(Icon) Global Oriental Bhd (6) - The Best Of The Best

Icon8888

Publish date: Sun, 20 Apr 2014, 12:38 PM

When I first invested in GOB, I only have a vague idea that they have substantial land bank in Seberang Prai, and that area is attracting a lot of attention for its development potential pursuant to opening of Penang Second Bridge.

Apart from that, I don't really have a feel of what is happening on the ground.

However, yesterday, The Edge came up with an excellent article on Seberang Prai property sector. Based on those information, I managed to put together a big picture, which I am happy to share with everybody.

1. Some Interesting Facts About Seberang Prai

Seberang Prai was ceded by Sultan of Kedah to the Brirish in 1798, which then incorporated it into Penang state.

Bukit Mertajam is the highest peak in the region (a town was named after it).

Seberang Prai has land area of 755 sq km, almost 2.5 times Penang Island's 293 sq km.

Both has more or less the same population (Penang Island 750,000, Seberang Prai 819,000)

Penang Island's population density is 2,600 per sq km while Seberang Prai's population density is 1,049 per sq km.

2. Bandar Cassia

Before I read The Edge's article, I can't exactly depict GOB's project in clear term.

However, there is now a name that can put a face on the concept, it is called Bandar Cassia.

Seberang Prai is a huge area, it is divided into Seberang Prai Utara, Tengah and Selatan (almost 1/3 in proportion each).

