(Icon) Borneo Oil (1) - Hiding Light Under A Bushel

Icon8888

Publish date: Fri, 01 Jul 2016, 07:58 AM

1. Introduction

First of all, hat tip to forum members Bonescythe and Yoloooo for discovering and promoting this interesting stock.

Borneo Oil was previously known as Sugar Bun. It is now controlled by the Lau family, which also owns majority stake in Hap Seng Consolidated Berhad.

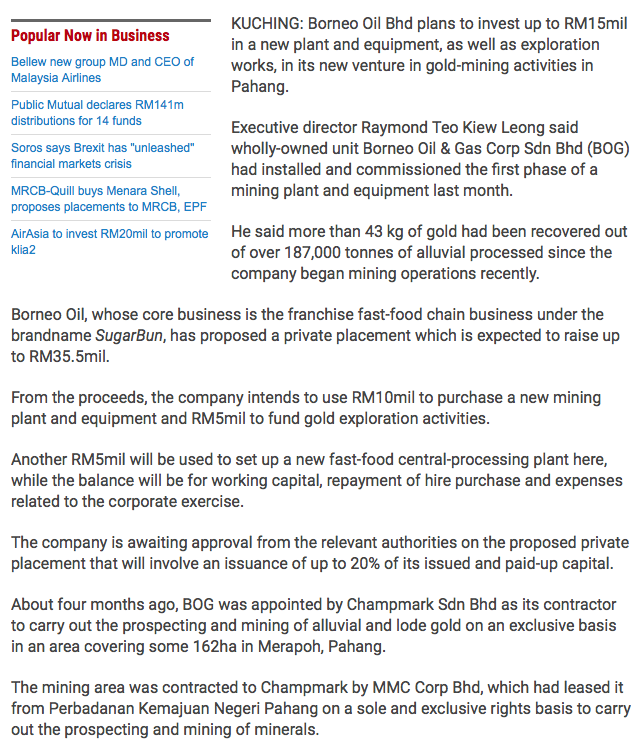

In 2015, Borneo Oil ventured into gold mining in Pahang. Many people criticized that move. It turned out that the critics were wrong. The gold mining division has been doing well.

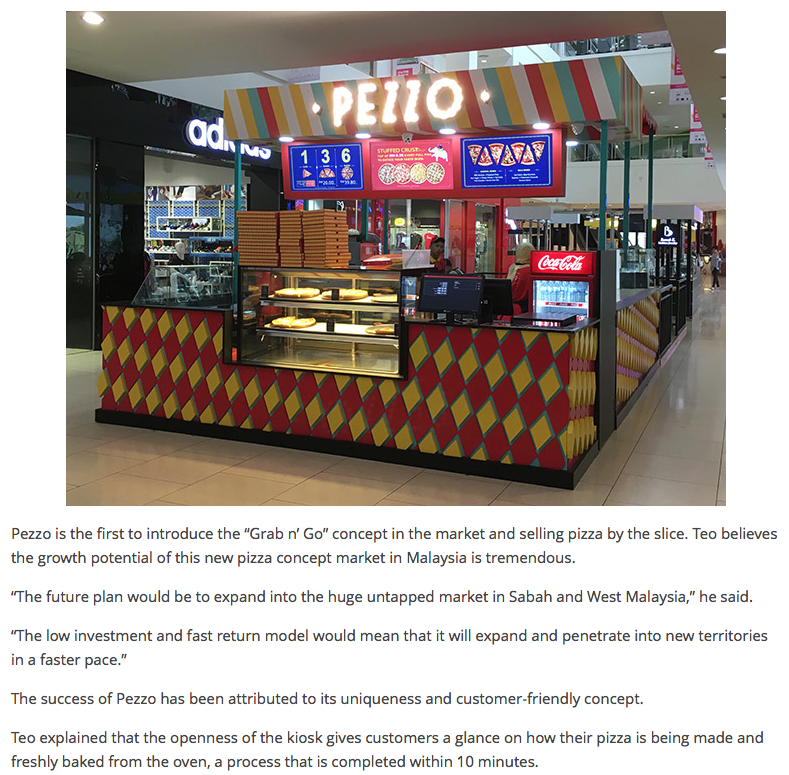

Borneo Oil has maintained Sugar Bun's business. On top of that, they started a new franchise Pezzo Pizza.

2. Background Financials

Based on 2.97 billion shares and 15 sen, market cap is RM446 mil. The reason the share cap is so big is because it just completed a massive rights issue by end 2015.

The group has strong balance sheets, with net assets and cash of RM550 mil and RM71 mil respectively. It has zero loan.

Based on past 12 months aggregate net profit of RM21.4 mil, historical PER is 21 times.

3. Historical Profitability

The company has just released its April 2016 result yesterday. Net profit came in at RM10.7 mil, an all time high. Most of us (forum members) are very happy and satisfied.

