Mplus Market Pulse - 26 Apr 2022

MalaccaSecurities

Publish date: Tue, 26 Apr 2022, 08:39 AM

Uncertainty persists

Market Review

Malaysia:. The FBM KLCI (-0.8%) snapped a 3-day winning streak as volatility strikes alongside with the weakness across the regional markets. The lower liners were also downbeat, while the plantation sector (+2.9%) was the sole winner against the negative broader market.

Global markets:. Wall Street rebounded as the Dow (+0.7%) rose after recovering from its intraday low on bargain hunting activities ahead of the corporate earnings releases from technology giants later this week. The European stock markets also remained downbeat, while Asia stock markets ended mostly lower.

The Day Ahead

The FBM KLCI skidded below the key 1,600 level as selling pressure dominated the local bourse amid bearish regional sentiment driven by concerns over China’s Covid-19 situation and anticipation on more hawkish interest rate hikes tone in the US by the Feds. While bargain hunting activities may emerge following yesterday’s decline, we expect investors’ sentiment to remain wary and upside on the FBM KLCI could be limited around 1,600 for now. Still, we are optimistic on the recovery themed sectors on the back of declining Covid-19 daily confirmed cases. On the commodities, the crude oil price is hovering above USD100, while the FCPO traded above RM6,200.

Sector focus:. We expect the Indonesia’s ban on palm oil related products should continue to benefit the plantation sector over the near term. Investors may position themselves within the sector ahead of the stronger earnings season due to elevated FCPO prices in 1Q22. Besides, we may see mild bargain hunting activities in the technology sector, riding on Nasdaq’s rebound.

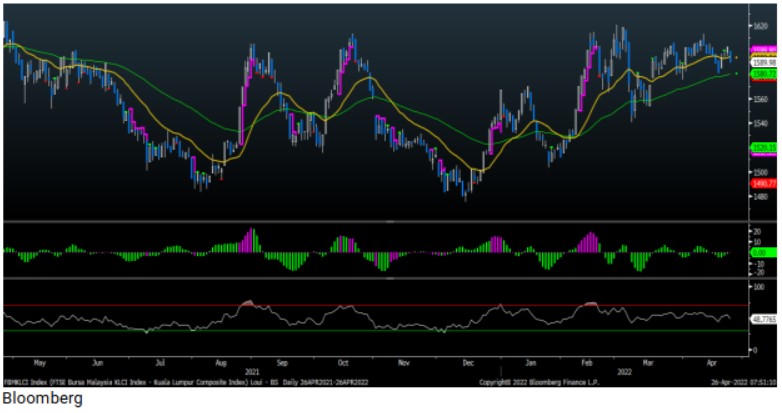

FBMKLCI Technical Outlook

The FBM KLCI snapped a three-session winning streak, turning away from the key 1,600 resistance and closed below its daily EMA20 level. Technical indicators turned negative as MACD Histogram is below zero, while the RSI crossed below 50. Resistance is set at 1,600-1,620, while the support is located at 1,580.

Company Brief

Fraser and Neave Holdings Bhd’s (F&N) indirect 65.0% owned subsidiary, Dagang Sejahtera Sdn Bhd (DSSB), is acquiring the entire shares in Ladang Permai Damai Sdn Bhd for RM215.6m cash. Ladang Permai Damai is principally engaged in the cultivation of oil palm, processing of fresh fruit bunches and marketing of crude palm oil, palm kernel and fresh fruit bunches. The intention for DSSB in acquiring Ladang Permai Damai is for the F&N group to embark on the upstream fresh milk business for downstream production and distribution of fresh milk. (The Star)

Ireka Corp Bhd’s external auditors Messrs Crowe Malaysia PLT has submitted its resignation to the company. Messrs Crowe explained that their resignation was due to Crowe's lack of sufficient resources to perform their auditing services throughout their clientele. (The Star)

Capital A Bhd's wholly-owned aircraft maintenance, repair and overhaul unit Asia Digital Engineering (ADE) has announced its newly-formed board of directors. The board includes Berjaya Corp Bhd independent non-executive director Datuk Hisham Othman, who has been appointed ADE chairman to oversee the firm's future strategy of becoming a leading aircraft MRO firm in Southeast Asia. (The Edge)

Sime Darby Property Bhd is ready to launch Phase 3B of the Battersea Power Station project in 2022. The Battersea Power Station project in Central London is showing promising prospects, with crowds returning to the development for summer. Sime Darby holds 40.0% of the joint-venture development project and it is currently chairing the venture. (The Edge)

Telekom Malaysia Bhd (TM) has committed to expanding its fibre network to an additional 6.0m premises by the end of 2022 under the National Digital Network (Jendela). This is part of TM's focus on helping the country rebuild and recover from the pandemic in the coming years, and the main measure to achieve this is by intensifying its national digitalisation efforts. (The Edge)

Petronas Dagangan Bhd (PetDag) is working closely with the Ministry of Finance (MoF) on the increase of fuel subsidy bill amid near-record high crude oil prices. The downstream oil and gas group understands the current predicament with the high global oil prices that is impacting the country and every other nation. (The Edge)

