(Icon) Dufu Tech - Weak Ringgit Boosts Profitability, Strong Cashflow Conducive For High Dividend

Icon8888

Publish date: Wed, 13 Jan 2016, 09:56 AM

(Dufu factory located at Bayan Lepas, Penang)

1. Background Information

Dufu is principally involved in manufacturing of components for Hard Disc Drive industry.

(Precision turning products)

(Precision machining products)

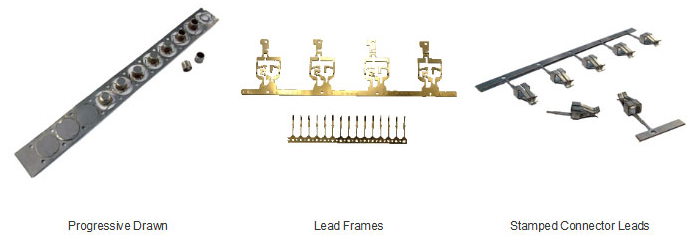

(Metal stamping products)

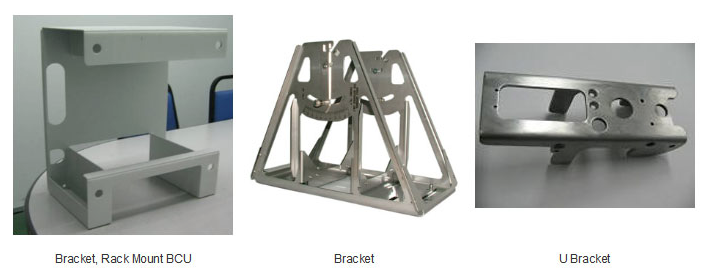

(Sheet metal fabrication)

(Tool and die fabrication)

(Plastic components)

Based on 175 mil shares and price of 55 sen, market cap is RM96 mil.

The group has net assets of RM109 mil, loans of RM15 mil and cash of RM16.9 mil. As such, net cash is RM2 mil.

The group has not done well in the past few years. Same as many other manufacturing companies, Malaysia was not cost competitive compared to China and Vietnam.

| F.Y. | Revenue ('000) | Profit Attb. to SH ('000) | EPS (Cent) | PE | DPS (Cent) | DY | NAPS |

|---|---|---|---|---|---|---|---|

| TTM | 165,450 | 6,717 | 3.83 | 13.32 | 2.00 | 4.00 | 0.6220 |

| 2014-12-31 | 135,668 | 5,939 | 3.38 | 7.85 | - | - | 0.5680 |

| 2013-12-31 | 104,195 | -5,539 | -3.78 | - | - | - | 0.5230 |

| 2012-12-31 | 114,084 | -2,194 | -1.83 | - | - | - | 0.6960 |

| 2011-12-31 | 119,296 | -4,809 | -4.00 | - | - | - | 0.7230 |

| 2010-12-31 | 128,495 | 6,825 | 5.69 | 7.21 | 1.00 | 2.44 | 0.7460 |

| 2009-12-31 | 116,642 | 11,125 | 9.27 | 4.64 | 1.00 | 2.33 | 0.7220 |

| 2008-12-31 | 121,480 | 9,798 | 8.17 | 4.04 | 1.50 | 4.55 | 0.6380 |

| 2007-12-31 | 109,509 | 12,152 | 14.14 | 4.88 | - | - | 0.7590 |

| 2006-12-31 | 90,601 | 7,861 | 12.94 | - | - | - | 1.4400 |

| 2005-12-31 | - | - | - | - | - | - | - |

However, in the recent quarters, their profitability improved. Please refer to next section for information.