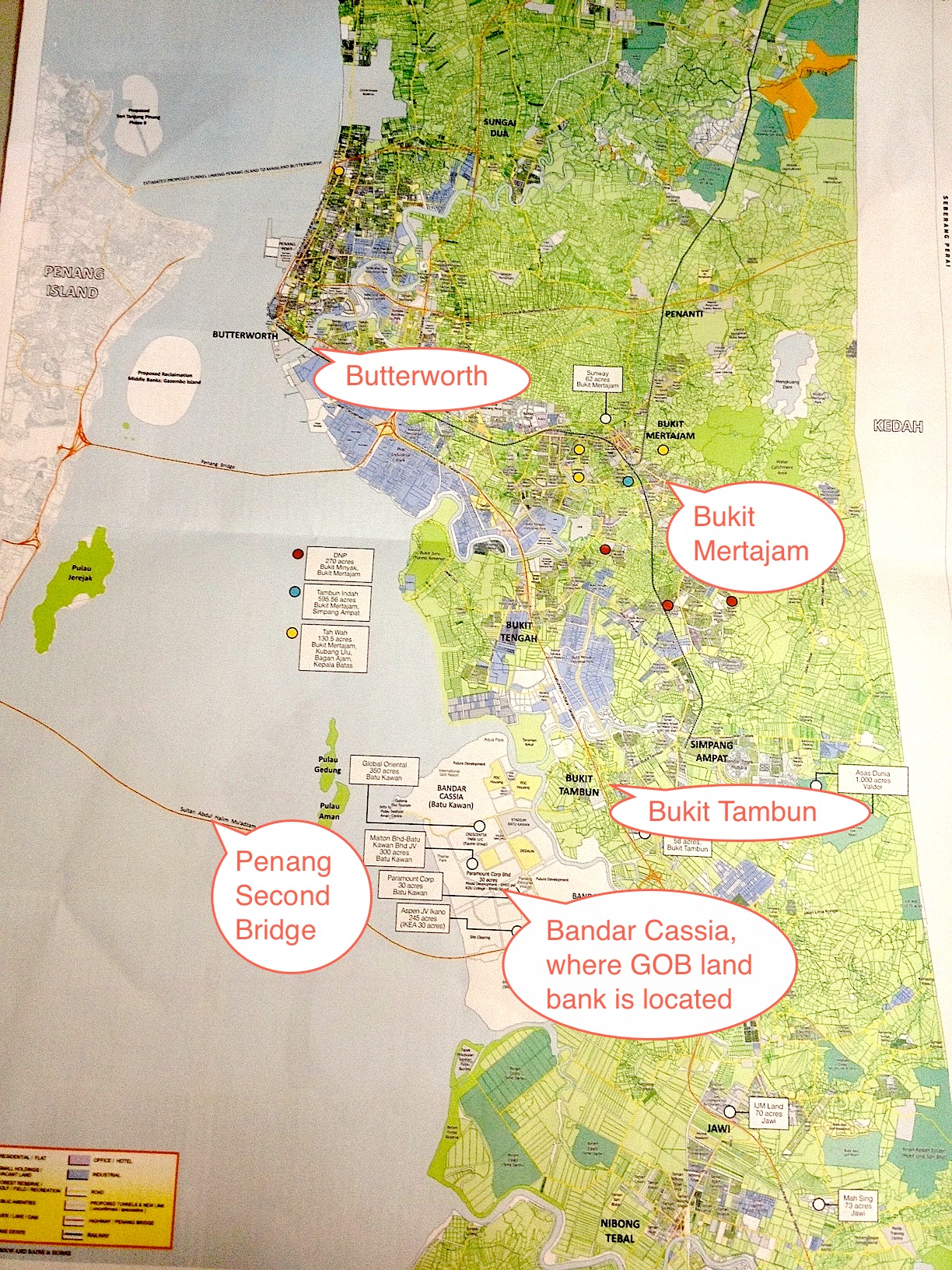

The Penang Government has carved out a piece of land at the landing site of Penang Second Bridge at Seberang Prai Selatan and named it Bandar Cassia. Please refer to the map below.

Bandar Cassia is where the actions will be.

According to the development blueprint prepared by the State Government, Bandar Cassia will have light and heavy industries at the south, Theme Park at its west, Golf Resort at its north. There will also be university, college, malls (IKEA), etc.

And of course, residential areas, of which GOB will be one of the major developers with 350 acres of land.

Upon completion in few years time, Bandar Cassia will definitely become a vibrant city. A place that anybody travel up North will stop by and pay a visit.

(An overview of Seberang Prai)

3. Best of the Best

GOB is not the only beneficiary of Penang Second Bridge.

When come to Seberang Prai Selatan play, names like Malton, Ecoworld, Paramount, Ivory Properties, DNP, Tambun Indah, IJM Land, Asas Dunia and Mah Sing also crop up regularly.

However, after reading The Edge's article, I came to realise that not all Sebrerang Prai Selatan players are equal. They are divided into two broad categories : those that are in Bandar Cassia, and those that are not.

