IPO - Agricore CS Holdings Bhd (Part 2)

MQTrader Jesse

Publish date: Wed, 05 Jun 2024, 09:40 AM

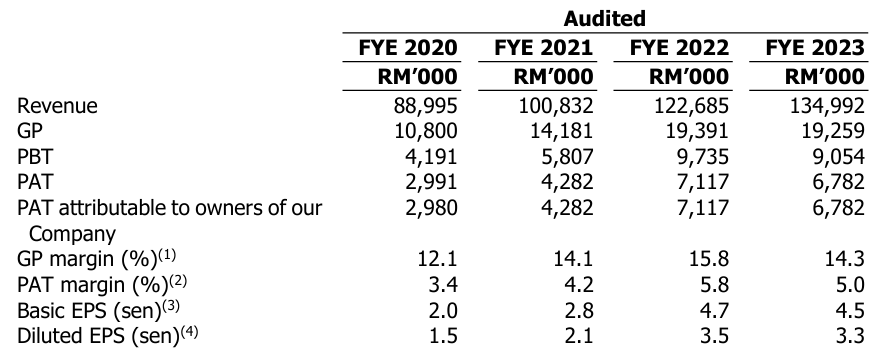

Financial Highlights

The following table sets out the financial highlights based on the combined statements of profit or loss and other comprehensive income for FYE 2020 to 2023:

- The revenue grew from RM 88 million in FYE 2020 to RM 134 million in FYE 2023. The company is expanding its market share in this industry.

- The gross profit margin grew continuously from 12.1% in FYE 2020 to 15.8% in FYE 2022 but declined to 14.3% in FYE 2023. The decline in the margin in FYE 2023 is mainly due to the effect of an unfavorable exchange rate of the RM against the USD. In comparison, the RM depreciated against the USD by approximately 3.6% in FYE 2023 (average USD1: RM4.57) compared to FYE 2022 (average USD1: RM4.41), as the Group was unable to fully pass the higher cost to the customer. (Generally, a GP margin of 20% is considered high/ good).

- The PAT margin grew from 3.4% in FYE 2020 to 5.8% in FYE 2022, and then declined to 5.0% in FYE 2023.

- The gearing ratio was 0.9 times in FYE 2023, which is above the benchmark. This is not a good sign for the company as it is involved in financial risk. (A good gearing ratio should be between 0.25 – 0.5).

