(Icon) Chee Wah (2) - Beneficiary Of Strong USD. Limited Exposure To US Market

Icon8888

Publish date: Mon, 09 Jan 2017, 01:50 PM

1. Introduction

I first wrote about Chee Wah in November 2015.

http://klse.i3investor.com/blogs/icon8888/86876.jsp

Chee Wah is principally involved in manufacturing and sale of stationery products under the brand name Campap.

Chee Wah exports the bulk of its products (75%). As such, it is a beneficiary of strong USD.

One thing I like about Chee Wah is that it has limited exposure to US, which makes it not so vulnerable to protectionsim by Donald Trump.

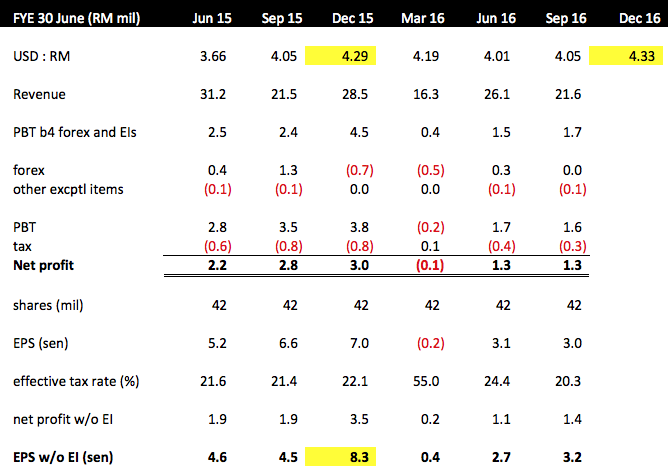

2. Historical P&L

Key observations :-

(a) As an exporter, Chee Wah's profitability is sensitive to USD movement. In December 2015 quarter when average USD was 4.29, the group reported core EPS of 8.3 sen.

(b) During the three months ended 31 December 2016, average USD was 4.33. Because of that, I believe coming quarter result will be very good.

3. Concluding Remarks

As pointed out above, I found Chee Wah an interesting export play because it has very limited exposure to US. As we all know, the new President is making noises about Buy America First.

The coming quarter result should benefit from strong USD. However, as usual, I don't have insider information. Your money your own decision.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Icon8888 Gossips About Stocks

Created by Icon8888 | May 01, 2020

Created by Icon8888 | Mar 10, 2020

Created by Icon8888 | Mar 01, 2020

Created by Icon8888 | Nov 13, 2019

Discussions

with recent run, they started pay dividend, last dividend on December was 3.5cents

2017-01-09 21:24

Bank Negara Malaysia (BNM) via its press statement on 2 December 2016 announced several measures intended to enhance the liquidity of the foreign exchange (FX) market with effect from 5 December 2016.

Details are as follow :

A. Treatment of export proceeds

Please kindly be informed that, resident exporters until further notice-

(1) continue to be subject to the 75% requirement to convert proceeds from export of goods.

The remaining balance may be retained in foreign currency trade account (FCA Trade).

(2) may reconvert the 75% of export proceeds for purpose of import and loan obligation supported with firm or anticipatory underlying.

All conversion of ringgit into FCA Trade shall not exceed the 6-month obligation for credit into FCA Trade.

The reconversion shall use the same conversion rate on spot or forward basis (subject to forward points) entered on the same day.

B. Settlement in foreign currency between resident (Grace Period)

All payments due to resident suppliers contracted in foreign currency with another resident shall be allowed to continue to be settled in foreign currency from tomorrow until 31 March 2017.

However, in line with the measures introduced on 2 December 2016, all new contracts and renewed contracts shall be in RINGGIT.

2017-01-10 08:24

this is the problem of the our government, hardly see facilitation for business, I'm seeing bigger concern on human resource instead, nevertheless, the bottom line is export counter will make money.

2017-01-10 08:41

Because of this failed government, the private companies and the rakyat need to pay for it.

We don't have to go very far. Look at Singapore, does the Singapore government need to do all this crab actions ???? and Sing$ keep on going up.

Worst is the people still not waking up and continue to vote for corruptors.

2017-01-10 09:25

well this country is screwed anyway, u will see ringgit will start falling to 5 and above by end year

2017-01-11 16:37

Employee suffering as salary no longer match to inflation, food price is shooting high sky, GST stopping people spending, when ringgit plunge further, next probably will be interest rate hike, business unable to repay debts, product unable to sell since cost price unable to mark down, what next we expect?

2017-01-12 00:00

RainT

Compare with ASIAFILE

Asia file better ?

2017-01-09 13:51