[ EKOVEST ] - How is it considered as undervalue ??? - J4 Investment Capital

J4InvestmentCapital

Publish date: Tue, 24 Jul 2018, 08:02 PM

[ EKOVEST ] - How is it considered as undervalue ??? - J4 Investment Capital

Ekovest Berhad is a stable yet slow-growing company which involves in 3 main business divisions- Construction , Property Development and Toll Operation for almost 30 years of experience.

This company is holding a total of RM 14 billion worth of contracts until now which will keep them busy for at least 3 - 5 years .

For the construction sector - its subsidiary company ( EkoRiver Construction Sdn Bhd ) has been awarded a few mega projects from DBKL which is known as River Of Life to transform and upgrade the locations near Klang River area . Those mega projects is awarded to the company in 2016 , 2017 and 2018 March , at total worth of RM 600 million .

For the Property Development sector - the company currently have a land bank of 39 acres located primarily in northern Kuala Lumpur where they will be focusing in for the next few years . While there are also 25 acres of land in Johor Bahru and 12 acres of land in Kuantan . In 2017 , the company has also obtained their permit to develop an area near Gombak which is known as the “ Kuala Lumpur River City “ . The ongoing project - EkoCheras ( 3 exquisite serviced apartments, a Grade A office tower, a classy hotel and four storeys of urban lifestyle shopping mall ) and EkoTitiwangsa ( 3 blocks of freehold service apartments with a total of 696 units and retail spaces ) and other projects which worth more than RM 7 billion .

For the Toll Operation sector - The company currently involves in 3 highways which is located around Kuala Lumpur , DUKE 1 , DUKE 2 and DUKE 3 ( Setiawangsa Pantai Expressway - SPE ) . In the year 2016 , the company has sold 40% of DUKE 1 and 2 highways ‘ share to EPF , for an amount of RM 1.3 billion . The remaining highways , DUKE 1 and DUKE 2 ( 60 % ) have started to fully operate early this year and the contract is due to Aug 2059 . The SPE highway worth RM 3.7 billion is currently in process and is expected to be done in early 2020 and the contract is due to Aug 2069 .

However , the company ‘s executive chairman , Tan Sri Lim Kang Hoo who is believed to have a close relationship with the former government is one of the reason making the investors exiting at instant after PH take over the government . In the PH ‘s manifesto , they had announced to review all the projects and to abolish all the tolls in Malaysia . These had made the situation even worse where there is almost 30 % of the company ‘s revenue is from the Toll Operation sector . DUKE 1 and DUKE 2 highway which has just started operating early this year and DUKE 3 highway ( SPE ) where it is said to be completed in 2020 will be completely wasted and the company may not be able to maintain their annual growth .

Is that a worry to you ? There ‘s a few point need to be highlighted . First of all , PH government promised not to take revenge on those company which previously sided BN . Most of the projects awarded have been on - going for more than 2 years and there is no reason to be pulled - back yet need to to be paid for a huge amount of cash . Although there is no guarantee in future , but based on their toll operating sector where there is 40 % of DUKE 1 and 2 ‘s shares belongs to EPF , will the government purposely creates a huge loss to its own department ? The on - going SPE highway has started since 2016 , it has already reached half- way through its completion . The both DUKE 1 and 2 highway has a NTA price of RM 0.79 which is about 10 % below current price (RM 0.715 ) excluding the SPE highway , company assets and receivable value . This is why we chose it as a very very undervalued stock .

P/E : 11.89

ROE : 6.63

Profit Margin : 8.4 %

DY : 2.8 %

NTA : 0.93

E/Y : 11.24

Debt to Equity : 0.4

EV/ EBIT : 8.9

Price to Book : 0.66

Dividend Policy : -

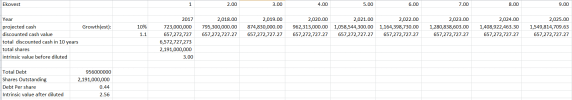

Intrinsic Value Analysis:

According to cash valuation method , with a conservative estimate growth ( 10 % ) , the intrinsic value indicated is RM 2.56 ( included debts) which is higher than the current trading price of ( 0.715 ). Pursuant to this valuation method , there is a 253 % gain in the long run .

NOTE : The est growth% is based on our analysis on fundamental and future prospect , the assumption need not to be 100 % accurate , it is just a rough figure that we estimate .

PER Ratio = PE / Est . Growth %

=11.6 / 10

= 1.6 ( overvalue )

Technical Analysis :

It’s late to publish our analysis on Ekovest , there is a very clear signal on the yellow bounded region ( key reversal day) , followed by three bullish flag pennants and the fourth in making .

TP1 : 0. 78

TP2 : 0. 89

Support : 0.7 / 0. 66

It is quite a good entry point on the current trading price , with a positive momentum , the trend reversal is being confirmed and there is a potential RM 0.19 potential gain at our recommended buying price of 0.70 .

Disclaimer : Information above is for sharing and education purposes , not a buy and sell advice , please refer to ur advisory for any buy or sell call , buy and sell at your own risk .

Happy investing !

Feel free to visit our FB Page , give us a like and share it out so that we can share more things to you !!!

https://www.facebook.com/J4-Investment-Capital-398139627315097/

J4 Investment Capital.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on J4 Investment Capital

Created by J4InvestmentCapital | May 20, 2019

Created by J4InvestmentCapital | Apr 10, 2019

Created by J4InvestmentCapital | Mar 31, 2019

Created by J4InvestmentCapital | Jan 17, 2019

Created by J4InvestmentCapital | Jan 16, 2019

Created by J4InvestmentCapital | Jan 15, 2019

Discussions

i lazy to do a SOP valuation for their 3 separate businesses.

just based on highway valuation already more than market cap.

2018-07-24 21:26

We all know is undervalued,but why not perceived it that way? Think deeper.then is it worth taking the risk to buy and hold

2018-07-25 00:18

Ya every body know ekovest is undervalue.

I Buy in ekovest to bet on political view.

I bet on ph new government won't dare to go populism.

They will go practical , capitalism and business friendly administration.

Use hard earned money to bet on personal political view , instead of empty blow water in coffee shop like uncle

Take advantage of it,if believe in own point of view

2018-07-25 01:41

botak make a blunder when he tried to merge ekovest with iwh. prices dragged south plus the GE 14 result. topping it cancellation of major china backed investment link companies by new pH. botak is known have close links with Kunnan { FT minister }. all this adds up to the negative on ekovest

2018-07-25 07:26

yup.fundamentals are good but dragged down by people perceptions and timing. just keeping my finger crossed for better days. if higher yields and dividends forthcoming ?this FY funds will have a relook at ekovest

2018-07-25 15:26

It was nice to know about the leading Construction engineering company, Ekovest Berhad and understand its mechanism for Property Development and construction sector.

Ida,

http://www.assignmenthelpfolks.com/

2018-12-10 18:14

Worth reading here about Ekovest Berhad which is a constant yet slow-growing company which includes in three main business divisions- Construction , Property Development and Toll Operation for almost 30 years of experience.

Alyssa,

http://www.secureassignmenthelp.com/

2019-01-09 20:34

Alyssa, what a well-written article. The article is extremely fabulous I went through the entire blog of J4 investment capital. You have explained each and everything about the investment capital very ephemerally. I will give a 5-star rating to this blog. Yesterday I have read some other blogs on finance and I have given a 5-star rating to the blogs of https://penmypaper.com/essay-writing-service.

2019-11-30 13:02

cheoky

more undervalued is mini ekovest-azrb

2018-07-24 20:46