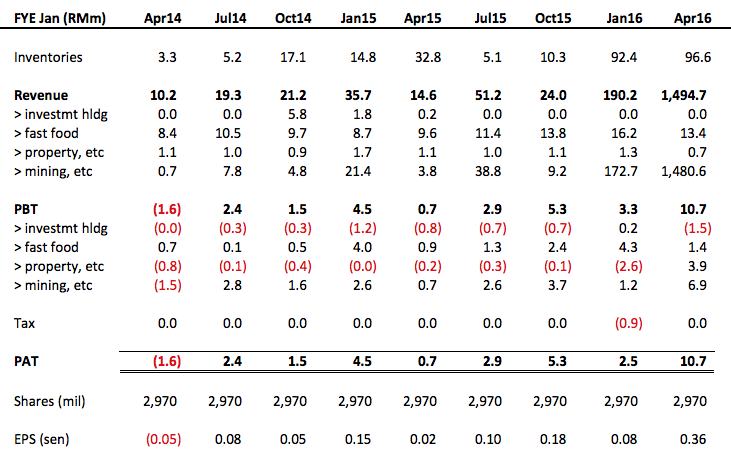

The table below sets out the group's past few quarters' performance.

Key observations :-

(a) Unlike many companies that I have written before, Borneo Oil currently is not reporting strong and consistent profit. However, in my opinion, this does not necessarily mean that it is not profitable.

If my understanding is correct, the group will only book in revenue and profit for its mining operation when the gold is sold.

However, it seemed that the group has been holding on to the bulk of its gold as inventories (which explains why it keeps going up). As a result, quarterly profit is not a good indicator of how well the group is doing. Inventories is a better gauge.

(b) In the latest quarter, mining operation generated staggering revenue of RM1.48 billion. However, it only generated PAT of RM6.9 mil. The company did not provide further details. However, I suggest not to simply jump into conclusion that the RM1.48 billion revenue is entirely due to sale of gold extracted from mines. I don't think they have so much gold in the first place. Has the group been trading gold ? Is that why the revenue was so huge ? Hopefully the company can provide further details in the future.

(c) Fast food business generated net profit of approximately RM9.4 mil per annum. Nice.

4. Details of Mining Agreements

Mukim Batu Yon

(a) On 14 March 2014, Champmark Sdn Bhd (CSB) appointed Borneo Oil to be the subcontractor to carry out prospecting and mining of gold on exclusive basis in Mukim Batu Yon with total area of 162 hectares.

(Mukim Batu Yon is part of Merapoh Area, the mining right of which originally belonged to Bursa listed MMC. MMC granted the mining rights for Mukim Batu Yon to CSB in 2004)

(b) Borneo Oil shall undertake prospecting and mining at own risk with no recourse to CSB.

(c) Borneo Oil shall pay tribute to CSB. If revenue is more than RM2 mil per month, amount to be paid is up to 12% of revenue for alluvial (sediment) and 14.5% for lode gold (hard rock).

(d) The agreement only covers gold. If other minerals are detected, Borneo Oil needs to seek consultation with CSB.

(Note : that is probably why Borneo Oil reports gold and gold dore seperately (gold dore is roughly 70% gold, 30% silver))

(e) CSB is responsible for paying tribute to MMC and PKNP and 5% to Pahang Government (5%).

(Note : if Borneo Oil pays CSB 12% and CSB pays MMC, PNKP and Pahang Government 12% (in total), what is left for CSB ? Does CSB have a share of the gold produced by Borneo Oil ?)

Mukim Hulu Jerai

(a) On 5 January 2015, Jusra Mining Merapoh Sdn Bhd (JMMSB) appointed Borneo Oil to be the subcontractor to carry out prospecting and mining of gold on exclusive basis in Mukim Hulu Jerai with total area of 203 hectares.

(Mukim Hulu Jerai is part of Merapoh Area, the mining right of which originally belonged to Bursa listed MMC. MMC granted the mining rights for Mukim Hulu Jerai to JMMSB in July 2014)

(b) Borneo Oil shall undertake prospecting and mining on exclusive basis.

(c) Borneo Oil shall pay tribute to JMMSB amounting to 10% of revenue from gold sale.

(d) The agreement only covers gold. If other minerals are detected, Borneo Oil needs to seek consultation with JMMSB.

(e) JMMSB is responsible for paying tribute to MMC and PKNP and 5% to Pahang Government (5%).

(Note : if Borneo Oil pays JMMSB 10% and JMMSB pays MMC, PNKP and Pahang Government 12% (in total), what is left for JMMSB ? Does JMMSB have a share of the gold produced by Borneo Oil ?)

Mukim Keratong

(a) On 11 March 2015, HDL Global Sdn Bhd (HDL) appointed Borneo Oil to be the subcontractor to carry out prospecting and mining of gold on exclusive basis in Mukim Keratong with total area of 1,200 hectares.

(HDL obtained the rights from PKNP in May 2010)

(b) Borneo Oil shall undertake prospecting and mining of gold in the relevant area.

(c) Borneo Oil and HDL shall split the Net Profit After Tax on 60 : 40 basis. NPAT is calculated based on revenue less operational cost less tributes and tax.

(d) The agreement only covers gold. If other minerals are detected, Borneo Oil needs to seek consultation with HDL.

(e) The tributes payable by Borneo Oil to PKNP and Pejabat Tanah and Galian shall not be more than 2.5% and 5% respectively.

