THIS OVERLOOKED STOCK POSTED HISTORICAL NET PROFIT !!! ALSO NEW VENTURE INTO HEALTHCARE WITH SUBSIDIARY OPEN IN S'PORE !!!

Investhor

Publish date: Sat, 04 Jul 2020, 01:39 PM

Hi to all fellow investors and traders !

Today I would like to share my thoughts the following counter:

PCCS GROUP BERHAD or PCCS (Code 6068, MAIN Market, Consumer

Products & Services)

Some basic info on this company:

i. Number of shares float : 210.4 million

ii. Market Cap : RM 70.49 million

iii. Last closing price : 33.5 cents

iv. Website : https://www.home.com.my/symphony-life-formerly-bolton-berhad

PCCS - THIS OVERLOOKED STOCK POSTED HISTORICAL NET

PROFIT !!! ALSO NEW VENTURE INTO HEALTHCARE WITH

SUBSIDIARY OPEN IN S'PORE !!!

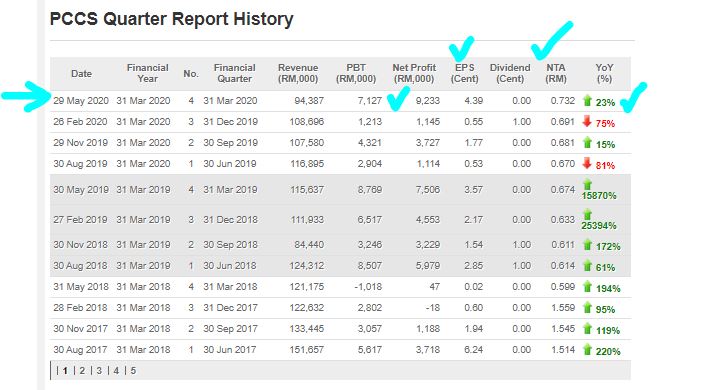

1. Posted all time high net profit in May 2020 QR

Refer below the latest QR summary for PCCS.

As we can see, during the latest QR, PCCS managed to post an all time high net profit of RM 9.2 mil or EPS 4.39, despite the effect of COVID19 pandemic on the global economy.

This means that after summing up all 4 quarters, PCCS is currently trading at about 5X PE Ratio, which is considered quite low in this sector.

Taking a fair ratio of around 8-10X PE for apparel company, we should target a fair vaue of 56-70c in the upcoming future.

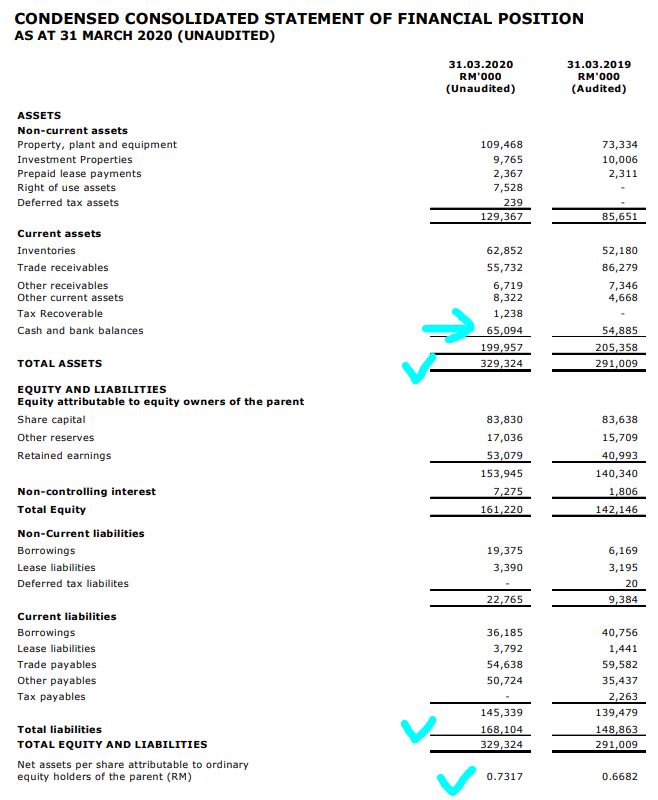

2. Trading at 54% discount to NTA of 73c, and also has RM 65 mil cash in the bank equivalent to

31c cash per share

Refer below latest asset versus liability sheet of PCCS in the latest QR.

