Sunway Berhad – Not Just a Good Civil Engineer

Neoh Jia En

Publish date: Mon, 09 May 2022, 09:57 AM

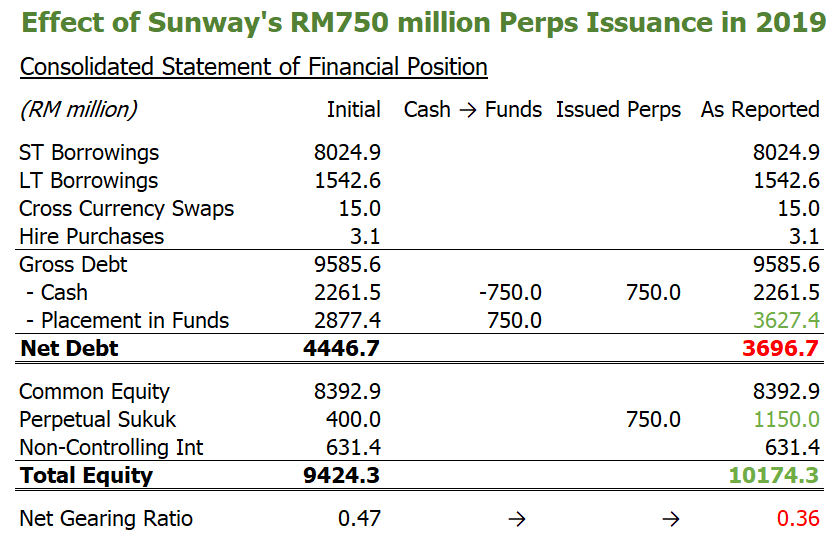

- Excluding the RM400 million subscription by the company’s major shareholder in 2018, the remaining RM750 million worth of Sunway’s equity-classified perpetual sukuk as at end 2019 was actually taken up by Sunway and its subsidiaries via wholesale funds controlled by the group.

- While doing so would reduce Sunway’s leverage ratio, there were likely other reasons for such a transaction that did not raise money from outsiders, since Sunway and its subsidiaries had also subscribed to all the group’s unsecured MTNs outstanding as at end-2019.

- Treasury management is a likely explanation as Sunway could move cash within members of the group by transacting in those instruments via its wholesale funds. A successful equity financing of SunREIT has also been achieved, with the wholesale funds' subscription for the entire issuance of perpetual notes by the associate in 2019.

- Unfortunately, the need for Sunway to reclassify its perpetual sukuk to liabilities post-consolidation of wholesale funds into the group’s balance sheet is still not well understood.

Tracing its roots back to the development of a tin-mining wasteland in 1974, Sunway Berhad (Sunway) is a successful Malaysian conglomerate with businesses in real estate, construction, education, healthcare, retail, and hospitality. Besides Sunway’s own listing on the main market of Bursa Malaysia, the company’s 54.6%-owned construction-arm Sunway Construction Group Berhad and 40.9%-owned Sunway Real Estate Investment Trust (SunREIT), which holds the group’s real assets, are also names favoured by public equity investors in Malaysia. Successful executions of Environmental, Social, and Governance (ESG) strategies have landed Sunway an early spot in the FTSE4Good Bursa Malaysia Index.

Given the capital-intensive nature of real estate businesses, assessing new financing options is crucial to Sunway’s growth. The group has been active in exploring non-conventional equity financing: SunREIT is the first real estate investment trust in Malaysia to have issued perpetual bonds (perps) (see the analysis titled “Is Sunway REIT's proposed RM10b perpetual notes a poison chalice to unitholders?” by The Edge Malaysia on how perps could help SunREIT to overcome regulatory gearing limit), while Sunway’s issuance of irredeemable convertible preference shares has led to the following conversation with shareholders that confirmed my previous conclusion about net assets per share:

Sunway’s question-and-answer session during the company’s 11th annual general meeting

Shareholder: Net Tangible Assets (“NTA”) per share for the year improved from 163 sens to 186 sens. A significant improvement of 23 sens. What contributed to the increase in NTA for the year?

Management: The higher NTA was primarily due to the issuance of irredeemable convertible preference shares (“ICPS”) amounting to RM977.8 million during the year.

Shareholder: Shouldn't ICPS be capital, not assets?

Management: There is no specific standard that governs net assets per share and hence, we did not use the fully diluted method.

