(Icon) Poh Huat (7) - Result So Good Until I Rubbed My Eyes In Disbelief

Icon8888

Publish date: Thu, 22 Dec 2016, 08:26 PM

1. Introduction

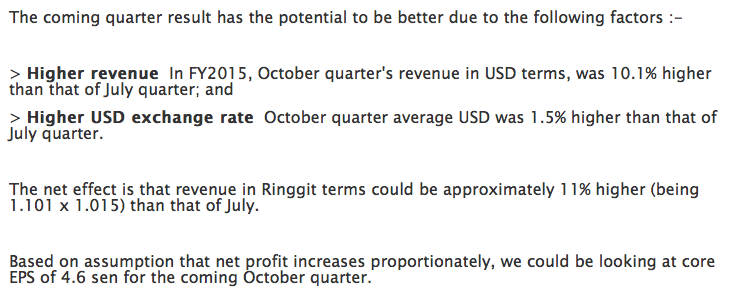

In my previous article dated 27 November 2016, I predicted EPS of 4.6 sen for Poh Huat's October quarter result.

Poh Huat released its result today. EPS was 8.9 sen (!!!). After excluding insurance claim of RM2.2 mil, core EPS was still an extremely impressive 8.0 sen. This is 74% higher than the 4.6 sen I expected.

2. Earning Review

Key observations :-

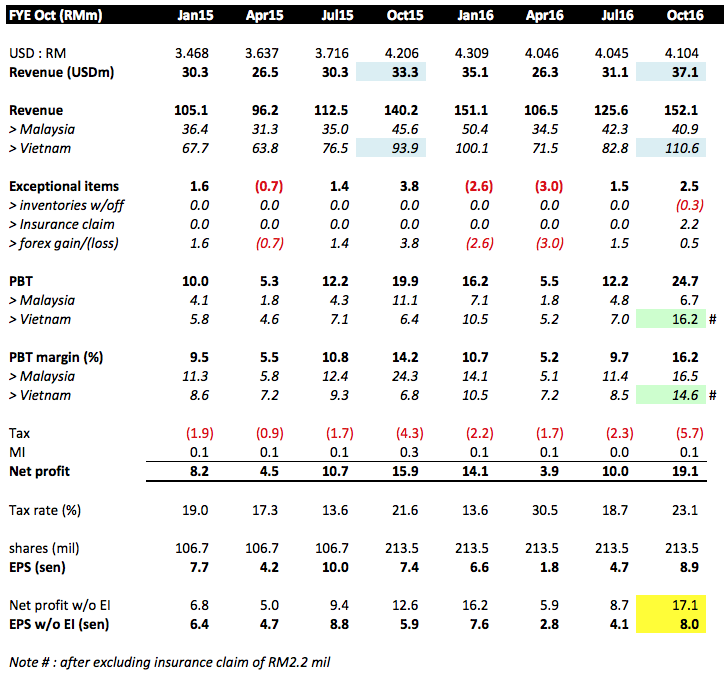

(a) Malaysia operation's performance was reasonable. Its revenue, PBT and profit margin were more or less the same as previous quarters.

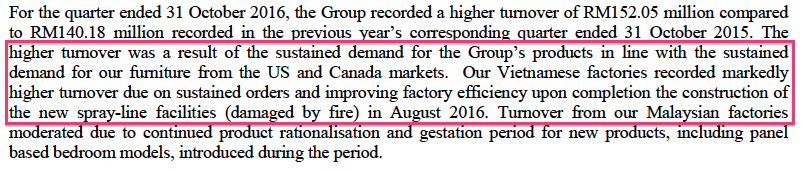

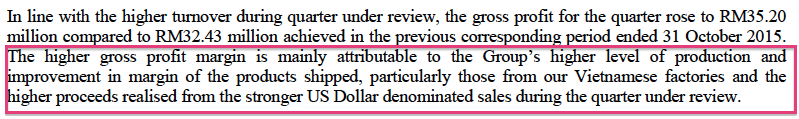

(b) Vietname operation sprang a HUGE positive surprise. Revenue increased by more than 17% Y-o-Y, while PBT increased by 153% from RM6.4 mil to RM16.2 mil (after excluding RM2.2 mil insurance claim). PBT margin increased from 6.8% to 14.6%.

