(Icon) Johore Tin (4) - Some of My Thoughts On High Inventories

Icon8888

Publish date: Fri, 05 Jun 2015, 11:27 AM

One thing that caught many people's attention is the spike of inventories since September 2014. From RM74.1 mil as at June 2014, inventories increased to RM130.7 mil as at December 2014, an increase of RM56.6 mil (and further increased to RM148.2 mil as at March 2015). There are many questions to be asked.

1. Additional Inventories For Whom ?

We can more or less rule out the possibility that the additional inventories are for the tin manufacturing division.

According to the latest annual report, the tin manufacturing division's total assets increased from RM140.6 mil in FY2013 to RM149.5 mil in FY2014, an increase of RM9 mil only.

On the other hand, the F&B division's total assets increased from RM86.2 mil in FY2013 to RM206.5 mil in FY2014, an increase of RM120.3 mil.

In my opinion, the above data is sufficient for us to conclude that the additional inventories are for the F&B division.

This is actually a good news. The tin manufacturing division has not been reporting revenue growth at all. I would be very worried if the massive inventories build up is for this division (rows of unsold tins & cans would have freaked me out). The F&B division on the other hand, has been growing by leaps and bounds. It is only natural to have a higher level of inventories.

2. Is The Build Up Rational ?

According to the table below, the group traditionally holds inventories sufficient for approximately 25% of its annual revenue, which is equivalent to 3 months sale.

This is logical as planning horizon of 3 months coincides with the Bursa quarterly financial reports. And also, there is no need to unnecessarily hold large amount of perishable goods that ties down cash flow for no good reason.

Under normal circumtances, it seemed that 3 months inventories is the optimum level.

However, the spike in inventories recently saw the ratio jumps to 40%, which is almost half a year of revenue.

| (RM mil) | FY2012 | FY2013 | FY2014 | Mar2015 |

| Revenue | 246.4 | 241.4 | 315.5 | 90.8 |

| Inventories | 49.7 | 58.3 | 130.7 | 148.2 |

| Inventories / revenue (%) | 20.2 | 24.1 | 41.4 | 40.8 * |

* based on annualised revenue

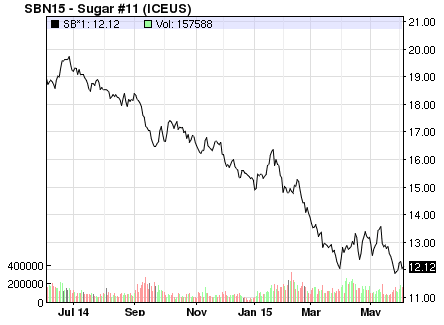

The company did not provide explanation for the build up. The only logical explanation is that they are trying to take advantage of the recent low raw material price to stockpile as much as possible.

My guess is that this will be particularly beneficial for its milk powder packaging business (a new division, more details later), which involves buying milk powder in bulk from international market (currently at low price), simply split them into smaller packages and sell to retail customers (mostly overseas).

As a Malaysian, one thing we know very well is that when commodity prices go up, prices for consumer items will be allowed by the government to go up. However, when commodity prices come down, have you ever seen prices for those consumer items come down ? It never happens.

Maybe from the company's point of view, it is a no brainer to stock up to arbitrage ?

Of course, that is merely my speculation. There isn't sufficiant data to conclude that this is indeed the case. As a shareholder of Johotin, I inevitably will have positive bias and wishful thinking for what the company does. A such, please take whatever I said with a pinch of salt. Having said so, I feel that at current low price environment (backed by possible fat margin, if my hypothesis above is correct), there is not much downside for stocking up. It is indeed a no brainer.

3. Funding Cost

It is fine to hold a higher level of inventories for arbitrage (if my hypothesis is correct). But it won't come free. The additional inventories will have to be funded by loans.

Pursuant to quarterly reports, it seemed that the company is making use of short term trade facilities for that purpose (Trust Receipts).

