(Icon) Geshen (1) - Acquisition Will Boast EPS By More Than 300%

Icon8888

Publish date: Mon, 16 Mar 2015, 11:36 AM

Executive Summary

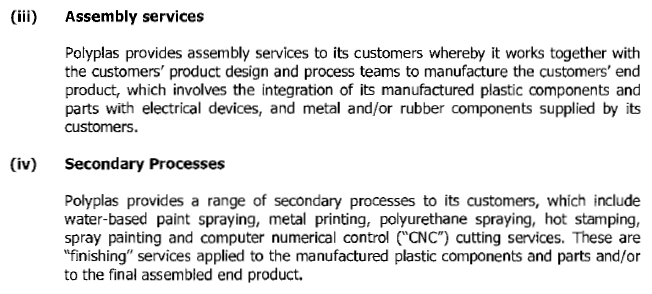

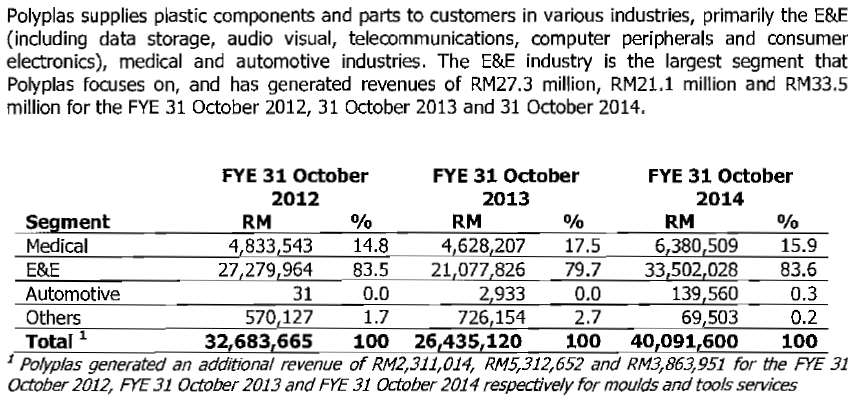

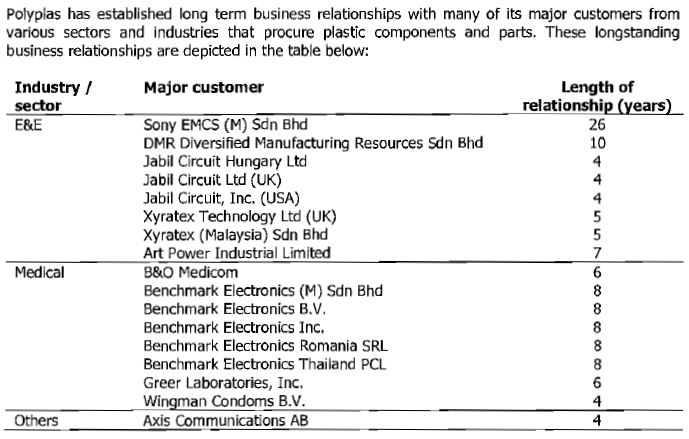

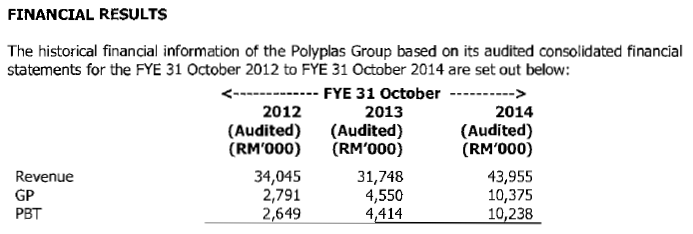

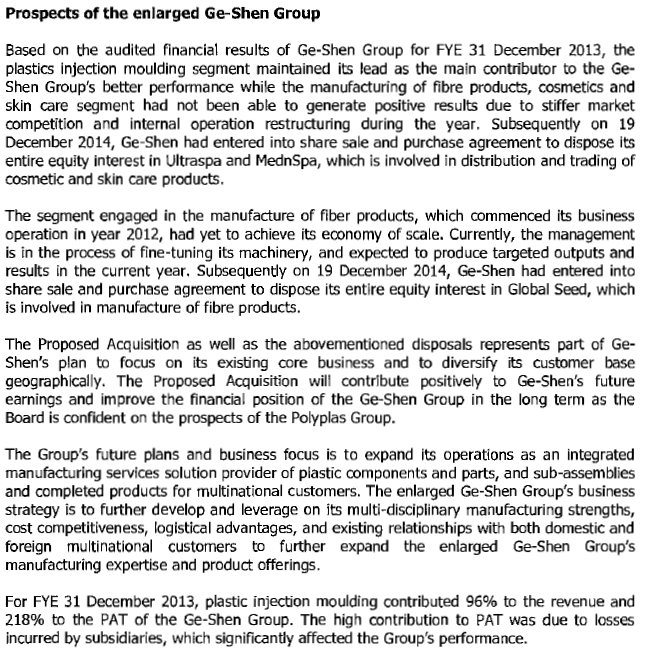