According to Circular to shareholders dated July 2015, Mukim Batu Yon has started production for more than 2 years. Borneo Oil is still undertaking exploration activities for Mukim Hulu Jerai and Mukim Keratong.

5. Production Data and Inventories

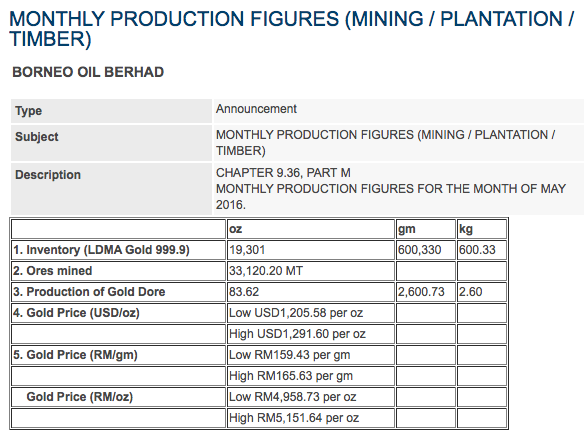

As a mining company, Borneo Oil makes announcement of production data on monthly basis. A typical announcement will look like the following :-

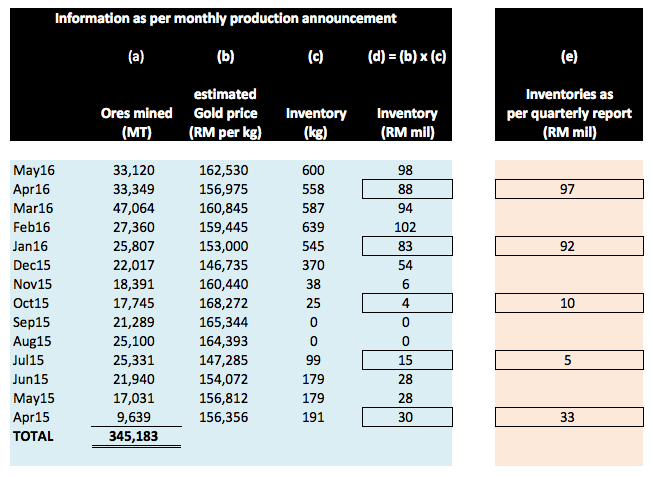

I have extracted the relevant information and put them in the table below :-

There are not many mining companies in Malaysia. Many investors (forum members) don't really understand how to interprete the data (including me).

Inventories

In the monthly announcement, there is an item called "inventory", which is measured in kilograms. This item generated a lot of confusion. For example, in May 2016, Inventory is 600 kg. There is intense debate among forum members what exactly does that mean ?

Does it mean "the company produces 600 kg of gold in the month of May 2016" or "gold inventory as at May 2016 is 600 kg" ?

After studying the data carefully (including making comparison with balance sheet inventories figures in quarterly reports), I arrived at the conclusion that "600 kg" most likely means "as at 31 May 2016, the group onws 600 kg of gold".

I am pretty confident that this interpretation is correct because item (d) in table above matches (e) quite closely. The small differences are most likely due to (b) is an estimated figure by me (the company announced highest and lowest gold price during the month, I took the average and called it (b)).

Ores

As shown in table above, the group has processed 345,183 MT of ores so far.

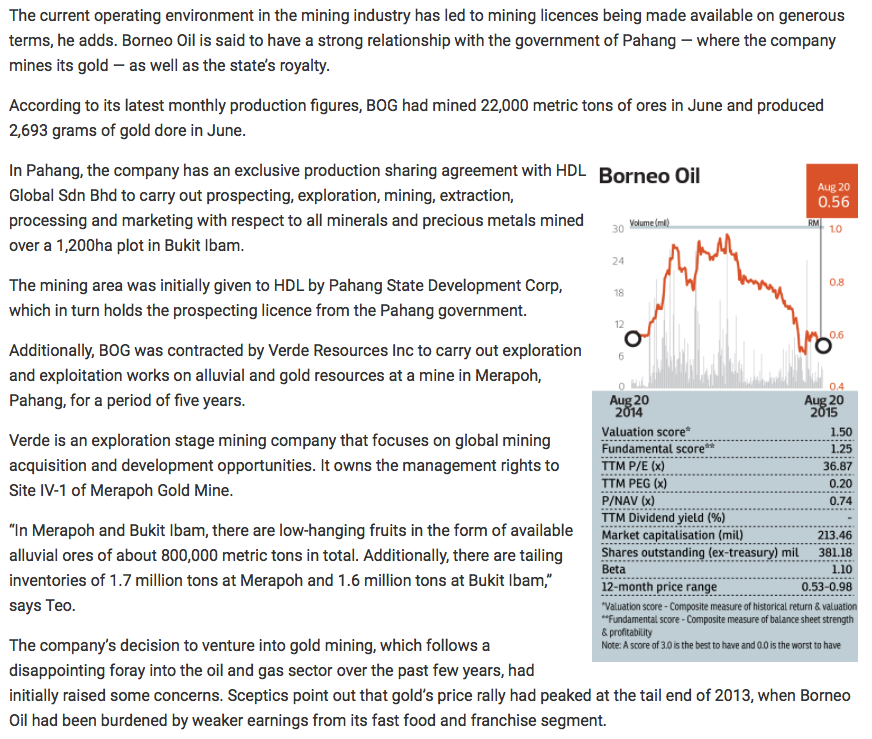

According to an interview with The Edge in September 2015, the Company mentioned that Merapoh and Bukit Ibam mines' total alluvial ores is approximately 800,000 MT. As such, there is still approximately 455,000 MT of ores remained.

