(Icon) LB Aluminium (3) - Excellent Result, Profit Back To Previous All Time High

Icon8888

Publish date: Fri, 25 Mar 2016, 08:28 PM

1. Introduction

The title of my previous article for LB was "Sun Rise or False Dawn ?".

That was because in the previous quarter ended 31 October 2015, the group showed signs of turning around and I was not sure whether it will be able to sustain the momentum.

Today, LB released its January 2016 quarterly report. The result is very satisfactory. Looked like it is not a false dawn (touch wood).

2. Latest Quarter Result

Compared to previous quarter, revenue has not grown by much. However, EBITDA margin improved substantially, reaching an ALL TIME HIGH of 12.6%.

This item alone single handedly elevated net profit by almost 100% (compared to previous quarter).

As a matter of fact, in my previous article, I have identified EBITDA margin as an important factor to watch. Please refer to cut and paste below :-

In this latest quarter, it seemed that the group not only able to maintain the positive momentum, but improved further on it.

One of the contributing factor is of course the lower raw material cost (aluminium price was 1.8% lower). However, in my opinion, that should not be sufficient to deliver such strong growth in EBITDA margin. The group must have been successful in passing higher cost to customers, as mentioned in previous article.

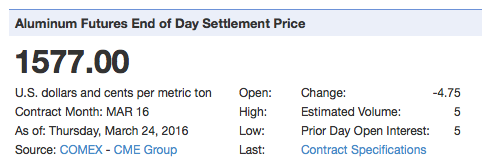

3. Aluminium Price

For those not familiar with this group, let me point out (once again) that Aluminium is used as raw material by LB. As such, high Aluminium price will adversely affect the group, and vice versa.

According to Index Mundi, latest Aluminium price is USD1,577 per MT.

This is an increase of 6.4% compared to LB's estimated cost of USD1,482 per MT during the period from November 2015 until January 2016. However, the Ringgit has strengthened from 4.328 per USD to 4.028 now. Based on the latest exchange rate, LB's estimated Aluminium cost is RM6,352 per MT. This works out to be approximately 1% lower than previous quarter's RM6,414 per MT.

Of course, the above figures are for discussion purpose only. The group's actual cost might be different as it is dependent on timing of buying, hedging policy, etc. However, the general idea is still that recent Ringgit strength could play a role in mitigating rise of USD Aluminium price. Let's wait for next quarter to find out the truth.

4. Concluding Remarks

I have only good things to say about this quarter's result. As mentioned in my previous article, LB has a difficult time in the past few quarters. However, it seemed that things had stabilised. Hopefully the positive momentum can be sustained.

If you annualise the past 3 quarter EPS, you will arrive at EPS of 5.3 sen for FY2016. At current price of 50 sen, prospective PER will be 9.5 times.

However, if you annualise the latest quarter EPS, you will arrive at EPS of 8.4 sen for FY2017. At current price, prospective PER will be 6 times.

It is up to you to decide which EPS is more reflective of the group's prospects. Your money your choice.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Icon8888 Gossips About Stocks

Created by Icon8888 | May 01, 2020

Created by Icon8888 | Mar 10, 2020

Created by Icon8888 | Mar 01, 2020

Created by Icon8888 | Nov 13, 2019

Discussions

Aluminium US 1,797.39 still benefit?

http://www.theedgemarkets.com/my/article/china-aluminum-6-month-high-after-li-says-economy-stabilising

(b) It seemed that the group will do exceptionally well when aluminium price was lower than RM6,000 per MT (yellow highlighted).

http://klse.i3investor.com/blogs/icon8888/90343.jsp

2016-03-27 10:42

Haha..someone posted aluminium ingot price in LB forum. Icon and investors confused. Confuse also being confused. If ingot 1.7% hike, aluminium price should b around that. Post in Pmetal forum is correct. Not in this counter.

2016-03-27 15:54

Jan'16-Aluminum price USD 1482 vs USD 1797 in Edge article still benefit LB Aluminium? Ringgit still weak above RM 4.

http://www.theedgemarkets.com/my/article/china-aluminum-6-month-high-after-li-says-economy-stabilising

2016-03-27 16:06

Latest aluminum price traded at LME is 1469 USD. In the Edge article, 1797 USD

is the aluminum ingot price trade at Shanghai Futures. Ingot is different grade aluminum(higher price). Of course hike in China should resulted hike at LME price. But not as much as 1482(normal aluminium) to 1797(ingot). If you still not clear. Pls google to LME n Shanghai Futures.

2016-03-27 16:30

Icon blog use Mundi futures. Slightly higher than lme. 1797 is Shanghai Futures n different product(posted in the edge). Different place different product how to compare. Tomorrow check Mundi futures is the correct way.

2016-03-27 16:49

Now Mundi Alu price is USD 1577 still higher than USD 1482 Icon used in his blog so next qtr report not so good?

http://www.indexmundi.com/commodities/?commodity=aluminum

2016-03-27 16:59

Icon8888

9 months EPS is 4 sen, with latest Q EPS being 2.1 sen. If you don't have the guts to assume next Q they can make at least 1.3 sen such that full year is 5.3 sen, you shouldn't be in stock market. Better call your banker to enquire about fixed deposit

------------

"If you annualise the past 3 quarter EPS, you will arrive at EPS of 5.3 sen for FY2016. At current price of 50 sen, prospective PER will be 9.5 times."

2016-03-26 10:41