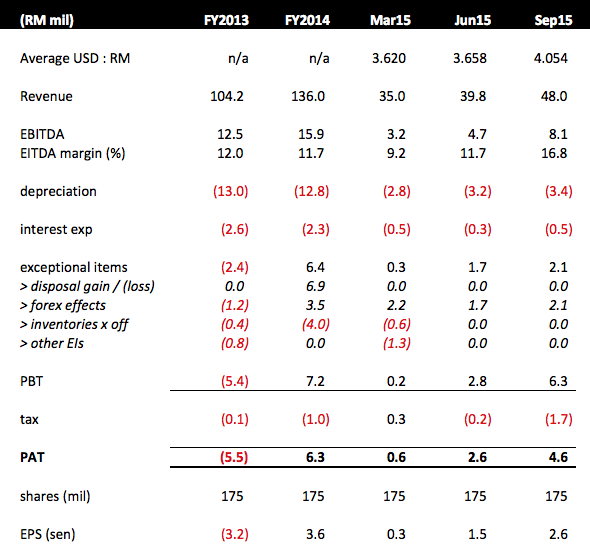

2. Historical Profitability

The following table sets out the group's historical profit over past two years and recent quarters :-

Key observations :-

(a) Strengthening of USD resulted in forex gain. According to latest quarterly result, more than 80% of the group's revenue was derived from overseas.

(b) As the Ringgit depreciated throughout 2015, the group's EBITDA margin expanded from 9.2% in March (average USD of 3.62) to 16.8% in September 2015 (average USD of 4.05). EBITDA margin is expected to further expand in the coming December quarter as average USD was higher than 4.20.

3. Financial Irregularity

In June 2015, tipped off by whistle blower, Dufu discovered some payment related irregularity. The amount was not huge, approximately RM3 mil plus. A special panel was set up by the company to investigate the matter. The case was settled after the then CEO tendered resignation and replaced by an acting CEO.

4. Expect Strong Dividend Ahead

On 7 December 2015, Dufu announced interim dividend of 2 sen per share. The dividend went ex on 29 December 2015.

One of the pleasant surprise from studying Dufu is the discovery of its potential to become a strong dividend play.

Over the past few years, the group has been aggressively degearing. From January 2013 until September 2015, the group has pared down borrowings by RM29.3 mil.

With the elimination of those borrowings, the group is currently in very healthy financial position. As mentioned earlier, as at September 2015, net cash is RM2 mil.

Strictly speaking, as the group's cash is sufficient to cover its existing borrowings, its surplus operating cashflow can be fully used to pay dividend.

In the first 9 months of 2015, the group generated net cashflow of RM15.3 mil after capex, but before loans repayment. For discussion sake, let's assume full year net cash flow of RM17 mil. Based on 175 mil shares, the group is in a position to pay out dividend per share up to 9.7 sen. Based on existing price of 55 sen, dividend yield works out to be 18%.

Of course, this represents the upper limit. In real life, the company is unlikely to pay out so much. But the overall concept of strong dividend payment is real, not a fantasy. The company has given shareholders a taste of things to come by paying 2 sen interim dividend in December 2015. We can expect more in subsequent quarters.

