(Icon) EG Industries (2) - Good Results, Beats Expectation

Icon8888

Publish date: Fri, 26 Feb 2016, 09:29 PM

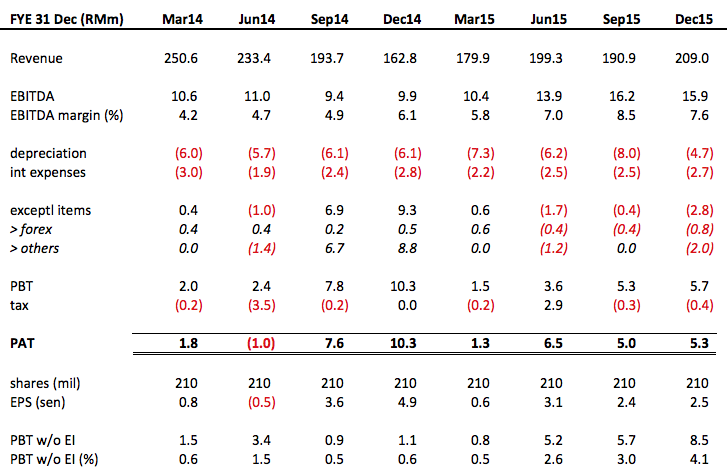

Today, EG announced December 2015 quarterly results. For me, the result is satisfactory and above expectation.

Key observations :-

(a) The group's turnaround actually started in June 2015 quarter with PBT of RM5.2 mil (without exceptional items).

(b) In this latest quarter (December 2015), revenue increased by 9.4% Q-o-Q.

Despite higher revenue, EBITDA declined slightly from RM16.2 mil to RM15.9 mil, driven by lower margin.

What saved the day was the lower depreciation charges of RM4.7 mil (RM3.3 mil lower than previous quarter's RM8 mil). The company did not provide explanation for the sharp drop and it is not clear whether can be repeated.

As a result of lower depreciation charges, operating PBT increased by RM2.8 mil from RM5.7 mil to RM8.5 mil.

However, the group incurred RM2 mil expenses for the rights issue and private placement exercise completed in Q4 of 2015. As a result, the final PBT was only RM5.7 mil, slightly higher than previous quarter's RM5.3 mil.

The company used weighted average number of shares to calculate the EPS. However, I prefer to cut through all the confusions and use the 211 mil shares outstanding. As a result, latest quarter EPS is 2.5 sen, more or less the same as previous quarter's 2.4 sen.

Based on annualised EPS of 10 sen and latest closing price of RM0.89, PER is about 9 times.

This level of PER is not exactly very exciting. However, investors are buying the stock for its future. EG is at early stage of a beautiful growth story. With targeted completion of new plastic injection factory by second half of 2016, group performance is expected to further improve.

Exciting times ahead.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Icon8888 Gossips About Stocks

Created by Icon8888 | May 01, 2020

Created by Icon8888 | Mar 10, 2020

Created by Icon8888 | Mar 01, 2020

Created by Icon8888 | Nov 13, 2019

Discussions

not really leh... sometime not screwing up is already a big achievement... just look at geshen..

2016-02-26 21:43

Hi! Icon8888 thank you for the quick article that really help instead I hv to read through the whoke reports. Will chewing for the Prospects part of Eg. Keep the great works, stay focus.Huat yaa..

2016-02-26 21:47

Icon u are dead wrong u should include the rights issue payment it is not recurrin so it actually registered a growth of 40pc quarter comparison

2016-02-26 22:20

Is EG Ind China stocks? Why they don't declare dividend also people don't bother?

2016-02-26 22:23

Haiyoh, confused; if u really followed. U will know that Eg has juz started their Transforming program, if they hv more monies, they will buy back Own share. Too early to talk for Div. For a fast booming Eg. .at least not in 2016.

Posted by confuse > Feb 26, 2016 10:23 PM | Report Abuse

Is EG Ind China stocks? Why they don't declare dividend also people don't bother?

