(Icon) Clash of The Titans (3) - Uncle Koon's Obsession

Icon8888

Publish date: Wed, 06 Jan 2016, 07:27 AM

1. Introduction

"Clash of The Titans" is an article series written by me to talk about various style of investing based on my observation of Sifus in i3.

Part 1 was an introduction. I identified Value Traders as a disctinct group of market players that operate differently from Value Investors, even though both are guided by fundamentals.

In Part 2, I provided the theoretical background for Value Trading via the discussion of Shaughnessy's study of High Relative Strength Investing.

The title of that article was "Ooi Teik Bee Demystified". However, as many readers would have noticed, the objective was not to discuss OTB, it was to discuss Shaughnessy's findings. I slapped on the OTB tag as a marketing gimmick to attract your eyeballs.

In this article (Part 3), I will look into the investing strategy of another Sifu - our phoenix rising from the ash Uncle Koon.

2. Emphasis On Earnings Growth

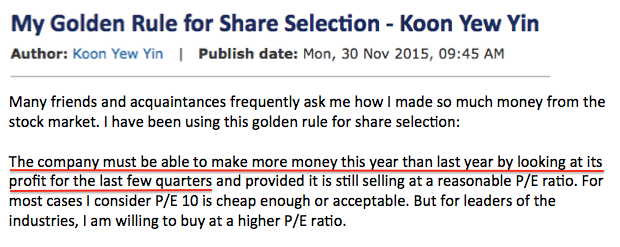

Uncle Koon's concept of investing is very simple - buy stocks that you think this year's earning will be higher than that of last year.

How do I feel about Uncle Koon's strategy ? Let's do a study before we jump into conclusion.

3. My 2015 Experience

The best way to determine whether Uncle Koon's method will work is to study the correlation between profit growth and share price gain.

