(Icon) Magnum - Strong Earning Recovery Backed By 7% to 8.8% Dividend Yield. BUY

Icon8888

Publish date: Wed, 01 Jun 2016, 10:27 AM

1. Strong Profit In Latest Quarter

Magnum released its March 2016 quarterly result last week.

Q-o-Q, net profit increased by 74% to RM68.8 mil. EPS works out to be approximately 4.8 sen.

Quarter Result:

| F.Y. | Quarter | Revenue ('000) | Profit Attb. to SH ('000) | EPS (Cent) | DPS (Cent) |

|---|---|---|---|---|---|

| 2016-12-31 | 2016-03-31 | 752,563 | 68,840 | 4.84 | 4.00 |

| 2015-12-31 | 2015-12-31 | 668,431 | 39,541 | 2.80 | 3.50 |

| 2015-12-31 | 2015-09-30 | 660,174 | 37,972 | 2.70 | 2.50 |

| 2015-12-31 | 2015-06-30 | 657,289 | 59,825 | 4.20 | 5.00 |

| 2015-12-31 | 2015-03-31 | 791,276 | 90,763 | 6.40 | 5.00 |

| 2014-12-31 | 2014-12-31 | 727,414 | 60,588 | 4.20 | 5.00 |

| 2014-12-31 | 2014-09-30 | 669,986 | 45,417 | 3.20 | 5.00 |

| 2014-12-31 | 2014-06-30 | 696,596 | 67,999 | 4.80 | 5.00 |

| 2014-12-31 | 2014-03-31 | 792,545 | 82,534 | 5.80 | 5.00 |

2. Share Price At All Time Low

Back in 2013, Magnum used to trade as high as RM4.00. Its current share price of RM2.28 is an all time low.

3. Strong Dividend Yield

Magnum traditionally declared 20 sen dividend per annum. However, it scaled down to 16 sen in FY2015, in line with weaker earnings.

| F.Y. | Revenue ('000) | Profit Attb. to SH ('000) | EPS (Cent) | PE | DPS (Cent) | DY |

|---|---|---|---|---|---|---|

| 2015-12-31 | 2,767,010 | 228,101 | 16.00 | 15.69 | 16.00 | 6.37 |

| 2014-12-31 | 2,886,541 | 256,538 | 18.00 | 15.17 | 20.00 | 7.33 |

| 2013-12-31 | 2,991,338 | 267,798 | 18.80 | 16.81 | 20.00 | 6.33 |

Based on current price of RM2.28, dividend yield is 7%.

Please note that back in FY2013 and FY2014, Magnum declared DPS of 20 sen when EPS was approximately 18 sen.

With the recent earning recovery, can DPS go back to 20 sen, thereby translating into dividend yield of 8.8% (based on RM2.28) ? The likelihood is there.

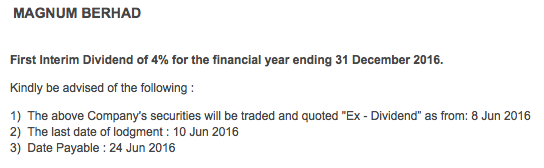

Anyway, the company declared an interim dividend of 4 sen last week. It will go ex on 8 June 2016. Please refer below :

4. Concluding Remarks

It is not easy to make money in stock market. We are now almost 6 months into 2016, and my portfolio has only begun to turn profitable. Some of the stocks that I bought made quite good profit. However, there are other stocks that lost money. Overall, it is a hard struggle to generate positive return for the entire portfolio. I believe the same happens to many people.

However, if you buy into a high dividend stock like Magnum, without lifting a finger, the comany will be delivering 7% to 8.8% return to you every year. And it is done in hard, solid cash, not some elusive paper gain.

I set a very modest target for my portfolio. If I can consistently generate 15% to 20% return per annum, I will be very satisfied. Stocks like Magnum appeal to me because it helps me to achieve half of my targeted return on recurrent basis. That really makes life easier.