2016-02-26 22:29

Hi Icon, may i know why you take 211 mil instead of 116,391,196 to get the EPS? Thanks and appreciated :)

2016-02-26 22:41

their original share cap was 74.8 mil, rights issue of 115.2 mil, private placement of 19.2 mil

as such, total = 210 mil

116 mil is the weighted average. It takes into consideration that rights issue and private placement was completed around December 2015 and hence has a 1 month effect

2016-02-26 22:46

I really disagree with what u said, is a beat expectation not in line, if not for the corp exercise, eg profit will be superb, and this has just started, more to come

2016-02-27 01:19

quite agree with u

Posted by muscle > Feb 26, 2016 09:42 PM | Report Abuse

Talk cock la.. In line is not enough, must b exceeed expectstion

2016-02-27 02:00

This article is wrong already la, already beat expectation, annualise 12.8m will be RM25.6 divide by 211m shares = PE 8.5x still cheaper than SKP and VS

2016-02-27 09:20

U know what is EMS? and you know what is nature of business or not?

Western digital has been their client for more than 20 years, Dyson as well, this are recurring orders, geshen is a pure plastic player, eg is a EMS+ downstream plastic as well, haven't even started plastic if you read carefully between the lines

assume 0 contribution from plastic, ems still very profitable as they are moving into goxbuild

2016-02-27 09:52

muscle maybe spend some time to read my Part 1

The story is not like what your impression is

I hope u can join us, and make money

We Huat together

2016-02-27 10:25

I still can't understand how it is considered good result.

But most company didn't perform well

It is not irrational to assume it is mediocre result at best

2016-02-27 10:32

Future is exciting for any other company

It is not only exclusive to them

But can we assume any tech company can survive in say 10 years time frame?

Many Japanese tech company end up can't perform well and force to merge with other company for example Sharp recently declare merger with Honhai

2016-02-27 10:42

Vertical integration services is there to improve value of the supply chain, above will not be any issue. Eg is now on a product mixing .

2016-02-27 23:46

TO me , the results r poor....n not convincing at all. What is 2.5c compared with 2.4c?

2016-02-28 15:36

Yes, poor margin. Easily slip into red if the is any change of business conditions.

2016-02-28 16:59

they got long distance to go before ,any one would call ,performed well lah, usually i stay far far away from companies like this.

2016-02-28 20:14

From the several comments above, it seemed that many people do not understand EG

You can basically separate its business into two categories.

The first one is the old business supplying to Western Digital (in operation for the past ten years). This business generated revenue of RM800 mil but net profit of RM2 mil (margin of 0.25%). This is the thin margin that you all criticized.

If this is the only business, none of us will be interested, and you won't see me writing about it.

We are buying for its second business - box built.

The box built business is new and it started contributing in June 2015. This business has high margin of 10%, according to one interview of CEO by the press.

This new business is in its infancy and has huge growth potential. That is the reason we are interested in the company.

I provide the above information to explain that I am not trying to con you by selling a proton as a Ferrari to you.

If you are interested to find out more, you can read Part 1. I have explained the company's evolution there.

2016-02-28 20:42

quoted " In purebull, when KYY calls Stocks fly non stop. Now even KYY&Co shout n yell, stocks r not bothered. "

typical bear market mah. : )

2016-02-28 20:46

to push it back to RM1.2 and above must have articles 1-10 hentam terus : )

2016-02-28 20:47

No need to push. 2015 experienced showed that when result is consistently strong, it will go up gradually by itself. Hevea, Lii Hen, Pohuat, Thong Guan, etc all are like that

If results not good, it will go down like geshen, genetic, Johotin, etc

Your money your risk your reward

Results determine everything, not optimism, not cynicism. Market is emotionless and indifferent to our view

2016-02-28 20:53

Q1 - 5.5m

Q2 - 7.3m

Q3 - ? If can do 6m is good enough, all ems and tech cos are weak on cny season

2016-02-28 20:56

5 mil per quarter has already been factored in share price

To go up, they need to produce 7 mil to 8 mil per quarter. If they can deliver that next Q, price will go up. Otherwise will remain at this level.

2016-02-28 20:58

Bro icon all tech and ems players are weak on cny, 2 weeks holiday in china, check out vs inari mpi and unisem, if eg can do 6 next q is very good already

2016-02-28 20:59

murali

Looks good

2016-02-26 21:40