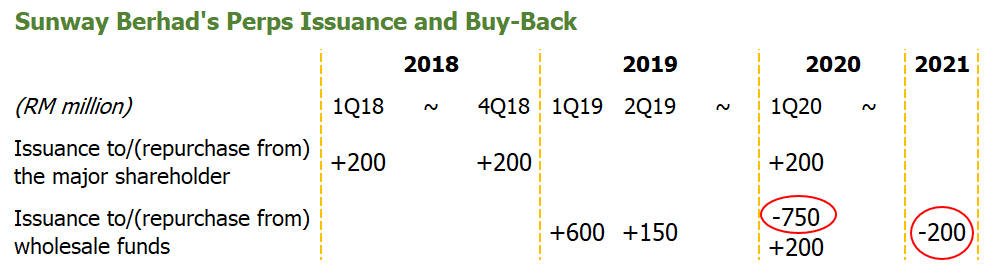

As an early adopter of financial innovations, Sunway is also among the few Malaysian companies that have issued equity-classified perps. Its first perps issuance, done in the first quarter of 2018, raised RM200 million and came with a relatively low distribution rate of 5.50%. Subsequent perps issues increased Sunway’s outstanding value of perps from RM400 million at end-2018 to RM1,150 million at end-2019.

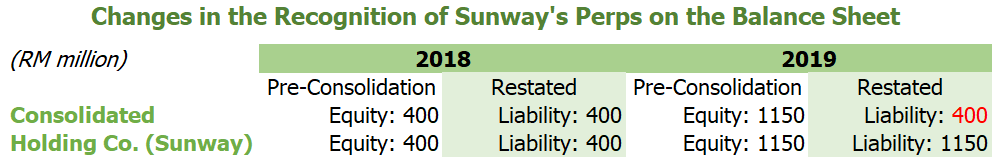

In what was probably the first case for Malaysian corporates, Sunway, in its fourth quarter report for the year 2020 released on 31st March 2021, announced the reclassification of its perps from equities to liabilities starting from its financial year ended 31st December 2020, with restatements of previous years’ figures for comparative purposes (prior year adjustments). This reclassification was triggered by the consolidation of some wholesale funds, in most of which Sunway is the sole investor, into the group’s balance sheet.

The consolidation was in turn driven by the company’s adoption of amendments to Malaysian Financial Reporting Standards (MFRSs). While Sunway did not specify which amendment(s) led to the management’s reassessment, it was likely one or both of the amendments to “References to the Conceptual Framework in MFRS Standards” and to “MFRS 3 Definition of a Business.” Both amendments were announced in 2018 and effective from 1st January 2020.

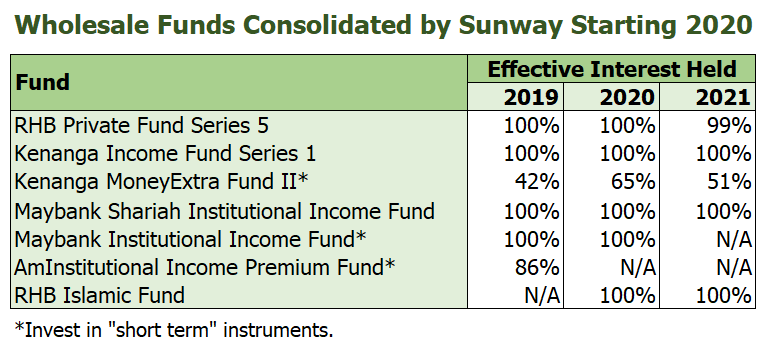

The wholesale funds involved

As disclosed in Sunway’s annual reports, the consolidated wholesale funds are “managed by the respective fund managers, who apply various investment strategies to accomplish their respective investment objectives.” From the list of funds disclosed, they are indeed managed by external parties.

Management explained that the group invested in these wholesale funds to generate “short term to long term income for their treasury management purposes.”

In justifying the consolidation, Sunway mentioned that the group’s fund-unit investments gave them nearly 100% of the exposure to or rights to variable returns from those funds, which hence should be considered as the company’s subsidiaries.

The poorly-explained reclassification

Although what Sunway has gone through could have been a good case study for potential perps issuers, the company has unfortunately provided scarce explanation for the event.

Other than page 8 of Sunway’s fourth quarter report for the year 2020 where a two-sentence rationale could be found, page 372 of the company’s 2020 annual report provides the most comprehensive explanation:

“The reassessment of the Group’s and the Company’s involvement in their investments in wholesale funds had resulted in the reclassification of the perpetual sukuk of the Group and of the Company from equity to financial liability as it ceased to meet the definition of equity in accordance with MFRS 132 Financial Instruments: Presentation.