At the rate it is going, it will probably take them another two years to finish processing. As 345,183 MT of ores produced more than 600 kg of gold (the group has sold some gold along the way). Can the remaining ore produce at least another 600 kg of gold for the group ?

Note 1 : Based on conservative RM150,000 per kg, 1,200 kg of gold is worth approximately RM180 mil. Based on 2.97 billion shares, gold per share will be 6.1 sen, 40% of current share price of 15 sen.

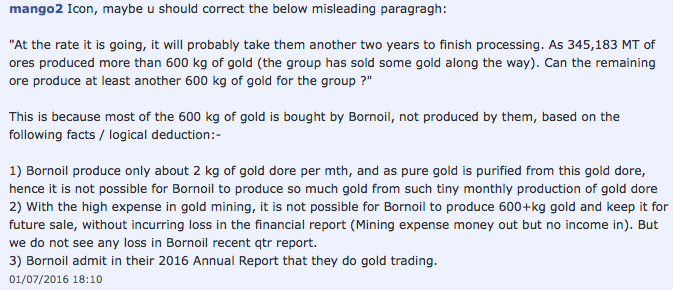

Note 2 : Forum member mango2 is not convinced that Borneo Oil's inventories are gold from mining extraction. He believes they are bought by the group for trading purpose. I have cut and pasted his view below for your consumption. Please go through to decide yourself which is the more likely scenario. Everybody is entitled to his own view.

During that interview, Borneo Oil mentioned that apart from the 800,000 MT of alluvial ores (as discussed above), there are tailing inventories of 1.7 mil tonnes and 1.6 million tonnes at Merapoh and Bukit Ibam respectively. The figures looked very substantial. However, I am not able to determine how much gold those tailings can produce. I will write about them if I managed to find out more info in the future.

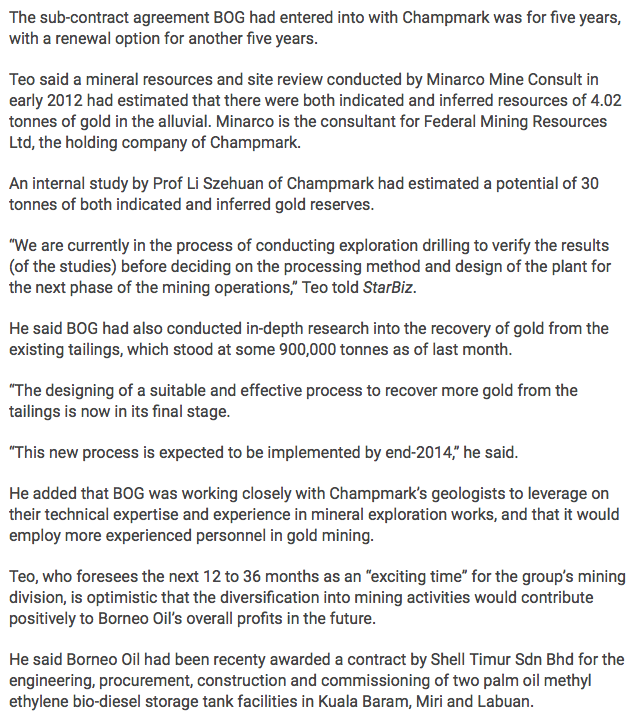

6. Potential Gigantic Reserve ?

If you think what I have mentioned so far is impressive, you should hold on to your chair (so that you don't fall off it) - according to an article in The Star dated July 2014, there is potentially as much as 30 tonnes of "gold reserves". I don't exactly know what it means. Is it referring to "ore" ? Or is it referring to "gold" ? I have no idea. But it is defintitely A LOT.

However, before you pour your entire savings into Borneo Oil, let me just caution you that you should not take the above information too seriously. The information is quite outdated, and there is no further update since the article was published. It is better to take a conservative stance by ignoring it until further information, if any, is made available to us.

