Mplus Market Pulse - 27 Apr 2022

MalaccaSecurities

Publish date: Wed, 27 Apr 2022, 12:00 AM

Still flirting along 1,600

Market Review

Malaysia:. The FBM KLCI (+0.4%) recovered some of its previous session losses as bargain hunting activities emerged in more than two-thirds of the key index components yesterday. The lower liners also rebounded, while the plantation (- 0.7%) and property (-0.01%) sectors underperformed the positive broader market.

Global markets:. Wall Street took a beating as the Dow (-2.4%) sank on sluggish corporate earnings from General Electric Co (-10.3%), while Tesla Inc (-12.2%) plunged after Elon Musk agreed to purchase Twitter Inc (-3.9%). The European stock markets ended mostly lower, while Asia stock markets closed mixed.

The Day Ahead

The FBM KLCI staged a rebound amidst mixed regional market, powered by bargain hunting activities following Monday’s decline. However, we anticipate a further downside risk on the local bourse following the steep slide on Wall Street overnight, especially within the technology sector. Meanwhile, investors may position themselves in companies with solid earnings prospects ahead of the earnings season. The FCPO was traded above RM6,400, while the crude oil price sustained above USD100.

Sector focus:. Investors may position themselves within the plantation and oil & gas sectors while waiting for the earnings season in view of elevated commodity prices. Meanwhile, the technology stocks may be caught in a rout following the steep selldown in Nasdaq overnight. Besides, we may look into the consumer and banking related stocks in view of the reopening of travel borders.

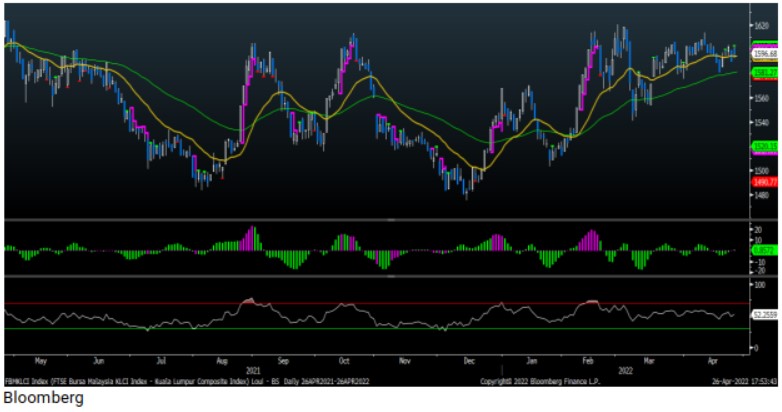

FBMKLCI Technical Outlook

The FBM KLCI rebounded back above the daily EMA9 lavel, albeit volatility remained in place. Technical indicators are more encouraging as the Histogram has turned into a positive bar, while the RSI is hovering above the 50 level. The next support level is located at 1,580, while the resistance is pegged along 1,600-1,620.

Company Brief

United Plantations Bhd’s (UP) 1QFY22 net profit fell 20.2% YoY to RM59.7m, due to a windfall tax of RM20.4m. Revenue for the quarter, however, increased 60.9% YoY to RM642.9m. (The Star)

Comintel Corp Bhd has secured a subcontract worth RM33.8m from Pertama Makmur Sdn Bhd for the construction of an office and training centre (design and build) for a government department. The subcontract shall commence on 7th June 2022 and to be completed within 20 months. (The Star)

Malayan Flour Mills Bhd (MFM) is working on a price adjustment proposal among several measures to mitigate business uncertainties due to volatile commodity prices, as the global economy contends with the lingering impact of Covid-19- driven movement restrictions. The group is also mindful of the effects from the ongoing Ukraine geopolitical situation and the potential unfavourable impact of global weather on its business. (The Edge)

Malaysia Airports Holdings Bhd (MAHB) is to issue a combined RM800.0m worth of Islamic medium-term notes (IMTN) on 27th April 2022. The IMTN will be issued in 2 tranches under the group’s RM5.00bn sukuk wakalah programme. (The Edge)

Bintai Kinden Corporation Bhd has secured a series of subcontract projects worth RM1.6m from Petro Flanges & Fittings Sdn Bhd (PFF). The contracts were awarded to its subsidiary Bintai Energy Sdn Bhd to supply pipes, valves, fittings and flanges for onshore and offshore pipeline projects to established oil and gas related companies in Malaysia. (The Edge)

Nestlé (Malaysia) Bhd’s 1QFY22 net profit grew 17.1% YoY to RM205.2m, underpinned by stronger sales, coupled with lower Covid-19 related expenses. Revenue for the quarter rose 16.9% YoY to RM1.69bn. (The Edge)

Westports Holdings Bhd’s 1QFY22 net profit fell 27.1% YoY to RM151.9m, no thanks to the one-off prosperity tax in 2022, and the absence of other income of RM20.0m recognised in 1QFY21. Revenue for the quarter, however, rose 1.6% YoY to RM516.4m. (The Edge)

KPower Bhd has proposed to acquire the entire stake in hydro power plant developer One River Power for RM130.0m, to be satisfied via a combination of cash and issuance of new shares in the group. One River Power is principally involved in the development of three hydro power plants based in Sabah, with a total combined power generation of 29.1-MW. (The Edge)

Country Heights Holdings Bhd (CHHB) intends to invest about RM250.0m in capital expenditure for the next 5 years, following its partnership with Beijing Wodong Tianjun Information Technology Co Ltd (JD.com) to develop an omnichannel business model in Malaysia. The group had allocated RM50.0m funding for the initial expenditure of the first flagship physical store, spanning 150,000 sqf of retail space on the ground floor of the Mines International Exhibition and Convention Centre (MIECC). (The Edge)