Total NTA stood at 73c, this means latest closing price of 33.5c represents a 54% discount to its NTA.

Also, total assets stood at RM 329 mil versus liabilities of RM 168.1 million, which means this stock is a net asset company by about RM 160.9 million.

Also, something significant worth to note, is its cash position of RM 65 million, which represents a net CASH PER SHARE of 31c in the bank, against its latest closing of 33.5c. This means that the cash in the bank itself is nearly worth 92.5% of its total market cap.

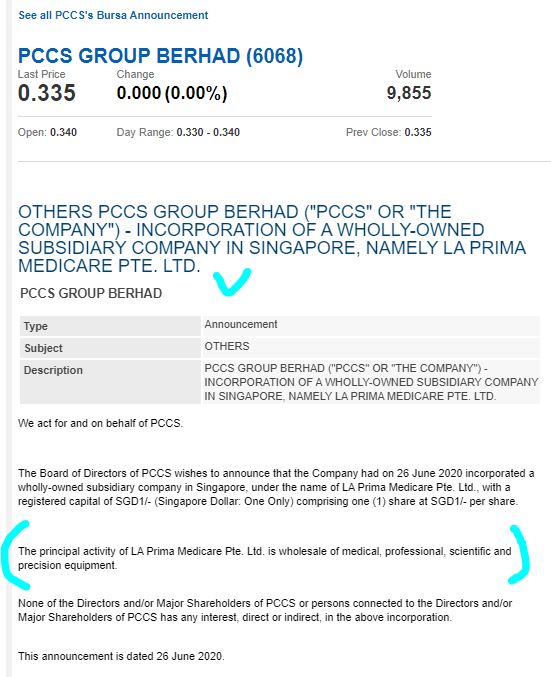

3. Latest venture into healthcare by opening new subsidiary in Singapore, La Prima Medicare Pte.

Ltd.

Refer below latest announcement by PCCS on 26th June 2020. PCCS had incorporated a wholly-owned subsidiary company in Singapore, under the name of La Prima Medicare Pte. Ltd..

The principal activity of La Prima Medicare Pte. Ltd. is wholesale of medical, professional, scientific and precision equipment.

Of course it is still at the early stage of incorporation. However, the time to invest is usually at the early stage, where the price of the stock is still undervalued.

Once they have obtained few licenses to distribute medical equipment and started distribution of products into the market, I believe that the price of this company will not be this cheap any more.

4. Technical Analysis - Bankers chips increasing position in 60m chart, Bankers chips slowly

accumulating position in daily chart

Let's take a look at the 60 minutes chart of PCCS using Homily software:

A few observations:

i. Recently, price faced some retracement below the support line, as the number of weak sellers increased

ii. However, if we look at the circled area, it seems that most recently bankers chips started to increase position in this stock, as the green holders start to reduce indicating less weak holders inside

Should the stock continue trending upwards next week, there would be more renewed interest in buyers wanting to take a stake in the trend

Let's take a look at the daily chart of PCCS using Homily software:

A few observations:

i. After hitting low in March 2020, bankers chips had started to accumulate position in this stock

ii. Recently the stock faced some selling pressure, however we see that bankers chips still remain inside this stock despite the recent price retracement

iii. As of latest, it seems that green chips (weak holders) position has been reduced to a very small amount, indicating that selling might be weak should buyers decide to continue uptrending this stock

CONCLUSION

Based on my opinion, PCCS should be given attention in coming weeks, based on below:

i. Posted all time high net profit in May 2020 QR, fair value of 56-70c based on 8-10X PE ratio

ii. Trading at 54% discount to NTA of 73c, also net cash per share very high at 31c per share

Thanks for reading and see you in the next post.

THE ABOVE IS NOT A BUY OR SELL CALL AND IS ONLY A PERSONAL OPINION ARTICLE AS A SHARING TO BSKL COMMUNITY MEMBERS.

Yours Truly,

INVESTHOR

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Investhor's Mighty Hammer of Wisdom

Created by Investhor | Sep 27, 2021

Created by Investhor | Aug 14, 2021

Created by Investhor | Aug 07, 2021

Created by Investhor | Mar 20, 2021

Created by Investhor | Aug 22, 2020

dompeilee

BEDEKMaster looking to steal money from newbies' pockets again LOL!!!

2020-07-05 11:23