(a) Ge-Shen is principally involved in manufacturing of precision plastic parts. The group has not done well. Over the past few years, average net profit was only approximately RM2.18 mil.

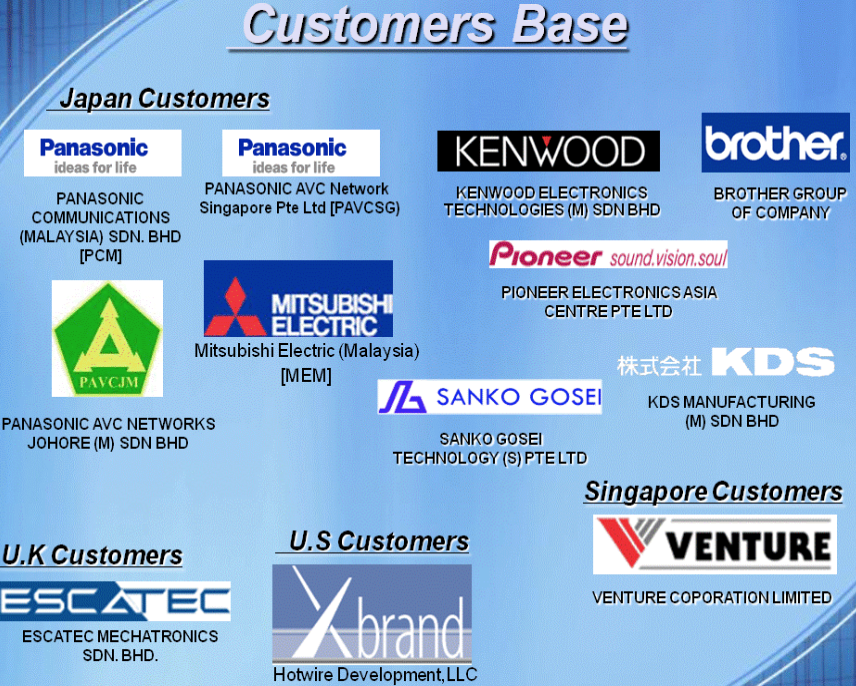

(b) However, the group is in the process of acquiring 75% equity interest in its industry peer Polyplas Sdn Bhd at attractive PER of 5.75 times. Circular to shareholders was issued on 13 March 2015. EGM will be held on 4 April 2015.