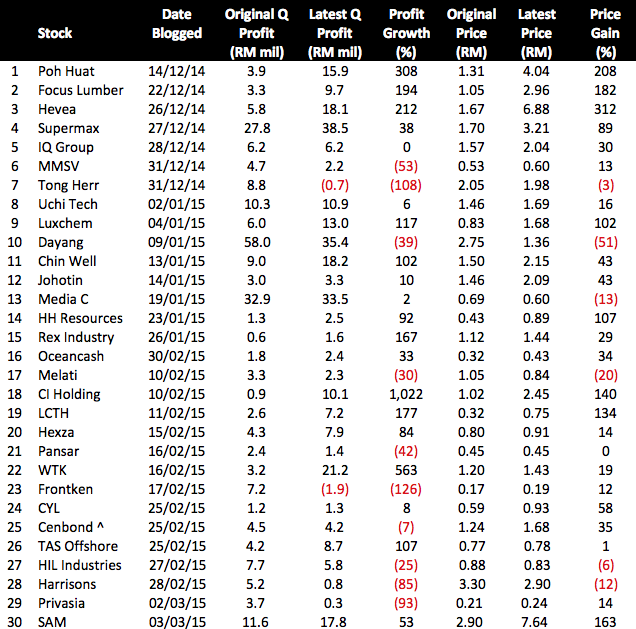

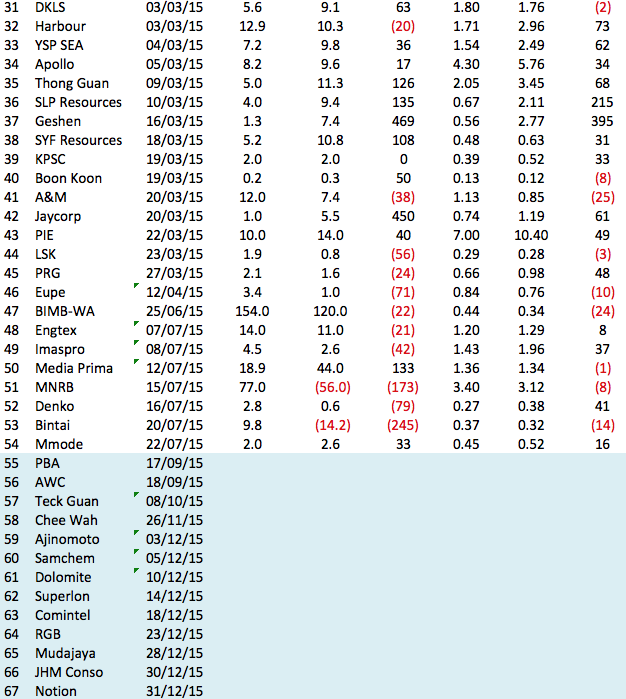

In 2015, altogether I have written about 67 stocks. I did a quick check of their status. The complete list has been attached at the Appendix section for your reference.

Out of the 67 stocks, I only make use of the first 54 stocks for analysis purpose. The remaining 13 stocks were covered too late by me (from September 2015 onwards) to be useful as samples.

My first step is to identify those stocks with strong profit growth. I want to find out whether strong profit growth will drive share price.

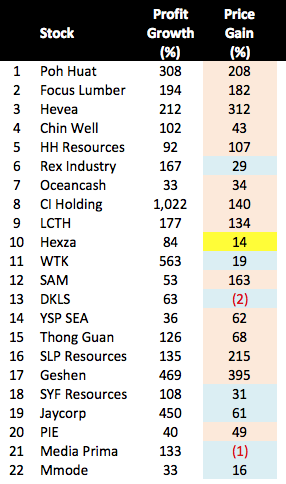

Out of the 54 stocks, 22 stocks reported very strong profit growth during the relevant period. They are shown in table below.

Of the 22 strong profit growth stocks, 14 stocks exhibited strong price gain (orange highlighted).

Of the remaining 8 stocks that the price hasn't gone up proportionate to profit growth, 7 stocks can be explained away (blue highlighted), only 1 stock cannot (yellow highlighted).

The 7 that can be explained away (blue highlighted) are :-

(i) Rex Industry - Too low profile, illiquid, erratic quarterly performance.

(ii) WTK - Before profit growth, the stock traded at high PER (backed by high net assets per share). Strong profit growth only brought PER down to a more reasonable level. As such, investors did not chase the share price up substantially.

(iii) DKLS - Ipoh based construction company. Too low profile.

(iv) SYF Resources - Recent strong earnings growth driven by property division. Investors are not particularly keen about this sector at the moment.

(v) Jaycorp - Earlier profit marred by exceptional items. Investors knew that. So they tolerated a relatively high PER. The earnings growth played the role of bringing PER down to a more reasonable level.

Having said so, there is also an element of mispricing. With prospective EPS of 16 sen, forward PER is only 7.4 times. There is room for further price gain.

(vi) Media Prima - EPF selling pressure, market perception of conventional media as sunset industry.

(vii) Mmode - I don't speak for all investors. However, I never quite feel comfortable with the business they are in. They distribute digital content such as music, lifestyle, entertainment, etc through mobile devices. I always have this fear that they will be the first one to get hit in the event of economic downturn (better save your money for essential items). Maybe other investors have the same perception ?

The only stock that cannot be explained away is Hexza. Its latest quarter strong earning is sustainable. In my opinion, underperformance of its share price must be due to mispricing. Call your remisier now !!! (I don't own any Hexza share)

Summary Findings Out of 22 strong profit growth stocks, 21 stocks (being 14+7, representing 95%) behaved rationally with share price going up in accordance with their fundamentals. Only 1 did not behave as it should (representing 5%).

Pursuant to the above findings, YES, profit growth does cause share price to go higher

Has Uncle Koon found the key to King Solomon's treasures ? Can his formula forever lift all Malaysians out of poverty ?

Yes and No. Please read on.

4. The Devil Is In The Details

(Jayatiasa and Mudajaya's Painful Experience)

It is not my intention to open up old wound. However, our discussion about Uncle Koon's stock picking strategy will not be complete without looking back at the past.

