For Some Shareholders, A Good Sapura Might Just be a Dead Sapura

Neoh Jia En

Publish date: Sat, 02 Apr 2022, 09:26 AM

- “Net assets per share attributable to ordinary equity holders of the parent” might not be the liquidation value received by ordinary shareholders, even if all assets are sold at their book value and there is no liquidation cost.

- The difference in payoffs for and potential conflict of interest between ordinary and non-ordinary shareholders imply that investors should exercise extra caution when analysing companies with non-ordinary equity interests.

Just eight years ago, none would have expected Sapura Energy Berhad (Sapura) to end up a penny stock. As a constituent of FTSE Bursa Malaysia KLCI Index fetching nearly RM28 billion in market capitalisation in December 2013, Sapura, then known as SapuraKencana, was the oil and gas company in Malaysia. Since then, the company has lost 98% of its market value due to the energy market rout and financial difficulties, among others.

The dominance of Sapura in the local oil and gas industry has prompted (at least one) call(s) for a government bailout. Conventionally, a bailout should be good for shareholders. However, does this statement always hold?

Disregarding a politician’s plan to maybe make Sapura the second world-famous Malaysian company, holders of Sapura’s Islamic redeemable convertible preference shares (RCPS) might disagree with a government’s rescue under strict assumptions.

