Is the market heaven or hell? Part 5 Opportunity or Threat?

kcchongnz

Publish date: Sun, 05 Apr 2015, 09:04 PM

“History doesn’t repeat but it does rhyme” Mark Twain

My previous posts show that Bursa, like other stock markets in the developed world has been on a long-term uptrend trend. It has been providing the best return on investment in the region of 10% to 12% a year since 1974, much better than any other investments available.

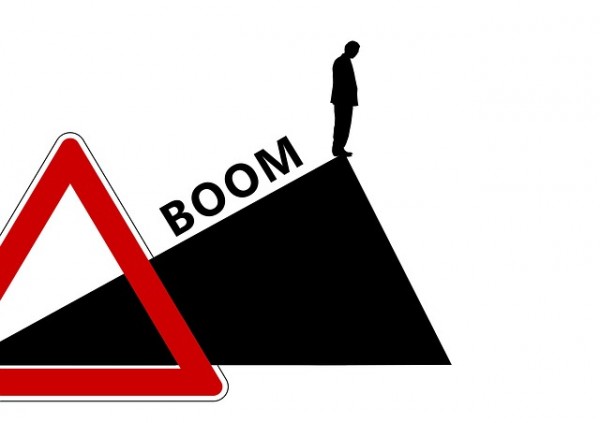

However, the market is not always up in a straight-line, rather it comes in cycles of boom and bust as shown in the long-run broad market movement below.

The peaks and troughs of the cycle are highly unpredictable. Hence it may be advisable to stay invested in the market most of the time, unless there is clearly evidence that the market is in the irrational exuberance stage such as that of the Dotcom Bubble in the US at the end of the old millennium, the out-of-control Second Board euphoria in 1997 in KLSE, the mania of the US Subprime mortgage crisis in 2008 etc, during which investors should just stay away from the market.

Savvy and experienced investors could in fact capitalize the fear and greed of the crowd during these booms and busts cycles and made outsized returns; for example invest in a big way during the downturn and reduce position or get out completely from the market near their peaks. It is not easy to do this though as as shown in the past, mainly due to the human nature of fear and greed. Moreover nobody had that predictive power to tell when is the peak and trough of the cycle.

Lesson from the crash of the marker during the US Subprime Mortgage

“Most of success in life is in just showing up.” Woody Allen

Let us examine the outcome of our investment if we have utilized the experience we have acquired in the boom and bust cycles in the past as described in the previous four parts of this topic in i3investor and started to invest after the most recent market collapse in Bursa in April 2009.

The steep fall of share prices until end of March 2009 provided numerous investing opportunities for those who are knowledgeable, experienced and were well prepared financially and psychologically. That was one of the very few “Once in your life time” kind of investing opportunity. But many speculators and punters were badly burnt and few, after the bitter experience during the fall, have the stomach and guts to invest in the market. Even long term investors were not brave enough to “add bullets” to their investment.

KLCI rose from the low of 873 from 6 years ago to 1831 points at the recent close on 31 March 2015. This is equivalent to a total return of 130% in 6 years, or a compounded annual rate of return of about 16%. This return is 5 times more than the average return of the fixed deposit in banks during this period. RM100000 invested in the share market for 6 years will provide you a return of RM130000; whereas the RM100000 you placed in bank deposit only yield less than RM20000.

The 130% return mentioned above is from the return of the broad market for those who were just invested in the top 30 highest market capitalized stocks in Bursa. What if one instead of invested in the broad market, invested in some good second liner stocks when they were selling at great prices after the collapse of the market in March 2009?

Return of small capitalization stocks using the Magic Formula

Below I just use a portfolio of stocks I am familiar with to illustrate the great opportunity one had and build enormous wealth investing in the stock market, when the opportunity was presented. These stocks were in my three stock portfolios published in i3investor, without choosing and picking to avoid data mining. For illustration purpose, those stocks which were not listed then or without data were omitted. Some of this omission include big movers such as Jobstreet, Prestariang, and Datasonic which would have result in the average total return a lot more. These stocks were chosen mostly based on the Joel Greenblatt’s Magic Formula Investing as shown in the link below:

http://klse.i3investor.com/blogs/kcchongnz/51631.jsp

And some are from the Graham net net current asset value investing here:

http://klse.i3investor.com/blogs/kcchongnz/52382.jsp

Table 1 in the Appendix shows the return of those stocks since April 2009 till to date on 31 March 2015. The data is obtained from Yahoo Finance adjusted weekly prices.

