INVESTORS WOULD BE MAD NOT TO HOLD THIS GEM ! DIVIDENDS PAID QUARTERLY WITHOUT FAIL SINCE 2014 !!!

Investhor

Publish date: Sun, 07 Jun 2020, 01:12 PM

Hi to all fellow investors and traders !

Today I would like to share my thoughts the following counter:

MATRIX CONCEPTS HOLDINGS BHD or MATRIX (Code 5236, MAIN Market, Property)

Some basic info on this company:

i. Number of shares float : 834.21 million

ii. Market Cap : RM 1.51 billion

iii. Last closing price : RM 1.81

iv. Website : https://www.mchb.com.my/

MATRIX - INVESTORS WOULD BE MAD NOT TO HOLD THIS GEM ! DIVIDENDS PAID QUARTERLY WITHOUT FAIL SINCE 2014 !!!

1. PROPERTY Sector Stimulated by PENJANA

Refer below news link. The PENJANA Economic Recovery plan announced by government on 5th June 2020 is a boost to property sector due to below:

a) Revival of Home Ownership Campaign (HOC)

b) Real Property Gains Tax (RPGT) exemption for property sold between 1/6/2020 to 31/12/2021

c) stamp duty exemption for purchases

d) lifting of 70% margin of financin limit for third housing loan onwards

Based on all the above initiatives, I believe would benefit the property sector overall, including MATRIX as one of the property players.

2. Dividends Paid Quarterly Without Fail Since May 2014

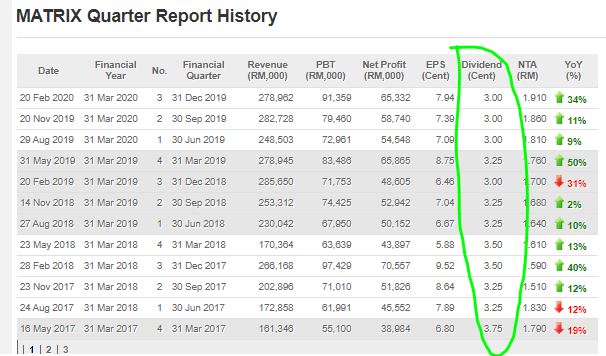

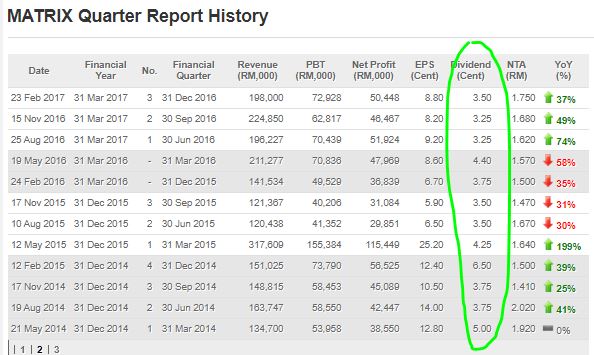

Refer below image for summary of QR since May 2014 till latest Feb 2020. As we can see, MATRIX has paid a dividend of between 3 - 6.5 cents per quarter without fail since 2014. Let me summarize the annual dividend below for ease of reading:

a) FY 31 DEC 2014 : 19c

b) FY 31 DEC 2015 : 11.25c

c) FY 31 MAC 2016 (6 months) : 8.15c

d) FY 31 MAC 2017 : 13.75c

e) FY 31 MAC 2018 : 13.5c

f) FY 31 MAC 2019 : 12.75c

g) FY 31 MAC 2020 (9 months) : 9c

Any investor or fund manager looking at decent quarterly dividend payment would be mad not to buy and hold MATRIX into their portfolio. In addition, we can see that their Earnings Per Share (EPS) allows the dividend payment to be made, as their EPS usually falls in the range of 6 - 10c for the past 3 years.

