YNH Property Berhad – Looking Beyond the 99.998%

Neoh Jia En

Publish date: Fri, 06 May 2022, 11:46 AM

- AEON Credit, Sunway, YNH Property, and Uzma have corrected their previous mistake of not excluding profits distributed to perpetual bond holders from EPS.

- YNH Property, in particular, saw significant impact with EPS’ turning into LPS for the year 2020. Intriguingly, the company did not announce any amendment.

- IASB has acknowledged the existing gap in profit allocation requirement between IAS 1 and IAS 33, and this gap will likely be closed soon.

In preparing my January’s writeup on perpetual bond (perps) issuers that do not exclude profit distributed to perps holders from their earnings per share (EPS), I have endeavoured to identify as many perps issuers as possible. In doing so, I relied on two sources: Bondsupermart for a list of perps issued in Malaysia and Singapore, and Bloomberg, for filtering out Malaysia-listed companies with unusually high level of financing via “other equity.”

However, the article titled “Perpetual bonds: The good and the bad” published by The Edge Weekly in early April surprised me with a few names of perps issuers that did not show up in my screenings. Furthermore, the article’s mentioning of a case where Securities Commission warned an unnamed (both in the article and in the Securities Commission’s annual report) issuer in 2021 for failing to reclassify its perps also intrigued me.

The publishing of the article titled “Revisiting perpetual securities” by The Edge Malaysia on 25th April, which provided a comprehensive but still “selected” list of perps issuers in Malaysia, further confirmed the loophole in my initial screening methods.

To gain more evidence on the accounting practice of perps issuers in Malaysia, I have explored two new screening methods as discussed below.

Casting a wider net

While a systematic way to track perpetual bonds issued by overseas subsidiaries of Malaysian companies is still unattainable, two databases are helpful in tracking perps issued by Malaysian companies: (1) the Securities Commission’s list of corporate bonds and sukuk registered under the Lodge and Launch (LOLA) Framework and (2) Bank Negara Malaysia’s facility information hosted at the central bank’s Fully Automated System for Issuing/Tendering (FAST). The former provides the list of (active) wholesale bonds launched since June 2015, and the latter hosts information on bonds issued via tender or private placement since July 1997.

Comparing the data on perps on both websites, the Securities Commission’s list is easier to navigate but information on perps issued before June 2015 is unavailable. This shortfall could be compensated by Bank Negara Malaysia’s FAST database, although some manual procedures are needed to eliminate non-perps issuances.