Accordingly, the entire perpetual sukuk net of the amount of perpetual sukuk invested by the wholesale funds of the Group and the entire perpetual sukuk of the Company have been reclassified from equity to non-current liability respectively. This has also resulted in the reclassification of distributions to holders of perpetual sukuk from transactions with owners recognised directly in equity in the statements of changes in equity to profit or loss.”

From this announcement, we could understand that those consolidated wholesale funds invested in perps issued by Sunway. This is normal for portfolio diversification, so long as transactions made by those funds are on arm’s length basis. If Sunway consolidates those funds into the group’s balance sheet, perps purchased by them will have to be removed from the balance sheet.

Still, what have been provided are far from sufficient. How did the consolidation of wholesale funds lead Sunway’s perps to fail their classification as equities? This is an effect that differs from the elimination of intra-group equities/debts.

Due to the way how financial liabilities and equities are defined in MFRS 132, which is equivalent to IAS 32, it is actually easier to judge that an instrument has fulfilled the definition of financial liability rather than that it has failed to meet the definition of equity. Paragraph 4.64 of the Conceptual Framework for Financial Reporting puts it neatly: “… [equity claims] are claims against the entity that do not meet the definition of a liability.”

For better understanding, the question could hence be rephrased as: how did the consolidation of wholesale funds led Sunway to have contractual obligation (before liquidation) to deliver cash to another entity? A more careful look at the terms of those perps and transactions done by wholesale funds may help in solving the riddle.

The perps in question

Issued under a RM5 billion perpetual sukuk programme, Sunway’s perps were equities raised by the holding company. Proceeds from the perps are used as “loans given to the subsidiaries in the course of the Company’s business for the purpose of producing of gross income.”

Examining the principal terms and conditions of these perps, three clauses relevant to the issue being discussed are found:

- Sunway could redeem the perps five-year from their issuance date, at a price roughly equals to the perps’ nominal value plus accrued distributions (the ‘Optional Redemption’ clause);

- Sunway could redeem the perps when they could no longer be recorded as equity due to changes or amendments to accounting standards, and this change must be certified by the external auditor (the ‘Accounting Event Redemption’); and

- Sunway and its subsidiaries, related corporations, or agents may purchase the perps in the open market or by private treaty, and those perps that are purchased by Sunway and its subsidiaries or agents must be cancelled (the provisions on ‘buy-back’).

Unfortunately, none of these terms could explain the reclassification. Even with those wholesale funds being deemed to be controlled by Sunway, they do not have the contractual right to require Sunway to not defer distributions, or to redeem the perps, based on these terms alone.

A tip of the iceberg

A look at the quantum of Sunway’s perps transacted by the consolidated wholesale funds, however, revealed quite a different picture than what was painted.

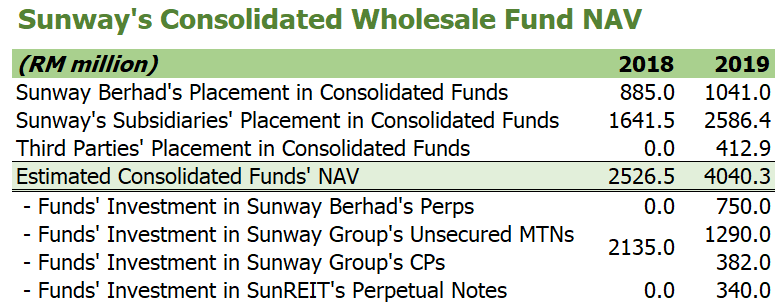

Looking at the value of perps eliminated from the consolidated balance sheet due to prior year adjustments, we could derive that those wholesale funds bought RM750 million worth of Sunway’s perps in 2019 – a rather large proportion of the total perps outstanding of RM1,150 million as at the end of the same year.

Following this lead, investments made by those funds in other Sunway-related instruments are unravelled.

Other than perps, the consolidated wholesale funds also invested in unsecured medium-term notes (MTNs) and commercial papers (CPs) issued by Sunway and/or its subsidiaries, and also in perpetual notes issued by associate SunREIT.