The table shows that all 17 stocks made positive returns after the fall in March 2009, without exception. The average return of the 17 stocks in the three portfolios of above has gone up 5 times more, and the median return more than three and a half times more than the broad market. At a total return of 521% over six years, it is equivalent to a compounded annual return (CAR) of 35.6%. In fact the average return of this portfolio after the fall, has recovered and now surpassed the previous peak by a whopping 290%, or a CAR of 25.5%.

Many of the stocks returned 10 baggers; they are Pintaras (+1339%), SKP Resources (+2025%), and Latitude (+1341%). Others are all triple digits return except for Tong Herr (+46%).

Fourteen out of seventeen stocks have recovered and surpassed their peak prices at end of November 2007 by very wide margins. Only three are still below their peaks then, but just; Tong Herr at -19%, UchiTech -14% and Pantech -1%.

This shows that good stocks though prices have retreated when the overall market dropped, they eventually recovered, even above their previous peaks before the plunge. Hence one shouldn’t be unduly worry too much about market collapse if he has the knowledge and skills to invest in good companies selling at good prices.

Do all smaller capitalized stocks behave in such a manner? Not really. The link below are the returns of some other high growth stocks which investors have paid too much for with too high expectations in the future that I have written here before:

http://klse.i3investor.com/blogs/kcchongnz/63777.jsp

The articles above have shown all the red flags which were quite obvious for those who have the knowledge and experience to spot at and they would never have bought those shares which I consider as "Lemons" for investment purpose .

Return of lemons

Table 2 in the Appendix shows the returns of some of the stocks in the portfolio of lemons during the same period from April 2009 to March 2015 which I have written often and published in i3investor. Some of them were omitted as they were not even listed in 2009 then. They were the favourite hot and "sure win" stocks during that time.

Half of four stocks were still below their troughs 6 years ago after the plunge, when the broad market has risen by 130%. Guan Chong at 85.5 cent now is the only one with its share price now above the 2007 peak, but it won’t be for long looking at its financials, in my opinion.

KNM was the mother of all hot and growth companies growing at about 40% a year for a number of years in 2000s. Its share price was chased up by growth investors, including many institutional investors to the dizzy height of RM10.35 on 31st March 2007. It dropped to a low of about 40 sen a couple of years ago, and it is now at 65.5 sen, a humongous drop of 94% when the broad market has recovered then. I couldn’t imagine how disastrous it was if one had invested in this stock with margin financing, hoping to make exaggerated outsized return from other people's money.

London Biscuits, another high growth company in the high teens for a decade, at 77.5 sen now, is still 38% below its peak in November 2007. Anything changes in the company? None that I can see.

This demonstrates that simply buying any stock following rumours and hypes, and without understand its fundamentals is a sure way of losing. Understand and know how to interpret the financial statements will avoid the pitfalls in investing. With that half the battle in investing is won.

Conclusions

The stock market goes up and down, and sometimes violently as shown. This volatility in the market can be capitalized to build long-term wealth. The extra-ordinary return from the market can be realized with the necessary knowledge and experience in picking good companies to invest at cheap price, and avoid all the pitfalls. This is a viable proposition in an insfficient market such as that of Bursa.

What would be the direction of the market going forward from now? I wish I have a crystal ball in front of me but I don’t. What I can see is there was no abnormal rise of the market especially in recent time, nothing compared to the previous booms and euphoria when there were abrupt steep rises of the market. Though the market is not cheap now, there are still many pockets of bargains available. As I have mentioned before, it is hard to time the market, and know exactly when the market will stop rising, or even spurt, and when it will collapse.

One thing I know for sure is I will never use margin financing to invest, or advise anybody to do that at this time. This we should learn from the past market crashes. Very few people with margin financing could get up after those crashes. Those who could would have lost a limp or two, or more.