If I am not wrong, Uncle Koon started blogging in early 2014. He has been very consistent. Since day one, he preached the same message that "you must buy stocks that the earning this year will be higher than last year".

In accordance with that principle, Uncle Koon recommended, among others, Jayatiasa and Mudajaya.

The Buy call for Jayatiasa was based on expectation that maturing estates will drive earnings growth, thereby resulting in capital gain. The Buy call for Mudajaya was based on expectation that the commissioning of India IPP will boast earnings, thereby resulting in capital gain.

As we all know, things didn't quite work out as planned. Due to multiple negative developments, Jayatiasa and Mudajaya's share price declined by more than 50% over the subsequent one year.

(Windfall Gain In 2015)

Just when everybody has more or less written off Uncle Koon, he made a stunning comeback in 2015. With the help of some advisers, Uncle Koon did extremely well in that year.

What has actually transpired ? With the same strategy, why did Uncle Koon fail in 2014 and succeed in 2015 ? What conclusion can we draw from these two starkly different episodes ?

Well, the conclusion is very simple :-

Uncle Koon's concept is valid, but its success is highly depedent upon execution. I think not many people will dispute the merit of buying stocks with strong earnings growth potential, the challenge is to correctly identify those stocks.

5. Concluding Remarks

(a) 2014 demonstrated the challenges faced by stock pickers trying to identify companies with strong earnings growth potential. Things do not always work as planned.

Despite extensive analysis and excellent market intelligence, negative events could happen to delay the process by a significant margin.

Worse, sometime the entire theme will get derailed and investors will face multi year set back.

(b) Not that I want to deny Uncle Koon the credit that he deserves, I believe his stockpicking strategy worked well in 2015 because there was a strong export theme for all of us to leverage on. Due to sharp depreciation of Ringgit, even the weakest exporters managed to chalk up some growth.

Before 2015, I very seldom invest in manufacturing companies. During that time, Malaysia was not cost competitve. We also did not posses any technological advantage. Most manufacturing companies were half dead. It was closed to impossible to predict earnings. Without that, how do you identify "companies that will have higher earnings than last year" ?

(c) Despite the challenges mentioned above, same as Uncle Koon, I believe that his method is an excellent way to pick stocks with potential for capital gain. There will always be something that exhibits earnings visibility. The challenge is to do it properly that you end up with the right candidates. For this purpose, riding the industry up cycle always help.

For example, lets' assume in 2017, oil price rallies and Ringgit strengthens back to RM3.50. We will lose earnings visbility for exporting companies. However, oil and gas industry will be able to step in to fill the void. That will be where we should zoom in to try to identify the next Heng Ong Huat stocks.

The game continues.

Appendix

More articles on Icon8888 Gossips About Stocks

Created by Icon8888 | May 01, 2020

Created by Icon8888 | Mar 10, 2020

Created by Icon8888 | Mar 01, 2020

Created by Icon8888 | Nov 13, 2019

Discussions

I guess it was not to be.... the one that I followed you closely was Rex Industry... fate la... or maybe it was done during your early days...

But this is 2016 now... I will follow you and see... Icon8888... the Great Filter

2016-01-06 08:42

He is the one who is able to differentiate the truth. Will be following closely his articles.

2016-01-06 08:45

Icon just my opinion. As everyone is aware, you are a value guy. When you do those stocks writeup, those list of stocks are generally 'cheap' & has 'low expectation' if not undervalued, because I do not study all of them. To use your list of stocks to proof the theory that 'profit increase lead to share increase', and as we all know, it is a positive correlation. It proof the theory applies to reality.

But if you use that theory and applies to a bunch of high PEs stocks, that is when the theory is very likely to generate a very different outcome in real life and fall apart.

