(RICHE HO) Pensonic Holdings Berhad - Premier Malaysian Electrical Home Appliances Brand

RicheHo

Publish date: Tue, 12 Apr 2016, 07:36 PM

PENSONIC HOLDINGS BERHAD (“PENSONIC”)

Background

PENSONIC was founded in year 1965 as Keat Radio and Electrical Co. in Penang. It was started as a small retailer cum workshop for electrical home appliances and grew under the leadership of its founder, Dato’ Seri Chew Weng Khak.

In year 1988, PENSONIC commenced manufacturing and marketing of Electrical Home Appliances under the “Pensonic” brand. Henceforth, PENSONIC entered history as the nation’s first “Made in Malaysia” electrical home appliances. The name “Pensonic” is a tribute to the founder Dato’ Seri Chew’s beloved home state Penang while ’sonic’ is an audible reminder of the company’s roots in selling radios.

In Dec 1995, PENSONIC was listed on the Second Board of Bursa Malaysia.

The core businesses of the Group are manufacturing, importing, exporting, distribution and marketing Electrical Home Appliances for the domestic and international markets. PENSONIC is currently focused on its Own Design Manufacturing for several international brands in the Electrical Home Appliances industry

The first product that PENSONIC successfully made on its own was the slow cooker.

Financial Highlights

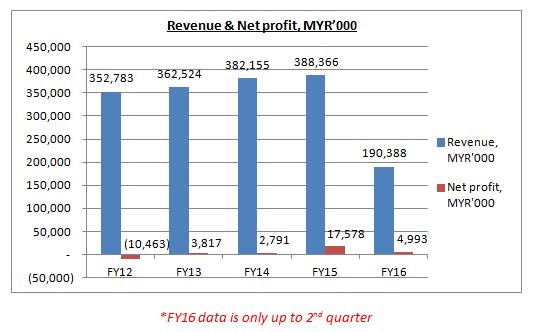

Over the past 4 years, PENSONIC revenue was growing slowly and steadily, which mainly contributed by its overseas sales. Despite global economic uncertainties and implementation of GST in year 2015, PENSONIC overseas growth had surpassed both of these impacts.

In term of net profit, PENSONIC had shown significant improvement in FY15 onwards. Its excellent result in FY15 was contributed from the recognition of financial gain on disposal of property of about MYR8.4m. However, even though we exclude this figure, PENSONIC still delivers net profit of MYR9.2m, which is 3 times higher than its net profit in FY14.

It was mainly contributed from the improvement in its operation efficiency. FYI, in FY15, PENSONIC management had implemented decentralized organizational structure with KPI and Incentives. Besides, it had conducted efficient cost control exercise and focused in its productivity which included better management of inventory and credit control. With such system and control measures in place, PENSONIC saw an increase in its profit for both local and overseas market.

FY16 is very likely to be another excellent year for PENSONIC whereby it only took two quarters to surpass its FY13 and FY14 whole year net profit.

On its prospects, PENSONIC said it anticipated that competition would remain intense. It will continue explore new market, product innovation, maintaining excellent customer relationship, placing emphasis in cost control, inventory management and overhead cost rationalization.

In line with the group’s effort in expanding emerging markets, PENSONIC will carry on to promote and distribute its products to overseas customers through engaging more overseas distributors and business partners. In order to keep up with the ever-changing needs of the electrical appliances markets, PENSONIC will continue to devote efforts in research and development of new products.

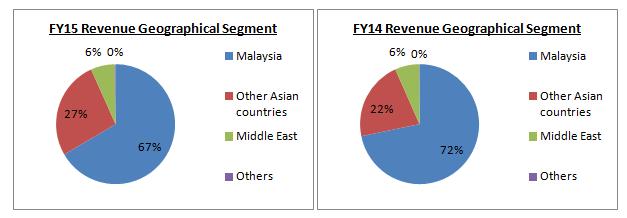

Foreign Currency Risk

PENSONIC’s main revenue contribution in FY15 is from local market 67%, followed by other Asian countries 27% and Middle East countries 6%.