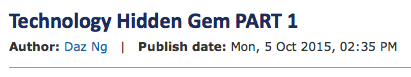

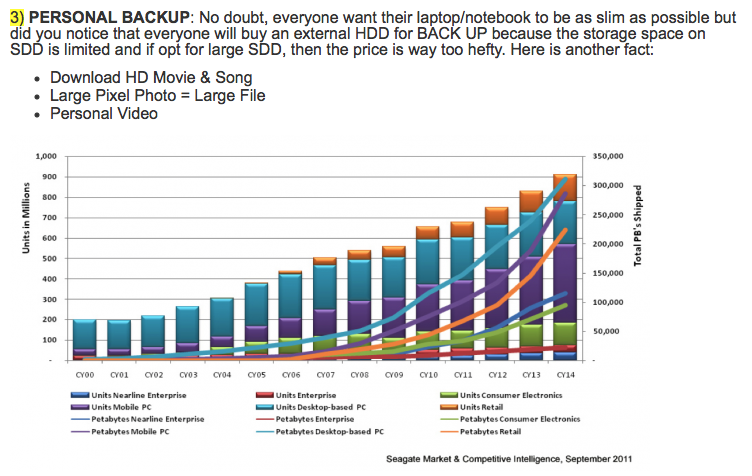

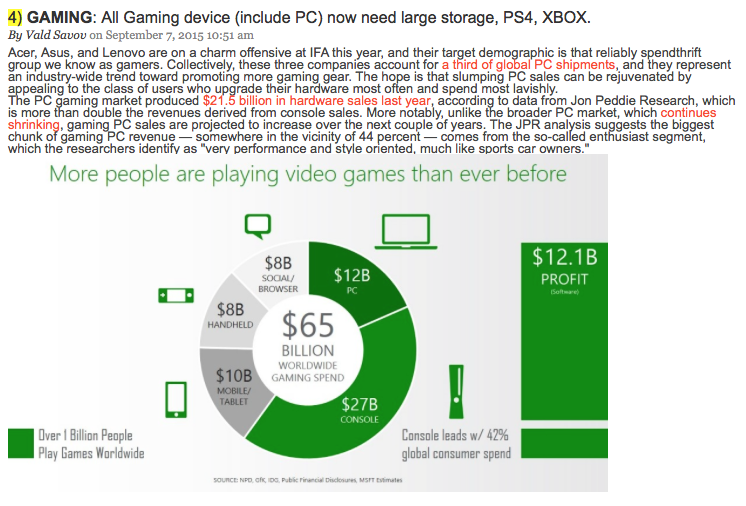

Appendix - Prospects of The Local HDD Industry

Not too long ago, the investing community had the perception that HDD is a sunset industry as Solid State Devices gain popularity. However, this notion has been dispelled decisively by one EXCELLENT article written recently by our own forum member Daz Ng bearing the following title :-

I like the article so much that I am going to cut and paste the entire section about HDD industry here for you to go through :-

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Icon8888 Gossips About Stocks

Created by Icon8888 | May 01, 2020

Created by Icon8888 | Mar 10, 2020

Created by Icon8888 | Mar 01, 2020

Created by Icon8888 | Nov 13, 2019

Discussions

Haiz...party just begin and bursa wisel on uma...haiz

Like when u small playing in the house and your dad come back suddently

2016-01-13 12:07

just some views...

Benefit of SSD: http://www.storagereview.com/ssd_vs_hdd

price SSD vs HDD: http://www.diffen.com/difference/HDD_vs_SSD

--> So you see the trend down for both SSD and HDD... wait a moment, is HDD stop decreasing? look like it is the bottleneck... NAND flash still has room to improve anyway.

additional info:

http://www.marketwatch.com/story/2015-year-in-review-the-sp-500-2015-12-28

3. Western Digital Corp. (NASDAQ: WDC) posted a new 52-week low of $66.08 on Friday, before closing the day down about 1.5% at $66.82. The computer storage device maker announced a $19 billion acquisition of SanDisk on October 21, and the stock has dropped more than $5 a share since then. The stock’s 52-week high is $114.69, and shares lost 16% in the month of October.

WDC emphasis on Enterprise storage?? So, more profit margin? Let's see the revenue and earning :http://financials.morningstar.com/income-statement/is.html?t=WDC®ion=USA&culture=en_US

Why WDC or HDD sector wants to focus on ES? because they have no way to challenge SSD, in term of speed and power efficiency.

If HDD is so much of benefit and future, why WDC wants to spend billions to acquire sandisk? Wanna turn sandisk to hdd maker? or they want to involve into NAND business?

http://www.wdc.com/en/company/pressroom/releases/Default.aspx?release=e5f16023-3969-4cd0-bc3b-fe7e35572518

Anyway, does SSD win all? no...

1. Price is still higher though it has been decreasing rapidly since a few years ago. With 3D NAND technology mature, SSD could go even cheaper.

2. Data retention issue is the major problem~ But we never know when it could be solved...

2016-01-13 12:54

送上杜甫的诗一首《登高》

风急天高猿啸哀,渚清沙白鸟飞回。

无边落木萧萧下,不尽长江滚滚来。

万里悲秋常作客,百年多病独登台。

艰难苦恨繁霜鬓,潦倒新停浊酒杯。

2016-01-13 14:06

Dufu Dividend policy is 50%, unless increase in eps or policy changed, otherwise 9.7 sen / 1x% dividend yield being materialized remain a question mark.. my 2 cent opinion

http://www.malaysiastock.biz/Dividend-Policy/

2016-01-13 15:13

hi icon888, may i know normally UMA will take how long the Bursa to annouce back the reply from the share company? coz i'm newbie for share trading. Thanks for info :)

2016-01-13 16:14

i don't believe this crap, failed to convinced me when price was 0.20 back 102 years ago. Why buy above 0.60?