And now to people that just take KYY golden rule at face value, they dont really look at all these, they will think 'oh topglove will grow, public bank will grow, lets buy it' So it become indiscriminate that what people call 'buy at any price, as long profit is growing'. And I say it many times, public bank profit will grow whether you buy it at RM1 or RM100, but your investment return on one end is beggar and another end is millionaire. That is the problem with this golden rule.

2016-01-06 08:50

Your point is valid. I think Uncke Koon is aware of the issue too. I can see he inserted the wording "preferably with reasonable PER". It wasn't there in the 2014 version

2016-01-06 09:33

there is no wining formula. even warren buffee was wrong in investing Amerian Airlines. there are times you are spot on the counter but due to reasons beyong your control timing is off. even a long term investor ( 3-5 )years may not see the result. we mere mortals holding period are even shorter. Envron is a classic example where too big too fail. Lehman bros is another classic case. Coming closer to home is Peter lim (Singapore) invested 1 Million Shares ( SGD ) in Wilmar 1996. sold off the block for 1.5 BIllion . that one is a lucky shot. happy trading

2016-01-06 09:50

There is no 100% winning formula..

But still there are winning formulas...if 7-8 out of 10 of yr picks (from yr winning formula) could make money then u are very very geng oredi...

2016-01-06 09:58

Thank you Icon kor-kor.You are 68 and I am 67.I started learning to trade shares at 40.My most memorable trading experience was buying SIN HENG CHAN at RM12 and selling at RM60 in 1993.Like you I also hope to leave behind a legacy for my children.WISHING ALL A HUAT,HUAT YEAR OF 2016.

2016-01-06 11:25

No point criticize any writer in I3, just learn good and valuable strategies from the writer and we perfect it. It can be used to improve our performance in KLSE.

I learn a lot from all sifu in I3.

Thank you.

2016-01-06 11:28

Dear All,

In i3, We are here to help the investment community by sharing the investment knowledge and not to curse each other. No one is GOD here. For those who recommend stock in i3, please also has the courage to admit mistake if the stock is not performing as expected and move on. For those who follow the buy call, please always remember that you are the one who are responsible for your decision. Do not blame others. It is not easy to recommend a buy call as there are so many factor that can impact the share price which is beyond our control.

2016-01-06 11:40

Couldn't disagreed with Sifu OTB ....... indeed just like how we teach our children - "remember the good and forget the bad" !! We r no perfect n how can we hv "perfection" !!! Is much easy to shoot at the back than in the front ............ so let's carry on to learn together n hopefully for some it will make a diff for other gahhhh !!! Happy & Healthy & Prosperous 2016 . Happy trading too

2016-01-06 11:47

I just subscribed to I3 last month and find your article informative, interesting and valuable for small retail investors like me. sifu Koon's theory works generally well if the reported numbers are not exaggerated or falsified. I had fallen victim to companies like Transmile and NamFatt which reported fictitious revenue and profits. Since then, I am vary of companies whose directors I have lack of confidence, especially China companies listed in Bursa such as Xinquan, CSL etc. thank you for sharing your experience and knowledge of companies listed in the Exchange

2016-01-06 11:53

Oh my. This is such a good read. Clash of The Titans series are wonderful bro Icon8888. Great job and I wish you success with your kindness in sharing those knowledge bombs.

Thanks!

2016-01-06 11:54

Thru reliable sources say few "top 30" holders for XingQua had begun to offload batch by batch ????

2016-01-06 11:58

Well some of the observation/comments is correct/good especially on hexza while some is base on assumptions

Hexza is a good company , net cash company with ample cash - somebody already writing on it , and discovered this gem.

It was insider Asia stock feature and also written by another blogger

http://klse.i3investor.com/blogs/kianweiaritcles/86642.jsp

2016-01-06 12:04

I really learn and gain knowledge every time i read your articles. Thank you very much Icon8888.

2016-01-06 12:40

Its called conviction when right and win big

also called stubborn when wrong and lose big

2016-01-06 12:43

Many people said investment forum very dangerous, so far i3 is the best and most updates and most honest forum to all.