Some are more equal than others

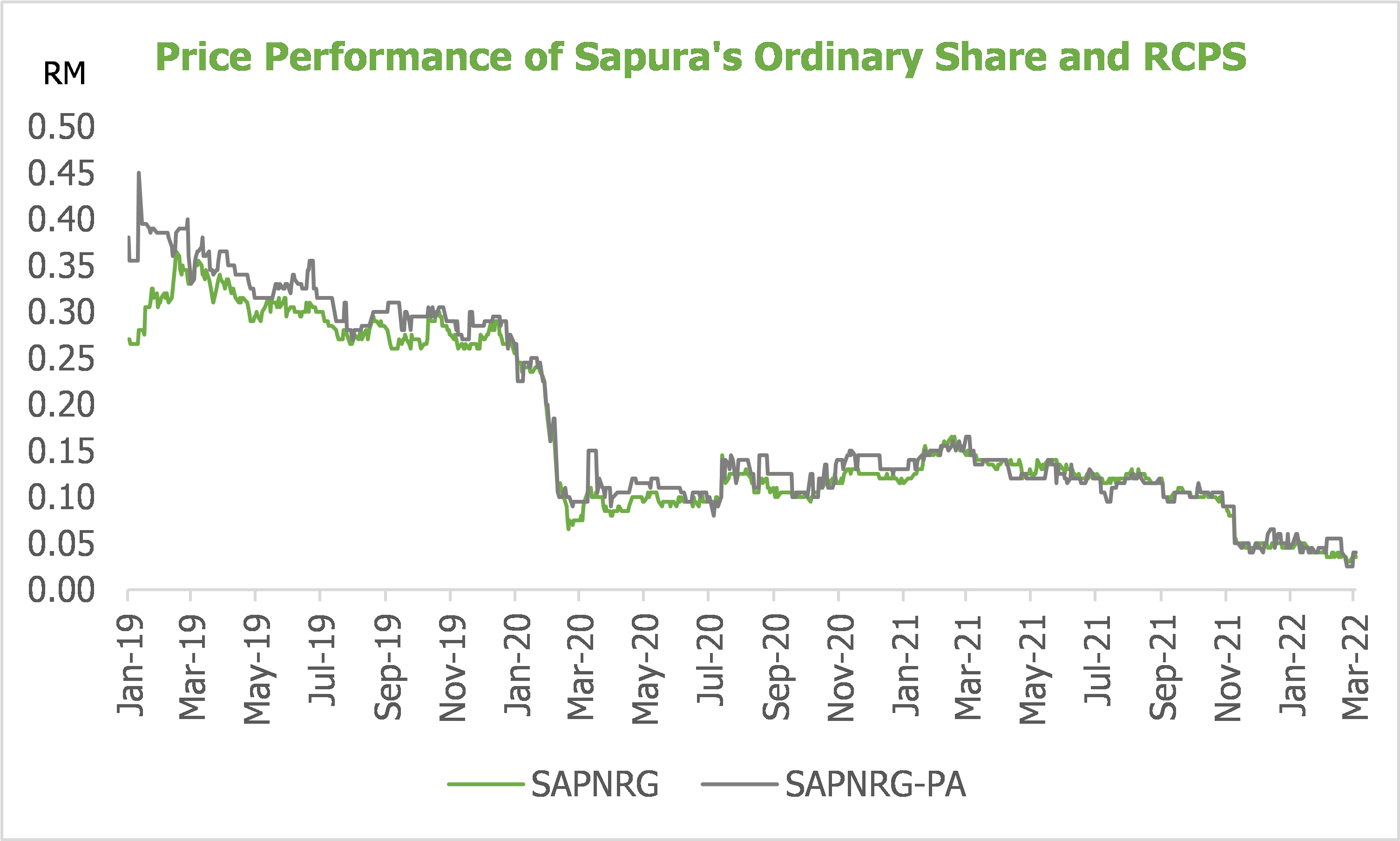

Listed on 29th January 2019, Sapura’s RPCS is traded on Bursa Malaysia as SAPNRG-PA. Its price action since listing suggests that the RCPS is equivalent to ordinary shares of Sapura.

While each RCPS will indeed be automatically converted into one ordinary share of Sapura only upon reaching maturity on 23rd January 2024, the market seems to have ignored the liquidation preference of RCPS – each RCPS is entitled to claim 41 cents in proceeds from liquidation before ordinary shareholders could receive anything, provided that there is residual value after paying off debts.

Assuming that Sapura is liquidated at its book value, investors would hence normally expect proceeds of 41 cents per RCPS and 1.59 cents per ordinary share, the latter based on the last reported “net assets per share attributable to ordinary equity holders of the parent” (which has been rounded up to two cents).

Unfortunately, the equity value used in computing Sapura’s net assets per share has not deducted RCPS’ liquidation preference. Based on the latest net asset figure, ordinary shareholders have in fact been wiped out, while RCPS holders could theoretically receive only 10.6 cents per share in liquidation proceeds.

Illustrating the trade-off

Based on the last-traded price of 3.5 cents for one ordinary share of Sapura, ICPS holders should prefer a liquidation for payoff of 10.6 cents rather than a conversion into ordinary shares, assuming that the current share price hold still until after the maturity of ICPS.

A clear counterargument would hence be the potential recovery in ordinary share price, from which ICPS holders would benefit with conversion. Then, how strong should the ordinary share price recover for ICPS holders to be better off with converting?

A simple answer would be a 203% recovery to 10.6 cents per ordinary share. However, this ignores the potential economic factors that could drive both the ordinary share price and liquidation value of ICPS in the same direction. When Sapura’s ordinary share trades at 10.6 cents, the liquidation value of ICPS might have risen to be higher than 10.6 cents per share. Since rationale investors should disregard their original investment cost and consider only the marginal profit to be made for each trade, ICPS holders might still be better off with liquidation even when the ordinary share price hits 10.6 cents. An analysis of trade-off is hence required.

For the ease of discussion, I now assume that Sapura’s ordinary shares would trade at the diluted net assets per share or 1x price-to-book ratio after ICPS matures on 23rd January 2024. This implies that any increase in share price should be accompanied by profit and hence net asset growth. Such an assumption may not be too far off from the reality given that Sapura is now valued on price-to-book ratio basis by four out of the eight research houses that I managed to track.

