(RICHE HO) ICAP – 令人费解的投资

RicheHo

Publish date: Mon, 26 Sep 2016, 05:55 PM

ICAP – 值得投资吗?

ICAP是一家封闭 式基金,上市于2005年10月。其主要投资理念是从股票投资取得长期的资本增值 (capital appreciation),而股息只是次要的考虑因素。简单来说,ICAP是个较为保守和谨慎的价值投资型基金,专门投资认为是被低估的股票,并且不可以借贷投资,除非获得股东批准。

到底ICAP的整体表现如何?首先,我们来看这基金以往的股价表现。假设你在2011年1月以RM2.00购买100股ICAP,然后坚持拥有到今天。目前ICAP的股价是RM2.39。在这接近6年期间,你在2013年获得一次9.5仙的股息。整体来说,你目前的纸上盈利是24.25%,而复合年增长率 (CAGR) 只是区区的3.85%。从股价来看,ICAP的表现是不达标,毕竟和定期 (fixed deposits) 存款利率差不多。

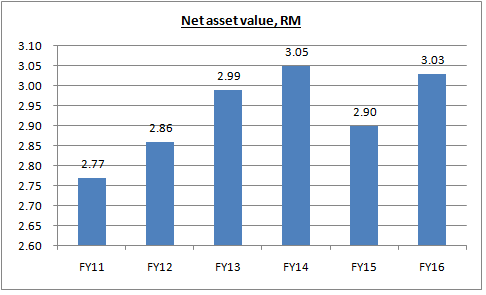

之后,我们再从ICAP的资产净值 (net asset value) 来评估该基金的表现。ICAP在上市初期的资产净值是每股RM0.99。截至FY16Q4,ICAP的资产净值是RM3.03,意味着ICAP在接近11年的时间里成长了206%,相等于10.97%的复合年增长率。这个还算达标,但如果只评估过去6年的表现,这就不一样了。ICAP在FY11的资产净值是每股RM2.77,也就是说ICAP从FY11至FY16期间只增长了26仙,相等于区区的1.81%复合年增长率。

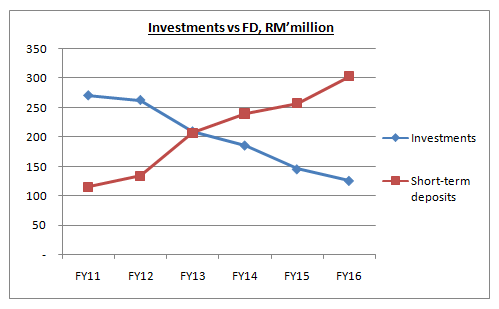

目前,ICAP拥有RM126m的投资组合,这已是连续5年出现下滑,和FY11的RM270m相比,已经跌了超过50%。此外,ICAP目前手上的定期 (fixed deposits) 存款竟然高达RM303m,和FY11的RM116m相比,增加了186%!这也代表着ICAP在卖出股票套利或止损后,鲜少再买进股票。必须强调的是,大马股市在FY11至FY14期间是处在牛市。更讽刺的是,根据ICAP年报所提供的数据,过去6年的平均定期存款利率是3.04%,比其资产净值的1.81%复合年增长率更高!换个说法,ICAP每一年的资产成长更多时候贡献于定期存款利息。

Capital Dynamics Asset Management 是ICAP的基金经理,每一年都会从ICAP获得一笔基金管理费。这笔管理费自FY11起,每年都在增加,直到FY16才首次降低。从FY11的RM2.55m到FY16的RM3.08m,这笔管理费有3.80%的复合年增长率。投资回报率似乎和管理费的增幅不符合。

值得一提的是,ICAP在FY15和FY16期间并没有任何买入动作,只是在FY15认购【BOUSTEAD】的附加股。去年是出口主题股的牛市,ICAP却没买入任何出口股,从而失去了那么好的赚钱机会。出口股在去年最少都有20%的回酬。因此,ICAP保留现金的做法,令投资者非常不解。