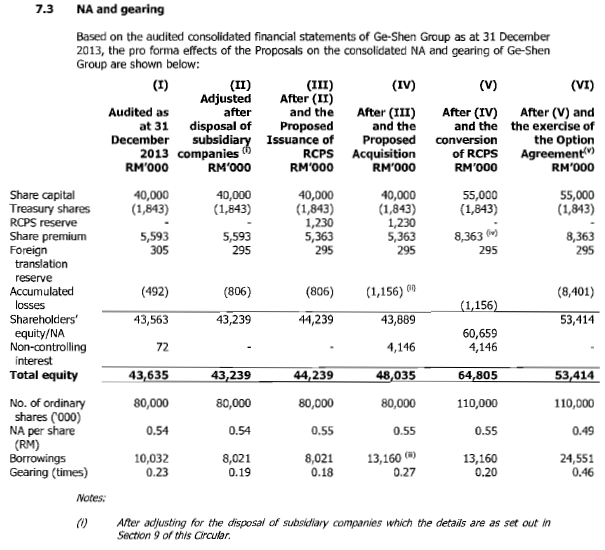

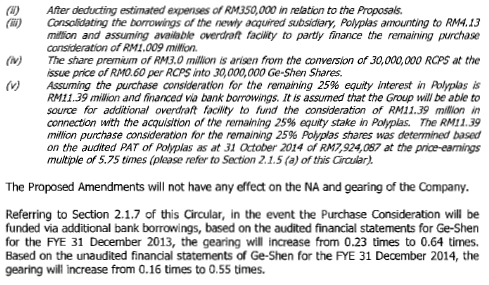

Polyplas is very profitable and reported net profit of RM7.83 mil in the financial year ended 30 October 2014. According to Ge-Shen's circular to shareholders, on pro forma basis, the acquisition will increase the group's net profit by 372% from RM2.13 mil (FY2013) to RM10.06 mil. EPS will increase from 2.78 sen to 13.08 sen (please scroll down to end of this article to check out the financial effects of the transaction).

(c) In addition to the above, on 2 March 2015, the group completed the disposal of two loss making subsidiaries. These two subsidiaries reported total losses of RM2.8 mil in FY2013 (latest available figures). With the de-consolidation of these two non-performing subsidiaries, overall net profit of the group should increase by the same amount accordingly.

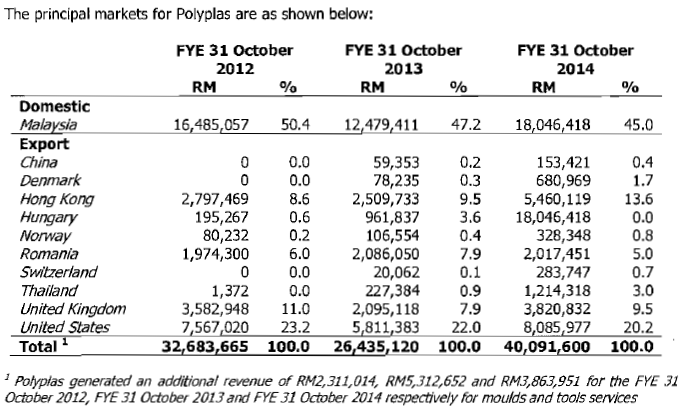

(d) The acquisition of Polyplas is timely. Since locking in the deal in October 2014, the Ringgit has depreciated substantially against the US dollar, making Malaysia's manufacturing industry super competitive.

With all these favorable factors in play, the enlarged Ge-Shen group should do well in coming quarters.

