(CHOIVO CAPITAL) OSK, Should you buy the warrants or the share?

Choivo Capital

Publish date: Thu, 19 Jul 2018, 08:05 PM

OSK is one of the companies i think is quite interesting now, and am buying a little bit. However, i caught myself asking the question, which is more worth it? The Warrant or the stock?

Below is my calculation and thought process

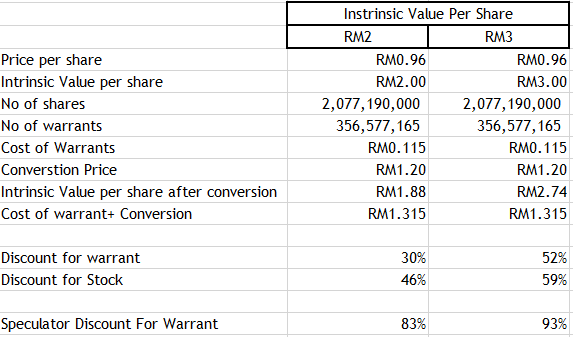

We first assume intrinsic value of the share to be RM2 and RM3.

As we can see here, for most investors other than Ong Leong Huat, the stock represent more value at 46% discount to intrinsic value (assuming RM2) and 59% (assuming RM3). While the warrant's discount is only 30% and 52% respectively.

Now, if one were to assume the intrinsic value is RM4, i think the discount for the warrant will exceed those of the stock, but i dont think the stock is worth anywhere near RM4.

Why do i say other than OLH?

Well, assuming OLH thinks the share is worth much more than what is traded (which he does), he would want to buy more shares, but given the low amount of public float, he is unlikely to be able to buy much, without pushing the price (and thus his cost) up considerably.

As he has roughly 149 million warrants, regardless of where the price is, it represents a great opportunity for him to buy 149 million shares, without pushing the price up!

Of course, this calculation is for people with a long term investment mindset, and would actually want to convert the warrants. And not so much be relying on the goreng factor or prediction of future price.

Speculator Calculation.

For a speculator, you may want to take into consideration the potential goreng factor, if the price goes up to say RM1.5 or RM2.

Or, you may also want to consider the speculator discount on the warrant.

For RM0.115 per warrant, you are able to buy the option to purchase the discount between the instrinsic value of the share after conversion and the conversion price!

For example,

RM2 Intrinsic value:

The difference between the intrinsic value of the share after conversion and the conversion price is RM0.68. And you only need to pay RM0.115 for the option to purchase this. Giving rise to a discount of 83%!

RM3 Intrinsic value:

The difference between the intrinsic value of the share after conversion and the conversion price is RM1.54. And you only need to pay RM0.115 for the option to purchase this. Giving rise to a discount of 93%!

Clearly quite lucrative, espeacially since you have till 22 July 2020, or 2 more years, for this discount to contract to near intrinsic value, even temporarily, and for you to take your profit.

But that could very well not happen, China debt is incredibly heavy, and recently a government linked company, fell, bringing down USD11 billion worth of debt.

Interest rates around the world are rising, and US, Canadian, Australian and Hong Kong businesses and homeowners are overleveraged and may very well not be able to pay if interest rise futher, causing them to forfeit and trigger a crisis.

If you dont get the chance for you to convert, or worse if we fall into crisis. You will end up with zero.

Conclusion

Well, i know what i'm buying. Let me know what you think, or if you think i am wrong or coming from a different perspective.

====================================================================

Facebook: Choivo Capital

Website: www.choivocapital.com

Email: choivocapital@gmail.com

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Choivo Capital

Created by Choivo Capital | Dec 09, 2020

Created by Choivo Capital | Dec 05, 2020

Created by Choivo Capital | Nov 09, 2020

Created by Choivo Capital | Nov 09, 2020

Created by Choivo Capital | Nov 03, 2020

Discussions

Jon Choivo, how to hold for 50 years if you are holding the warrants...? Remember your topic is : should you buy warrants or shares...?

2018-07-19 22:00

Never said i was buying the warrants. :)

but it is a potentially lucrative punt. EV should be positive.

2018-07-19 22:03

Talk like kids. Auditor think they know everything....They never know 人心难测

2018-07-19 23:02

Ya.. alot auditor think sendiri know everything liao.. think gt acca then banyak hebat liao.. in the end.. aizzzzzz mah need to work like dog

2018-07-19 23:05

@paperplane Kindly refrain from bashing other ppl when you have Ekovest as stock of the year

2018-07-19 23:09

pls mind yr term, conversion price = exercise price of warrant, which is a fixed price!