(a) Bandar Cassia Play

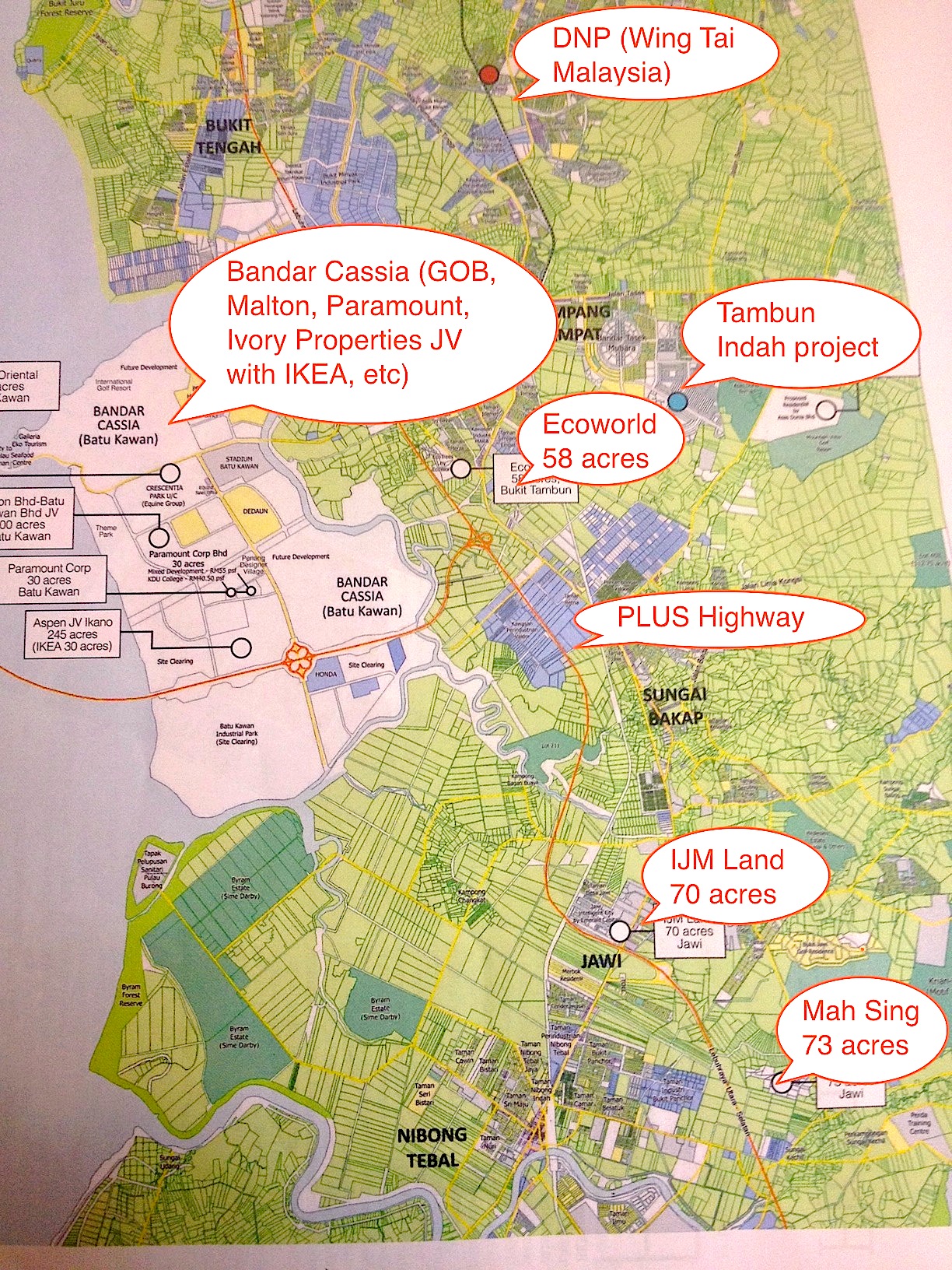

GOB, Malton, Paramount, Ivory Properties (49% JV with Aspen Land for IKEA project), Ecoworld, Tambun Indah

(According to the map, Tambun Indah's project is actually quiet a driving distance away from Bandar Cassia. However, it is politically incorrect for me not to recognize such a famous company as part of the theme. So I have politely included it in the Bandar Cassia group)

(b) Others

DNP (Wing Tai Malaysia), Asas Dunia, IJM Land, Mah Sing

To explain why I separate them into two categories, if you look at the map below, IJM Land and Mah Sing each has land bank at Seberang Prai Selatan.

However, their land bank is located further down south, away from Bandar Cassia.

To be fair, theirs are still a viable proposition as their locations allow them to directly tap the PLUS Highway for access to Penang Second Bridge, and subsequently all the way over to Penang Island.

In other words, IJM Land and Mah Sing's projects allow their residents to have speedy access to the Bridge by avoiding traffic jams associated with the trunk roads.

However, they will not benefit from Bandar Cassia's lifestyle and commercial vibrancy. They are simply in a different leauge.

Ecoworld in a technical sense, is not part of Bandar Cassia development blueprint. However, according to the map, they are located right next to Bandar Cassia, which will allow their residents to tap into Bandar Cassia's amenities, infrastructures and other conveniences.

DNP and Asas Dunia are also beneficairies of the development of Seberang Prai. However, they are located quite far away from Bandar Cassia. (DNP is almost closed to Bukit Mertajam)

(Various development projects at Seberang Prai Selatan. Please note Bandar Cassia is highlighted in white colour)

4. Concluding Remarks

Before this, I was a bit worried about competition as there seemed to be quite a number of players involved in Seberang Prai Selatan.

However, pursuant to further analysis, it seemed that products offered by DNP, Mah Sing, Asas Dunia, IJM Land, and to a certain extent, Tambun Indah, are in a different category from that of the Bandar Cassia group. Those companies' projects allow residents to have speedy access to Penang Second Bridge. However, they don't really provide exposure to Bandar Cassia's first class infrastructure, vibrancy, lifestyle and commercial opportunities.

The Bandar Cassia group will be the blue eye boys of Seberang Prai Selatan. They are simply the best of the best.

