Stocks Screening - watch list

Hiu Chee Keong

Publish date: Sat, 16 Apr 2016, 10:18 AM

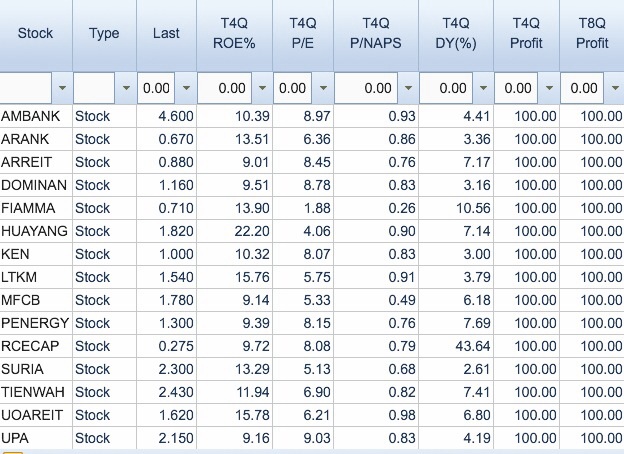

I run through a stock screening at klse.my with some strict rules :

stock price below RM5, PE below 10, Div above 2%, ROE above 9%, P.Book below 1, profit making and give out dividend for last 5 years. Last 8 quarter also in positive profit. Here the result :

Note, this is not a buy call, as this is just base on past result, haven't check estimate PE, PEG, major share holders, target price yet. But some of it i certainly will keep in my watch list, and buy some when market is in bargain again.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2025-02-04

AMBANK2025-02-04

AMBANK2025-02-04

AMBANK2025-02-04

AMBANK2025-02-04

AMBANK2025-02-04

AMBANK2025-02-04

ARREIT2025-02-03

AMBANK2025-02-03

AMBANK2025-02-03

AMBANK2025-02-03

AMBANK2025-02-03

AMBANK2025-02-03

KEN2025-02-03

KEN2025-02-03

KEN2025-02-03

KEN2025-02-03

KEN2025-02-03

KEN2025-02-03

KEN2025-02-03

KEN2025-02-03

KEN2025-02-03

KEN2025-02-03

KEN2025-02-03

KEN2025-02-03

KEN2025-01-31

AMBANK2025-01-31

AMBANK2025-01-31

AMBANK2025-01-31

RCECAP2025-01-28

AMBANK2025-01-28

AMBANK2025-01-28

AMBANK2025-01-27

AMBANK2025-01-27

AMBANK2025-01-27

AMBANK2025-01-27

ARREIT2025-01-27

ARREIT2025-01-27

ARREITMore articles on My trading

Created by Hiu Chee Keong | Jul 12, 2017

Created by Hiu Chee Keong | May 10, 2017

Created by Hiu Chee Keong | Jan 10, 2017

Discussions

RCECAP and FIAMMA DY so high probably bcos some on time event like capital payback or bonus after selling some assets, and klse.my counted it in ad DY, Need further investigation.

I have sold ambank and penergy after gain 10%+, still keep huayang bcos good dividend. Has queye arreit quite some times but havent get it.

2016-04-16 13:50

The list is not fully updated the latest development of the corporate exercises i.e. DY for Fiamma is only about 3.5% after taking into account subdivision and bonus issue.

2016-04-16 14:45

Up_down, yes, klse.my sometime lag in updating latest info. I will use it just as base and do more research on other sources. Normally i will check at least two sources.

2016-04-16 16:26

Icon8, at 3.5%, still not bad, and still meet my screening criterion. But i wont buy at current price, maybe if later market in bargain again, and it fall to 0.60 then only i will consider, at better risk reward ratio. If tomorrow oil production countries meeting fail, then oppurtunita arise again.

2016-04-16 17:26

A good one. Hope some more good ones like this to come.

Agree w you that klse lags sometimes. Care to share what are the two sources you will refer to? Thanks.

2016-04-17 11:29

King36, another very good source i use is bursamarketplace.com, it has a lot of valueable information, included all the research reports from most of the research firms. and, of course, here, this investor.com here.

2016-04-17 12:21

hi chee keong, great to see your list has some similarities with mine http://www.isaham.my/screener/value-investing

2016-04-17 21:22

Azhakha, what is the total score means ? The more the better or the less the better ?

2016-04-17 21:35

Short answer, yes. Click on each stock name to know the total score breakdown.

2016-04-17 21:41

Azhakha, thanks for the link. Now only i know isaham.my, ther did proivde some valuable information that i cant get from klse.my and bursamarketplace.com.

2016-04-17 21:56

Icon8

I own 2 stocks in above list ie HuaYang and Penergy which has DY above 7%. Doubtful on Fiamma and RCECap DY going forward.

http://klse.i3investor.com/servlets/pfs/54604.jsp

2016-04-16 11:33