already.

This is my count... Primary Wave 1 was from mid-March to end-Jul. Primary Wave 2 was from 30th July to 30th Oct which that low became the anchor to the UT line. In most impulse waves that is usually the case but not all the time tho. Primary Wave 3 started in Nov with minor wave 1 ended on 16th Dec. Minor wave 2 is almost done based on our observations. This week will confirm it for us. Just my humble opinion.

2021-02-01 22:31

Good shot bro...I can see some of your primary counts was my minuette wave counts. I hope you did revise some counts in between March to April for the higher degree of Wave 1 and 2 as there were some complex waves which caused the momentum changes in June. Moreover, there were a lots of counts criteria penetration and complex waves formations which lead to revision along the way. Instead of just using Daily chart, try use Higher Degree Waves counts in Weekly to filter those noise in Daily as Daily noise could wrack the entire picture. Also I do verify smaller time frame for smaller degree waves incurred within. Then, the whole picture would be matching each other from smallest time frame (minutes to hours) to higher time frame (weekly or monthly or quarterly if available on your software). Currently, I wish I could see the immediate correction to end now but I really can't ignore the Head and Shoulder formation which was formed quite nicely and WXY complex wave indicating reckless waves ahead. Let's see how it goes.

2021-02-02 00:39

Appreciate your guidance bro! Will go back to my drawing board as identified by your updates above & counter check mine again. U're so much pro than me so I had better learn & improve. Thanks much again Wave Believer!

2021-02-02 12:16

No mentioned bro. I am also learning and preparing for any unexpected changes everyday. Keep it up !

2021-02-02 12:49

KUALA LUMPUR (Feb 2): RHB Research Institute and Kenanga Research have trimmed their target prices (TPs) for Supermax Corp Bhd due to a lack of visibility of its average selling prices (ASPs) and execution risk of its US venture.

Kenanga Research analyst Raymond Choo Ping Khoon, who kept his "outperform" call, said the research house had cut its TP to RM9.05 from RM7.80 previously based on 12 times calendar year 2022 estimated (CY22E) earnings per share (EPS) as the research house rolled over its valuation base from CY21 to CY22.

This was due to execution risk of the company's US venture to manufacture medical gloves and other personal protective equipment (PPE) with an initial capital outlay of RM405 million, as well as the lack of ASP visibility, he noted.

Supermax previously noted that while ASPs had not peaked in the first quarter of 2021 (1Q21) yet, demand is expected to moderate with the roll-out of Covid-19 vaccines.

As at the time of writing today, shares of Supermax had risen seven sen or 1.03% to RM6.87, valuing the group at RM18.69 billion. It had seen some 15.97 million shares traded.

Meanwhile, RHB Research Institute, which maintained its "buy" call on Supermax, lowered its TP to RM10.60 (from RM13.25), with a 56% upside and an about 7% yield.

“Our TP reflects 8.3 times FY22F P/E (price-earnings forecast for the financial year ending June 30, 2022; a 20% discount versus peers). This discount is justified due to Supermax’s lower market capitalisation. Our ‘buy’ call is premised on stronger earnings prospects for 3QFY21 (the third quarter ending March 31, 2021), an expected positive news flow from its venture to build a manufacturing plant in the US and its dual listing on the Singapore Exchange (SGX).

“We lower our TP to RM10.60. [Our] long-term ASP [assumptions] have been lowered to US$47 (RM190.04)/box (from US$48) as higher near-term ASPs should result in stronger competition in the long run. Beta has been increased to account for higher share price volatility,” said RHB analyst Alan Lim.

To recap, the glove maker’s net profit for the latest quarter, 2QFY21, climbed 34% quarter-on-quarter (q-o-q) to RM1.06 billion from RM789.52 million for the preceding 1QFY21, while quarterly revenue surged to RM2 billion compared with RM1.35 billion for the preceding quarter.

On a yearly basis, net profit jumped by a whopping 3,142% from RM30.17 million a year ago, while revenue also surged from RM385.5 million for the previous year.

However, despite cutting their TPs for Supermax, both research houses raised their earnings forecasts due to higher ASPs seen for the coming quarters.

Kenanga said it likes Supermax for its original brand manufacturing (OBM) model, which enables it to extract higher margins from distributor pieces compared to original equipment manufacturer (OEM) models at lower factory prices.

“[We] raise [our] FY21E/FY22E net profit by 27%/16% after hiking our ASP [assumptions] from US$65/1,000 pieces and US$45/1,000 pieces to US$70/1,000 pieces and US$50/1,000 pieces respectively,” said Choo.

RHB also increased its forecast for FY21 by 36% due to a higher ASP assumption.

“However, we maintain our FY22F-23F earnings as we keep [our] ASP assumptions unchanged. Note that our FY21-23F blended ASPs of US$89, US$57 and US$48 already assume an ASP decline in the future once Covid-19 ends,” said Lim.

In the short term, Lim said RHB expects earnings for Supermax to continue to rise for 3QFY21.

“Beyond that, Supermax is a beneficiary of stable glove growth demand of 8%-10% annually. Our ESG (environmental, social and governance) score for Supermax is 2.89,” added Lim.

2021-02-02 20:03

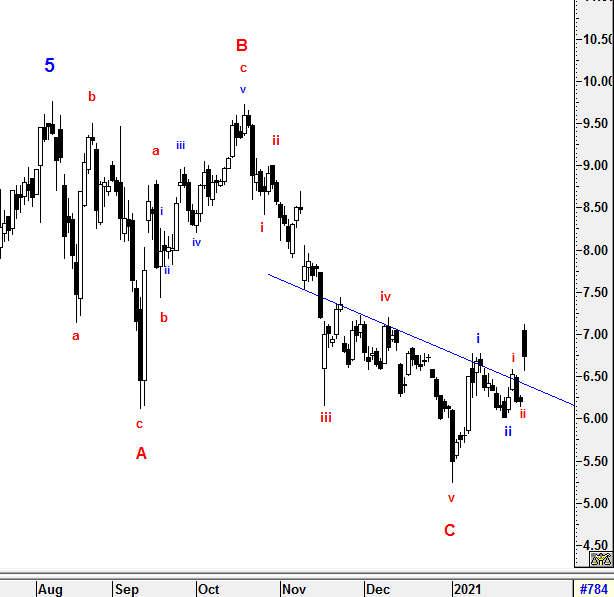

Although Supermax is not in my Best Wave count list, I think it's wave structure is smoothening into my category and coming soon.

Some bankers cutting it's TP and hope to get cheaper prices. I can assure that they will miss the boat once impulsive waves emerged where it would be too late to catch the glove wave.

2021-02-02 20:35

.png)

.png)

CJkenho

Hey fellow wave watcher.. just wanted to appreciate your consistent weekly sharing of wave counts. I've been following your Sunday analysis & comparing with mine as I'm still learning like a noob. Like you I'm a big fan of the Wave Principle, but only after spending some time trading with TA. Felt WP helps me see further & should've learn it first before entering the market. Even better is when I use WP with TA. So yeah thanks again & keep it up!

Regarding KLCI fri's candle, I thought it stood very nicely on the 200ema line on the daily chart. Hence gives an impression that Wave Y has ended (hence forming the bigger Wave A) & next week would start Wave B. Going by your highest level count, this is only the start of primary Wave 2 correct?

2021-01-31 17:23