Urusharta Jamaah Sdn Bhd (UJSB) has disposed of its entire stake in Integrated Logistics Bhd and ceased to be a substantial shareholder of the group. UJSB disposed of 20.5m shares or a 10.8% stake in the company on 20th April 2022. (The Edge)

ES Ceramics Technology Bhd’s 3QFY22 net profit increased 41.2% YoY to RM12.0m, helped by higher sales output from the additional production capacity. Revenue for the quarter rose 30.1% YoY to RM29.4m. (The Edge)

Press Metal Aluminium Holdings Bhd’s Sarawak subsidiary has reached an amicable settlement with the Inland Revenue Board in respect of additional assessments for the years 2014 to 2019. Press Metal Bintulu Sdn Bhd reached a final settlement of RM26.7m based on a letter received from the IRB dated 22nd April 2022. (The Edge)

Divfex Bhd has announced that its group chief executive officer Kenny Chin Wui Chee has been redesignated as its executive director. Chin's redesignation takes effect on 25th April 2022. He was appointed as Divfex CEO on 10th August 2020. (The Edge)

Texchem Resources Bhd’s 1QFY22 net profit jumped 97.2% YoY to RM13.1m, mainly on stronger contribution from its food and restaurant divisions. Revenue for the quarter rose 15.3% YoY to RM307.5m. (The Edge)

Mr DIY Group (M) Bhd has proposed a bonus issue of up to 3.14bn shares on the basis of 1 bonus share for every 2 shares held. The entitlement dates for the bonus issues will be determined later. (The Edge)

IHH Healthcare Bhd unit Fortis Healthcare Ltd, has received a final order from the Indian regulators to recover 397.1 crore rupees (RM225.0m) with interest, which is said to be diverted from the Fortis group for the benefit of its former controlling shareholders. The Securities and Exchange Board of India (SEBI) also imposed a penalty of 1.0 crore rupees (RM567,000) and 50.0 lakh rupees (RM284,000) on Fortis and its wholly-owned unit Fortis Hospitals Ltd respectively. (The Edge)

Destini Bhd is seeking shareholders' approval to diversify into renewable energy business and related activities. Destini has identified solar energy as viable businesses to venture into, in line with its strategy to diversify and create an additional income stream. (The Edge)

Caely Holdings Bhd has reported that 2 of its independent directors, Datuk Seri Mazlan Lazim and Noor Azri Azerai, have resigned from the board to pursue other opportunities. The two had a rather short stint on the troubled lingerie company's board, as both were appointed only about a month ago. (The Edge)

TWL Holdings Bhd is buying 8,479-sqm piece of land in Seri Kembangan, Selangor for RM13.9m, with an intention to develop the land into a residential project with a gross development value of RM84.3m. The proposed acquisition is in line with the group’s business strategy of focusing on the construction and property development segments. (The Edge)

CTOS Digital Bhd has upped its shareholding in RAM Holdings Bhd to 17.2% by buying out the collective 9.1% stakes owned by OCBC Bank (M) Bhd, Affin Bank Bhd and Affin Hwang Investment Bank Bhd (Affin Hwang IB) for RM25.1m, cash. CTOS has inked share purchase agreements on 4th February 2022 and 25th April 2022 to acquire 910,000 RAM shares. (The Edge)

Jadi Imaging Holdings Bhd has received conditional approval from the Ministry of Health (MoH) to distribute Covid-19 Antigen self-test kits (saliva) manufactured by Dyna Source Sdn Bhd in Malaysia. Dyna Source is a registered company with MDA and holds a Good Distribution Practice for Medical Devices certification. (The Edge)

After much hype about setting up the first artificial intelligence (AI) park in Malaysia, the Memorandum of Understanding (MoU) signed between G3 Global Bhd and two Chinese companies has finally lapsed on 25th April 2022. G3 Global insisted that it remains committed to the vision for the development of an AI park. (The Edge)

Source: Mplus Research - 26 Apr 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-17

