(Icon) Thong Guan (7) - A Tsunami Of Profit

Icon8888

Publish date: Thu, 25 Feb 2016, 10:21 PM

(Icon8888 is all smile today)

1. Excellent Results

Thong Guan released its December 2015 quarterly result today with EPS of 9.8 sen per quarter (after factoring in full conversion of ICULS).

The EPS of 9.8 sen is very closed to my forecast of 9.4 sen. Please refer to this article.

http://klse.i3investor.com/blogs/icon8888/88890.jsp

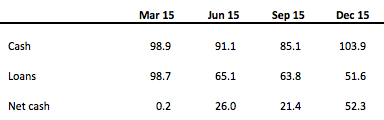

2. Balance Sheets Continue to Improve

In March 2015 quarter, net cash was RM0.2 mil. It has now increased to RM52.3 mil. Based on 158 mil shares, net cash per share is 33 sen.

3. Interesting Insights From Cash Flow Statement

So far, I have written 6 articles about Thong Guan. But I have never discussed its cashflow in detail.

Dear readers, there is one piece of very interesting information embedded in the cashflow statement below. Do you manage to spot it ? I give you 2 minutes.

Ok, time's up.

The interesting information is that from 2014 until 2015, the group has only spent RM55 mil on capex.

What is the implication ?

Thong Guan has stated numerous time that during the period from 2014 until 2016, the group will be spending RM100 mil on capex. As such, the RM55 mil capex so far is only half way through.

If you still don't get it - the recent earning explosion is caused by half of the capex only. What will happen after the entire RM100 mil was fully spent ? It is time to stretch your imagination !!!

Previously, if you tell people that Thong Guan can make RM60 mil per annum, people will say you are crazy. This is because in the past 10 years, Thong Guan's profit hovered around RM20 mil to RM30 mil.

But with this latest quarter's net profit of RM15.5 mil, most people will readily accept that RM60 mil can be the norm (let's just say that strong USD will be here for the next few years - which is my view).

But now with this latest insight gained from analysing the cashflow statement, I would like to be the first one to plant the flag - should we revise upwards our expectation and aim for earnings of at least RM70 mil ? (EPS of 44 sen based on 158 mil shares)

The possibility is there. However, as usual, only time can tell.

My optimisim does not exist in vacuum - the following article dated 26 June 2015 contains details of 2016 capex.

As stated in the article above, the group will be spending RM35 mil on capex in 2016 to produce nano layered strecth flm and stretch hood. These two new products will be KEY CONTRIBUTORS TO GROUP REVENUE IN TWO YEARS.

Sounds like big impact projects !!!

Just in case you wonder what is strecth hood, this is how it looked like.

4. Noodle Division Will Be The New Star Performer

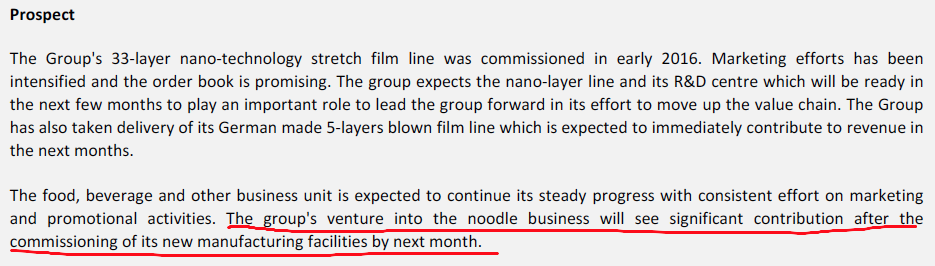

If you think that whatever I wrote above is already sizzling hot, just wait until you read about its noodle division. In the latest quarterly report, the company has some positive things to say about this division :-

If you are scratching your head wondering what is happening in the noodle division, you must have missed out this latest article dated 11 February 2016 :-

KUALA LUMPUR: Kedah-based packaging group Thong Guan Industries Bhd plans to work with its Chinese partner, the COFCO group, to tap the organic noodles market in China, and eventually spin off its food and beverage (F&B) and other consumable product business, which is deemed to have a better margin, profit and valuation than its core packaging business, in three years.