Ge-Shen Corp Bhd (GSCB) Snapshot

|

Open

0.51

|

Previous Close

0.51

|

|

|

Day High

0.51

|

Day Low

0.51

|

|

|

52 Week High

09/30/14 - 0.62

|

52 Week Low

03/18/14 - 0.35

|

|

|

Market Cap

38.8M

|

Average Volume 10 Days

14.0K

|

|

|

EPS TTM

0.03

|

Shares Outstanding

76.9M

|

|

|

EX-Date

08/6/07

|

P/E TM

14.9x

|

|

|

Dividend

--

|

Dividend Yield

--

|

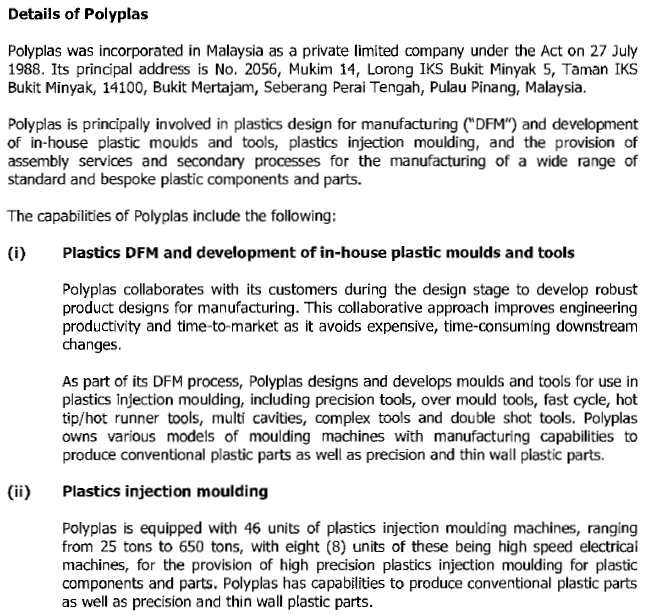

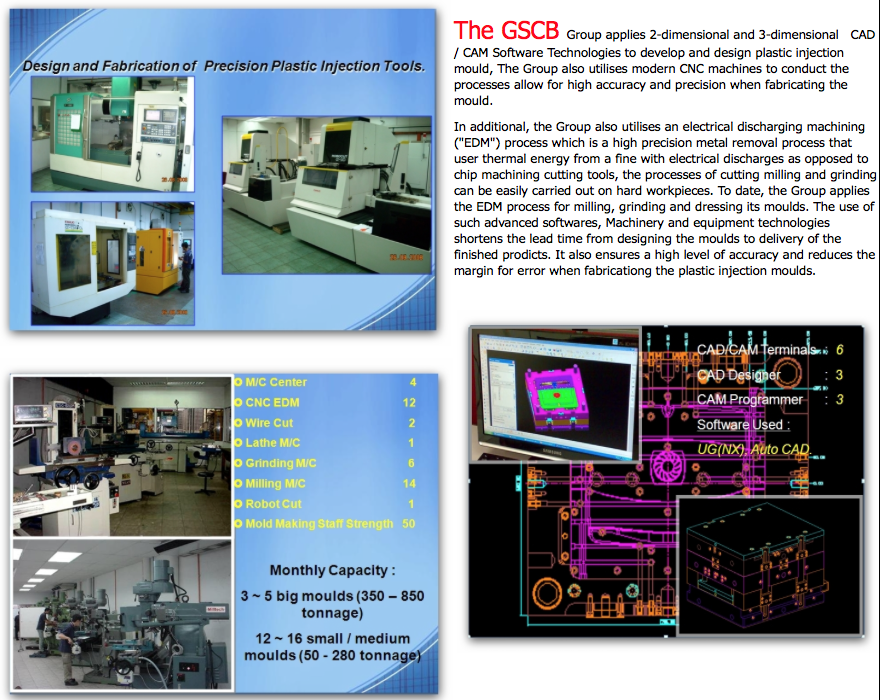

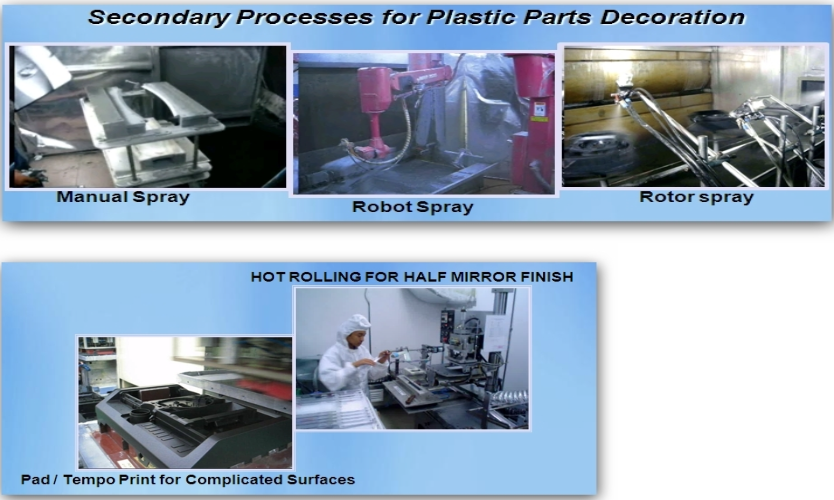

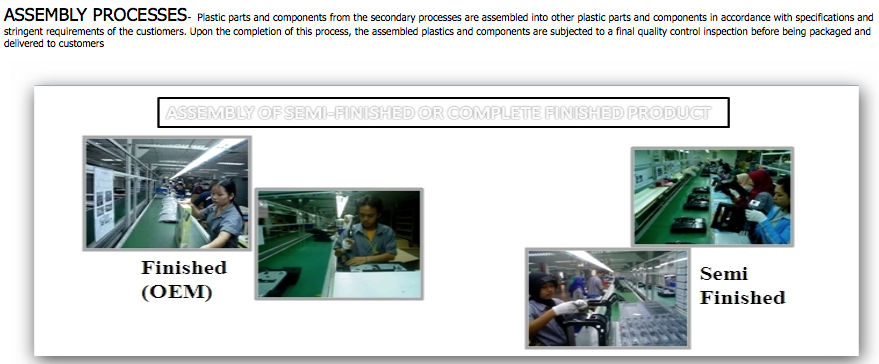