Major customers and suppliers

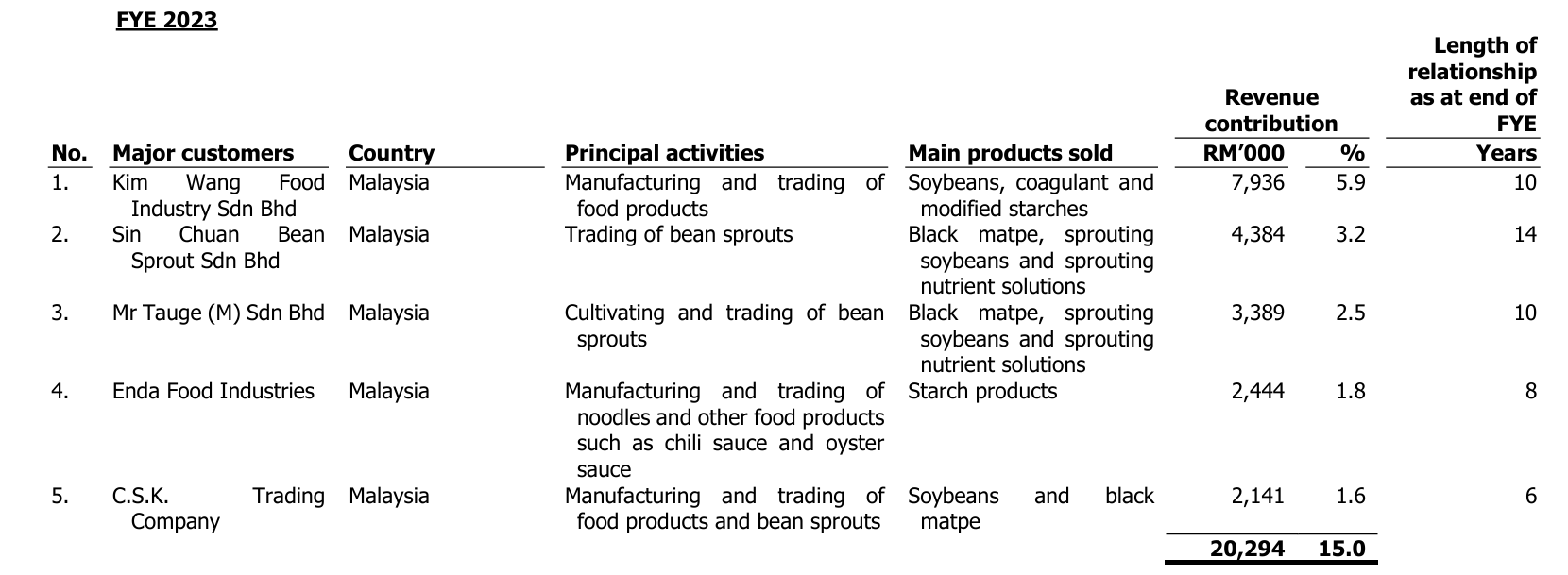

Major Customers

The major customer for FYE 2023 is as follows:

The top 5 customers contributed 15.0% of the revenue. The company is not dependent on any of its major customers. This shows that management has well diversified its customer base to avoid high-concentration customer risk.

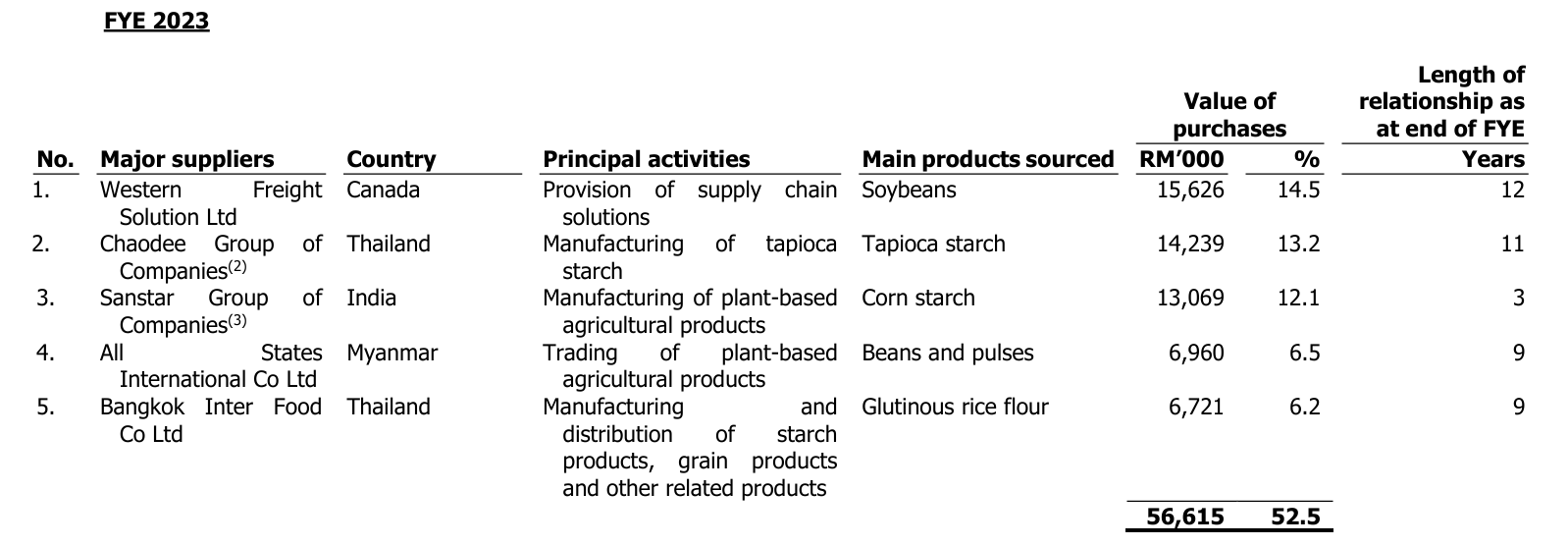

Major Suppliers

The top 5 major suppliers for FYE 2023 as follows:

The top five suppliers account for 52.5% of the purchases. Management mentioned that although they mainly source tapioca starch from Chaodee Group Companies, they are not dependent on Chaodee Group Companies for the supply of tapioca starch, as it is readily available and can be easily sourced from other suppliers in the market. Furthermore, management emphasizes that the group is not dependent on any single supplier, as they are able to source products from other suppliers.