2018-07-19 23:21

You calculate wrong.

lets say price does not move for 80 years. But the dividend remains at 6.2%. All dividend is reinvested. Say i invest Rm20,000.

By the end of 80 years, i would have RM2,115,920. 105,800% return. Not a bad result at all.

Considering the goal is to,

1) Not lose money

2) Not forget rule no 1.

For a guy with ben graham as your dp, you seem to have forgotten that.

On your ekovest, your highway makes net after interest RM8mil, you sure the whole highway worth Rm2.8 bil boh? at that price 477 P/E for the highway or 0.02% return.

Tbf, there is a really good chance that mcuh of the debt is not yet utilized for duke 3 etc. but still... :)

===================================================================================

paperplane 80 yrs for 200% return, smart or not smart???

19/07/2018 23:02

2018-07-19 23:40

Please, ACCA is for noobs. Hahaha. I come with a higher power.

If you think all auditors are like me, your opinion of an auditor in general is far too high. :)

Most auditors are actually like the general i3 population, gamblers in the market, often failing their calculation of odds and EV completely.

At best, the companies they buy wont go bankrupt, they just fail really badly at the valuation. And suffer permanent loss of capital. They are also often not good judges of quality and moat of business, unless this is a topic they are interested in.

===================================================================================

targetinvest Ya.. alot auditor think sendiri know everything liao.. think gt acca then banyak hebat liao.. in the end.. aizzzzzz mah need to work like dog

19/07/2018 23:05

2018-07-19 23:46

U do one KPS value and EV and let everyone see ur level until where la

2018-07-20 00:03

all financial ratio has got no meaning if management now willing to take care of shareholders la

2018-07-20 00:04

although dividend is high, there must be growth,

if not , i just buy annjoo 0.19/RM2.14 = 8.88% dividend yield @ 50% payout ratio and PE of below 6x

2018-07-20 00:08

Jayc, is olh a shareholder or not a shareholder? He never take care of himself, is that what you're saying?

Target, no idea what you're saying.

2018-07-20 00:09

Annjoo, owes 800mil to the bank. The current earning they have is due to tariffs and China cutting down capacity.

Given their record earnings, they will still need at least 4 years to payback the debt.

Entreprise value over earnings is about 10 times.

I think paying 10 times record earnings for a steel company wit zero moat is a fools errand once expected value over the long term is taken into consideration.

A possible punt though, but I'm too lazy to punt and predict prices.

2018-07-20 00:12

Jon Choivo Annjoo, owes 800mil to the bank. The current earning they have is due to tariffs and China cutting down capacity.

Given their record earnings, they will still need at least 4 years to payback the debt.

Seeing the above i have to get worried if u managed my fund

2018-07-20 08:21

paperplane Talk like kids. Auditor think they know everything....They never know 人心难测

19/07/2018 23:02

Jon Choivo, I sincerely hope that u dont have to spend years in stock mkt to find out the above

2018-07-20 08:24

That is why i don't manage your fund, or funds of people who have completely different philosophy compared to me.

What is a stock if not for a fractional piece of a business?

Are you telling me, if you had RM1.2bil right now in cash, you would buy out the entire company of annjoo, and take on RM800mil in debt?

A company in a cyclical industry with very little moat? The moment the tariff is gone, or china decide to restart some steel factory, the company will lose money until vomit blood.

If the profit drop by half next quarter how? The price drop by 30% straight away. You dare to double up? I know i wouldnt.

Convince me on why ANNJOO is better than say, RCECAP or OSK. If you are right, i will be very eager to change my mind. No point having an ego in the market, the goal is to know whats right, not to be right.

Find out what?

“The real trouble with this world of ours is not that it is an unreasonable world, nor even that it is a reasonable one. The commonest kind of trouble is that it is nearly reasonable, but not quite. Life is not an illogicality; yet it is a trap for logicians. It looks just a little more mathematical and regular than it is; its exactitude is obvious, but its inexactitude is hidden; its wildness lies in wait.”

― G.K. Chesterton, Orthodoxy

I am fully aware investing is far beyond just numbers on a piece of paper. But i don't see how the thesis of ANNJOO is attractive to me.

As a punt, maybe. But remember MASTEEL, HENGYUAN etc etc

===================================================================================

CharlesT

Seeing the above i have to get worried if u managed my fund

20/07/2018 08:21

Jon Choivo, I sincerely hope that u dont have to spend years in stock mkt to find out the above

20/07/2018 08:24

2018-07-20 08:37

A company in a cyclical industry with very little moat? The moment the tariff is gone, or china decide to restart some steel factory, the company will lose money until vomit blood.

