Market Chat - 4Q21 Outlook & Strategy - Recovery begins with an ENDemic

MalaccaSecurities

Publish date: Mon, 27 Sep 2021, 11:01 AM

- We believe Covid-19 may turn endemic as more than 80% of the adult population has been vaccinated. That may provide potential economic recovery going forward and we are anticipating some goodies for the construction, tourism, and consumer sectors in the upcoming Budget 2022 to boost the economy.

- Recovery theme play should be interesting under the NRP from 4Q2021 going into 2022 as business activities are likely to return to normalcy by then.

- Also, we like technology and telco on the back of higher adoption for 5G and IoT devices, electric vehicles as well as the 5G rollout story in Malaysia.

Covid-19 status

- Subsiding Covid-19 sub-indicators. Despite the daily cases on the local front still hovering above 15k mark, most of the important indicators such as death toll, hospitalisation rate, ICU occupancy are on a declining trend since two weeks ago.

- Smooth vaccination progress. Nearly 60% of the total population has achieved fully vaccinated status (2 doses), while about 70% of the total population have done at least 1 dose. Meanwhile, Klang Valley (KV) is getting nearer to the 80% mark on the fully vaccinated status.

- Malaysia in gradual recovery mode… Kedah is currently under Phase 1 and most of the states are in Phase 2 and Phase 3. Meanwhile, Labuan and Negeri Sembilan are the regions with Phase 4 status under the National Recovery Plan. PM has announced that offices will be allowed to operate under certain conditions from 17th Sept 2021 if their workforce is 40-60% fully inoculated. Also, interstate travel and tourism activities are allowed when adult vaccination rate is above 90%.

- Crucial 80% target. Although most of the indicators are pointing for a recovery, the downside risk could be the Delta variant. Hence, the 80% fully vaccinated target for Malaysia citizens will be important for the economic recovery going forward. Still, wearing facemasks and social distancing should continue to reduce daily infections.

Economic review and outlook

- The Federal Reserve is less dovish. The Fed maintained its interest rate and asset purchase programme direction, but signals potential interest rate hike by end-2022. However, the next meeting in November may send more clues to future monetary policies. Do note that the Fed is purchasing at least USD120bn of bonds monthly.

- Stimulus packages should be cushioning the downside risks. Over the past 1.5 years, Malaysia has put in efforts releasing stimulus packages, worth roughly RM380bn to support the economy. We opine these measures are able to cushion the downside risk. However, to reboot the economy to the fullest potential we think the government will need to provide more boosters in the upcoming Budget 2022.

- Near term domestic focus. Domestic driven catalysts are likely to be seen in Budget 2022, as the travel borders remained restricted. Thus, higher development expenditure is expected and may benefit the construction sector, while measures or policies related to domestic tourism, automotive and property sectors could be crafted to rekindle the domestic consumption activities.

- Lower expectation on economic growth. In 2020, Malaysia’s GDP contracted -5.6% YoY. Based on Bloomberg consensus, Malaysia’s GDP is projected to grow at a rate of 4.1% and 5.7% in 2021-2022. Do note that MoF has toned down their projections for 2021 to 3-4% (vs. 6.5-7.5% in Budget 2021), and this will be a realistic target as we are coming out of the Covid-19 pandemic environment.

Market review and outlook

- Global markets look overvalued, while the local market is at a discount. The MSCI World Index and S&P500 are trading at 24.2x and 26.7x vs. 10Y avg PE of 19.7x and 19.5x, respectively, while the FBM KLCI is trading at 14.9x PE (10Y avg PE of 17.7x).

- Trading activities slowed down, but foreign funds are returning. YTD average daily trading value (ADTV) dropped 26.2% to RM3.75bn in 2Q21 (1Q21: RM5.08bn). QTD, ADTV has declined further to RM2.85bn. Nevertheless, foreign investors have turned net buyers for the month of August, scooping up RM1.05bn in equities, while MTD registered another RM847.9m of buying flows in the local exchange.

- Big caps were flat, but small caps gained strength. In 3Q21, the FBMKLCI was flat, while FBM Small Cap and FBMACE added 3.0% and 3.1%, respectively. Overall, technology (+23.0%) was the leading sector, followed by the industrial products (+7.7%) sector. Meanwhile, the healthcare and energy sectors lost -13.7% and -9.9% respectively.