Ge-Shen Corporation Berhad manufactures plastic molded products and components. Its services include the design and fabrication of precision plastic injection tools; injection molding; secondary processes for plastic parts decoration; and assembly of semi-finished or completely finished products.

The company operates primarily in Malaysia, Vietnam, and Singapore. Ge-Shen Corporation Berhad was incorporated in 1995 and is based in Johor Bahru, Malaysia.

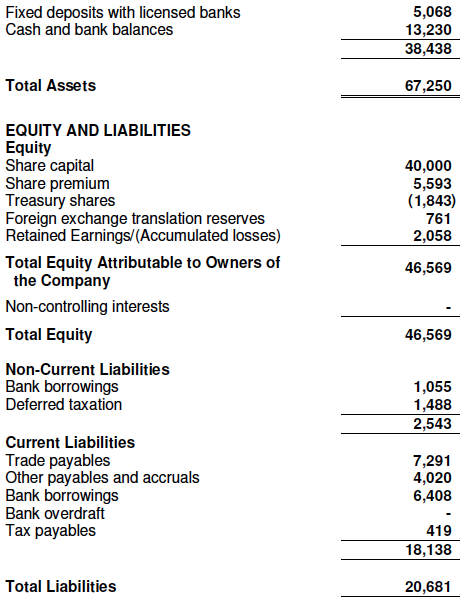

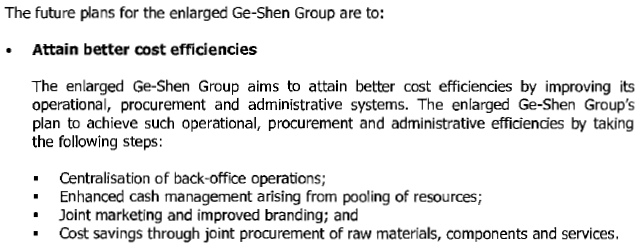

As shown above, the group is in net cash position with loans of RM7.4 mil and cash of RM18 mil. However, the cash will be used to part fund the acquisition.