Have a pleasant Sunday afternoon.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Icon8888 Gossips About Stocks

Created by Icon8888 | May 01, 2020

Created by Icon8888 | Mar 10, 2020

Created by Icon8888 | Mar 01, 2020

Created by Icon8888 | Nov 13, 2019

Discussions

any target prices by research houses? if no then we can discuss here with the experts on GOB....how this stock going to perform next friday,,after strong surge on friday... so for newbies who want to buy this stock,,should they chase this stock,,or wait for some minor correction after the friday surge?? any oppinion members out there?

2014-04-20 15:42

If your holding period is 2 to 3 years, I think you will easily more than double your investment. By that time, DaMen mall is up providing recurring earnings. Thier Batu Kawan projects and JV with Lembaga Getah wil be in full swing. And if what RHB reported is correct that they will dispose off DaMen to Pavillion REIT for RM500-600m (> RM1 diluted share), this will put GOB is an extremely comfortable position.

2014-04-20 15:49

Thanks for yr sharing. Malton is still more potential than gob in current price

2014-04-20 22:18

icon, u seriously need to take a look at sbc corp, i do think that it is more undervalued than GOB now given GOB has run 20% for the past 1 week

2014-04-20 23:21

Part 7 of GOB series will be published this evening. It will be exciting, I promise

2014-04-21 14:29

@ Icon8888, if it is not too much of a hassle, please include Malton in your write up. Thanks a million.

2014-04-21 14:57

Aiyo this one is all old info. Don't write if you have nothing new lah. Don't kill off the interest of the market. And now share cannot move. Stupid fella....

2014-04-22 17:15

The way you write if for kiddy. You want to get newbie go far far if looking for student. BODO

2014-04-22 17:16

Hi Icon8888, Your article (GOB Part 6 Best of the Best) really makes alot of sense. Cross check against TheEdge report on 21st Apr'14 and the facts tie out. Thanks for the good work.

2014-04-22 18:29

This is a very very old information. Don't confuse ppl and write old news. This news is just rewritten and search you will find even before bridge is open and the big investors are laughing at 2censt

2014-04-22 18:33

@ icon8888,

need your advice about portfolio balancing. Currently, i have 2 counters under my belt - Tambun Indah (TI) and Malton. Been waiting patiently on the sidelines to load on GOB.

About TI - its current market price is RM2.04 (today's close). If its fair value (as touted by RHB Research) is RM2.20, there is a potential profit of RM0.16. This is the opportunity cost for selling TI.

I am thinking of selling off TI and waiting to load GOB when the price of GOB drops to below RM1.10. If GOB has risen way above my budgeted entry price of RM1.10, then, maybe i will just recoup the profit from Malton.

All i wanted is to have additional bullets when GOB drops to below RM1.10. For me, i think market sentiment for GOB is hyped up and the price may drop in the future.

Do you think this is a wise choice?

2014-04-22 19:14

kancs, I am afraid I am unable to advise you on your strategy.

My style is different from yours :-

(a) Firstly, I don't aim for small percentage gain. I always aim for 100% over three years.

(b) Secondly, I don't go in and out. Once a stock reach my target price (usually is 100% gain), I will sell the entire block and walk away. I don't keep bits and pieces for sentimental value. And also, I don't sell, wait go down, then buy again, then sell again when it goes up... etc. Once I sold, I never look back

You can see that my style above is different from yours, Since I never practise your ways, I don't think I am in a position to advise whether it makes sense or not

sorry

2014-04-22 19:50

Adamlambert, how about Part 7 ? that one is new information

can give some credit or not ?

2014-04-22 20:15

Referring to Adamlanbert and Top Investor comments that I am presenting old news for Part 6, I would like to apologize to this two ladies / gentlemen for writing on something they already know so well. The reason I wrote it is because it is actually new info for me. I have not been actively researching Seberang Prai property until recently I bought GOB. Anyway, I think the info could be useful for a lot of other readers who like me, is not so familiar with the subject

2014-04-23 06:47

james70

If you look at the map on page S8 of the Seberang Perai special report, you can see that GOB has 73.34acres of commercial land. From my understanding GOB will have a few service apartments/condominium blocks, a mall, office tower and possibly a hotel for recurring earnings. This will be launched once IKEA is established. And these development will have a green lung which is the theme park(eco park) next to it. You can bet that these projects will do very well.

2014-04-20 14:23