More importantly, the quantum of investments was large: Sunway-related instruments accounted for 84.5% and 68.4% of those wholesale funds’ assets in 2018 and 2019 respectively. In the case of unsecured MTNs and SunREIT’s perpetual notes, all amount outstanding as at the end of 2019 was taken up by the funds. Such a high concentration of investments in a single group is unusual when risk management is concerned and when the objective is to generate “short term to long term income.”

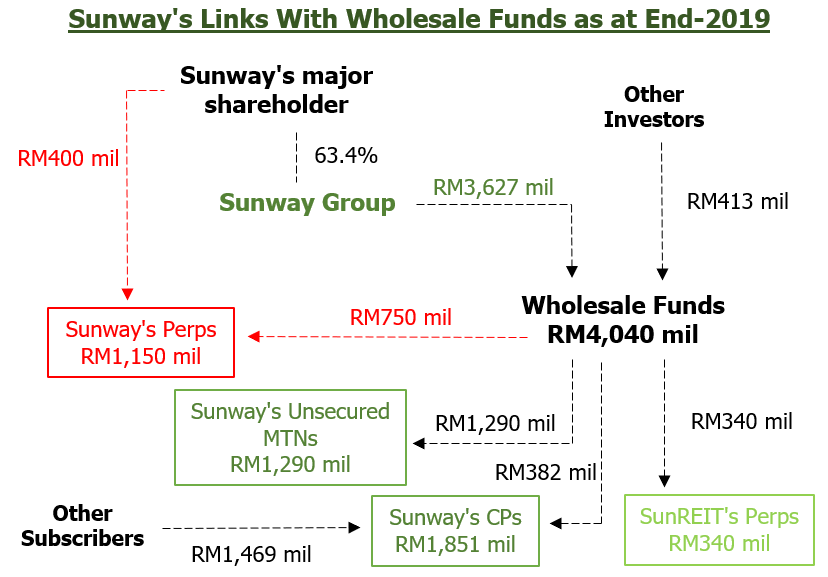

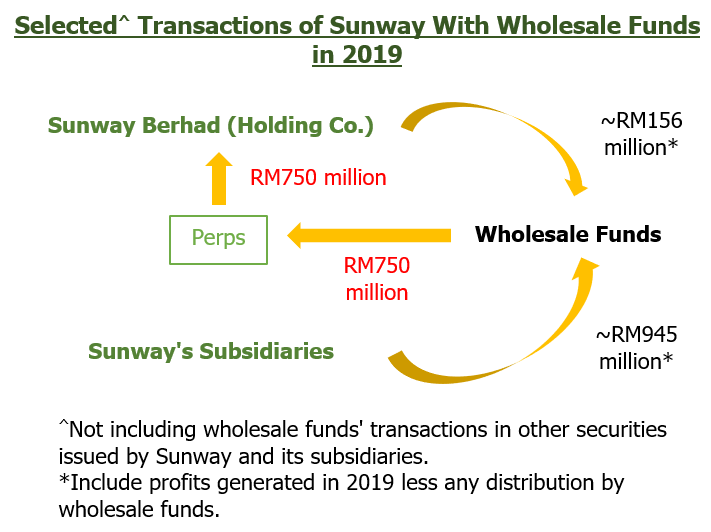

Digging into details available in Sunway’s annual reports, we could see that the only other investor of Sunway’s perps is the company’s major shareholder who owns a 63.4% stake. The relationships among Sunway, the consolidated wholesale funds, and Sunway-related instruments bought by those wholesale funds could hence be presented as follows:

The raison d'être

One implication from the relationships uncovered is that Sunway’s issuance of perps did not raise money from non-related parties. The RM750 million purchases by wholesale funds is especially puzzling, since the money just flowed within the group (those wholesale funds with minority interest were unlikely to have subscribed for perps due to their principal activities of investing in “short term” instruments). What is the purpose of doing so?

For investors who have followed the debate on perps, the first thought that comes to mind is likely that Sunway was utilizing those perps to boost its equity and reduce its gearing ratio.

This could indeed be true before Sunway consolidated its wholesale funds. By just placing RM750 million of cash in wholesale funds, which then passed the cash back to Sunway via subscription of the perps, Sunway could raise both its equity level and placement in funds, which was deducted from net debts.

Unlike the normal case of issuing equity-classified perps to outsiders, neither Sunway nor potential subscribers would face cash outlays from such an arrangement, assuming zero transaction cost. Hence, such a transaction could theoretically be repeated indefinitely to make both equity and placement in funds approach the infinity, but covenant on the utilisation of proceeds would likely prevent Sunway from doing so.