CAPITALA2024-11-17

MRDIY2024-11-16

MRDIY2024-11-16

TWL2024-11-15

BJCORP2024-11-15

CTOS2024-11-15

CTOS2024-11-15

DFX2024-11-15

F&N2024-11-15

IHH2024-11-15

IHH2024-11-15

IHH2024-11-15

IHH2024-11-15

MRDIY2024-11-15

MRDIY2024-11-15

MRDIY2024-11-15

MRDIY2024-11-15

MRDIY2024-11-15

MRDIY2024-11-15

MRDIY2024-11-15

MRDIY2024-11-15

PETDAG2024-11-15

PETDAG2024-11-15

PETDAG2024-11-15

PMETAL2024-11-15

SIMEPROP2024-11-15

TM2024-11-15

TM2024-11-15

TM2024-11-15

TM2024-11-14

CAPITALA2024-11-14

F&N2024-11-14

IHH2024-11-14

IHH2024-11-14

IHH2024-11-14

MRDIY2024-11-14

MRDIY2024-11-14

MRDIY2024-11-14

MRDIY2024-11-14

PETDAG2024-11-14

PETDAG2024-11-14

SIMEPROP2024-11-14

SIMEPROP2024-11-14

SIMEPROP2024-11-14

SIMEPROP2024-11-14

TM2024-11-14

TM2024-11-14

TM2024-11-14

TWL2024-11-13

CAPITALA2024-11-13

CAPITALA2024-11-13

CAPITALA2024-11-13

CAPITALA2024-11-13

CTOS2024-11-13

CTOS2024-11-13

CTOS2024-11-13

F&N2024-11-13

F&N2024-11-13

IHH2024-11-13

IHH2024-11-13

IHH2024-11-13

IHH2024-11-13

MRDIY2024-11-13

MRDIY2024-11-13

PETDAG2024-11-13

PETDAG2024-11-13

PMETAL2024-11-13

PMETAL2024-11-13

TM2024-11-13

TM2024-11-13

TM2024-11-12

CTOS2024-11-12

CTOS2024-11-12

CTOS2024-11-12

CTOS2024-11-12

CTOS2024-11-12

CTOS2024-11-12

CTOS2024-11-12

DESTINI2024-11-12

DESTINI2024-11-12

DESTINI2024-11-12

DESTINI2024-11-12

F&N2024-11-12

F&N2024-11-12

F&N2024-11-12

IHH2024-11-12

IHH2024-11-12

IHH2024-11-12

IHH2024-11-12

IHH2024-11-12

MRDIY2024-11-12

MRDIY2024-11-12

MRDIY2024-11-12

MRDIY2024-11-12

PETDAG2024-11-12

PETDAG2024-11-12

SIMEPROP2024-11-12

SIMEPROP2024-11-12

SIMEPROP2024-11-12

SIMEPROP2024-11-12

TEXCHEM2024-11-12

TM2024-11-12

TM2024-11-12

TM2024-11-12

TM2024-11-11

CAPITALA2024-11-11

CAPITALA2024-11-11

CTOS2024-11-11

CTOS2024-11-11

DESTINI2024-11-11

ESCERAM2024-11-11

F&N2024-11-11

F&N2024-11-11

IHH2024-11-11

IHH2024-11-11

IHH2024-11-11

IHH2024-11-11

MRDIY2024-11-11

PETDAG2024-11-11

PETDAG2024-11-11

SIMEPROP2024-11-11

SIMEPROP2024-11-11

TM2024-11-11

TM2024-11-11

TM2024-11-11

TM2024-11-08

CTOS2024-11-08

F&N2024-11-08

F&N2024-11-08

IHH2024-11-08

IHH2024-11-08

IHH2024-11-08

IHH2024-11-08

IHH2024-11-08

IHH2024-11-08

IREKA2024-11-08

MRDIY2024-11-08

PETDAG2024-11-08

SIMEPROP2024-11-08

SIMEPROP2024-11-08

TM2024-11-08

TM2024-11-08

TM2024-11-08

TM2024-11-08

TWL2024-11-07

CTOS2024-11-07

CTOS2024-11-07

CTOS2024-11-07

CTOS2024-11-07

F&N2024-11-07

F&N2024-11-07

F&N2024-11-07

F&N2024-11-07

F&N2024-11-07

F&N2024-11-07

IHH2024-11-07

IHH2024-11-07

IHH2024-11-07

IHH2024-11-07

MRDIY2024-11-07

MRDIY2024-11-07

PETDAG2024-11-07

PETDAG2024-11-07

SIMEPROP2024-11-07

SIMEPROP2024-11-07

SIMEPROP2024-11-07

TM2024-11-07

TM2024-11-07

TM2024-11-07

TM2024-11-06

BJCORP2024-11-06

CTOS2024-11-06

CTOS2024-11-06

CTOS2024-11-06

CTOS2024-11-06

F&N2024-11-06

F&N2024-11-06

F&N2024-11-06

F&N2024-11-06

F&N2024-11-06

F&N2024-11-06

F&N2024-11-06

F&N2024-11-06

F&N2024-11-06

F&N2024-11-06

F&N2024-11-06

IHH2024-11-06

IHH2024-11-06

IHH2024-11-06

IHH2024-11-06

IHH2024-11-06

MRDIY2024-11-06

MRDIY2024-11-06

PETDAG2024-11-06

PETDAG2024-11-06

SIMEPROP2024-11-06

SIMEPROP2024-11-06

SIMEPROP2024-11-06

SIMEPROP2024-11-06

SIMEPROP2024-11-06

SIMEPROP2024-11-06

TM2024-11-06

TM2024-11-06

TM2024-11-06

TM2024-11-05

DESTINI2024-11-05

F&N2024-11-05

F&N2024-11-05

IHH2024-11-05

IHH2024-11-05

IHH2024-11-05

IHH2024-11-05

IHH2024-11-05

IHH2024-11-05

PETDAG2024-11-05

PETDAG2024-11-05

SIMEPROP2024-11-05

SIMEPROP2024-11-05

SIMEPROP2024-11-05

TM2024-11-05

TM2024-11-05

TM2024-11-05

TM2024-11-05

TM2024-11-05

TM2024-11-05

TM2024-11-05

TM2024-11-05

TMMore articles on M+ Online Research Articles

Created by MalaccaSecurities | Nov 15, 2024