For those who wish to learn the art of fundamental value investing to prepare for the investment opportunity presented to build long term wealth and to avoid the pitfalls of the stock market for a fee, please contact me at:

ckc15training2@gmail.com

“If you don’t know where you are going, you will end up somewhere else” Yogi Berra

K C Chong (5/4/15)

Table 1: Return of stocks from April 2009 to 31st March 2015

|

No. |

Stock |

Code |

31/3/2009 |

31/11/2007 |

31/3/2015 |

Change |

From peak |

|

1 |

Kfima |

6491 |

0.34 |

0.55 |

1.99 |

485% |

262% |

|

2 |

Pintaras |

9598 |

0.28 |

0.50 |

4.03 |

1339% |

706% |

|

3 |

Plenitude |

5075 |

0.82 |

1.18 |

2.30 |

180% |

95% |

|

4 |

Pantech |

5125 |

0.32 |

0.73 |

0.725 |

127% |

-1% |

|

5 |

SKPRes |

7155 |

0.04 |

0.08 |

0.85 |

2025% |

963% |

|

6 |

NTPM |

5066 |

0.27 |

0.23 |

0.76 |

181% |

230% |

|

7 |

MFCB |

3069 |

0.61 |

1.19 |

2.52 |

313% |

112% |

|

8 |

Tien Wah |

7374 |

0.89 |

0.83 |

1.88 |

111% |

127% |

|

9 |

Willow |

*0008 |

0.15 |

0.18 |

0.78 |

420% |

333% |

|

10 |

Daiman |

5355 |

1.05 |

1.62 |

2.57 |

145% |

59% |

|

11 |

Magni |

7087 |

0.57 |

0.82 |

3.20 |

461% |

290% |

|

12 |

Latitude |

7006 |

0.44 |

0.75 |

6.34 |

1341% |

745% |

|

13 |

Padini |

7052 |

0.29 |

0.38 |

1.41 |

386% |

271% |

|

14 |

Scientex |

4731 |

0.95 |

1.08 |

6.71 |

606% |

521% |

|

15 |

Tasco |

5140 |

0.49 |

0.97 |

3.43 |

600% |

254% |

|

16 |

Tong Her |

5010 |

1.42 |

2.56 |

2.07 |

46% |

-19% |

|

17 |

UchiTech |

7100 |

0.77 |

1.76 |

1.52 |

100% |

-14% |

|

|

|

||||||

|

|

Average |

521% |

290% |

||||

|

|

Median |

386% |

254% |

||||

|

|

|

||||||

|

|

KLCI |

KLSE |

873 |

1445 |

1831 |

110% |

27% |

Table 2: Return of some high growth stocks from April 2009 to 31st March 2015

|

No. |

Stock |

Code |

31/3/2009 |

31/11/2007 |

31/3/2015 |

Change |

From peak |

|

1 |

Guan Chong |

5102 |

0.16 |

0.26 |

0.855 |

434% |

229% |

|

2 |

LonBis |

7126 |

0.67 |

1.24 |

0.775 |

16% |

-38% |

|

3 |

KNM |

7164 |

1.7 |

10.35 |

0.655 |

-61% |

-94% |

|

4 |

MPCorp |

6548 |

0.41 |

0.55 |

0.195 |

-52% |

-65% |

More articles on kcchongnz blog

Created by kcchongnz | Jan 22, 2024

Which to buy, Insas or Insas WC?

Created by kcchongnz | Jan 15, 2024

Created by kcchongnz | Jan 01, 2024

Created by kcchongnz | Dec 25, 2023

Created by kcchongnz | Oct 02, 2022

Discussions

Very valuable...to those who havent got the 'experience'....you do not know how valuable this infos are.....

2015-04-05 23:23

Whether bull or bear market, be it good or bad times, in health or illness, through thick or thin...investtors rides 'em out all!

Yes, investors don't jump in and out of stocks, they stay invested at all times in quality, value, growth, dividend...stocks.

It is the job of the traders/timers/speculators not investors to forecast, predict, outmaneuver or outsmart mart short to mid term trajectories.

Whatever it is...no right or wrong...so long one is happy and making $$$!