As extracted from its annual report 2015, PENSONIC exposed huge amount of trade payables which denominated in USD. In other words, PENSONIC probably purchases its raw materials from oversea suppliers. Since its main revenue contribution is in term of MYR and its purchase is in term of USD, PENSONIC will be a victim of strengthening of USD against MYR.

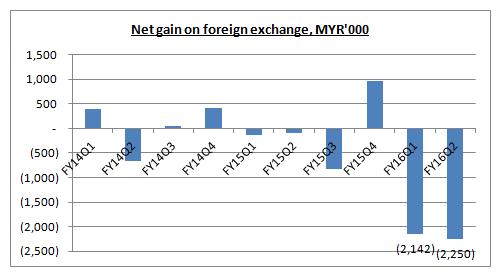

PENSONIC had faced a significant net loss on foreign exchange in FY16. Its net loss in first two quarters of FY16 is up to MYR4.4m. This is the time frame where USDMYR was the highest since economy crisis in year 2008.

Having said so, PENSONIC is still able to deliver an excellent profit. Its management had carried out the right measurement to handle this.

Cheap Valuation

|

Price |

= MYR0.65 |

|

Net tangible assets per share (“NTA”) |

= MYR0.88 |

|

Earnings per share (“EPS”) |

= 8.70 cent* |

|

Price earnings ratio (“PE”) |

= 7.47 |

|

Dividend |

= 3.50 cent |

|

Dividend yield (“D/Y”) |

= 5.38% |

|

Net current asset value (“NCAV”) |

= MYR0.06 |

*after excluded recognition of financial gain on disposal of property of about MYR8.4m

Based on its current price of MYR0.65, PENSONIC had a PE of 7.47, which is very low. It had excluded the one-time gain on disposal of property as well. I would say it is cheap in term of its earnings power. PENSONIC had achieved EPS of 3.85 cent in first two quarters of FY16. Let assume it is able to deliver the same profit in third and fourth quarters, its whole year EPS will be 7.70 cent. With a PE of 10, PENSONIC is worth 77 cent.

Secondly, surprisingly PENSONIC had been declaring dividends twice in FY15. It is not part of special dividend. Its dividend of 3.50 cent in FY15 is equivalent to D/Y of 5.38%, which is pretty attractive! FYI, its dividend payout ratio from FY13 to FY15 is 47%, 60% and 50%. If it is able to deliver the same profit in third and fourth quarters, PENSONIC is very likely to declare the same dividend amount.

Other than that, its NTA is up to 88 cent per share. In term of assets, PENSONIC is seems to be undervalue. It currently traded 26% below its NTA.

New Headquarters

In Oct 2015, PENSONIC had opened its new MYR50m headquarters in Bukit Minyak on the back of a modest growth in its revenue. The new headquarters built on six acres of land will house multi-use spaces and facilities, and infrastructure equipped with research and development laboratories.

PENSONIC had moved towards diversifying its products range, with the Aug 2015 launch of its Fonebud Essential Plus smartphone accessory under its Fonebud range.

Penang Chief Minister Lim Guan Eng, who officiated the opening of the new headquarters, said the opening of the new building shows that the manufacturing sector in Penang is still strong. He also congratulated PENSONIC for a rapid growth of 207% through export sales between year 2011 and 2014.

On the right: Vincent Chew, son of founder Dato’ Seri Chew Weng Khak, managing director of PENSONIC

In addition to this, the current slow-down in the economy has come at the “right time” as PENSONI now has stronger fundamentals and is in a good position to ride a recovery in the economy when the time comes.

Operation Efficiency

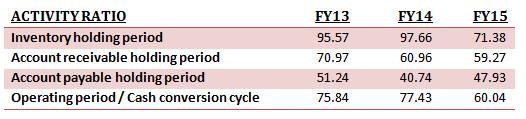

As a result of efficient cost control exercise and focused on productivity which included better management of inventory and credit control in FY15, PENSONIC’s cash conversion cycle had been reduced from 78 days in FY14 to 60 days in FY15!