If the profit drop by half next quarter how? The price drop by 30% straight away. You dare to double up? I know i wouldnt.

Spend more time to study China's policy in steel production.

As long as it can do well till 2020 then it will justify my investment in Annjoo now

Unless u want a stock which can do well for 50 years or 100 years

2018-07-20 08:44

Heng Yuan moved up from Rm2+ from early 2017 to RM19+ early this year and it's now RM6+...

So what does it tell U?

I would rather invest in PBB or most of their mutual fund...likely to perform better than yrs (basing on yr investment style)

2018-07-20 08:46

Anyway hopefully u will still be around in I3 by 2020...

We will see how then...how will be yr investments style by then...

2018-07-20 08:49

Posted by CharlesT > Jul 20, 2018 08:46 AM | Report Abuse X

Heng Yuan moved up from Rm2+ from early 2017 to RM19+ early this year and it's now RM6+...

If u can be part of such cyclical stock at early stage one stock alone can make much more than yr div yield stock

However, if u only join the game at the very final stage then sorry loh

2018-07-20 08:52

Icon888 recommended Hengyuan at RM6 to RM8. Davidtslim, from RM9 to RM13. Stockraider from RM6 to RM19. Probability from RM 8 to RM19.

Don’t even need to talk about Masteel.

If you followed any of their calls and still held, you would have suffered massive losses. Especially since you are likely to average up and down. Stockraider after selling at RM15. Started buying again and now have average cost of RM10.

Yes, you are right, buying cyclical stocks are the bottom and selling near the top is the way to make money, but that must mean you are able to tell when is the top and when is the bottom.

Nobody recommended HY at RM2, everyone recommended at RM10- Rm18.

At the bottom of a cyclical stock, people don’t think of it as cyclical, but as hopeless. Lionind can hit RM0.2, Masteel RM0.3 pre-split.

At the peak of a cyclical stock, people think of it as brighter future all the way. Hengyuan can hit RM19, with people thinking crack spread fat forever, Masteel RM1.8, thinking construction will boom forever and steel price forever high.

Don’t forget it’s a commodity. Its price has no edge or moat.

Now, what is very clear to me, is that to an extent property development companies are cyclical. And right now, people think property market is dead or need a few years to restart, when they are all still very profitable, profit drop from peak is less than 20% from some, but prices have dropped more than 60-70%

Except, business optimism is up 24% in Q2. Optimism and hope towards our nation is high, people with money all want to come back.

But the stocks are still selling as if they are close to bankrupt and people want to liquidate.

Looks like the bottom of a cyclical stock to me. And I will buy all the way down.

===================================================================================

Heng Yuan moved up from Rm2+ from early 2017 to RM19+ early this year and it's now RM6+...

If u can be part of such cyclical stock at early stage one stock alone can make much more than yr div yield stock

However, if u only join the game at the very final stage then sorry lo

2018-07-20 11:30

CharlesT, i guarantee you this.

9 months from now, it wont be in your portfolio, no need talk till 2020. :)

2018-07-20 11:32

john choivo, i remember the hgyuan story, each gave higher and highr TP, u haven't released the full list.

2018-07-20 11:33

Yeap, they are better ways to make money than misrepresenting to auntie uncle.

At the end of the day, if you have enough money, money is just numbers on a screen.

I don't want that kind of money.

Here are two articles i wrote on those two.

(CHOIVO CAPITAL) An estimate on the real refinery earnings of (HENGYUAN)

https://klse.i3investor.com/blogs/PilosopoCapital/150917.jsp

(CHOIVO CAPITAL) Lessons from Hengyuan, Petronm and other Oil & Gas related Companies.

https://klse.i3investor.com/blogs/PilosopoCapital/144887.jsp

===================================================================================

hollandking john choivo, i remember the hgyuan story, each gave higher and highr TP, u haven't released the full list.

20/07/2018 11:33.

2018-07-20 11:42

Posted by Jon Choivo > Jul 20, 2018 11:32 AM | Report Abuse

CharlesT, i guarantee you this.

9 months from now, it wont be in your portfolio, no need talk till 2020. :)

If Annjoo hit Rm3.50 to RM4.00 in 2018 i certainly wouldnt hold it till 2020 as my TP is met.

Posted by Jon Choivo > Jul 20, 2018 11:30 AM | Report Abuse

Icon888 recommended Hengyuan at RM6 to RM8. Davidtslim, from RM9 to RM13. Stockraider from RM6 to RM19. Probability from RM 8 to RM19.