- Supercycle commodities are still upward trending. Most of the commodities that have rallied under this Covid-19 pandemic due to shipping disruptions and supply constraints could remain elevated. However, technical readings on Bloomberg Commodity Index might be forming bearish divergence signal.

4Q21 Strategy – Recovery begins with an ENDemic

- Covid-19 induced recession to regain momentum. Economy contracted in 2020, but we opine that the recovery is on its way. With the help of a smooth vaccination drive, 80% of Malaysia’s adult population are fully vaccinated with Covid-19 vaccine and it will be meaningful for businesses to operate under comfortable conditions with less severe Covid-19 conditions. Eventually, rebooting the economic activities in a broader manner and returning to normalcy by 2022.

- Restarting the construction is crucial… Given the international travel restrictions are not uplifted, we expect more infra works to be seen in the upcoming Budget 2022 and that should kick start the economy at least for the domestic front. Also, we favour the building material segment, which is the proxy to the construction sector.

- …and revitalising the domestic economy. While waiting for the international borders to be uplifted, domestic tourism will be important in stimulating the economy. With the Langkawi travel bubble pilot project started recently, we feel the revenge spending is surfacing in a significant manner and that should be a decent catalyst for tourism, aviation and consumer related stocks.

- Technology sector is likely to be the winner. Technology sector continues to rise despite the chip shortages issues globally; the Bursa Technology Index rose 39% YTD. We believe the adoption in 5G and IoT devices, as well as higher demand in electronic gadgets under the Covid-19 environment will remain as the main catalysts for the sector. Meanwhile, the hype in electric vehicles will continue to provide positive sentiment for the sector.

- Progressive 5G rollouts in Malaysia. Malaysia has setup the National 5G Task Force in Nov 2018 and introduced Jalinan Digital Negara (JENDELA) in Aug 2020 to provide wider coverage and better quality of broadband experience for the Rakyat and it was further supported by the Digital Economy Blueprint – MyDIGITAL that focuses on the rollout of 5G technology going forward, where Malaysia’s 5G network and infrastructure across the whole nation will be done by Malaysia’s single wholesale 5G-network operator - Digital Nasional Berhad (DNB).

Sector and stock picks for 2Q21

- Building Materials: OKA, SCGBHD, OMH

- Construction: AME, JAKS

- 5G-related: BINACOM, OCK, ROHAS

- Healthcare: OPTIMAX, SCOMNET

- Plastic/ paper packaging: BPPLAS

- Technology: FRONTKN, GREATEC, KGB, KRONO

- Tourism: GENM, GENTING

- Transport & Logistics: AIRASIA, AIRPORT

AIRASIA – Domestic travel bubble to get the ball rolling

- AIRASIA is the largest multinational low-cost airline headquartered in Malaysia by fleet size and destinations; the group operates scheduled domestic and international flights to more than 165 destinations spanning 25 countries.

- Domestic travel is restarting as 80% of the adult population has taken the Covid-19 vaccine. Langkawi is the first travel bubble pilot project and may extend to various tourism spots going forward, when the Covid-19 vaccination rate hit 90%.

- Waiting the international borders to be uplifted. We expect revenge travelling and spending to return once the Covid-19 subsides and the borders are being uplifted; that should boost the aviation industry to the fullest potential.

JAKS – Renewable energy to take the lead

- JAKS is a medium scale contractor with involvement in the property sector and has diversified recently into power-related sectors that will provide long-term sustainable income for more than 20 years.

- Establishing its footprint in the renewable energy sector through the 2 MoU signed with Qhazanah Sabah and T&T Group in Vietnam to improve long-term earnings visibility through solar, hydro and gas-fired power solutions.

- Tapping into the revival of the construction sector in the upcoming Budget 2022, which expects the rollout of mega infrastructure projects.

OKA – Gaining momentum alongside the construction sector

- OKA engaged in manufacturing and sale of precast concrete products and trading of ready-mixed concrete that are used in the drainage, sewerage, buildings and water related infrastructure works.

- Construction activities to restart. With the smooth vaccination rate, construction activities are restarting in tandem with the NRP and Budget 2022 may provide some booster to the sector, eventually benefiting the building material segment.