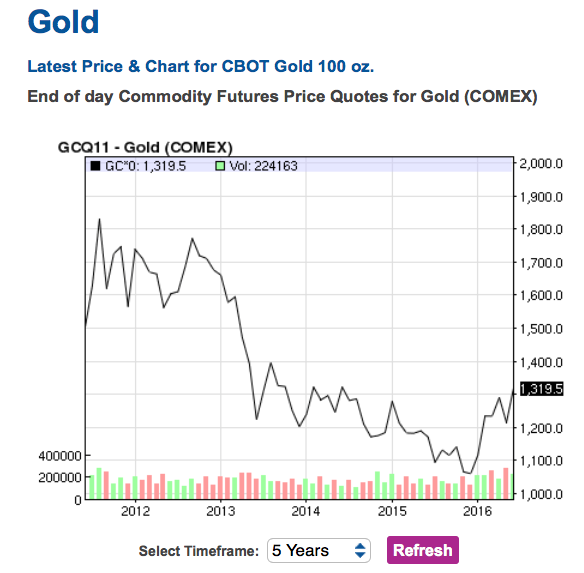

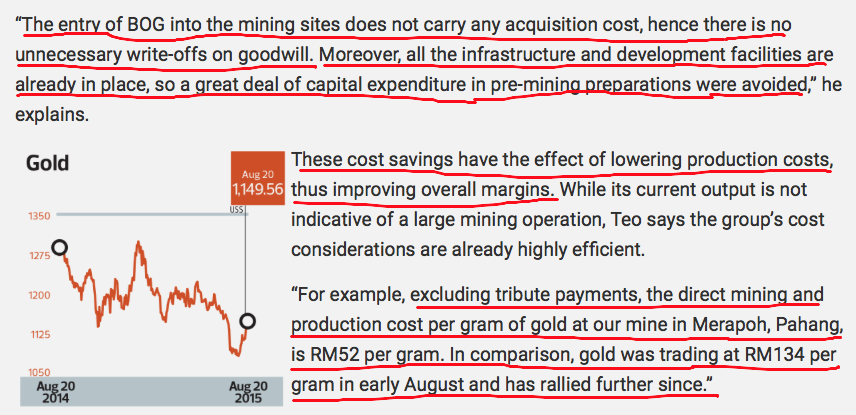

7. Impeccable Timing

Borneo Oil obtained the rights to mine gold in Pahang at very cheap price (please refer to newspaper clipping below).

In this world, nothing comes free. When something is lucrative, you need to pay a huge amount to get it. Why is it that Borneo Oil can get it so cheap ?

This is because they entered the industry at the bottom of the cycle.

Gold peaked in 2012 at more than USD1,800 per oz. It entered bear market between 2013 and 2015, touching as low as USD1,100 per oz.

Due to the bearish sentiment, in the past two years, many people were willing to let go of gold assets at depressed price. It was during that time that Borneo Oil stepped in to scoop up the assets.

It turned out that their timing of entry has been excellent. In 2015, the Ringgit started depreciating. This benefited Malayaian gold miners as gold are sold in USD pricing. To add fuel to fire, at beginning of 2016, gold price (in USD) started going up. As at the date of this article, gold price is trading at approximately USD1,320 per oz.

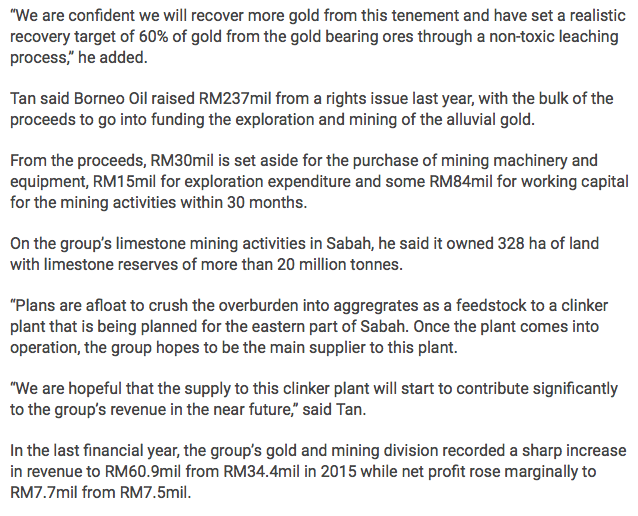

8. Limestone Reserve

Apart from gold mines, the group also has limestone reserve in Lahat Datu, Sabah.

9. Future Prospects ?

The following is extracted from annual report.

I can't help but to notice the company's statement above, "gold is trading below what we called total cost (direct production cost, investment cost, development cost, all added up)", as though the group's operation is hardly profitable.

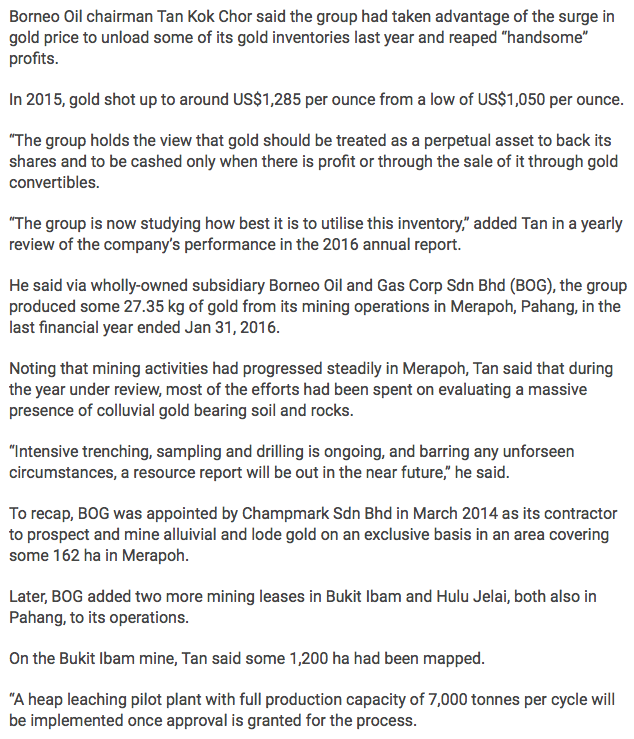

On the other hand, it stated that, "we unloaded some of our inventories and made some handsome profit".