2016-01-13 16:21

Law81, uma need reply within same day...but normally the answer are copy and paste standard answer

2016-01-13 17:13

Reply to UMA

After the investigation, the board of director wish to announce that the share price of Dufu Tech actively trade because of one very great investor cum guru from i3investor has post a very detail and accurate of Dufu Tech analysis today morning.

Further investigation found out that, the name of this guru is (Icon8888 aka sea cucumber/tilapia) and we found out that in dec 2015, his article on Comintel was given an impact of 100% share price increase within 1.5 days.

By looking into Dufu Tech was only increase with less than 23% today, we feel that icon8888 must quickly to come out with Dufu Tech part 2.

Thanks and if we have any news in future, we shall update from time to time.

2016-01-13 17:38

When the price up sure see icon sifu , not yet up no see write , you really buy or not ? Icon sifu . 2016 stock pick why no see dufu , or today gang up 23% you buy

2016-01-14 00:26

Godinvest please check time of article , it was published at 956am

your conspiracy theory will only be valid if I was able to write an article within 56 minutes (after Dufu surged, according to u)

Not impossible, but unlikely, right ?

If u don't have the intellectual capacity to figure out that point, u r unlikely to do well in Stockmarket

Why not in 2016 stockpick ? Because I only saw it two days ago.

Thank you

2016-01-14 07:25

its true, thanks for Icon888 sharing the analysis. I think some people actually think that you should post earlier so that they are able to catch the train and earn maximum.. they do not appreciate the FOC work that easily get it in the forum.

btw, what is the TP?

2016-01-14 07:35

No TP woh

Everybody play by ear

Set TP will get me into trouble if things turn sour

Ha ha

2016-01-14 07:55

By the look of thinngs... obviously.... trading and speculation is main stream

Trade first... ask later.. but what the heck..

Yo... to be fair to those who have a day job... to post before 8.00am would be more appropriate

2016-01-14 08:11

Icon88.. can you don't post out the stock you found it's good.

Always the good company stocks after your article must be flooded with flippers. .good company stocks become bad stocks....

2016-01-14 11:50

Hi Koon bee, thanks for your answer. Sorry late reply. I wish all can earn much in year 2016 :)

2016-01-14 14:24

hi icon, do u like JCY? I wrote something here.. hope to get your comment

http://klse.i3investor.com/blogs/genzinvestor/89851.jsp

2016-01-15 15:19

just a question, does anyone know a platform like i3investor, able to view simplified financial statement yoy of singapore equities? Basically I'm already accustomed to viewing simplified shares financials through i3investor before detail studies onto the shares. But seems like in i3investor singapore lack of this function...

2016-01-15 17:23

Icon8888, dont simpan hati. I believe readers are smart and mature here.An open mind to chewing your article always benefit me

2016-01-15 18:55

Actually not because of icon88 analysis not good. It's because too many speculators make use of icon and create the roller coaster effect. So, don't simply follow icon next time.

2016-01-15 19:08

Dufu vs JCY

turnover Dufu 160k, JCY 2 billion.

dufu is taufu JCY is elephant.

both in same same business..........

Dufu got i3 icon, I Con........

JCY got what?

2016-01-18 04:11

biggest con job of the year?

JCY vs Dufu.

elephant vs ant

look right, look left, look center, JCY is a better company, cheaper offering.

but Dufu got I Con...........

Laughgaodiemeliao biggest holland ship in the history of i3.

2016-01-18 04:14

The mesmerising power of Icon.

see to believe.

Learn some thing new everyday.

2016-01-18 04:18

in the short space of a few weeks, I have witnessed Comintel, Dufu. ...I am sure others I missed.

marching to the beat.

see to believe.

breathless.

2016-01-18 04:22

amazing herd mentality.............I am talking about you.

Go compare JCY with Dufu yourself....same same business.

Felix still mesmerised,.........hahahaha

2016-01-18 04:33

.png)

Koon Bee

Euro chart very nice...cup and handle

2016-01-13 12:00