FYI, cash conversion cycle is a metric used to gauge the effectiveness of a company's management and, consequently, the overall health of that company. The calculation measures how fast a company can convert cash on hand into inventory and accounts payable, through sales and accounts receivable, and then back into cash.

PENSONIC management is on the right track to improve its operation efficiency and fundamental.

Technical Chart

As at 8th Apr 2016, PENSONIC closed at 0.655.

Currently, it is still riding on its uptrend line, which is still very bullish. It has a strong support at the level of 0.64. If based on its past record, PENSONIC is likely to go for a rebound soon after it touches the trend line. It probably will go up and test 0.69 followed by 0.73.

However, if PENSONIC drops and closes below 0.64, it indicates a change of trend and its uptrend probably had come to an end. Do exit from this counter.

Conclusion

Overall, PENSONIC is still in the midst of growing. It had improved its operation efficiency in FY15 and it definitely will not be one-time gain on this.

Besides, PENSONIC is a beneficiary of strengthening of MYR against USD. In beginning of year 2016, USD/MYR had dropped from 4.10 in end of year 2015 to lowest 3.88. Currently, it is quoted at 3.90.

So, I strongly believe with these two catalysts, PENSONIC financial performance will be even better in the last two quarters of FY16.

In addition with its cheap valuation and its nice technical chart, I strongly believe PENSONIC will break new high by this year. It is just matter of time.

Hey guys, I am writing stock analysis report to earn some pocket money. For more information, you may email me at richeho_92@hotmail.com

For any enquiry, you may contact me as well. Sharing is caring.

Happy investing!

Cheers!

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Road to Success

Created by RicheHo | Mar 18, 2017

Created by RicheHo | Feb 19, 2017

Created by RicheHo | Feb 16, 2017

Created by RicheHo | Jan 08, 2017

Discussions

Riche, after reading your report again, does it mean Pensonic is actual Beneficiary of strong ringgit like Airasia?

If now RM3.9, the company will have forex gains in the coming Quarters.

The effect of that will be tremendous, LOWER COST OF GOODS/MATERIALS & FOREX GAIN.

2016-04-12 23:08

Very informative & easy to read analysis, Riche, I like your technical chart, it is very beautiful.

Well done & keep it up!

2016-04-12 23:38

very good analysis.

3rd q result will release by end of this month.

if not mistaken,coming result should very good,and much better than 1st half,driven by stronger ringgit and steady sales.

with margin been improved steadily,what i am concerning now is whether the revenue will break RM100m mark with fans and coolers demand increased strongly in past few month.

if everything goes smooth,pensonic could be next rocket counter.

but,no contra for this counter.

2016-04-12 23:42

Precisely, sherlock, consumer stocks are always slow & steady.

If you look at the technical chart in the analysis, it is very predictable.

2016-04-12 23:50

I have been following up with Panasonic, Fiamma & Pensonic.

During the last 6 months:

Panasonic has increased from RM21 to RM29 (UP 38%)

Fiamma has increased from RM1.70 to RM2.12 (UP 24%)

Meanwhile, Pensonic has only increased from RM0.58 to RM0.66 only. What can we expect from Pensonic now?

2016-04-12 23:51

I have been following up with Panasonic, Fiamma & Pensonic.

During the last 6 months:

Panasonic has increased from RM21 to RM29 (UP 38%)

Fiamma has increased from RM1.70 to RM2.12 (UP 24%)

Meanwhile, Pensonic has only increased from RM0.58 to RM0.66 only. What can we expect from Pensonic now?

NOW you know why?

LOUSY COMPANY LOUSY RESULTS

2016-04-26 12:29

meaning he go to holland very soon?

Posted by paperplane2016 > Apr 26, 2016 12:32 PM | Report Abuse

Road to Success

=To Holland

2016-04-26 14:19

the whole portfolio of paperplane down by 4% in a day but yet he try to divert people attention by talking nonsense here & there

2016-04-26 17:35

moneySIFU

Very good analysis report, if Pensonic was suffering exchange losses when ringgit weak, should we expect exchange gain when ringgit getting stronger?

Riche, very well spot on.

2016-04-12 19:47