The two statements seemed to contradict each other. What is the real picture ? Is the group's gold mining operation profitable or not profitable ?

According to past few quarters' results, it seemed that sale of gold inventories brought in good profit. Please refer to table in Section 3 above.

And also, as highlighted in Section 7 above, the group acquired the mining rights at cheap price. The existence of infrastructure also leads to low production cost.

If that is the case, is the statement "gold is trading below total cost" a miscommunication ? A careless attempt to try to portray how undervalued gold is from international mining point of view, but instead lead to misunderstanding of poor business economics ? Different people will have different view. I will leave it to you to decide.

Apart from the annual report, the company also discussed its prospects in the latest quarterly report.

This round, the message is quite clear, the company is expecting "much better" performance ahead. As usual, we should take all these mesaages with a pinch of salt. Let's wait for next few quarters to find out whether they can really deliver.

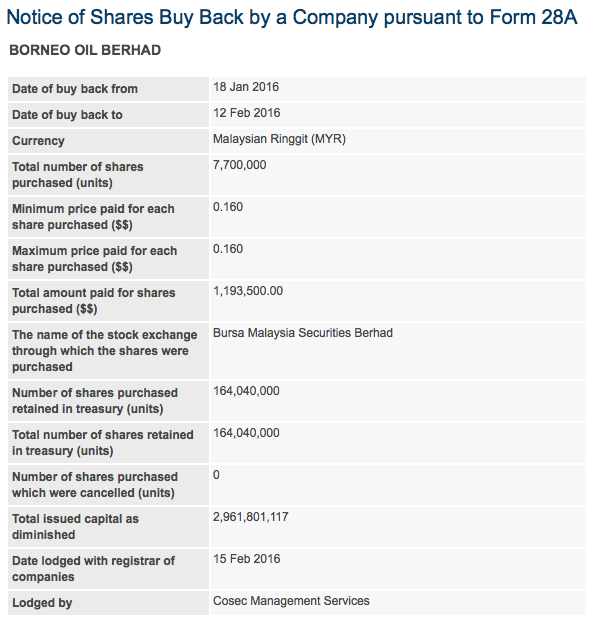

10. Shares Buy Back

So far, the company has purchased 164 mil shares from open market. I believe the constant buy back activities is the main reason share price has sustained around 15 sen (very resilient). With zero loan and cash of RM71 mil, I believe it is not difficult for the company to continue to do so in the future.

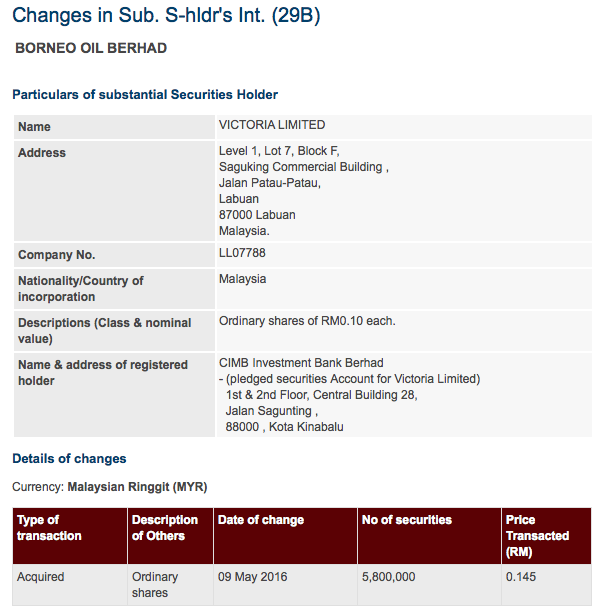

Major shareholder has also been buying in the market recently (of course now we know why, he knew the coming quarter result will be good).

11. Concluding Remarks

I first bought Borneo Oil in February 2016. However, very soon, I disposed all at a small loss.

There were two major reasons.

Firstly, the group lacked strong earnings. As many of my readers would have known by now, strong earning is the key criteria for me when come to stock picks. Without that, I felt like hovering in mid air. I didn't like that feeling.

Secondly, there were too many things I didn't understand about the group. I was particularly wary of the inventory data. Was it really referring to gold dug out from the ground ? If yes, it would be very valuable. However, there were forum members which debated that it could represent gold acquired for trading purpose. If that was the case, we are looking at potentially very thin profit margin when they were sold off.

The above major concern was addressed when the annual report for the financial year ended 31 January 2016 was released few weeks ago. This particular paragraph gave me a lot of comfort.

Even though the company still hasn't explicitly stated that the gold is not bought from market for trading purpose, the way they presented it more or less confirmed that it originated from own mining operation (you don't brag about the value of gold you bought from somebody else. You didn't get it for free, you pay for it !!!)

With that issue out of the picture, I am also no more so concerned about lack of strong earnings over the short term. When the gold is sold, the money will come in.