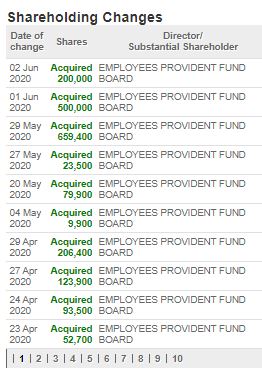

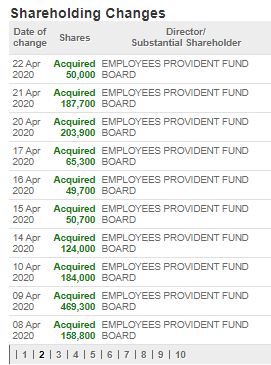

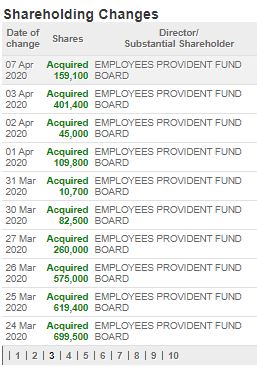

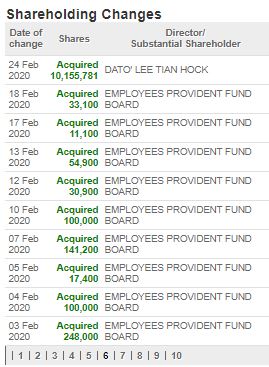

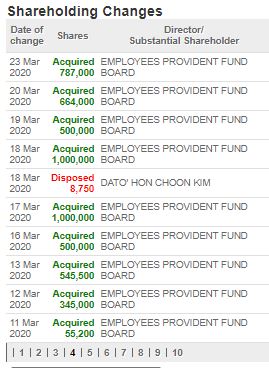

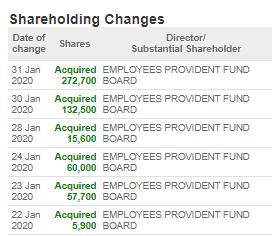

3. Since January 2020, EPF aggressively adding shares, roughly 13.26 million

Take a look at below summary of major shareholding change since Jan 2020. As we can see, EPF keeps buying shares of MATRIX since January 2020 and has added roughly 13.26 milion shares to take their total shareholding of MATRIX to 78.9 million shares (9.4%).

This shows us the EPF is valuing this stock as a longer term play as they keep adding shares eventhough during the COVID19 flash crash recently which brought this stock to a low of RM 1.24 on 17 March 2020.

3. MATRIX WARRANT A - A High Risk High Reward Entry - Low Price & Low Premium

Below the profile of MATRIX WARRANTS A (MATRIX-WA):

Below my observations on this warrant:

i. Strike price of RM 1.92, translating to premium of 6.63% for the warrant

ii. Latest mother shares close at RM 1.81, which is only 11c below the strike price

iii. Maturity of 20th July 2020, which is about 1 and a half months to go

iv. Latest closing price of 1c, indicating very low risk should the mother shares expire below strike price

Should the price of mother shares able to recover to Pre-COVID19 price of RM 1.90, I believe the warrant should see some trading interest. Especially if the mother breaks out above RM 1.92 strike price towards RM 2, then the warrant will see big interest in trading volume.

Let's say worst case scenario that the mother shares price is below RM 1.92 when the warrant expires, all warrant holders will have chance to convert the warrant into mother shares to avoid losing money on the warrant.

Longer term prospect, the mother shares should be trending upwards, as the PROPERTY market outlook improves and earnings will be boosted.

4. TECHNICAL ANALYSIS - Homily Chart - Breakout Above the TE Line - Long Term Investors Adding Position

Let's take a look at the 60 minutes chart of MATRIX using Homily software:

A few observations:

i. At Circle 1 - We see that red (bankers) chips are maximizing position into this counter with about 90% position taken up. This indicates long term or strong holders are buying and not short term/contra players

ii. At Circle 2 - We see that the price movement is strong above the pink trend line, indicating bullish momentum ahead

I would like to also highlight the daily chart of MATRIX as below:

A few observations:

i. From Circle 1, we can see that since March 2020, red (bankers) chips have been consistently adding position in this counter and taking up shares from green (weak) chips

ii. As of latest, red chips have taken up about 85% position, with balance of yellow 5%, and green 10%

iii. From Circle 2, we can see that the price has broken out above the pink trendline, indicating bullish momentum ahead as the PROPERTY sector is being stimulated by the PENJANA announcements

WILL WE SEE A LONG TERM UPTREND AGAIN IN THIS COUNTER? ONLY TIME WILL TELL.

CONCLUSION

Based on my opinion, MATRIX should be given attention in coming weeks, based on below:

i. PENJANA announcement by government to stimulate PROPERTY sector in the long run

ii. Strong balance sheet, high EPS and dividend paid quarterly without fail since FY2014

Thanks for reading and see you in the next post.

THE ABOVE IS NOT A BUY OR SELL CALL AND IS ONLY A PERSONAL OPINION ARTICLE AS A SHARING TO BSKL COMMUNITY MEMBERS.

Yours Truly,

INVESTHOR

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Investhor's Mighty Hammer of Wisdom

Created by Investhor | Sep 27, 2021

Created by Investhor | Aug 14, 2021

Created by Investhor | Aug 07, 2021

Created by Investhor | Mar 20, 2021

Created by Investhor | Aug 22, 2020

Discussions

Convincing , their properties are value buy but still depends on how the location thrive soon.

2020-06-07 18:26

Caely Holdings Bhd will make fabric protective masks and personal protective equipment (PPE) for Ni Hsin Resources Bhd. Ni Hsin also sell masks

2020-06-07 20:26

So many good property stocks with good dividends and much higher NTA, why matrix ? Matrix-wa going to expire soon...major shareholders waiting to dispose the warrant to the greedy ikan bilis.

2020-06-07 22:40

greedy44444, well said.

Matrix not bad, but already have lots of property stocks.

2020-06-08 17:00

Sabarudin Abu Bakar

Good to buy matrix & don’t forget matrix wa only 1 sen.... prospek 5/6 sen

2020-06-07 15:04