My best wishes, love and prosperitty to all

Kevin

2015-04-06 19:29

Kevin,

You are one of the very few investors who follow what Woody Allen said:

"Most of success in life is in just showing up."

I can see the kind of extra-ordinary return you have been getting following this principle of investing in the market, just like the extra-ordinary return of the portfolio mentioned in this article.

Very hard to find experience value investors like you in public forums.

Well done.

2015-04-06 20:06

kc, kudos ! These five parts on "Is the market heaven or hell" can constitute a booklet by itself. They so aptly provide such a detailed description of the previous stock market crisis.

2015-04-06 20:25

Hi KC,

I'm just a very average growth investor. Since i first started trading in 1994, my humble portfolio returns is nothing to shout about...9.3% per annum.

My investing method is very eclectic...i am definitely not a value investor haha!

2015-04-06 21:04

ALOT OF PEOPLE ASK RAIDER.....IF U R BULLISH.....WHY TALK ABOUT MARKET DOOM & COLLAPSE LEH ?

RAIDER SAY.....IF U WANT TO COMPLETE.....YOUR INVESTMENT SKILL.....U MUST STUDY & UNDERSTAND THE MARKET BOOM & BUST LOH.....!!

BY UNDERSTANDING.....THIS SCENARIO.....U WILL KNOW HOW TO MANAGE YOUR RISK LOH....!!

SO HOW & WHAT IS THE SIGN OF MARKET EXTENDED & EUPHORIA LEH ?

RAIDER ADVISE U TO WATCHOUT THIS 2 CONDITION OR SIGN AND BE FEARFUL LOH....!!

SIGN 1

U MAKE ALOT OF MONIES ........U NEED TO BE FEARFUL LOH.....!!

SIGN 2

U LOSE ALOT OF MONIES......U NEED TO BE FEARFUL LOH.......!!

GENERALLY.....FOR MOST INVESTOR.....IT IS BETTER FOR U ...AND UR RETURN......DO NOT BE IN THE EXTREME LOH....!!.

2015-04-06 23:23

Posted by Kevin Wong > Apr 6, 2015 09:04 PM | Report Abuse

Hi KC,

I'm just a very average growth investor. Since i first started trading in 1994, my humble portfolio returns is nothing to shout about...9.3% per annum.

My investing method is very eclectic...i am definitely not a value investor haha!

Congrats, your $10000 invested in 21 years ago has become $65000. Not bad. The real return, after taking into consideration of inflation is easily about 5%, and that is good.

That is also about the long-term return of the broad market over those years. And I believe, you are better than at least 80% of the retail investors in Malaysia.

But why not engaging in value investing? Value investing doesn't mean buying cheap stocks only. It could be any good value or growth stocks selling cheap. See what the investors of Graham and Dodds have achieved here:

http://klse.i3investor.com/blogs/kcchongnz/50988.jsp

2015-04-07 06:17

haha thanks kc,

I like to keep my investing style simple. I don't have the patience and the amount of work and research one has to do of a value investor.

Maybe that is why i didn't manage to outperform market returns over the last 21 years.

2015-04-07 08:28

Human behaviour is the strangest thing. See these comments from the icap thread.

[Posted by penangkia75 > Mar 17, 2015 02:35 PM | Report Abuse

Hooi,observe u continue to collect ICA{, may I know what is ur reason behind? I had stop collect it. Thx]

[Posted by hooi > Mar 17, 2015 07:01 PM | Report Abuse

The reason is simple, i trust Teng Boo!]

Six years ago on April 1 2009, icap traded at an adjusted price of RM1.40 and it closed at about RM2.35 end of March 2015. The total return is 68% so far.

The total return of the broad market was 131% during the same period, or about twice higher than the return of icap.

If one holds the portfolio of stocks mentioned in this thread which return 521% during the same period, icap's is terribly miserable in its return.

Is there a psychologist here who can explain to me this statement?

[Posted by hooi > Mar 17, 2015 07:01 PM | Report Abuse

The reason is simple, i trust Teng Boo!]

2015-04-08 20:55

.png)

willnck

As usual,a great write up.Thanks Kc.

2015-04-05 21:32