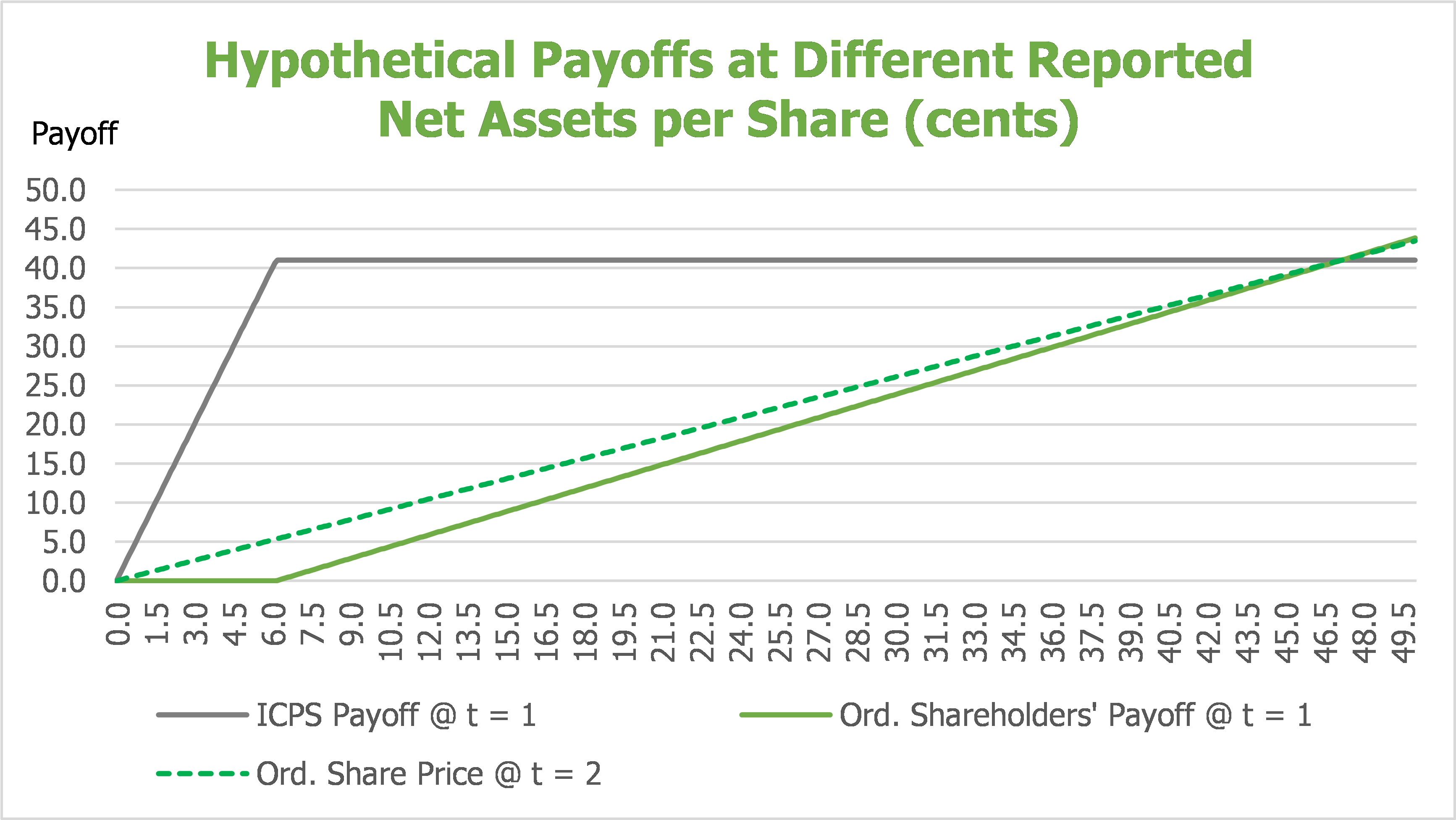

By varying the reported net assets per share based on existing ordinary shares outstanding, I simulate the corresponding liquidation payoffs for ICPS and ordinary shareholders before 23rd January 2024, represented by the period t = 1, and the corresponding ordinary share price/diluted net asset per ordinary share after 23rd January 2024, represented by the period t = 2. The hypothetical payoffs are shown in the chart below:

Four key levels of net assets per share are observed:

- If net assets per share stagnates at the current reported level of 1.59 cents, the ordinary share would trade at 1.38 cents after the conversion of ICPS, hence ICPS holders are better off with liquidation value of 10.6 cents per share.

