(Icon) CIMB (1) - Undervalued, But Patience Required

Icon8888

Publish date: Wed, 27 Jul 2016, 09:36 PM

1. Introduction

CIMB used to trade as high as RM8.70 back in May 2013. It is currently trading at RM4.29 (down 51%).

The downtrend was caused by decline in profitability. In 2013, CIMB reported net profit of RM4.54 billion. In the latest financial year, its profit had declined by 40% to RM2.85 billion.

Annual Result:

| F.Y. | Revenue ('000) | Profit Attb. to SH ('000) | EPS (Cent) | PE | DPS (Cent) | DY | NAPS | ROE (%) |

|---|---|---|---|---|---|---|---|---|

| 2015-12-31 | 15,395,790 | 2,849,509 | 33.62 | 13.51 | 14.00 | 3.08 | 4.8100 | 6.99 |

| 2014-12-31 | 14,145,924 | 3,106,808 | 37.48 | 14.84 | 15.00 | 2.70 | 4.4400 | 8.44 |

| 2013-12-31 | 14,671,835 | 4,540,403 | 59.97 | 12.71 | 23.82 | 3.13 | 3.9200 | 15.30 |

| 2012-12-31 | 13,494,825 | 4,344,776 | 58.45 | 13.06 | 23.38 | 3.06 | 3.8100 | 15.34 |

The stock looked interesting as it is currently trading at Price to Book Ratio of 0.88 times. A banking group like CIMB should trade at at least 1.5 times when its earnings recovers.

(When come to banking stocks, the Market has been quite fair and rational. The higher the ROE, the higher the valuation multiples).

The purpose of this article is to try to understand what are the major factors dragging down CIMB's earning in recent years and to try to have a feel of whether it will be turning around soon.

2. Historical Profitability

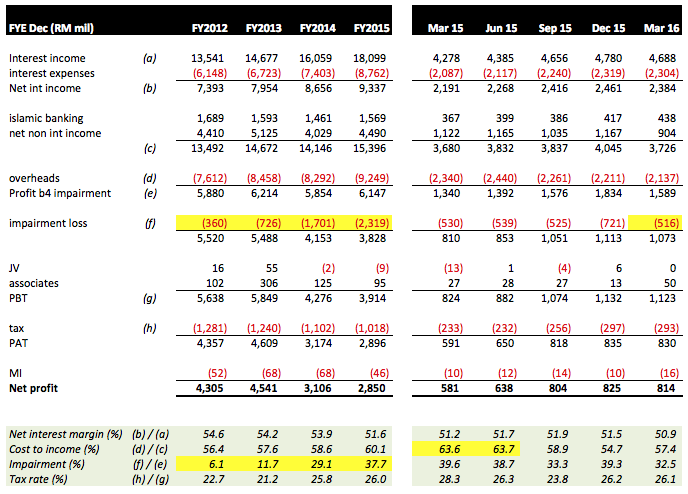

Key observations :-

(a) Loan impairment was the main reason CIMB's performance deteriorated over the years. In FY2012 and 2013, impairment charges were 6.1% and 11.7% of profit before impairment respectively. However, in FY2014 and 2015, it increased to 29.1% and 37.7% respectively.

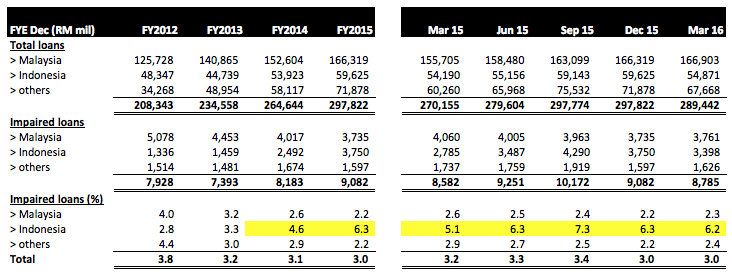

(b) Indonesia subsidiary CIMB Niaga accounted for the bulk of the bad loan spike.

As shown in table above, in FY2012 and 2013, only about 3% of CIMB Niaga's loans were impaired. However, in FY2014 and 2015, that has increased to 4.6% and 6.3% respectively.

Compared to Indonesia, Malaysia and other regions had been managing their loan books pretty well with impairment of 2% plus in FY2014 and 2015.

According to the company, collapse of commodity prices was the main reason for the spike in Indonesia bad loans. Indonesia relied quite heavily on commodity export. The downturn caused many borrowers to get into difficulties.

