GROSSLY UNDERVALUED PHARMACEUTICAL GEM! (UPDATED)

csan

Publish date: Wed, 21 Sep 2022, 12:22 AM

The August results period had ended and the valuation of a drug & supplement manufacturer stood out from its peers after releasing their results.

The company is YSP Southeast Asia.

In the 2nd quarter, YSP reported its 3rd highest quarterly profit in its history with a quarterly EPS of 7.86sen. Below is a screenshot of YSP's quarterly profits over the past year:

The company's business is simple. It manufactures generic drugs and supplements, selling them to the local market as well as exporting them to 8 other South East Asian countries. 25% of YSP's revenues come from exports.

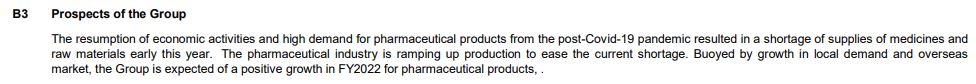

How did the company perform so well this quarter? There were 2 main reasons. The first is the very high demand for medicines in Malaysia and South East Asia as most of the economies have re-opened and entered the endemic phase. The second reason is the strengthening of the USD, helping to boost profits of their exports. Below is a screenshot of what YSP mentioned in their prospects:

How to value YSP?

Valuing YSP is very easy as this business is straightforward and there are 3 direct comparables that are listed on Bursa Malaysia that does the same business. They are Kotra, Duopharma and Apex Healthcare. YSP's profits for the next few quarters should be even stronger since USD/MYR has been hitting record highs recently while demand for drugs are expected to remain very strong. Kotra, Duopharma and Apex Healthcare are now trading at PE ratios of 10.6x, 18x and 20.6x respectively. At a PE of 10.6x - 20.6x and if we annualise YSP's latest quarterly EPS of 7.86sen, YSP should be valued at RM3.33 - RM6.48. At today's share price of RM2.05, YSP is only trading at a PE of 6.5x! Among the 3 companies, YSP also offers the highest dividend yield of 3.9% at today's share price. It is a matter of time before the share price of YSP increases significantly.

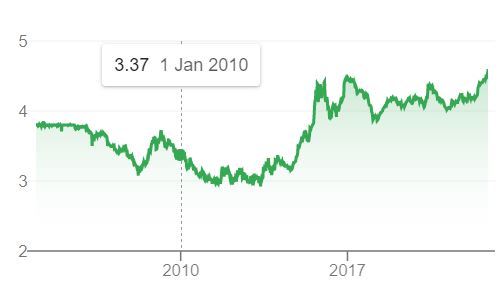

UPDATE: The actions taken by the US Federal Reserve and the UK government has shaken world markets, causing the USD to skyrocket and threatening a major global recession. This is actually the best time to invest in pharmaceutical companies like YSP and Kotra as their earnings have been shown to be recession-proof. The reason for their business being recession-proof is obvious because medicines will be needed whether or not there is a recession. The screenshot below shows YSP's stable earnings during the global financial crisis in 2009. The reason for the slight decline in profit back then was because of the depreciation of the USD by around 10% whereas it is a different scenario now where the USD is skyrocketing against the MYR.

UPDATE 2 (30 November 2022): YSP is now RM2.37. Investors should take profit as the USD/MYR has peaked and has fallen from 4.64 to 4.51 now. YSP should start to recognise forex losses next quarter and lower profit margins after that.

More articles on Art of Investments

Created by csan | May 23, 2024

Created by csan | Apr 01, 2024

Created by csan | Nov 18, 2023

Created by csan | Mar 06, 2023