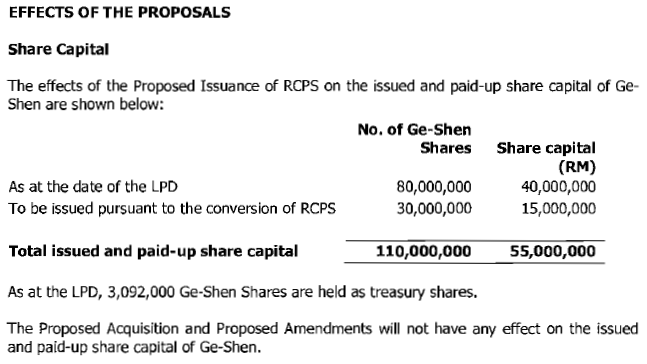

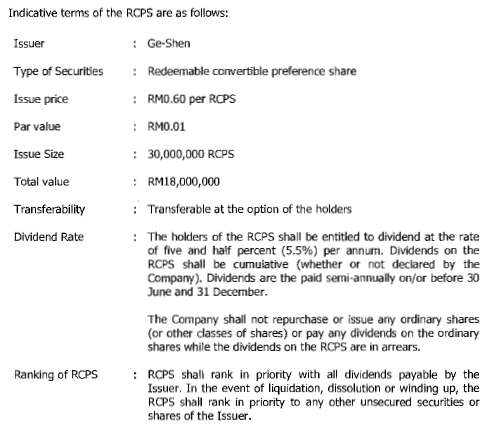

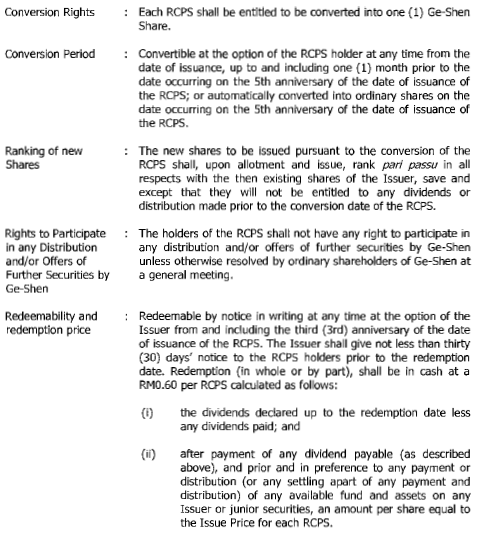

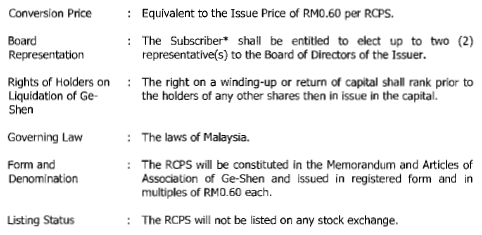

The company will issue RM18 mil RCPS to fund the remaining of the purchase consideration. The RCPS is NOT deemed a debt instrument as it is redeemable at the option of the Issuer (please refer to Appendix 3).

Upon completion of the acquisition, the group will have zero cash and loans of RM11.5 mil (being RM7.4 mil existing loans + RM4.1 mil Polyplas' borrowings).

Based on net assets of RM46.6 mil, net gearing will be at comfortable level of approximately 0.25 times post transaction.

Over past 3 years, the group reported average net profit of RM2.18 mil. Based on existing market cap of RM38.8 mil, historical PER is 17.8 times.

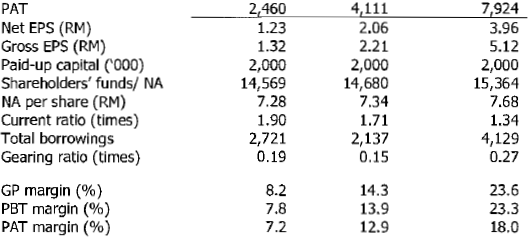

Annual Result:

| F.Y. | Revenue ('000) | Profit Attb. to SH ('000) | EPS (Cent) | PE | NAPS | ROE (%) |

|---|---|---|---|---|---|---|

| TTM | 85,000 | 2,558 | 3.32 | 15.22 | 0.6100 | 5.44 |

| 2014-12-31 | 85,000 | 2,558 | 3.32 | 16.72 | 0.6100 | 5.44 |

| 2013-12-31 | 80,179 | 2,197 | 2.86 | 11.54 | 0.5700 | 5.02 |

| 2012-12-31 | 89,603 | 1,781 | 2.32 | 8.63 | 0.5300 | 4.38 |

Quarter Result:

| F.Y. | Quarter | Revenue ('000) | Profit before Tax ('000) | Profit Attb. to SH ('000) | EPS (Cent) | NAPS |