Tapi, there is no free lunch!!!can't 100% people here with good intention more than 50% is bad intention. Happyly to see the good one to kick out the bad one.

Learn from all people. The thing quote from koon I think good and learn from him is:

Rule number 1: The profit for this quarter must more than last quarter. More ? 1m ?2 m30m ?100m? Consider more? Yourself decide.

2016-01-06 12:51

Its called conviction when right and win big

also called stubborn when wrong and lose big

Final results are based on strategy and stock picking skills.

First, most people really got no strategy one.

Secondly, on stock pickings, and buying and selling decisions,

the losers says Yes too often.

the winners rarely says Yes

2016-01-07 01:11

that's why it is called stock picking skills, not just good stocks.

of course if you got great marketing departments like i3, it helps.

<Posted by i4investor > Jan 7, 2016 10:42 AM | Report Abuse

timing is the key to success...good stock wrong timing also cannot up>

2016-01-07 10:46

some believe its almost impossible to reliably time mkt over the long term, they believe the key is to stay almost or fully invested in growth/value stocks at all times.

but so long one is happy, making $$ and harm nobody...no right or wrong method.

Good luck everybody!

2016-01-07 14:20

nobody is perfect. whatever we do keep it professional. share our ideas and thoughts. at this forum. there are good vibes and bad vibes. just filter out the bad vibes and keep the good vibes. happy trading

2016-01-07 14:26

Uncle Koon's Obsession... He has the track record and the skill set to handle it.

Now, every small time investor also want to be Uncle Goon ....the rage is on, it has even spread to the investment community in the analysts community. Nobody wants to miss the game.

When the market turns , everybody don't know what to do The analysts community just write reports, it is not their money. And they don't have the skill set to handle it.

To cut a long story short, there is no single rule...if there is it would be quickly arbitraged away and next time, somebody will invent another magic formula for short cuts. hahahaha

2016-01-07 17:44

Icon8888, good afford to research & analysis. I can study further to select above stock.

2016-01-07 18:41

fair comments well analysed report n researched done n covered enough.all good intentions and hard work given on research n diligent,little luck has a part in mans play.

2016-01-07 21:31

Hey Icon8888, mind to share how we could get info that you used in appendix?

2016-01-08 00:34

no single ratio is perfect but rather ratios should be use collectively to give a bigger picture to the puzzle.

2016-01-08 01:11

Nakata the info is tracked down one by one. I know the date I wrote the articke, so I dug out the price, the latest previous Q profit (when article published) etc

2016-01-08 05:40

@Icon8888 Thanks for this very useful and informative post. Plus your analysis. This is something which requires a lot of time and energy, not to mention a lot of brain power. Whether an individual agrees or not, and to what extent, is secondary. But I must say that this kind of post adds value to i3investor. Makes it worth the time to come here. You get an "A+" for your efforts. Very much appreciated.

2016-01-08 12:39

Once again a big Thank You. Your selection of shares for 2015 has been very successful and make a lot of people richer in this group. Of course not many people can afford to buy all the shares! Hope some have not selected the under performing shares.

2016-01-09 11:18

Icon8888,

I feel a little strange that why you exclude those stocks below which can be explained away from your already small sample size.

"Of the remaining 8 stocks that the price hasn't gone up proportionate to profit growth, 7 stocks can be explained away (blue highlighted), only 1 stock cannot (yellow highlighted)."

For example,

"WTK - Before profit growth, the stock traded at high PER (backed by high net assets per share). Strong profit growth only brought PER down to a more reasonable level. As such, investors did not chase the share price up substantially."

The above exactly explains why strong profit growth is not necessary follow by share price increase (unless it is being gorenged), because this profit growth has already known by insiders and their friends that the share price has already gone up way before the announcement of strong profit growth.

2016-01-09 19:25

master_tan

Uncle Icon, good work. I would suggest you include AEMULUS in your list of coverage. My analysis show that this company has potential to shine in year 2016.

2016-01-06 08:32