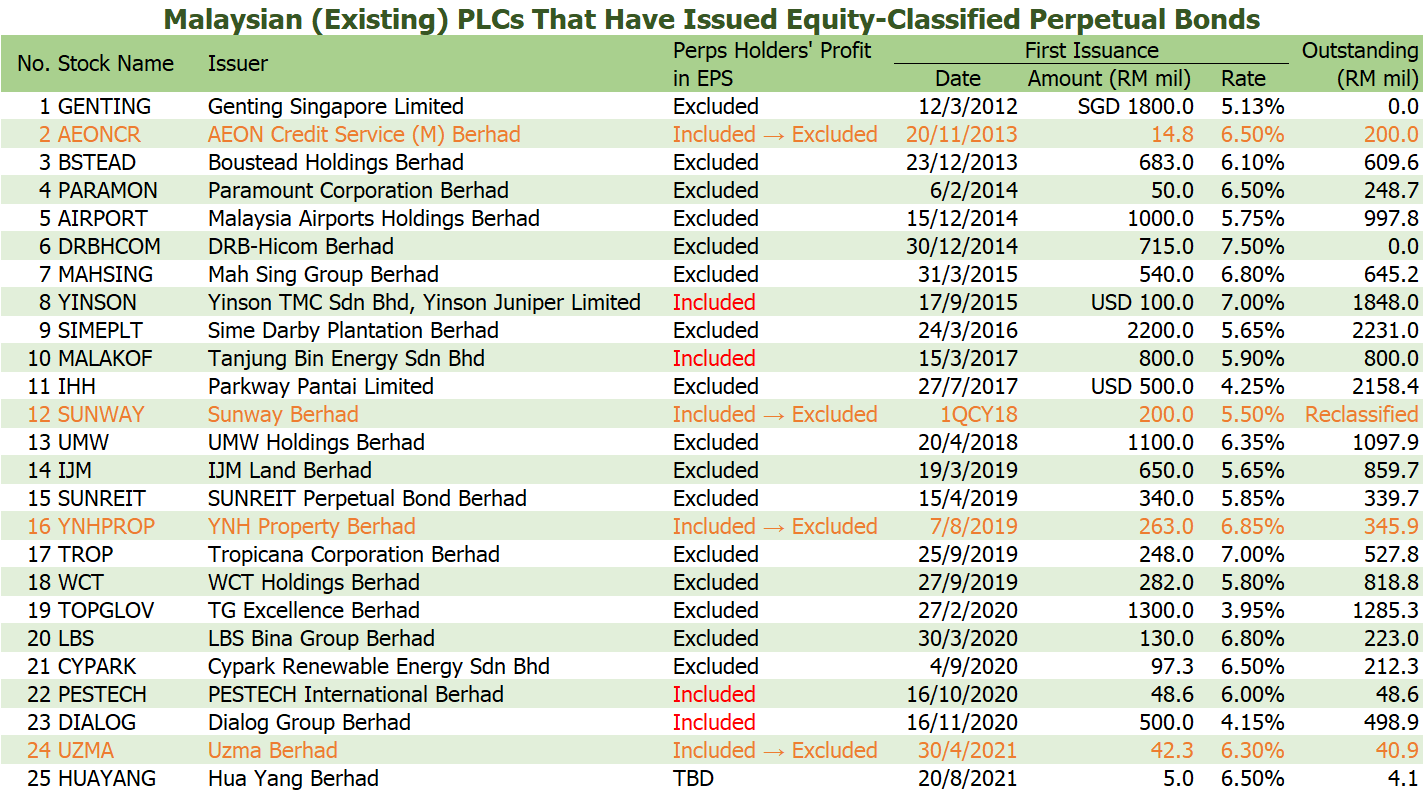

By combining information from both databases and checking those perps’ classification on the respective company’s balance sheet, I managed to expand my list of Malaysian publicly-listed companies (PLCs) that have issued equity-classified perps from 19 to 25, with a total outstanding value of perps amounting to over RM16.0 billion. Fortunately, I did not detect any more issuer that has questionable approach to EPS computation.

More interestingly, four cases where the issuer shifted to deducting profit distributed to perps holders from EPS after not doing so initially were seen, and there was indeed (at least) one case of perps’ reclassification. The lack of opposite move to include profit distributed to perps in EPS further supports my suspicion that doing so may be incompliant with the relevant accounting standards.

AEON Credit Service (M) Berhad – early missteps

Following the now-delisted Malaysian Airline System Berhad which issued RM1 billion worth of equity-classified perps on 12th June 2012, AEON Credit Service (M) Berhad (AEON Credit) is another early adopter of perps financing in Malaysia. The company’s first issuance of perps on 20th November 2013 had a modest size of RM14.8 million, but AEON Credit’s utilisation of such securities has been expanded to an outstanding value of RM200.0 million as at the end of financial year ended 28th February 2022 (FY 22).

Tracking AEON Credit’s accounts, the company did not deduct RM0.5 million and RM3.2 million worth of distributions to perps from its EPS in the first quarter ended 20th May 2014 and second quarter ended 20th August 2014 respectively, and this approach was changed starting from its third quarter report. Overall, the amount involved was small at less than 2% of AEON Credit’s profit attributable to ordinary shareholders for the 12-month period ended 20th February 2015.

Sunway Berhad – the messy one

Having issued its perps in the first quarter of 2018, Sunway Berhad (Sunway) did not recognise the impact of distributions to perps on its EPS in all four quarterly reports for the year 2018, but did so in the audited annual financial statement and subsequent quarterly reports for the year 2019 onwards. Again, the impact was minor at less than 2% of Sunway’s 2018 EPS.

Noteworthily, Sunway is the only perps issuer, in my radar, that has changed its classification of perps. As announced in its fourth quarter report for the year 2020, the company reclassified all its perps from equities to liabilities starting from 2020, triggered by the consolidation of some wholesale funds that it has invested in. Given the complexity of Sunway’s financial engineering manoeuvre, I will explore issues specific to the company in my next discussion.