The company's decision to stockpile has to take into consideration additional interest expenses. The benefit of lower raw material price must outweight its funding cost in order to make sense. Fortunately, short term facilities usually carries quite low interest rate. I think the company should have plenty of room for manouver as far as economics is concerned.

4. When Will This End ?

If the rationale for the stockpiling is to lock in raw material at low cost, this practice should logically persist until the raw material cost has gone up to a level that it is not justifiable to conitnue to do so anymore.

(Or should it be the other way ? If strong evidences surface to indicate that that raw material price will remain low for an extensive period of time, maybe there is no need to stockpile at all ?).

To be honest, I have no idea when inventories level will return to normal. The only way is to question the management in the forthcoming AGM. Can somebody do that and report back to this forum ? : )

5. Not To Be Confused With A Stockist

Last but not least, I would like to highlight a very important point - the company's recent stockpiling of inventories should not be confused with that of a stockist.

Johotin's business operation remains that of a manufacturer. It buys raw materials, processes them and then sells the end products to customers.

A stockist like Pantech and Engtex (their respective trading division) is different. A trading business will have to stockpile HUGE RANGE of inventories in order to meet customers different needs at different time. This kind of business model needs to have high inventory level on PERMANENT BASIS.

If my hypothesis that the purpose is to lock in low cost raw material is correct, Johotin's recent stockpiling is of different nature. It is more optional, rather than mandatory. And it is being done with an opportunity for handsome economics gain. If that is the case, there will be a point in the future the position will be unwind, with the liabilities extinguished and cash freed up.

Hopefully this is the case.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Icon8888 Gossips About Stocks

Created by Icon8888 | May 01, 2020

Created by Icon8888 | Mar 10, 2020

Created by Icon8888 | Mar 01, 2020

Created by Icon8888 | Nov 13, 2019

Discussions

i am also disappointed they didn't hedge their forex trust receipts in december 2014. Maybe they got caught off guard by the sudden decline of ringgit. For that, I don't defense their incompetence.

But in my opinion, forex is only an issue when a currency make a transition from one level to another level (from RM3.40 to RM3.70 during Q1 2015, for example). After it stabilise at a particular level, there will be no more impact.

Will RM fall lower than RM3.70 going forward ? If it does, there will be another forex loss. But if it strengthens, there will be forex gain. At current level, I would say that it is not clearcut that hedging will give best outcome. Unless 1MDB bankrupt Malaysia, ha ha. Who knows ? Maybe it will happen....

2015-06-05 12:56

Just a matter of illustration.

Lets say we buy a product at USD98 and sell it at USD100, we earn USD2 and we hedge the USD2 at the transaction date say at 3.7 now, our USD2 profit is a secured profit. We will have RM7.40 absolute profit.

If we do not hedge, we are facing a possibility that when the seller pay us, the USD may fall to 3.6 yielding only RM360 from the sale. On the other hand, there may also be a possibility that when we pay supplier, the USD may rise to 3.8, hence we have to pay RM372.40. The whole transaction become a loss making one as we loss RM12.40 instead of making a profit of RM7.40. This will happen if you don't hedge or you hedge wrongly!

USD rate is just too unpredictable these days.

2015-06-05 13:35

On the flip side, of course, if it happens the other way round, then you will enjoy bumper profit on this transaction as you will stand to earn RM27.20 as your profit.

But I am a prudent guy and will always support companies doing international business with proper hedging policies in place.

2015-06-05 13:51

From the above historical price chart of milk powder, it proved that the management heavy stock piling at end Dec 2014 was right as the price recovered in Q1 2015. However whether the stock piling at end March 15 is a wise decision is not certain at this moment.

2015-06-06 23:36

Great n details explaination. My concern is the high inventories too.. other than that, this company is showing growth and directors is buying more shares to keep refer to AR2014. Can keep long term? Lolx

2015-06-13 08:01

fengtzekai

My 2 sens - stock piling with a plan in hand - brilliant. Stock piling without a plan - its a gamble. Stock piling financed by USD borrowings - is another risk to be considered.

Maybe the shareholders can ask the management team for a response in the upcoming AGM.

2015-06-05 12:30