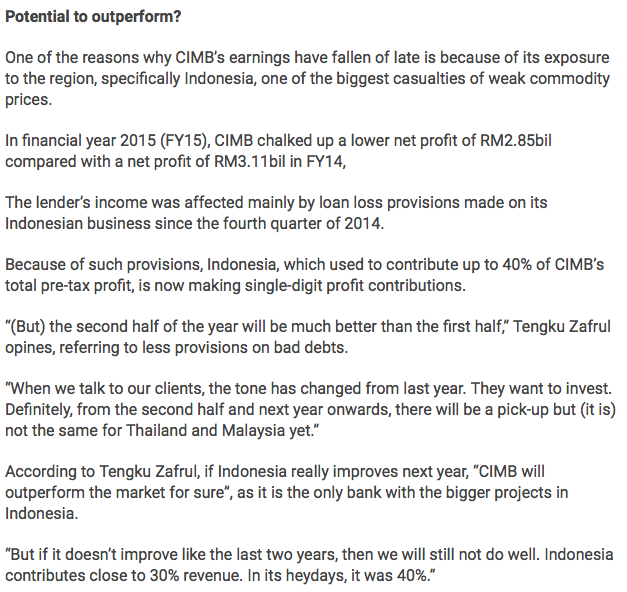

(c) In a recent interview with The Star, the CEO of CIMB expects Indonesia operation to perform better in second half of 2016.

(d) To improve performance, CIMB launched a campaign in 2015 called T18 (Target 2018) to revamp its operation. Among the measures put in place is reduction in overhead. The group's Cost to Income ratio has inched up in FY2015. The group targets to bring it down to 50% by 2018 (The group retrenched more than 3,000 employees in 2015 through a Mutual Separation Scheme).

3. Concluding Remarks

(a) By virtue of its 0.88 times PBR, I believe that CIMB is undervalued at current price of RM4.29. However, re-rating will only happen if its earnings improve.

(b) As mentioned above, the main reason the group's profitability has declined so much is because of non perfoming loans of its Indonesia subsidiary. After going through two rough years, there are signs that the Indonesian economy is gaining strength. CIMB's CEO has hinted of better performance in second half of 2016. Will that materialise ? We can only find out over time.

(c) The reason I invest in CIMB is because I believe it has limited downside. I do not have high expectation for this stock. If it can deliver 20% return for me by end of 2016 (Target Price of RM5.20), I will be very happy.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-21

CIMB2024-11-21

CIMB2024-11-21

CIMB2024-11-20

CIMB2024-11-20

CIMB2024-11-20

CIMB2024-11-20

CIMB2024-11-19

CIMB2024-11-19

CIMB2024-11-19

CIMB2024-11-19

CIMB2024-11-19

CIMB2024-11-19

CIMB2024-11-18

CIMB2024-11-18

CIMB2024-11-18

CIMB2024-11-15

CIMB2024-11-15

CIMB2024-11-15

CIMB2024-11-15

CIMB2024-11-15

CIMB2024-11-13

CIMB2024-11-13

CIMB2024-11-13

CIMB2024-11-13

CIMB2024-11-13

CIMB2024-11-12

CIMB2024-11-12

CIMB2024-11-12

CIMB2024-11-11

CIMBMore articles on Icon8888 Gossips About Stocks

Created by Icon8888 | May 01, 2020

Created by Icon8888 | Mar 10, 2020

Created by Icon8888 | Mar 01, 2020

Created by Icon8888 | Nov 13, 2019

Discussions

Not sure. Trial and error. If doesn't work, or better alternatives surface, will dump it

2016-07-27 22:01

CIMB cheaper than Ambank. Will give dividend in-specie CIMB Niaga soon.

Posted by RainT > Jul 27, 2016 10:02 PM | Report Abuse

Why not am bank ?

Ambank is much better than cimb

2016-07-27 22:11

CIMB Niaga is special dividend. CIMB half yearly dividend will still be given.

2016-07-27 22:21

Hello Icon, Maybank also has large exposure in Indonesia but no such impairment losses. From this point of view, CIMB does not manage well in the past few years.

Beside CIMB and AMBank, no other banks in your portfolio?

2016-07-28 06:52

Hahahha. Dunwan tease u la

U are great indeed. Following economic cycle during recovery the trend is for banking.. To be more specific Finance investment will overbeat market. They are such as TA, INSAS, KAF, APEX etc.....

Good job bro.

2016-07-28 07:59

I love Insas for its laggard play, after race for Financial ciunter.

In the meantime, waiting is the key.

2016-07-28 08:08

Hi Icon, between construction and banking counters, dont u think the former's future and earnings are more visible?

2016-07-28 08:54

Interest rate cut is positive for AeonCredit , negative for Cimb

Other than AeonCredit, the big gainer for this year for banks has been Rhb for the simple reason RHB has completed its capital raising exercise.

2016-07-28 09:01

Construction stocks........too obvious

Every year for the last 30 years, construction stocks have been the favorite stocks of analysts.

2016-07-28 09:03

Item 2C abt the CEO can forget it... You should his last interview before this one compare with what he said and the results... In fact if you look at what the bank has been saying past few quarters looking forward vs actual results you'd realise they r full of sh*t...

2016-07-28 22:41

No way. QR of Maybank and CIMB in Indonesia are so good. It is already a turning point.

2016-07-31 20:58

RainT

Banking stocks are you sure ??

2016-07-27 21:58