Uzma Berhad – the newcomer

New to the scene of perps financing, Uzma Berhad (Uzma) issued its first perps on 30th April 2021, but neglected to account for the impact of distributions to perps in its unaudited report for the same quarter. A distribution amounting to RM0.5 million, or just 3.4% of Uzma’s annual profit attributable to ordinary shareholders, was subsequently deducted from the company’s EPS in its audited annual financial statement for the financial year ending 30th June 2021.

YNH Property Berhad – a skeleton in the … showcase?

Unlike the aforementioned trio, of which the mistake of not accounting for distribution to perps had a limited impact on EPS disclosed in unaudited financial statements, YNH Property Berhad (YNH) only corrected its computation mistake one and half years after its first issuance of perps on 7th August 2019.

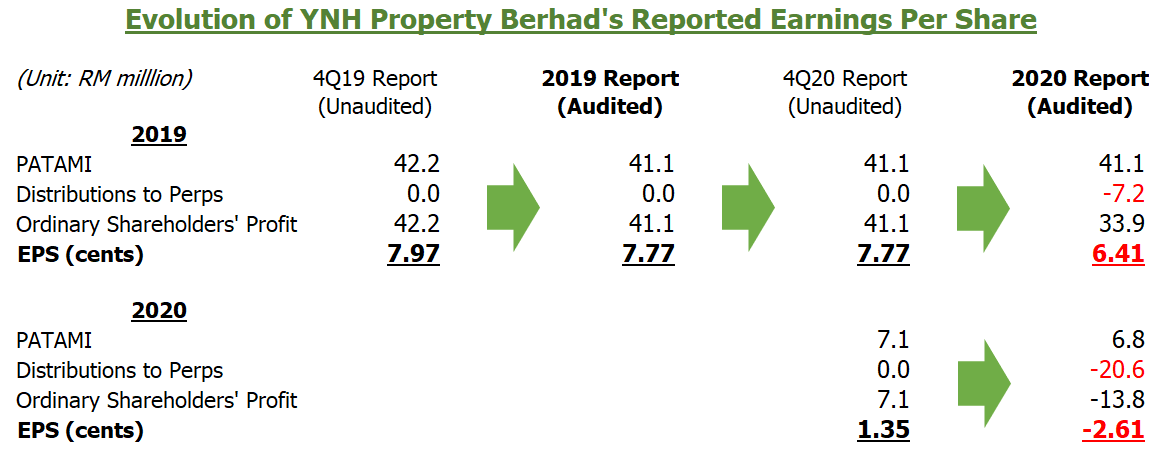

Alterations done by YNH were obvious. Taking 2019 EPS for example, YNH reported the full-year figure as 7.97 cents in its fourth quarter report for 2019, and as 7.77 cents in the audited annual financial statement after correcting for some income and expenses figures. Both figures did not deduct distributions to perps, and the 2019 EPS of 7.77 cents was reaffirmed in YNH’s fourth quarter report for 2020. Yet, in its audited annual financial statement for 2020, YNH quietly changed its 2019 EPS to 6.41 cents by taking out profit distributed to perps holders amounting to RM7.2 million.

The impact to 2020 EPS was worse: YNH reported a full-year EPS of 1.35 cents in its fourth quarter report for 2020, which became a loss per share (LPS) of 2.61 cents in the company’s annual financial statement for 2020, audited by Baker Tilly, after accounting for the impact of distributions to perps amounting to RM20.6 million.

To my surprise, YNH did not announce any amendment to its financial statements. Those changes did not arise from any change in accounting policies, hence what YNH did was correcting for prior period errors, defined in IAS 8/MFRS 108 as follows:

Prior period errors are omissions from, and misstatements in, the entity’s financial statements for one or more prior periods arising from a failure to use, or misuse of, reliable information that:

(a) was available when financial statements for those periods were authorised for issue; and

(b) could reasonably be expected to have been obtained and taken into account in the preparation and presentation of those financial statements.

Such errors include the effects of mathematical mistakes, mistakes in applying accounting policies, oversights or misinterpretations of facts, and fraud.