The group, which is expecting double-digit growth in both its top and bottom lines for the financial year ending Dec 31, 2016 (FY16), underpinned by continued expansion, is also on the hunt for merger and acquisition opportunities to grow its packaging segment.

In the planned organic noodles venture, Thong Guan executive director Ang See Meng, son of group managing director Datuk Ang Poon Chuan, told The Edge Financial Daily recently that COFCO, which stands for China National Cereals, Oils and Foodstuffs Corp, had shown its interest in jointly participating in the business.

One of China’s state-owned food processing holding companies, COFCO is also China’s largest food processing, manufacturer and trading group.

“We have not decided on the joint-venture details. It could be equity participation in Everprosper Food Industries Sdn Bhd, a new subsidiary of ours, which includes all related subsidiaries, or another new company we will form. It depends on the project size [of the organic instant noodles venture],” See Meng said.

According to See Meng, not many companies make organic noodles now and the margin is higher compared with conventional noodles. COFCO, he said, has expressed its interest in taking up at least a 40% stake in the venture, which he expects to take off sometime this year.

“Our discussions with COFCO are still ongoing. They see [the] potential in organic noodles for babies and organic instant noodles, and would like the noodles to be sold online. They also said Chinese consumers prefer imported food. We have visited them in Beijing twice so far. They are planning a visit after the Chinese New Year,” See Meng said.

The new venture will need certification papers from the Chinese government before it can mass-produce organic noodles for the Chinese market. “They (COFCO) have agreed to supply us organic flour in order for us to get the organic certification from China,” See Meng shared.

See Meng believes Thong Guan has the capability to export organic noodles worldwide and be the first to export organic noodles for consumption by Chinese babies, which are deemed a billion-dollar business.

The group’s noodles are now exported to 10 countries. China makes up about 10% of its total noodle sales — relatively small as the group only started supplying its noodles to COFCO two months ago. With the new organic noodle venture, Thong Guan expects the Chinese market to contribute at least 70% of its total noodle sales in two years.

“I believe there will be more orders, especially when we start providing organic noodles,” See Meng said, adding that besides COFCO, Thong Guan also gets orders from other Chinese companies. The group is now looking at setting up a branch and warehouse in Shuzhou to cater to growing demand.

With the planned venture and capacity expansion, Thong Guan expects revenue contribution from its F&B and other consumable product segment to grow to 30% in two to three years. The F&B and other consumable product segment makes up about 10% to 15% of group revenue now, but contributes about 30% of its profit. Its core plastic packaging segment, meanwhile, contributes about 85% of the group’s revenue, but 70% of its profit. Clearly, the margin is higher in the non-core segment.

“Our packaging division is stable and we are one of the largest in Asia. We want to realise more value from our F&B and other consumable product segment, so that it can stand alone and generate more value for shareholders,” See Meng said.

Thus, the group will eventually spin off its F&B and other consumable product segment as the market has not priced in the value of the segment of the group, hidden as it is below the plastic packaging segment.

“We definitely plan to list it as [a] separate entity in two to three years. It won’t necessarily be in Malaysia, as we hope to hedge the risk [of being only in one market]. For an industrial packaging company, the fair valuation is only between eight and 10 times P/E (price/earnings). But for F&B and other consumables, the market will give us more than 10 times P/E,” he added.

As for the M&A hunt for its packaging business, Thong Guan is now talking with two packaging firms, one each in Malaysia and Vietnam.

“The prices are still high now, so we are waiting for a more suitable time. We are talking, but it may take a while,” said See Meng, without giving a specific time frame for when the talks will come to an end.