- Solid balance sheet and steady dividend paymaster. As of 1Q22, OKA net cash stood at RM48.0m that translates to c.25% of its market cap. OKA has a solid track record in paying dividends and indicated yield stood at 4-5%.

OCK – Firing up both the telco and renewable energy segments

- One of the leading telecommunication network services providers with 4,330 telco sites in ASEAN region and will be leveraging on the infrastructure developments on rollout 5G network in Malaysia.

- Overseas ventures in Myanmar and Vietnam may provide long term and sustainable earnings visibility while undertaking the rapid expansion plans alongside with commitment to drive the towers' tenancy ratio.

- Involvement in green energy as OCK operates 17 solar farms with a combined capacity of 11.3MW in West Malaysia and will participate in large-scale tenders and proposed joint ventures with state governments over the foreseeable future.

SCGBHD – Cables and wires producers for power and communications

- SCGBHD engaged in manufacturing of cables and wires for power distribution and transmission, communications as well as control and instrumentation applications. SCGBHD is expected to transfer to the main market by 4Q21.

- Secured RM30.4m contract from TM. The group has secured a rectifier systems supply contract from TM and to be fulfilled over 30 months from Sept 2021.

- SCGBHD to expand into new products. Although SCGBHD focuses on power cables, they are developing new products into automotive, elevator and communications industries that should bode well with the 5G rollout as well as the EV trend.

KGB – Still riding the semiconductor supercycle

- Ultra High Purity (UHP) specialist, backed by multinational clients and well positioned to leverage on the semiconductor industry supercycle through the newly setup fabrication plant in China.

- Industrial gas to see improvement in utilisation rate pending the Halal certification application for its LCO2 plant to facilitate its plan to penetrate the food and beverage (F&B) segment.

- Record high orderbook of RM902.0m as of Sep-2021 will propel earnings growth over the next 2 years.

KRONO – Cloud services demand may continue to rise

- KRONO provides enterprise data management (EDM) solutions, such as (i) IT infrastructure optimisation and (ii) data protection. They have presence in most of the SEA countries, as well as India, Taiwan, Hong Kong and China.

- Profitable quarters despite Covid-19 pandemic. KRONO only registered one negative quarter in 1Q20, while net profit has normalised over the past two quarters. For 2Q22, it has registered RM5.1m of net profit.

- Acquired remaining stake in Quantum China Ltd (QCL). In May 2021, KRONO will acquire the remaining 83.3% in QCL for RM150m; this acquisition will provide a profit warranty of USD2m and USD2.5m for FY22 and FY23, respectively.

OPTIMAX – Higher foot traffic and surgeries expected

- One of the leading eye specialist services providers that offers a wide range of eye surgeries and services, backed by an extensive network of eye specialist centres.

- Ongoing expansion of eye specialist clinics towards east coast in Peninsular Malaysia and East Malaysia will bring in new resident surgeons and expand customer base, thereby contributing to top and bottom line growths.

- Easing restrictions amid increasing vaccination rate in Malaysia could drive recovery in foot traffic and number of surgeries conducted moving forward.

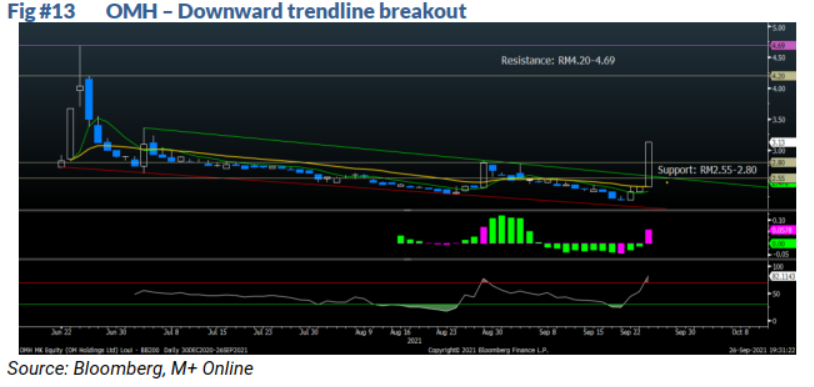

OMH – Benefiting from elevated FeSi and SiMn prices

- OMH engaged in mining and trading raw ores together with the smelting and marketing of processed ferro alloys (ferrosilicon and manganese alloys). Ferro Manganese, Silico-Manganese and Ferrosilicon are used in steel mills and foundries, while Metallic Silicon is used in chemicals, solar and electronics segments.