(c) In the quarterly report, management explained that Y-o-Y higher revenue in Vietnam was due to stronger demand from customers while profit margin was boosted by, inter-alia, the new spray line facilities completed in August 2016 (after the fire) as well as more favorable exchange rate.

(Note : I am surprised by the favorable forex effect. I was expecting the opposite. My figures showed that October 2015 quarter's average USD exchange rate was 4.2, higher than the 4.1 for the latest quarter. The group must have managed its exchange rate differently from the market average. Whatever it is, I believe the impact of exchange rate was not big)

3. Increase In Net Cash

As at 30 October 2016, the group has cash and borrowings of RM72 mil and RM29 mil respectively. The net cash of 43 mil was RM18 mil higher than previous quarter's RM25 mil.

4. Prospect

5. Concluding Remarks

Poh Huat's latest quarter result far exceeded my expectation. The main contributing factors were higher revenue and profit margin of its Vietnam operation. What excited me most is that this was achieved against the backdrop of a relatively weak USD exchange rate of 4.10. Well done.

Next quarter result is expected to continue to be good as it will still be a strong season (as a matter of fact, traditionally its sale was stronger than October quarter). Furthermore, USD has strengthened substantially. Instead of 4.10, average USD should be more than 4.30 for the coming January 2017 quarter.

Everything looked good for Poh Huat. It is undoutedly a Strong BUY at current price. The only risk and uncertainty is potential US protectionism. I have analysed and discussed this issue in my previous few articles and concluded that it is not easy to be implemented. However, the risk is there and it is up to you to decide your next course of action.

Your money, your risk, your reward.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Icon8888 Gossips About Stocks

Created by Icon8888 | May 01, 2020

Created by Icon8888 | Mar 10, 2020

Created by Icon8888 | Mar 01, 2020

Created by Icon8888 | Nov 13, 2019

Discussions

DONALD TRUMP going to impose 5% import tax. How it going to affect pohuat sales?

2016-12-22 20:34

wait till Lihen releases its results.

In last 10 years, Lihen had always outperformed Poh Huat.

Neighbors in Muar with friendly rivalry.

2016-12-22 20:38

Official opening of export theme in bursa. Furniture, semiconductor, plastic and packaging, wood & fiberboard.

Cheers!

2016-12-22 21:20

I don't trust plastics due to oil factor.

Posted by YiStock > Dec 22, 2016 09:20 PM | Report Abuse

Official opening of export theme in bursa. Furniture, semiconductor, plastic and packaging, wood & fiberboard.

2016-12-22 21:23

Icon, do you know what is the investment property in their books about ? Is that a new expansion or some factory they re planning to sell ?

2016-12-22 21:29

Apart from SLP and Superlon, all other plastic cos such as Tguan has cost pass through

2016-12-22 21:29

Posted by calvintaneng > Dec 22, 2016 09:45 PM | Report Abuse X

The last hurrah for Pohuat (Power Huat!)

Calvin's called to buy at Rm1.25. Up Rm3.80 & split

Calvin's 200% growth stock!

Now let Calvin tell all to Cash out Pohuat into strength.

This is the statement from Pohuat latest Qtr

On the back of healthy fundamentals, the demand for the Group’s products, particularly from the North

American market, is expected to remain for the next financial year. The Group is however mindful that the

global environment continues to be volatile due to the prolonged economic downturn in Europe and low

commodity prices. The Trump victory in the recent US election has also added elements of policy and

regulatory uncertainties.

Notice the phrase:

"The Trump victory in the recent US election has also added elements of policy and regulatory uncertainties."