Industry Overview

According to Smith Zander's research, Agricore CS Group primarily deals with plant-based agricultural food ingredients, focusing on pulses, legumes, flour, and starches. The food ingredients industry in Malaysia, excluding other categories like fruits, vegetables, and certain grains, grew from RM6.43 billion in 2020 to RM9.15 billion in 2023, with a CAGR of 12.48%. It is forecasted to grow to RM10.18 billion in 2024.

The pulses and legumes segment grew from RM1.57 billion in 2020 to RM2.47 billion in 2022 but declined to RM2.25 billion in 2023. It is expected to recover and grow to RM2.42 billion in 2024. The flour and starches segment grew from RM4.86 billion in 2020 to RM6.90 billion in 2023 and is expected to reach RM7.76 billion in 2024.

The food additives industry, measured by the sales value of distilled monoglyceride, grew from RM655.62 million in 2020 to RM1.02 billion in 2022 and is expected to reach RM1.18 billion in 2024.

Key Industry Drivers

- The significance of food security serves as a driving factor in propelling the growth of the food ingredients industry.

- Increased food needs as a result of the growth in population and economic affluence, presenting demand potential for food ingredients.

- Growth in demand from the F&B manufacturing and processing industry as well as the foodservice industry will boost the food ingredients industry.

- Government initiatives in promoting the F&B manufacturing industry will drive the demand for food ingredients.

Key Industry Risks and Challenges

- Fluctuating prices impact the food ingredients industry.

- Vulnerability to product contamination, tampering, adulteration or damage.

- Dependence on crop yield

Source: Smith Zander

Future plans and strategies for AGRICORE CS HOLDINGS BERHAD

The business objectives are to maintain sustainable growth and create long-term shareholder value. To achieve the business objectives, the company will implement the following business strategies over the period of 12 months from the date of the Listing:

- The company intends to increase the storage capacity by setting up a new regional storage facility in Klang, Selangor.

- The company plans to continue expanding the sourcing and distribution business by increasing its inventory levels.

- The company intends to expand the team to support its business growth.

MQ Trader View

Opportunities

- The company sources and distributes a wide variety of products due to its extensive network of suppliers and customers. This extensive network enables the company to offer a wide range of products to meet the diverse needs of its customers. The company has engaged a total of 80 suppliers from 13 countries for the supply of its plant-based agricultural food ingredients, which originate from 15 countries, including Malaysia.

Risk

- The company is exposed to foreign exchange fluctuation risk, which may impact the profitability of the Group. Supplies, including beans and pulses, starch products, grain products, shallots, onions, cooking oil, and packing materials, are sourced from local and/or overseas suppliers. The majority of these purchases are denominated in USD, accounting for 88.1% of the Group’s total purchases in FYE 2023.

- The company has a high gearing ratio, which may impact its operations. The high level of debt could expose the company to liquidity risk if there are any adverse external factors, such as a worsening economy or a market downturn. This might make it difficult for the company to manage its debt payments, resulting in a negative impact in the end.

Click here to refer the IPO - Agricore CS Holdings Bhd (Part 1)

Looking for flat 0.05% brokerage? Get started: https://bit.ly/mqamcash

Community Feedback

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion into the next release of the system.

We would like to develop this system based on community feedback to cater for community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedback coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties in the Internet. We may or may not hold position in the stock covered, or initiate new position in the stock within the next 7 days.

Join us now!

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators and quantitative data to generate accurate trading signals without the interference of human's emotions and bias against any particular stock. It comprises trading strategies which are very popular among fund managers for analysing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any enquiry:

Facebook: https://www.facebook.com/mqtrader

Instagram:https://www.instagram.com/mqtrader

MQ Chat: https://messenger.i3investor.com/m/chatmq

YouTube: https://www.youtube.com/channel/UCq-26SGjlQTVQfO7DoEihlg

Email: admin@mqtrader.com

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Initial Public Offering (IPO)