截至FY16,ICAP手上最大笔的投资是【PADINI】和【BOUSTEAD】。【PADINI】是ICAP目前最成功的投资,纸上回酬非常乐观。至于【BOUSTEAD】,ICAP首次买入是在2007年,买入价估计在RM1.50以上。到了今时今日,ICAP依然还持有这家公司。【BOUSTEAD】在FY11-FY14期间曾长期处在RM3.50-4.00之间。目前,【BOUSTEAD】的股价只是RM2.22,在过去的2年都处在下跌趋势,ICAP却没有作出任何套利动作,白白失去之前的纸上盈利。【PARKSON】也是ICAP另一家令投资者不明白的投资。ICAP是在FY07首次买入【PARKSON】,买入价估计在RM4.00以上。目前,【PARKSON】的股价只是RM0.79,处在有史以来的低点。ICAP在这投资上肯定纸上亏了不少钱。

以上只是一些分析,供大家参考。至于本专页的看法,与其投资在ICAP,不如投资在自己身上,花钱学习投资。

#ICAP

纯属分享!

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Road to Success

Created by RicheHo | Mar 18, 2017

Created by RicheHo | Feb 19, 2017

Created by RicheHo | Feb 16, 2017

Created by RicheHo | Jan 08, 2017

Discussions

icap operated likes unit trust. but the mgt get lucrative pay, regardless company performance. I rather buy unit trust.

2016-09-26 19:47

why pay Icap management fees to put your money into FD?

might as well u go to the bank and put your money into your own FD!

2016-09-27 06:51

change management fee based on basic monthly pay plus the performance quarterly pay in the AGM. This should be the proposal in the next AGM . why pay RM to management for poor results. Fair enough, if poor result, management get basic monthly low pay lah . Do u all agree?

2016-09-27 08:38

The moral of the story is YOU MUST KNOW what you are buying, not only icap but all types of investments e.g shares, unit trusts, properties, gold, bonds, FDs. insurance, private universities and so on.

2016-09-27 09:36

说到底就是"前怕狼,后怕虎"和"死不认输"心态作祟,还搬出一大堆"歪理"糊弄投资人,但任然许多股东也乐意被玩弄。应验邓主席一句话"不管黑猫或白猫,会抓耗子的就是好猫"!这ttb是吗?一天欧美政府不断扩展量化,就不给股汇大调整机会,ttb就慢慢等呗,可怜就是那些"傻等无回酬反亏本"的散户!连放定期利率都不如了,你说呢?

2016-09-27 09:46

All this waiting or stupidity is not your fault. Regardless of good or bad economy conditions ,A good fund manager' job is a continuous process he can still excel in his work in any conditions.

If you are a boss of a company , you surely will not agree with your sales manager telling you that better don't sell company's products now, market is going to be bad, lets' stop selling or else, you may find collection problems later on.

If you are boss, will you fire him or wait for your time to close shop? Bear in mind their salary you continue paying.....

Similarly, for Icap, your waiting is not due to your fault, did TTB expressively telling you all that he is not going to invest in previous few years in icap Annual report?

If he didn't do anything , he must be prepared to be sacked or overthrown.

Don't get frustrated, be prepare when City of London approaching for EGM( if any), just show your colour to him.

2016-09-27 11:19

can take management fee forever lah, no need to work, bit by bit, one day will finished all the fund

2016-09-27 11:27

surprisingly City of London investment support for the resolution to extend for another 5 years. must be something brewing...

2016-09-28 08:57

<<If you are a boss of a company , you surely will not agree with your sales manager telling you that better don't sell company's products now, market is going to be bad, lets' stop selling or else, you may find collection problems later on.

If you are boss, will you fire him or wait for your time to close shop? Bear in mind their salary you continue paying....>>

good example given by MG9231

2016-09-29 16:56

I would like to add on another example: Why you buy Unit Fund? Because you are confident you can make money in the bull market but not sure in the bear market. Therefore you pay Fund manager to manage your hard earn money so that you still can make profit and not loss your money in bear market and through inflation (Inflation is the monster always used by Unit Trust sales personnel to scare clients). As such, will you buy a Unit trust that they wont guarantee return because they believe bear is coming but don't know when? And the fund past 5 years records is lower than FD? Food for thinking...

2016-09-29 17:07

Jason Lim

Agreed.

2016-09-26 19:00