Nonetheless, deleveraging was a weak rationale for Sunway’s self-subscription of own perps. There are two reasons to support this argument: the first is Sunway’s healthy net gearing ratio of 0.47x before the exercise, and secondly, we have seen that Sunway subscribed to the group’s MTNs – doing so would not reduce the consolidated gearing ratio.

A more careful examination of cash flows that occurred among Sunway, its subsidiaries, and the wholesale funds provides a clue: Sunway might be using its perps to move cash from subsidiaries to the holding company, even though this was in contrast with the stated purpose for issuing those perps.

Taking 2019 for example, Sunway recorded a negative RM1,100 million in investing cash flows for fund placement on its consolidated statement of cash flows, and the amount was much smaller at RM156 million at the holding company level. This means that there could have been a RM945 million inflow, assuming no profit generated by and no distribution from wholesale funds, from subsidiaries into the wholesale funds, which was then diverted to the holding company via the perps placement.

Similarly, Sunway could transfer cash from the holding company to subsidiaries via the latter’s issuance of MTNs and CPs. Cancellation or buy-back of these instruments could also reverse the cash flow when needed.

If this is the case, then Sunway’s investment in wholesale funds would really be for treasury management purposes as claimed, even though focusing on the income generation purpose of treasury management might have been misleading. Much like the unsecured MTNs, perps were just a tool for moving cash among members of the group.

Lastly, a speculative guess on the reclassification

Although the exact reason to reclassify perps has not been disclosed, our discussion of the exact role of Sunway’s wholesale funds and perps could help in making a guess on where the obligation for the holding company might have arisen.

To facilitate the timely transfer of cash, Sunway and its subsidiaries might have separately made supplementary agreements with managers of its wholesale funds such that the holding company is obliged to pay distributions on or to redeem its perps under certain conditions. When viewed from the point of a consolidated entity, those agreements evidence an obligation to the holding company.

A case in point is Sunway’s “redemption” of perps in the first quarter of 2020 and in 2021, which incurred “redemption loss” of RM19.0 million and RM3.0 million respectively to the holding company.

Given that Sunway has stated its perps to be “non-call 5 years” and the announcement of reclassification was done only on 31st March 2021, those perps would not have been redeemed under the ‘Optional Redemption’ clause and the ‘Accounting Event Redemption’ clause.

What has most likely been done was that Sunway had repurchased those perps by private treaty. And since the holding company also issued RM400 million more in perps during the first quarter of 2020 when it “redeemed” RM750 million in perps, those “redemptions” were likely not done due to an excess of cash.

Still, what I have elaborated remains a speculation due to the limit of public disclosures and of my understanding. Unfortunately, I could not reach a definite conclusion on this topic. Shareholders who are interested in this archaeological study are better off posting the question directly to the management of Sunway during the company’s upcoming annual general meeting on 23rd June 2022.

*Sunway’s treasury management strategy might also positively impact the group’s liquidity ratios (consolidated balance sheet: + placement in funds; + long-term borrowings) and reduce financing costs (if the company is bidding for the same issue of CPs against other investors), although institutional fixed-income investors would likely have known about this arrangement by Sunway.

*This post is the last of my three Golden Week writeups, and is a loose follow-up to my previous post titled “YNH Property Berhad – Looking Beyond the 99.998%”.

*For a follow-up, see my post titled “Sunway Berhad – Part 2: Above the Rising Cloud.”

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2025-01-31

SUNWAY2025-01-31

SUNWAY2025-01-31

SUNWAY2025-01-28

SUNWAY2025-01-28

SUNWAY2025-01-27

SUNWAY2025-01-27

SUNWAY2025-01-24

SUNWAY2025-01-24

SUNWAY2025-01-24

SUNWAY2025-01-24

SUNWAY2025-01-24

SUNWAY2025-01-23

SUNWAY2025-01-23

SUNWAY2025-01-23

SUNWAY2025-01-23

SUNWAY2025-01-23

SUNWAY2025-01-23

SUNWAY2025-01-22

SUNWAY2025-01-22

SUNWAY2025-01-22

SUNWAY2025-01-22

SUNWAYMore articles on Lorem ipsum

Created by Neoh Jia En | Feb 02, 2024

Created by Neoh Jia En | May 29, 2023

Created by Neoh Jia En | Feb 10, 2023

Created by Neoh Jia En | Dec 30, 2022