Magnum traditionally traded at PER of around 15 times.

| F.Y. | Profit Attb. to SH ('000) | EPS (Cent) | PE |

|---|---|---|---|

| 2015-12-31 | 228,101 | 16.00 | 15.69 |

| 2014-12-31 | 256,538 | 18.00 | 15.17 |

| 2013-12-31 | 267,798 | 18.80 | 16.81 |

If the company can generate 17 to 18 sen EPS this year, it should trade between RM2.55 to RM2.70. Combined with let's say, 7% dividend yield, it is in good position to deliver aggragate return of 18% to 25% return per annum.

I usually don't outright ask my readers to take position. But for this particular stock, it seemed that there is limited downside and high visibility of positive return. BUY

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Icon8888 Gossips About Stocks

Created by Icon8888 | May 01, 2020

Created by Icon8888 | Mar 10, 2020

Created by Icon8888 | Mar 01, 2020

Created by Icon8888 | Nov 13, 2019

Discussions

Why not if consistent 7-8% dividend and with potential appreciation in share price.

2016-06-01 12:17

Thing to watch up is, if the givernmnet is short of money, they will increase the sin company tax. Tax cor tobacco and alcohol companies already raised, only gambling not yet..

2016-06-01 12:39

I have to agree with Veln82k6... during CNY periods, ppl tend to bet more...in fact, by comparing against Q1 2015, it is showing a sign of regression... Q1 2015, EPS = 6.4, Q1 2015, EPS=4.8. A sign of improvement or regression? You make the call... but I have to also concur with Icon that if you are aiming for good dividend yield, yes, you can consider this counter (but unlikely for share price appreciation in short term)

2016-06-01 12:52

Comparing to the so called SIFUs out there, ICON and KC are definitely more honest and sincere learned and highly knowledgeable.

2016-06-01 17:18

Icon, Magnum price is far below the Signal line and Zero line in the MACD chart as advocated by you now. How to buy ?

2016-06-01 17:42

my article mentioned that MACD Zero Line is suitable for those stocks that can exhibit strong trend. I don't think magnum will form a strong trend, running up by 50% to 100% like Lii Hen and Thong Guan, etc.. so the question is whether MACD is suitable for it ?

as for Signal Line, I don't find it to be useful, at least at my current stage of TA knowledge. Maybe I will use it in the future together with other TA tools, if I managed to find some

2016-06-01 19:20

Sorry bro. You r too amateur in tech analysis. U need to learn another 20yrs b4 u know wat i m talking

2016-06-01 19:29

Better wait RM 1.50. Now people no money because GST. Where to find money to buy 4-D?

2016-06-01 20:15

is time also to consider this defensive stock, do you know why toto is not performing than magnum?

2016-06-01 20:47

Profit down 25% year on year! That's quite bad. Better way is to compare year on year, cny more bets! 4D not just no growth but declining! Shift to CSCENIC icon. Look at my old article. Sama sama huat!

2016-06-01 20:50

Old man game & dying business, forget it, all young people now go for internet gambling.

2016-06-02 00:05

HI ICON, good post. thanks for sharing. By the way what is your target price for magnum?

2016-06-02 13:39

Dying business...nowadays so easy buy underground 4D using whatsapp...no need find parking go under the sun and queue and buy from shop anymore

2016-06-02 16:27

I dont understand increasing yoy? from what i see yoy quarter performance is reducing.. can someone explain?

2016-06-03 09:13

I have to disagree with your view on dividend play for Magnum. The company is paying dividend higher than its EPS , how is the sustainable ? In the longer run, the dividend payout will have to be reduced to balance the account

2016-06-03 18:52

Profit drop 56%.

http://www.malaysiastock.biz/Corporate-Infomation.aspx?securityCode=3859

2017-05-19 21:31

For dividend, KFima is not bad. The stock is cash rich and has strong fundamental.

2017-05-19 22:12

chkhooju, fyi. Fimacorp travel document business contract will end by this 3Q2017. This will affect Kfima's dividend policy in future.

2017-05-19 22:34

yeah a lot of illegal betting offer better prize,and also illegal internet 4d betting.some say that this illegal internet betting syndicate belong to insider people and it is doing it for long term.so avoid investing in magnum and bjtoto unless I can kena jackpot and I'll do more advertising for them to increase revenue.....hahaha

2017-05-19 22:46

veln82k6

No improvement at all.Should compare by year on year..Q 1 normally strong due to chinese new year.

2016-06-01 11:33