In other words, Trump taxing Pohuat furniture imports into the US might create uncertainties of future profits.

So now all fellow i3 forumers must take this opportunity to sell Pohuat into strength!

Yes sell all Pohuat shares all the way up!

Good luck!

2016-12-22 21:48

Icon, your latest pohuat article give very important guiden to furniture stock's future. Much Appreciated.

2016-12-22 21:53

cost pass through yes...but results not as spectacular as 2015.

Icon8888 > Dec 22, 2016 09:29 PM | Report Abuse

Apart from SLP and Superlon, all other plastic cos such as Tguan has cost pass through

2016-12-22 23:04

Liihen 3 quarter earning:

2015 - 38 mil

2016 - 54 mil

= + 38%

Tguan 3 quarter earning

2015 - 23 mil

2016 - 43 mil

= + 87%

Liihen result very much spectagular @_@

Tguan result not as spectagular @ @_@ @

2016-12-22 23:27

Noby....investment properties are those property for investment purposes, mainly collecting rental. These properties are not for own factory use. So, unlikely they will sell off. Investment properties always value at

market value or its cost (depends on their own accounting policy)

2016-12-22 23:41

Pohuat and Liihen two neighbourhood has been doing quite well recent years. No need argue who is better, buy both

2016-12-22 23:41

I like glove companies too, especially now when the overcapacity factor already priced in. They are both local and export theme. Price should start move north.

2016-12-22 23:44

Icon8888 always an opportunist, is a sell call for me. Calvin is right, is a sell call

2016-12-23 06:15

Icon sifu...they will start tariff

In short, China is angry, and may get its wish to retaliate soon, because as CNN reports (take it with a "real fake news" grain of salt) Trump's transition team is discussing a proposal to impose tariffs as high as 10% on imports. A senior Trump transition official said Thursday the team is mulling up to a 10% tariff aimed at spurring US manufacturing, which could be implemented via executive action or as part of a sweeping tax reform package they would push through Congress.

According to CNN, Reince Priebus floated a 5% tariff on imports in meetings with key Washington players last week. But the senior transition official who spoke to CNN Thursday on the condition of anonymity said the higher figure is now in play.

2016-12-23 09:24

Tariff are mostly country specific (in this case Target-China). As STM said, Malaysia is not on Trumpet radar

2016-12-23 10:42

chun chun die faster....what is good, is no good for others...that's life...we need to be smarter than sifu, then you be able to control and master your own destiny...

2016-12-23 14:52

sifu cakap bagus bagus...tapi keputusan muktamad di tangan anda...bandingkan dengan liihen dan pohuat....mestilah liihen lagi bagus... dividen lagi bagus...

2016-12-23 15:02

betul tu...malaysia tak ada dalam senarai radar donald trump...trump cuma cakap nak naikkan tarif disebabkan oleh china...."china only"... jangan nak kaitkan malaysia... donald duck belum jadi presiden... masih lagi presiden-elect sehingga 20 jan, 2017...

2016-12-23 15:51

Dollar will up 15 % ( border tax adjustment )

What is it?

Put simply, the proposal would tax US imports at the corporate income tax rate, while exempting income earned from exports from any taxation. The reform would closely mirror tax border adjustments in economies with consumption-based VAT tax systems. If enacted, the plan will likely be extremely bullish for the US dollar. What’s more, it would have a transformational impact on the US trade relationship with the rest of the world.

2016-12-23 16:14

result good but dividend no good...mesti ada wow faktor, baru kita orang suka pohuat... kalau cakap huat huat pun tak guna...tenaga batin tak kuat lagi...

2016-12-24 03:13

after Trump take over & kenakan tax kpada China saja, baru I beli Poh Huat. cakap omong - omong kosong saja Skarang. Wait & See

2016-12-24 09:31

tkp2

Icon chun chun call few weeks ago, congrat !!!

2016-12-22 20:28