- Ferrosilicon (FeSi) and Silico-manganese (SiMn) prices rocketed. As China has its energy consumption target for each province and energy intensive industries are now limiting production, translating to lower supply of FeSi and SiMn are affected.

- Benefitting from this supply disruptions environment. We believe OMH has the advantage under this situation, given its production facilities are mainly in Malaysia, coupled with its long-term access to low-cost electricity.

Source: Mplus Research - 27 Sept 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-08-25

CAPITALA2024-08-25

FRONTKN2024-08-25

GENTING2024-08-25

JAKS2024-08-24

GENM2024-08-24

KGB2024-08-23

AME2024-08-23

CAPITALA2024-08-23

CAPITALA2024-08-23

CAPITALA2024-08-23

CAPITALA2024-08-23

GREATEC2024-08-23

GREATEC2024-08-23

KGB2024-08-23

OCK2024-08-23

SCGBHD2024-08-23

SCGBHD2024-08-23

SCGBHD2024-08-23

SCGBHD2024-08-23

SCGBHD2024-08-22

CAPITALA2024-08-22

FRONTKN2024-08-22

FRONTKN2024-08-22

KGB2024-08-22

KGB2024-08-22

ROHAS2024-08-21

CAPITALA2024-08-21

KGB2024-08-20

AIRPORT2024-08-20

FRONTKN2024-08-20

GENTING2024-08-20

OCK2024-08-20

OCK2024-08-20

OCK2024-08-20

SCOMNET2024-08-19

AIRPORT2024-08-19

AIRPORT2024-08-19

AME2024-08-19

BINACOM2024-08-19

FRONTKN2024-08-19

GENTING2024-08-19

SCOMNET2024-08-16

AIRPORT2024-08-16

AME2024-08-16

AME2024-08-16

AME2024-08-16

FRONTKN2024-08-16

FRONTKN2024-08-16

FRONTKN2024-08-16

GENM2024-08-16

GENM2024-08-16

GENTING2024-08-16

GENTING2024-08-16

OCK2024-08-15

AME2024-08-15

AME2024-08-15

FRONTKN2024-08-15

FRONTKN2024-08-15

FRONTKN2024-08-15

FRONTKN2024-08-15

KGB2024-08-15

KGB2024-08-14

FRONTKN2024-08-14

FRONTKN2024-08-14

GENTINGMore articles on M+ Online Research Articles

Created by MalaccaSecurities | Aug 21, 2024

Created by MalaccaSecurities | Aug 19, 2024

Discussions

D) AND BETWEEN THIS TIME IS COLD COLD WINTER

Bank of America forecast this will be a Very Cold Winter & OIL will Spike Up to USD100 per barrel

See

Sept 13 (Reuters) - Bank of America Global Research said it could bring forward its $100 per barrel oil price target to the next six months from mid-2022 if the winter is colder than usual, potentially driving a surge in demand and widening a supply deficit.

BRENT OIL ALMOST USD80 NOW

WILL TRIGGER BIODIESEL ENGINE

BOOST SOYBEAN & PALM OIL FOR BIODISEL : UP UP & UP

DON'T MISS JTIASA NOW

https://klse.i3investor.com/blogs/www.eaglevisioninvest.com/2021-09-23...

2021-09-28 10:42

Yes buy palmoil stock loh!

Palm oil Sustained good prospect with undervalued share price

Posted by calvintaneng > Sep 28, 2021 10:42 AM | Report Abuse

D) AND BETWEEN THIS TIME IS COLD COLD WINTER

Bank of America forecast this will be a Very Cold Winter & OIL will Spike Up to USD100 per barrel

See

Sept 13 (Reuters) - Bank of America Global Research said it could bring forward its $100 per barrel oil price target to the next six months from mid-2022 if the winter is colder than usual, potentially driving a surge in demand and widening a supply deficit.

BRENT OIL ALMOST USD80 NOW

WILL TRIGGER BIODIESEL ENGINE

BOOST SOYBEAN & PALM OIL FOR BIODISEL : UP UP & UP

DON'T MISS JTIASA NOW

2021-09-28 10:45

.png)

penglum

pls remove this

2021-09-27 17:19