How about Target Price ? Due to lack of understanding for the group's operation, I don't really know how to set the Target Price. However, I believe 50% return over let's say, a period of two years, is not impossible. The group's operation seemed to be on right track. The potential to strike gold (pun intended) is there. Furthermore, balance sheets is squeaky clean and major shareholder is strong.

I don't know when the stock will be re-rated. But I am optimistic. One day, it will happen.

Appendix - Newspaper Articles

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Icon8888 Gossips About Stocks

Created by Icon8888 | May 01, 2020

Created by Icon8888 | Mar 10, 2020

Created by Icon8888 | Mar 01, 2020

Created by Icon8888 | Nov 13, 2019

Discussions

No wonder ppl said Malaysia education lvl real deteriorate. Now I know.

2016-07-01 23:22

No heart feeling icon. But you call yourself guru, windy being. Simple things also wanna talk so long. U guna oral or not.

Sorry lab, I top 10 last yr, now top3. I deserve to lansi you first.

2016-07-01 23:26

Ah plane, why so angry? Price didn't go up much even though "good" qtr?

May be u should think about that, rather than ask me to take accounting class. U want to sponsor me keh? oh so nice of u.

2016-07-01 23:44

Quote from recent Bornoil's quarterly report "..the Board is optimistic of much better and improved performance in the coming quarters.." unquote.

I noticed it is seldom for a management to make such statement saying next few quarters will have much better performance, unless they are really confident that it would happen.

That reminds me of Geshen's management whom also claimed the same thing in it's Q2 FY15 quarterly report. Quote " The Group envisages improved performance over the next quarter" unquote. It's EPS really rose significantly from 2.99sen to 9.6sen in subsequent quarter and it's stock price shot up after Q3 result.

Bornoil's reporting is not transparent and hence we can't really do a good valuation based on the available info, but if hanging on the management's confident statement above, it may worth to consider to bet small on this counter.

2016-07-01 23:55

You know why they dare not disclose so mUch?? You all must understand this is a sensitive business. I believe there must be some clause on confidential that they can't disclose too many details.

Remember who they jv with?? I believe some info they can't disclose in details one.

2016-07-02 00:05

And yeah. Icon do point out important point. Management rarely, in Malaysia rarely said we are confident to get better results one.

2016-07-02 00:07

They will only say that, when they can be 100% sure result is there Liao in 2q. As when publish this 1q result, they are in 2q position Liao. So I guarantee you, next q is even ! much better than 1q. So?

2016-07-02 00:08

Ah Plane, since u are so nice to concern about my accounting, shouldn't u be the nice one to sponsor me? kyy? no lah, afraid my england not good enough for his standard. Maybe u could be so nice to improve my england before I apply to kyy?

2016-07-02 01:28

England or English?? Boy....you need more than just accounting. How any sent you back kindergarten first??

2016-07-02 23:54

Aiya, where is your sense of humour? Anywhere, have enough of "constructive" chit-chat with u, have a nice day and good luck with your Bornoil. Bye.

2016-07-03 08:41

Did anyone notice that the gross profit margin for quarter 1 2017 is just 0.8%

In quarter 1 2016 it was 42%

Meaning what the company buy/costs of production then they only can profit 0.8% only

2016-07-03 18:33

In the annual report year 2016 it stated oil, gas , energy and mining revenue

This company also got do oil related business ?

2016-07-03 18:46

Icon, no need for us to debate anymore.

Borneo Oil chairman Tan Kok Chor had confirmed Bornoil only produced some 27.35 kg of gold in the last financial year ended Jan 31, 2016.

"He said via wholly-owned subsidiary Borneo Oil and Gas Corp Sdn Bhd (BOG), the group produced some 27.35 kg of gold from its mining operations in Merapoh, Pahang, in the last financial year ended Jan 31, 2016."

http://www.thestar.com.my/business/business-news/2016/06/10/borneo-oils-gold-mining-venture-pays-off/

Hence the balance 500+ kg gold in the inventory must have been purchased. Now everything is clear I think.

2016-07-03 23:08

Nope. Your statement misleading! Remember inventory only increase aggressively during Jan this yr.last fin yr is till Dec last yr. So he is true, but not accurate.

2016-07-04 00:27

Final month of the financial year ended Jan 31, 2016 is January 2016.

As at January 2016, Bornoil gold inventory is already 544.58 kg

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5012021

Media reports on 29/2/2016 for the Bornoil January 2016 gold inventory:

http://www.theborneopost.com/2016/02/29/gold-prices-to-continue-upward-trend-experts/

http://www.bernama.com/bernama/v8/bu/newsbusiness.php?id=1220328

2016-07-04 01:03

icon, paperplane, sorry but no offence. I have to agree with mango2 on his statement. In a whole year, the gold mined was merely 27.35kg and if we divide by 12, it is about 2.28kg (which is very close to what they announced in the May monthly production report (2.6kg)... gold dore is 70% gold and 30 silver so it is about 2.6kg x 0.7=1.82kg pure gold (production of pure gold within a month)... So i have to believe that most of the inventory (600kg) is bought from 3rd part for trading purposes (and this is a bit risky if gold price drops, even though many said gold price is likely to go up)...