|---|---|---|---|---|---|---|

| 2014-12-31 | 2014-12-31 | 16,534 | 1,209 | 1,284 | 1.67 | 0.6100 |

| 2014-12-31 | 2014-09-30 | 25,403 | 1,130 | 288 | 0.37 | 0.5800 |

| 2014-12-31 | 2014-06-30 | 24,475 | 969 | 399 | 0.52 | 0.5800 |

| 2014-12-31 | 2014-03-31 | 20,846 | 1,143 | 588 | 0.76 | 0.5700 |

| 2013-12-31 | 2013-12-31 | 21,118 | 750 | -23 | -0.03 | - |

| 2013-12-31 | 2013-09-30 | 23,524 | 1,800 | 1,026 | 1.33 | 0.5600 |

| 2013-12-31 | 2013-06-30 | 19,624 | 1,039 | 733 | 0.95 | 0.5500 |

| 2013-12-31 | 2013-03-31 | 18,502 | 622 | 461 | 0.60 | 0.5400 |

| 2012-12-31 | 2012-12-31 | 19,552 | -852 | -848 | -1.10 | - |

| 2012-12-31 | 2012-09-30 | 23,513 | 1,318 | 950 | 1.24 | 0.5500 |

| 2012-12-31 | 2012-06-30 | 23,432 | 1,433 | 1,148 | 1.49 | 0.5400 |

| 2012-12-31 | 2012-03-31 | 23,077 | 1,120 | 589 | 0.77 | 0.5300 |

In the latest quarter, the group reported net profit of RM1.28 mil. The net profit comprises gain on disposal of subsidiaries of RM1.19 mil and losses incurred by discontinued operation amounting to RM1.226 mil. Adjusted for those exceptional items, net profit in the latest quarter would be RM1.316 mil.

THE PROPOSED ACQUISITION

In October 2014, the company announced the proposed acquisition of 75% Polyplas for cash consideration of RM33.76 mil to be funded by :

(a) internal cash of RM15.76 mil; and

(b) issuance of RCPS of RM18 mil (30 mil x RM0.60).

On 13 March 2015, the company issued circular to seek shareholders approval for the proposed acquisition. Date of EGM is 4 April 2015.

![]()

The company targets to complete the acquisition by 2nd quarter of 2015.

========================================

Appendix 1 - The Ge-Shen Group

Appendix 2 - Polypas (The Acquiree Company)

Appendix 3 - Salient Terms of the RCPS

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Icon8888 Gossips About Stocks

Created by Icon8888 | May 01, 2020

Created by Icon8888 | Mar 10, 2020

Created by Icon8888 | Mar 01, 2020

Created by Icon8888 | Nov 13, 2019

Discussions

Icon8888, thanks for digging up Ge Shen. Looks attractive.

Are Ge Shen selling the 2 subsidiaries below book value ? It is ok for me to sell loss making subsidiaries below book value. However, if below book value, next quarterly report might look ugly.

Current market cap for GESHEN is 45 million. The enlarged market cap is around 65 million. Assuming the take over is completed, profit of RM 10 million would bring a market of probably 60 to 80 million. Upside is limited unless GESHEN benefits from lower material cost and synergy between the old and new business.

One thing I do not like about GESHEN is the PPE. PPE is more than Depreciation. I have a prejudice against that.

2015-03-16 14:06

disposal will result in gain of RM613,000 and RM300,000 respectively. If I am not mistaken, the gain has already been booked in (please refer to December 2014 quarterly report)

http://www.bursamalaysia.com/market/listed-companies/company-announcements/1835165

http://www.bursamalaysia.com/market/listed-companies/company-announcements/1835161

2015-03-16 14:19

Is that merely reporting ?

My style is to present the relevant facts systematically to guide the readers naturally towards a conclusion

Behind the cut and paste is a lot of thoughts

As a matter of fact, picking Ge Shen as a topic already accounts for 95% of the value creation.

