BTM (BSKL Code 7188) - Undervalued Gem Not to Be Missed !!

Investhor

Publish date: Fri, 11 Jan 2019, 12:35 PM

Hello everyone again !

I was looking at BTM (BSKL Code 7188) and saw that it had started an interesting pattern, therefore I feel that I should make a short write up about it for those out there who are looking for undervalued gems to keep in their portfolio.

BTM (BSKL Code 7188) - TP1, 15c (short term), TP2 20c, TP3 25c (mid to long term)

I find this counter interesting to note due to the below reasons:

1. Financial Analysis

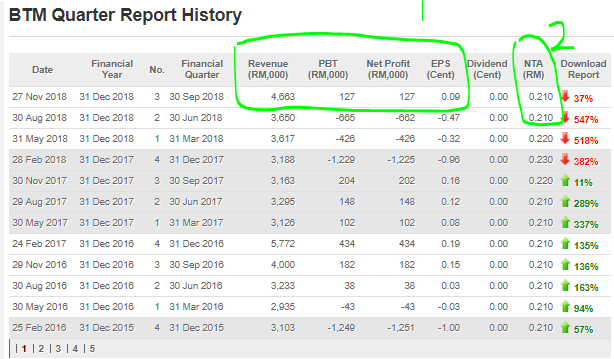

Refer image below screenshot from https://www.malaysiastock.biz on BTM latest quarterly report results:

From the above, first thing to note is current price (12c as of writing) is way below its NTA of 21c (refer circle 2).

As for its most recent quarter report, BTM has turned a profit compared to the last 3 previous quarter losses. This might signal that the trend has changed for BTM and financially the company is started to do better. From the above it is anticipated that BTM will record profit in the coming quarters.

Extracting from the quarter report, BTM was quoted saying "For the quarter ended 30 September 2018, the Group recorded a pre-tax profit of RM127,000 as compared to a pre-tax loss of RM665,000 in the previous quarter ended 30 June 2018, mainly due to higher turnover from its manufacturing operations during the current financial quarter." From this we should expect improvement in the coming quarters as turnover is starting to increase.

Therefore from FA view, I see this company as undervalued at current price due to trading significantly below NTA, the increase in its business turnover and recently turning from 3 straight quarter losses into profit.

2. Technical Analysis

Refer weekly chart of BTM below.

BTM has been downtrending since January 2018. Refer circles 1 and 2, where there have been about 4 attempts to break the downtrend but failed and the stock resumed downtrend.

Now currently we are in circle 3 area. Where the stock is now testing the downtrend again, and should the price break out and supported strong enough, the direction will be heading to 15 cents in short term and then 20 cents in mid term. At current price, downside is very limited as the support price range is 9-10 cents which had been hold strongly over the past months.

Therefore, in terms of TA view, I view the current entry as low risk (support at 9-10c for cutloss) but high potential upside (15-25c mid to long term).

Conclusion

From FA and TA view, I see this gem as undervalued and a good buy for an investor who is looking for undervalued companies that have big potential upside compared to downside.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Investhor's Mighty Hammer of Wisdom

Created by Investhor | Sep 27, 2021

Created by Investhor | Aug 14, 2021

Created by Investhor | Aug 07, 2021

Created by Investhor | Mar 20, 2021

Created by Investhor | Aug 22, 2020

speakup

wah this company...... speakup used to trade it long long time ago when it was like 30sen.

2019-01-11 15:58