2016-07-04 08:50

just my 1.5 cents, i know some investors (even myself sometimes) will become too subjective in own's belief once they are already in a certain share.. perhaps this is a common mistake we made - to try looking for reasons to justify our decision made in choosing a certain share... perhaps we should be more objective?

2016-07-04 08:55

"Gold is trading below total cost" for ordinary mining company ..... Bornoil manage to operate at much lower cost .... they will keep majority of gold in inventories for disposal at higher price later ....

2016-07-05 22:16

金本身是沒有盈利能力,沒有生產力,金的價格取決於二級市場的交易。投資者會選擇投資金是因為貨幣會貶值,金可以保值。今天的一克金,幾年後甚至更久,也是一克金。嘻嘻。

2016-07-06 07:51

Wrong. How can u said property up purely inflation. Then everything up also inflation. The result and cause u sudah confuse yourself. The result is inflation. Not cause.

2016-07-09 08:58

Mind boggling. Revenue jumped 685% quarter on quarter from RM190.2mil to RM1.4947bil. Out of these RM1.494 billions, RM1.486 billions or 99% comes from mining. Divide RM1.486 billions revenue from the latest price of gold from Bursa gold futures @RM176 per gram, that is 8,412,500 grams of gold. Bursa should send a query to Borneo on how it report mining revenue. If it is trading, revenue is recognize as when profit is realised and not transaction value. Something very wrong here.

2016-07-09 13:13

8,412 tonnes of gold within 3 months from last quarter is this possible? Bursa should question these dots....

2016-07-09 13:16

Play play can dont b too serious on their gold mining...people rather sit there goyang kaki collecting monies while bornoil hv to do all the donkey job while profit is not guaranteed

2016-07-09 13:27

market sentiment is in bornoil favour. we should follow the trend not against it. look at gold price trend , is a bull run. Dont u think singapore listed company which has gold mine in kelantan better than bornoil? in fact its total capacity is lesser than bornoil but its share price shoot up from 0.25 to 0.60 within 3 months. THIS IS CALLED AS GOLD BULL...kikiki...tak percaya...u short gold futures index n see...cry latter

2016-07-09 19:56

Having said so i also dare not underestimate tan sri's goreng power though bornoil's gold story may not as sexy as many thought...

2016-07-09 20:46

Focus malaysia weekly news also stated the huge revenues from mining sector could be its gold trading revenues. I agree a transparent report of its mining sector is needed to increase market confidence. However the word stated under current year prospects ie the board is optimistic of much better and improved performance in the coming quarters. made me HIGH...

2016-07-09 21:29

Focus Malaysia also said that their cost is approximately USD500/oz. Is that all-in-cost or all-in-sustaining-cost or just gross cost? Nobody knows. But if true, it's about the same as CNMC's one of the lowest in the world. Aiyah so little info, dunno head dunno tail, bet a bit lah.

2016-07-10 08:41

someone told me y bornoil dont have wave. my answer to him ini budak baru belajar ....gold mine baru keluar taugeh ...its production will grow sharply once all three gold mines start production. its latest ores mined around 33000 tons per month as compared to last year around 20000 tons per month , already grow around 60%

2016-07-10 17:13

wave 1 then 2 and 3 will occur later. time is needed to be adult. 2004 ronaldo first time in euro cup still young 18. today ronaldo is world no 1 . tonight he will show to the world he is the best. like bornoil one day malaysian will regonise bornoil as the best n the only malaysia listed gold producer.kikiki

2016-07-10 17:30

this should answer some questions http://disclosure.bursamalaysia.com/FileAccess/apbursaweb/download?id=73666&name=EA_GA_ATTACHMENTS

2016-07-11 23:56

The current operating mines of the group are in Merapoh and Bukit Ibam. Explorations are currently ongoing for hard rock gold for both the mines. For both mines, mining and production of gold are also conducted mainly on alluvial and colluvial ores. Unlike a typical exploration mining company where there is no revenue during exploration stage until the discovery of an economical ore reserves, the g business philosophy of "taking the low hanging fruit" has started mining operations on alluvial and colluvial gold ore. In addition, it has also taken advantage of investing in gold for the past year in the belief that low gold prices are temporary as it was trading below the industry mining and production costs. The investment has proven correct as gold prices have increased substantially due to many uncertainties in the financial markets.

2016-07-12 00:12

and it has proven what mango2 and I deduced is correct (that most of the gold inventory is purchased for trading)... you guys better watch out as gold trading is also a bit risky if gold price drops instead of go up... it is like betting to me...no one knows if gold will continue its uptrend move or the opposite direction...

2016-07-21 11:36

mango2

From your statement "....I was particularly wary of the inventory data. Was it really referring to gold dug out from the ground ? If yes, it would be very valuable. However, there were forum members which debated that it could represent gold acquired for trading purpose. If that was the case, we are looking at potentially very thin profit margin when they were sold off, "

I take it that u are not sure at first.

However u are later assured by the Annual Report in "that the way they presented it more or less confirmed that it originated from own mining operation"

So your reason is based merely on perception derived from the Annual Report, not on any valid facts / logical deduction.

I think that is not good enough, Icon. U can do better than that.

2016-07-01 19:07