Meanwhile, this year will mark the group’s last phase of its three-year RM100 million capital expenditure plan that began in 2014. The group spent RM60 million in the last two years. The remaining RM30 million will be used this year to expand its noodle business, fund a new polyvinyl chloride line and initiate its five-layer blown film stretch hood line.

“With the machinery we put in over the past two years, we are looking at double-digit growth for FY16,” said See Meng, adding that 2016 will be a better year for the group.

Thong Guan’s net profit grew 2.6 times to RM11.26 million in the third quarter ended Sept 30, 2015, from RM4.92 million a year ago. For the cumulative nine-month period (9MFY15), the group’s net profit rose 6.16% to RM22.99 million from RM21.65 million in 9MFY14. The improvement was mainly due to higher margins from exports.

Its shares closed down six sen or 2% at RM2.94 yesterday, valuing it at RM309.5 million.

===============

For your information, COFCO is no kicimeow company. It is a State Owned Enterprise and is the largest food trading and distribution company in China. It handles a wide variety of agricultural produce including edible oil, wheat, rice, sugar, tea, milk, etc.

Appendix - Thong Guan's Organic Noodles Partner - COFCO

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Icon8888 Gossips About Stocks

Created by Icon8888 | May 01, 2020

Created by Icon8888 | Mar 10, 2020

Created by Icon8888 | Mar 01, 2020

Created by Icon8888 | Nov 13, 2019

Discussions

Hi ! Icon8888, a big big like to the Yellow little Smiley. Congrate on your Darling counter ... Damp huat 2morrow @@

2016-02-25 22:28

World wide market is slowing down. This will spill over into any company.

2016-02-25 22:32

TGuan Mr. Ang, give Big Ang Pau to his supportors in the year of Fire Monkey.

2016-02-25 22:32

Great work Icon. Detailed & meticulous write up. Keep up the good work! Huat ah!!!

2016-02-26 08:21

all these growth stories were not new...the capex expansion and noodle business were reported earlier and higher Q4 profits also expected when oil prices and Ringgit still low. I recalled Yistock wrote a good article on this.

why the share price not performing earlier in Jan and Feb?

2016-02-26 08:34

Tguan is not only forex play, it is forex+expansion+improving margin. It is a stock to own even if ringgit strengthens.

2016-02-26 08:43

overall TGuan growth story is good...the only risk that can keep me awake at night is the escalating raw materials (oil prices) that is beyond the control of TGuan. It's good to note TGuan recognise this risk and diversify into food business and upgrade the product line to be less price sensitive.

I am sold by the TGuan story and a good stock to keep.

2016-02-26 08:55

For Icon8888, your 3 tons of lorries on Tguan warrants must have given you a very good profit for 2016. Your write up on Tguan indeed very accurate and precise. Please continue to enlighten us for more. Just one thing, Dolomite indeed exploded into losses! May be you can also enlighten us. Thank you.

2016-02-26 09:27

Icon8888, since you are so good in sporting companies. Would you help take a closer look on this? http://mrem.bernama.com/viewsm.php?idm=26278

This could potentially be a 2x bagger stock if it is correct la.. FY2015 was a massive turnaround and FY2016 seems to be in the bag with current order book.

2016-02-27 10:08

I have one question.

After showed us cash flow statement, you mentioned that so far the group spent 45 million on its CAPEX and another 55mil will be spending on 2016's expansion.

But i notice that the news which published by TStar stated the group will be spending 35mil for 2016 and 30 for 2015, a total of 65mil for 2 years.

So, whether the CAPEX for 2015 and 2016 is 65mil or 100mil?? Thank you.

2016-02-27 10:26

Thong guan can make 60million -70million this year, fair value should be RM4.50

2016-02-27 10:27

I think the best thing to take away from the cashflow report is that they have managed working capital better and has a net operating cashflow instead of an outflow. Expansion in assets does not necessary corresponds with increase in margins or sales

2016-02-27 14:51

Ricky Kiat

thumb up....

2016-02-25 22:25