Thong Guan Industries Bhd aims to at least double its annual revenue to reach RM2.00bn by the end of 2027. To get there, the group has laid out a 6-year (2021- 2026) expansion plan to ramp up production capacity at its new 16.0-ac manufacturing and office complex in Sungai Petani. (The Edge)

Parkson Holdings Bhd has reported that the number of owned and managed stores shrink to 85 from 102, but remains positive about its China retail operations' prospects, although Covid-19 containment measures and inflationary pressures remain a concern for the group's Southeast Asian business. (The Edge)

Cycle & Carriage Bintang Bhd’s 1QFY22 net profit jumped 152.2% YoY to RM8.6m, on higher vehicle sales volume that was helped by Malaysia's sales tax reduction. Revenue for the quarter rose 2.9% YoY to RM300.0m. (The Edge)

Sime Darby Plantation Bhd (SDP) has submitted a comprehensive report to the US Customs and Border Protection over forced labour claims against the planter. The report included a detailed assessment of its Malaysian operations mapped against each of the International Labour Organisation forced labour indicators; an in-depth description of improved governance structures and management systems; copies of policies, guidelines and standard operating procedures; details of facilities at SDP's operating units; corresponding supporting evidence; and independent reports from third party consultants appointed by SDP to assess various aspects of its operations. (The Edge)

AmFIRST Real Estate Investment Trust (AmFIRST REIT) is booking a fair value loss of RM22.0m following the revaluation of several properties, in line with regulatory requirements. Wisma AmFIRST reported the largest revaluation deficit at RM4.6m, followed by Prima 10 (RM3.8m), Jaya 99 (3.8m), Mydin Hypermall (RM3.1m), Menara AmFIRST (RM1.6m), The Summit Subang USJ (RM1.4m) and Prima 9 (RM188,798). On the other hand, Bangunan AmBank Group and Menara Ambank reported revaluation surpluses of RM500,000 and RM227,921 respectively. (The Edge)

Globetronics Technology Bhd’s 1QFY22 net profit fell 24.7% YoY to RM9.5m, due to lower volume loadings. Revenue for the quarter dropped 23.0% YoY to RM42.6m. (The Edge)

Source: Mplus Research - 27 Apr 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-17

AIRPORT2024-11-17

PARKSON2024-11-16

BINTAI2024-11-16

UTDPLT2024-11-15

AIRPORT2024-11-15

GTRONIC2024-11-15

NESTLE2024-11-15

RENEUCO2024-11-15

SDG2024-11-15

SDG2024-11-15

SDG2024-11-15

SDG2024-11-15

SDG2024-11-15

SDG2024-11-15

SDG2024-11-15

SDG2024-11-15

SDG2024-11-15

SDG2024-11-15

UTDPLT2024-11-15

WPRTS2024-11-15

WPRTS2024-11-15

WPRTS2024-11-15

WPRTS2024-11-15

WPRTS2024-11-14

NESTLE2024-11-14

NESTLE2024-11-14

SDG2024-11-14

SDG2024-11-14

UTDPLT2024-11-14

UTDPLT2024-11-14

UTDPLT2024-11-14

UTDPLT2024-11-14

UTDPLT2024-11-14

UTDPLT2024-11-14

UTDPLT2024-11-14

WPRTS2024-11-14

WPRTS2024-11-14

WPRTS2024-11-14

WPRTS2024-11-13

NESTLE2024-11-13

SDG2024-11-13

SDG2024-11-13

SDG2024-11-13

SDG2024-11-13

UTDPLT2024-11-13

UTDPLT2024-11-13

UTDPLT2024-11-13

WPRTS2024-11-13

WPRTS2024-11-13

WPRTS2024-11-13

WPRTS2024-11-12

NESTLE2024-11-12

NESTLE2024-11-12

SDG2024-11-12

SDG2024-11-12

UTDPLT2024-11-12

WPRTS2024-11-12

WPRTS2024-11-12

WPRTS2024-11-12

WPRTS2024-11-11

UTDPLT2024-11-11

WPRTS2024-11-11

WPRTS2024-11-11

WPRTS2024-11-11

WPRTS2024-11-11

WPRTS2024-11-11

WPRTS2024-11-11

WPRTS2024-11-11

WPRTS2024-11-11

WPRTS2024-11-11

WPRTS2024-11-08

BNASTRA2024-11-08

NESTLE2024-11-08

SDG2024-11-08

SDG2024-11-08

SDG2024-11-08

SDG2024-11-08

SDG2024-11-08

SDG2024-11-08

UTDPLT2024-11-08

WPRTS2024-11-08

WPRTS2024-11-08

WPRTS2024-11-07

PARKSON2024-11-07

PARKSON2024-11-07

UTDPLT2024-11-07

UTDPLT2024-11-07

UTDPLT2024-11-07

WPRTS2024-11-07

WPRTS2024-11-06

NESTLE2024-11-06

SDG2024-11-06

SDG2024-11-06

SDG2024-11-06

SDG2024-11-06

UTDPLT2024-11-06

UTDPLT2024-11-06

UTDPLT2024-11-05

AIRPORT2024-11-05

AIRPORT2024-11-05

BINTAI2024-11-05

BINTAI2024-11-05

BINTAI2024-11-05

BINTAI2024-11-05

BNASTRA2024-11-05

NESTLE2024-11-05

NESTLE2024-11-05

SDG2024-11-05

SDG2024-11-05

SDG2024-11-05

SDG2024-11-05

SDG2024-11-05

SDG2024-11-05

SDG2024-11-05

UTDPLT2024-11-05

WPRTSMore articles on M+ Online Research Articles

Created by MalaccaSecurities | Nov 15, 2024