(Icon) Hock Seng Lee (2) - The Worst Is Over. Ready To Take Off

Icon8888

Publish date: Thu, 01 Mar 2018, 02:06 PM

I first wrote about HSL in May 2017.

I bought HSL at around RM1.70 back in 2017. It subsequently went down to RM1.40+. But the good thing about stocks is that you can ignore the paper loss. As long as you do not sell, you have not actually picked a wrong stock yet. My patience finally paid off. Over the past few months, boosted by better prospects ahead, the stocks slowly climbed back up to RM1.60+. I am now closed to breaking even for my 2017 position.

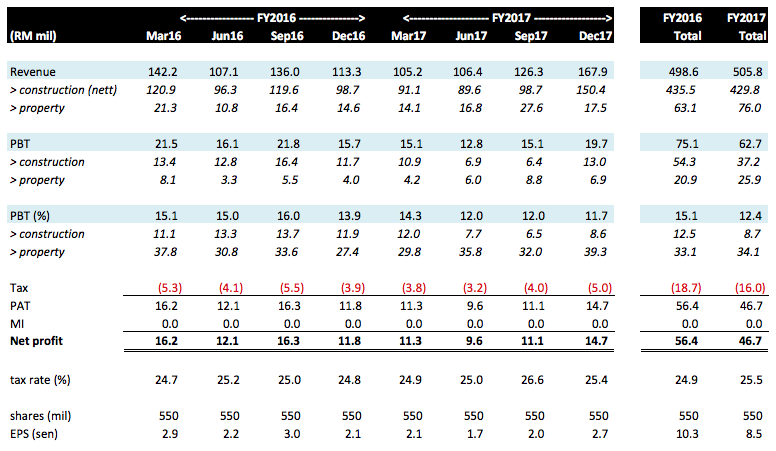

So, how has the company been doing lately ? Let's take a look at its past few quarters' performance.

Key observations :-

(a) As has already been widely known among market observers, the group has been slow to execute its construction contracts in 2017 due to multiple reasons (contracts finalisation, difficult terrain, etc). This can been seen from the FY2017 construction revenue of merely RM429 mil. With RM2.7 billion order book and expected completion period of 3 to 4 years, revenue should be between RM700 mil to RM1 billion per annum. Fortunately, things seemed to be picking up pace in latest quarter, which saw construction revenue jumped by closed to 50% to RM150 mil. More to come in coming quarters.

(b) Construction margin in FY2017 was also lower at 8.7% compared to 12.5% in FY2016. In an interview with The Edge recently, CEO mentioned that it is expected to normalise back to double digit in FY2018 as projects gather steam.

(c) The group's FY2017 earning has been saved by property division. With high profit margin of 34%, the division contributed 40% of PBT despite only accounted for 15% of revenue. This division could be the dark horse in FY2018, causing group earnings to exeed street estimates as most analysts do not seem to be aware of its important contribution.

(d) Balance sheet remains pristine. With net assets of RM730 mil, loans are only RM25 mil while cash holding is RM70 mil. In other words, the group is in net cash position. Those who like Enterprise Value would find its valuation very attractive.

Concluding Remarks

After sulking for one and a half year, the time has finally come for HSL to shine. Based on my very rough estimate, the group could potentially make RM80 mil net profit in FY2018.

This is arrived at based on assumed construction revenue of RM800 mil with PBT margin of 10% (CEO has already said likely revert to double digit). This will lead to construction PBT of RM80 mil. As for property division, I assume same PBT contribution of RM25 mil (same as FY2017).

Based on assumed PBT of RM105 mil (being RM80 mil + RM25 mil) and tax rate of 25%, net profit works out to be roughly RM78 mil. Based on 550 mil shares, EPS should be about 14 sen.

Based on 15 times PER, my FY2018 target price for the stock will be RM2.10, 27% upside from current price of RM1.65.

Do you find that attractive ? It is attractive enough for me to hold. Furthermore, with the remaining contracts to be excuted in 2019 and beyond, and the possibility of more contracts to be secured, RM2.50 by end 2019 is not impossible. If that happens, I will be very pleased.

More articles on Icon8888 Gossips About Stocks

Created by Icon8888 | May 01, 2020

Created by Icon8888 | Mar 10, 2020

Created by Icon8888 | Mar 01, 2020

Created by Icon8888 | Nov 13, 2019

Discussions

Let's it keep going to show bombastic QR results and wait until it giving bonus shares. Hold tight don't waste of your money keep going bigger and bigger

2018-03-01 16:40

Nowadays, many talks sense but they never a sensible one with open minding ... fixed mind.

including myself :)

2018-03-02 12:09

That's show how true character of this Icon8888

Posted by Icon8888 > Mar 2, 2018 11:41 AM | Report Abuse

Fxxk u lah

2018-03-02 12:09

This applicable to Icon8888.

When I made mistake, I admitted it & said sorry about it. What is the response from Icon? All he know is FU_CKING.

Posted by VenFx > Mar 2, 2018 12:09 PM | Report Abuse

Nowadays, many talks sense but they never a sensible one with open minding ... fixed mind.

2018-03-02 12:13

But, u never appreciate others working... that sad lor.

I wish u would come a good article...looking forward

2018-03-02 12:15

Don't blindly said anything, please check properly yourself before making such statement.

By the way, did I say anything

Posted by VenFx > Mar 2, 2018 12:15 PM | Report Abuse

But, u never appreciate others working... that sad lor.

2018-03-02 12:18

Anyway, when someone like Icon8888 talking like gangster & behaving like stock god, why should I respond back the same? You won't bark back when a dog bark you, right?

Good luck to all.

2018-03-02 12:20

Invest_Sensibly

hehe. lebih baik beli gkent

2018-03-01 14:42