- In period t = 1, ordinary shareholders would receive liquidation proceeds only if the reported net assets per share exceeds 6.15 cents (a growth of 287% from the current level), at and after which ICPS would hit its maximum liquidation value of 41 cents per share.

- Net assets would need to grow 666% to 12.19 cents per existing ordinary share by period t = 2 to achieve a share price of 10.6 cents, which is equivalent to what ICPS holders would receive now from liquidation. However, if this growth is achieved in period t = 1, ICPS holders should still prefer liquidation from which they would receive 41 cents per share.

- ICPS holders would be better off with conversion rather than liquidation only when the reported net assets per existing ordinary share exceeds 47.15 cents – a growth of 2,863% from the current level – at which the simulated ordinary share price in period t = 2 finally reaches 41 cents per share.

It is hence clear that ICPS holders would prefer a non-bankruptcy scenario only when Sapura’s net assets could grow 2,863% in less than two years’ time, and if the growth is less than 666%, ICPS holders would be worse off compared to receiving the current liquidation value of 10.6 cents. The next question is hence, could the company achieve such a supernormal growth?

While forecasting profit is arduous, a great insight could be drawn from the words of the aforementioned politician: “Once it has recovered, Sapura’s value will return to its previous level, which is 10 times more than currently.”

Since the wisdom was uttered after the release of the latest quarterly report and when Sapura traded at three cents per share, it implied that Sapura’s ordinary share price could reach 33 cents or reported net assets per share could recover to 17.5 cents. However, the timeline is unknown. If Sapura could hit these targets before 23rd January 2024, ICPS holders should prefer liquidation, but if it is after, then ICPS holders should prepare to be long-term shareholders.

The takeaways

As aforementioned, the simulated liquidation value is hypothetical. Owing to liquidation costs, difficulties in monetising intangible assets, and operating losses, it is likely that both ICPS and ordinary shareholders would be wiped out by a bankruptcy of Sapura at this point in time.

Notwithstanding, this discussion provides two insights.

Firstly, “net assets per share attributable to ordinary equity holders of the parent” reported quarterly by companies listed on Bursa Malaysia might not be a reliable estimate of liquidation value per share, even if assuming full monetisation of book value. This is true for most, if not all, companies that have issued preference shares, since the liquidation value for preference shares is not deducted before computing net assets per share.

Although its disclosure is mandated by Bursa Malaysia as an indicator for assessing potential impacts of corporate actions, net assets per share is not defined by either Malaysian Financial Reporting Standards or International Financial Reporting Standards. Hence, much like earnings before interest, taxes, depreciation, and amortization (EBITDA), net assets per share is among those so-called “alternative performance measures” that are subjected to management’s discretion. Unsurprisingly, this measure does not usually show up in audited financial statements.

Lastly, the surprising conflict of interest between ICPS holders and ordinary shareholders, despite being a simulated outcome of extremely restrictive circumstances, shows that investors should take extra caution when analysing companies with non-ordinary equity interests. This is further supported by my previous discussion on the earnings-per-share impact of distributions to equity-classified perpetual bonds.

*This post was written in response to one of my friends’ disturbing interest enquiry on Sapura Energy Berhad, and serves as a good extension to my previous discussions. I have no interest in any of the securities mentioned.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Lorem ipsum

Created by Neoh Jia En | Feb 02, 2024

Created by Neoh Jia En | May 29, 2023

Created by Neoh Jia En | Feb 10, 2023

Created by Neoh Jia En | Dec 30, 2022

TheOwlsandWolves

Next time never invest in any company owned by Samsuddin family. They are dumb businessman. All theirs companies end up in the drain. Remember their business in listed Uniphone, also go 'po kai'. Their business is just crony business, not smart at all.

2022-04-02 20:41