Paragraph 42 of IAS 8/MFRS 108 requires prior period errors to be corrected by retrospective restatement, while paragraph 49 clearly states that the reporting entity should disclose the nature and amount of correction, including the impact to EPS. It is intriguing that YNH chose to amend its EPS figures covertly.

One explanation is that YNH views the correction as immaterial – IFRSs only require the disclosure of material information (the likely reason why AEON Credit, Sunway, and Uzma did not disclose their corrections), and IAS 8/MFRS 108 has adopted the definition of materiality from IAS 1/MFRS 101. However, it is a tall task for YNH to argue that a change from EPS to LPS is not “reasonably be expected to influence decisions that the primary users of general purpose financial statements make on the basis of those financial statements.”

Why hast thou forsaken us?

Furthering discussions in my previous writeup, it seems that the gap in profit allocation requirement between IAS 1/MFRS 101 and IAS 33/MFRS 133 has caught some financial statement preparers off-guard.

Assuming that my list of equity-classified perps issuers is relatively complete, the rarity of financial statements where EPS need to be adjusted for distributions to perps could further explain the oversight by these accounting practitioners: for each Malaysian PLC that has issued equity-classified perps, there are 40-50 PLCs that have not; under each PLC, there are dozens of subsidiaries which do not need to report EPS; and for each subsidiary of PLCs, there exist hundreds of privately-owned companies which, again, do not need to disclose EPS.

According to the Companies Commission of Malaysia, there are 1,344,911 registered companies as at the end of 2019. 25-26 equity-classified perps issuers would hence represent only 0.002% of this population!

An obvious question is, why does the International Accounting Standards Board (IASB) not require the allocation of profit between ordinary and non-ordinary equity holders in the income statement?

The discussion paper titled “A Review of the Conceptual Framework for Financial Reporting” published by IASB in July 2013 explained the standard setter’s rationale in paragraph 5.5:

“Typically, entities divide total equity into various categories. IFRS does not generally prescribe which categories of equity an entity should present separately, because determining which categories are most relevant to users of financial statements may depend on local legislation and on the reporting entity’s governing constitution. Similarly, IFRS does not generally specify the categories of equity in which an entity should present the effects of particular transactions, measurements or other events …”

The exception to have stricter profit allocation requirement during EPS computation was highlighted in paragraph 5.41 of the same discussion paper:

“… [to see the effects of dilution and wealth transfers between different classes of equity holder under the proposed equity classification approach (which was abandoned later)], equity investors would need to look beyond profit or loss or comprehensive income. However, the need to look further would not be new: equity investors already need to do so if they wish to reconcile profit or loss to the numerator used in calculating earnings per share.”

The end is nigh

Acknowledging feedbacks from financial statement preparers and users during its agenda consultation in 2015, IASB has embarked on a project named Financial Instruments with Characteristics of Equity (FICE) to address issues with IFRSs regarding new forms of financing.

Issues specific to perps have been discussed and the board has tentatively decided to develop stricter presentation and disclosure requirements with regards to these securities.

As per its latest update, IASB is scheduled to finish discussions on the FICE project within this year, and to follow up with an exposure draft.

Since IASB’s exposure drafts usually clarify the existing gap in accounting standards, and they are circulated by the Malaysian Accounting Standards Board to the public including professional bodies, accounting firms, and public listed companies, some Malaysian perps issuers will likely get a wake-up call soon.

*This post is the second of my three Golden Week writeups, and is a follow-up to my previous posts titled “Has Yinson Found the Yellow Brick Road?” and “Malakoff Corporation Berhad – Part 2: A Gap in Understanding the Gap.”

*For follow-ups, see my posts titled “Sunway Berhad – Part 2: Above the Rising Cloud” and "Has Yinson Found the Yellow Brick Road? Part 4: Homecoming."

*For a discussion on Sunway’s perps reclassification, see my post titled “Sunway Berhad – Not Just a Good Civil Engineer.”

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Lorem ipsum

Created by Neoh Jia En | Feb 02, 2024

Created by Neoh Jia En | May 29, 2023

Created by Neoh Jia En | Feb 10, 2023

Created by Neoh Jia En | Dec 30, 2022