If u follow their calls at RM6+ u have the chance to enjoy 100%-200% gain within months time...As for Probability, I think his buy call was ard Rm4-RM5..earlier than other sifu

2018-07-21 05:56

Again,Jon, basing on yr investment style, I would rather buy Public Bank.....

2018-07-21 05:58

CharlesT,

Fair point. Why do you think Annjoo is worth RM3.5 to Rm4?

More precisely why would you pay RM2 billion to RM2.2 billion, and take on RM760 million in net debt, for a steel company that makes RM 200 million, on the high end of the cycle.

So in effect, you are paying RM2.76 billion to RM2.96 billion for a company that makes RM200 million.

Using current price, if you were buy this company in full, you will need 15 years to make back you money, and this is assuming their record earnings remain.

I am curious to hear your thinking. I hope you have some incisive insight that proves me wrong. As this would provide me an invaluable opportunity to learn.

Charles, I'm always open to new investors, but like i said, only the right kind of investors. And the right kind of investors, is the kind of understand my investment philosophy, the pros and cons.

If they cannot understand, or they think it does not make sense, like you do. I strongly suggest they find the fund manager that suits them, or buy the index. Not public bank unit trust as the fees are too high.

2018-07-21 13:08

Let me be clear, i dont think Annjoo at this price now is a bad investment, but i think one can find better.

Or at least better in terms of my philosophy.

2018-07-21 13:10

U read thru their bal sheet? So u only see their debts of rm800m but u didnt their stock, fixed assets?

2018-07-21 14:38

I dont think yr inv philosophy is bad but i think i rather buy pbb than following yr style

2018-07-21 14:40

why so complicated calculations?

everyone knows buy share if you want less fluctuations....buy warrants if you live in the fast lane.

2018-07-21 14:43

My reason of buying annjoo now is for my wawasan 2020 project..i wish to be part of this momentum play for 2 to 3 years...however if price rise till my tp eaelier than my expectation i would happily take profit

..it could be less than 9 months who knows

2018-07-21 14:44

Historically the assets of steel companies sell for far below book value. For an easy example, sell megasteel.

Occasionally though, you can find someone willing to pay a high price for these assets, or at least assets producing commodities, like saprng. Which is in big trouble.

Wawasan 2020. Well, i'd rather buy more property development companies, its cheaper and more valuable, and will definitely rise in tandem with the economy.

What if Malaysia remove the steel tariff in order for us to have access to cheaper steel and get to wawasan 2020. Mai habis liao?

===================================================================================

CharlesT U read thru their bal sheet? So u only see their debts of rm800m but u didnt their stock, fixed assets?

21/07/2018 14:38

2018-07-21 14:53

Historically most steel co in msia were suffering like hell...

Why the sudden change since 2016???

2018-07-21 15:01

I will tell you once thete is any changes in the policy (msia on import tariff) or China's policy which go against msia stee co i will sell all my annjoo...

2018-07-21 15:12

I just wonder do u aware of china's policy on their steel production till 2020???

2018-07-21 15:13

Haha its a decent ish punt.

But i don't like punting or betting on macro-economy or government policies around the world, because i cant and i dont think people can predict it with any high level of consistency.

I go bottoms up, what is a good business at a cheap valuation. And then i study if there is good macroeconomics behind it possibly, or bad ones etc.

2018-07-21 15:20

U meant after u bought yr stock u just keep it inside yr safe for 10 years or 20 years?

1) RCECAP 20000 shares

2) AEONCR 1100 shares

3) TIMECOM 1700 shares

4) FAVCO 3000 Shares

5) LIIHEN 2200 shares

6) LATITUDE 1900 shares

7) PLENITUDE 5200 shares

8) DNEX 14800 shares

All yr above shares will not be subjected to any macro-economy or government policies around the world or in Msia??

2018-07-21 15:28

http://www.sunsirs.com/uk/prodetail-927.html

Markets are dynamic, if prices go up and it becomes more lucrative, more plants will reopen, pushing supply up and prices will go down etc etc.

The only ones in the list i am willing to hold for a very long time or permanently is

1) RCECAP 20000 shares

2) AEONCR 1100 shares

3) TIMECOM 1700 shares

The rest, its cheap and i don't mind waiting for the contraction between intrinsic value and price.

I am thinking of starting a 10 year stock pick competition (with some different rules to be more suited) :) would be interesting.

2018-07-21 15:55

Jon Choivo

At that price, you'd think they are liquidating the property development business.

But its clearly very profitable, with huge land banks being held at low prices.

2018-07-19 21:25