You can have a clerk that can write 1,000 pages essay and add in colourful diagrams and charts. But does that really get you what you want in terms of stockmarket investment ?

Don't meant to be rude, but I think u r a bit shallow

2015-03-16 22:33

If you want articles that yell "strong buy!!!", "undervalued gem!!!", you should follow clavintaneng

Haha

2015-03-16 22:40

Maybe you should employ and Long Jane To type things like terms of the rcps.

2015-03-16 22:57

Long Jane has already found employment with Long John. Everyday she will write a 1,000 pages report to guide him on what to wear, do and eat the next day

2015-03-16 23:04

I have my long term holding portfolio,it does mean I won't change if there is better invest, I like and thankful to those who had tried their best to uncover hidden gems, because I don't have the ability and lazy. I evaluate every recommendation carefully using kcchong tecniques, I only invest in those that have met my selection criteria, because he recommend but not guarantee, in this respect icon has help me a lot. thank

2015-03-17 10:10

respect Icon888, always take the effort to share detail, better than those shout buy and sell only

2015-03-17 12:32

thanks Icon888 for sharing the analysis of the counter with us. thank you very much by doing so you are helping the newbies.. syabas to you for your great work

2015-03-17 13:17

Apini,

I like my sifu kcchong CAGR track record in evaluating growth stocks, CFFO or FCF included

2015-03-17 13:27

A few weak points I think good to mention:-

1. Poor profit margin of Ge-shen, Polyplus slightly better.

2.The projected cashflow from Polyplus seems very good...Is it really tht good?

3.Poor utilisation of machines, 2014-52% utilisation rate

2015-04-02 13:37

he has cut n paste not less than 60 stocks in bursa. so when anyone comes up, he will quickly jump into the thread to claim credit. but all he did was cut and paste.

he has no analysis capability. except GOB.

2015-04-05 10:51

Gob no point I defense myself

Stock make money is hero

Lose money deserved to be whacked loh

2015-04-05 17:54

game not yet end,,,don't give up,,,maybe tortoise GOB can win over the rabbit in the race,,,we dunno yet.

2015-04-05 18:10

Next quarter result guarantee good

Got exceptional gain from land disposal (ha ha, cheating)

2015-04-05 18:11

Thanks for highlighting this stock... I m amazed at your ability to discover these hidden gems... i m sure these type of stocks will not appear on any fundamental or TA screeners...

2015-04-22 09:56

@icon8888 wanna ask whether the acquisition of polyplas has been completed?

2015-04-22 10:14

then I shall assume the coming quarter result should be staggering good. Cheers!

2015-04-22 16:24

Icon8888, though i don't like some of your comments in some counters... but, I must agree that you are quite a pro investor

2015-08-07 21:03

Geshen, there is a market maker, a new CEO with impressive titles and corporate player. Geshen...like Instacom have been planned for more than 1 years.

The nearest comparison to geshen is Instacom. , not Comintel.

Comintel has a web site that don't even have a section called Investor Relations. Comintel was heading towards bankruptcy until the ringgit dropped drastically., and a BOD and management that has already given up until they are rescued by the fall in the ringgit.

2016-01-03 19:26

Geshen is a very special stock

I asked paperplane to buy when it was 56 sen, he gave me a stern lecture about bankruptcy blah blah blah

It is now RM2.80

The 56 sen was 12 months ago, not 12 years

2016-01-03 19:37

No need to argue until red face

I pocket RM2.80

Paperplane eats west north wind

2016-01-03 19:51

Btw, this is the profile of your much revered fund manager paperplane

http://klse.i3investor.com/blogs/icon8888/80184.jsp

He is nothing but a highly geared young punk loaded with tonnes of housing loans and car loans (he accidentally told us)

U r new here, I am helping to bring u up to speed

2016-01-03 20:06

I not only cover stocks, I profile my forum members also

Give me more info, I can even do a piece for u

2016-01-03 20:07

Desa, if I knew opus directors is into geshen I might buy some. As I know he is goreng kaki, keke

2016-01-03 20:20

r°Moi

The........ :)

2015-03-16 13:36