WANT TO BE A SPARTAN?

--------------------------------------------------------------------------------------

DATE : 20th October 2017

Stock : GPACKET (0.40 cts)

Target Price : RM0.45 cts (immediate)

THE INFO

Green Packet Berhad is a company headquartered in Malaysia, which provides carrier grade Mobile data offloading solutions, and 4G devices that supports LTE, WiMAX and Wi-Fi technologies. It is a technology-based company originally founded in Silicon Valley. It is principally involved in the provision of solutions and devices for various telecommunications technologies. The firm is also engaged in the wholesaling of voice traffic.

Green Packet 4G Networks Operations

-

Launched commercial 4G services in 2008 as a Greenfield Operator

-

50% population coverage since 2013

-

2.3Ghz and 2.6GHz TDD spectrum operation licensed by the Government of Malaysia

-

Key technology and strategic partners in Intel and SK Telecom

GPACKET - At an inflection point (webe is history). Having posted cumulative losses since 2010, FY17 would be at an earnings inflection point for Green Packet as the company no longer bears the losses from webe – Telekom Malaysia’s (TM) converged 4G operator – from 4Q16. To recap, the company’s stake in webe was reduced to 18.9% in 3Q16 (from 31.1%) after TM exercised its rights under an earlier convertible medium-term notes (MTN) programme. Expect the profitable core segments of communications and solutions to drive a steady stream of recurring earnings moving forward, with the new digital investments fuelling a stronger earnings recovery from FY18. (sources : RHB securities)

GPACKET - Internet of Things (IoT) and smart services – the icing on the cake. Green Packet has singled-out e-services and IoT to be the new growth engines and has embarked on several related M&As to strengthen its execution capabilities. Among the notable acquisitions were a 22% stake in listed Yen Global (Yen) for MYR18.2m (Aug 2016) and a 20% stake in Shenzhen Memo Technology Co Ltd (Memohi) for MYR6.4m. Yen’s subsidiary, Atilze Digital SB (Atilze) is rolling out the long range, low power wide area (LoRA) network in the country, which would be used for the deployment of IoT via embedded sensors. (sources : RHB securities)

GPACKET - Emerging financial technology (fintech) play. Green Packet has put in place a payment platform to provide end-to-end solutions for its digital ambitions. In Aug 2016, it purchased an 80% stake in WOL – a Bank Negara Malaysia (BNM) e-wallet license holder – for MYR9m to facilitate cashless and card-less transactions. The company has also set-up a mobile wallet application – Kiple (kiplepay.com) – to tap on the rapidly-growing e-commerce segment. Green Packet is also collaborating with the Government on a cashless/smart payment card that would eventually be rolled out in schools nationwide. The smart preloaded card would eventually replace cash payments by students at cafeterias, canteens and bookshops, and would ride on WOL’s infrastructure.(sources : RHB securities)

"The company's good and I agreed what RHB claimed as their Jewel. But I am forsees more into play as title of Budget 2017 beneficiaries immediately". - Kim Spartan

THE KEYNOTES

GPACKET - (OCT 2017) - Kim's stockwatch call it to monitor for benefit BUDGET to be announce soon.

GPACKET - (OCT 2017) - High Expectation for G3 Global. Techpreneur Puan Chan Cheong claims to have created a tech unicorn in Malaysia when Green Packet Bhd a company he founded in 2000 achieved a valuation of RM3 billion in 2007. They claims created the first unicorn when Green Packet achieved a RM3 billion market cap within seven years. Their expectations are high for G3 to break Green Packet’s record. The business has what it takes to make such an attempt.

The shares of G3 have gained 61% to 75 sen apiece year to date, giving it a market capitalisation of RM309 million. For it to become a unicorn, its market cap would have to grow at least 13.7 times, based on today’s exchange rate

GPACKET - (OCT 2017) - Telekom Malaysia Bhd’s (TM) equity stake in webe could potentially rise to 85.9 per cent from 72.9 per cent currently, from the group’s subscription of RM495 million nominal value of the third and final tranche issuance of webe’s convertible medium term note (CMTN) programme.

GPACKET - (SEP 2017) - Green Packet co-founder and substantial shareholder Puan Chan Cheong was appointed chairman of G3 Global earlier this month. Has boosted its stake in jeanswear maker G3 Global Bhd (formerly Yen Global Bhd) to 32%, just below the 33% threshold for triggering a mandatory offer. It had acquired, for RM12.38mil, a further 82.5 million rights shares in G3 Global, which last year expanded into selling telecommunication solutions and services. The total purchase, funded by internally generated funds, made Green Packet the single biggest shareholder of G3 Global. Prior to this, Taiwanese global provider of wireless broadband solutions and Internet of Things (IoT) player, Gemtek Technology Co Ltd, was the biggest investor in G3 with a 30% stake. The acquisition is in line with the company’s direction to make further strategic investment to strengthen the group’s ICT (information and communications technology) equipment business.

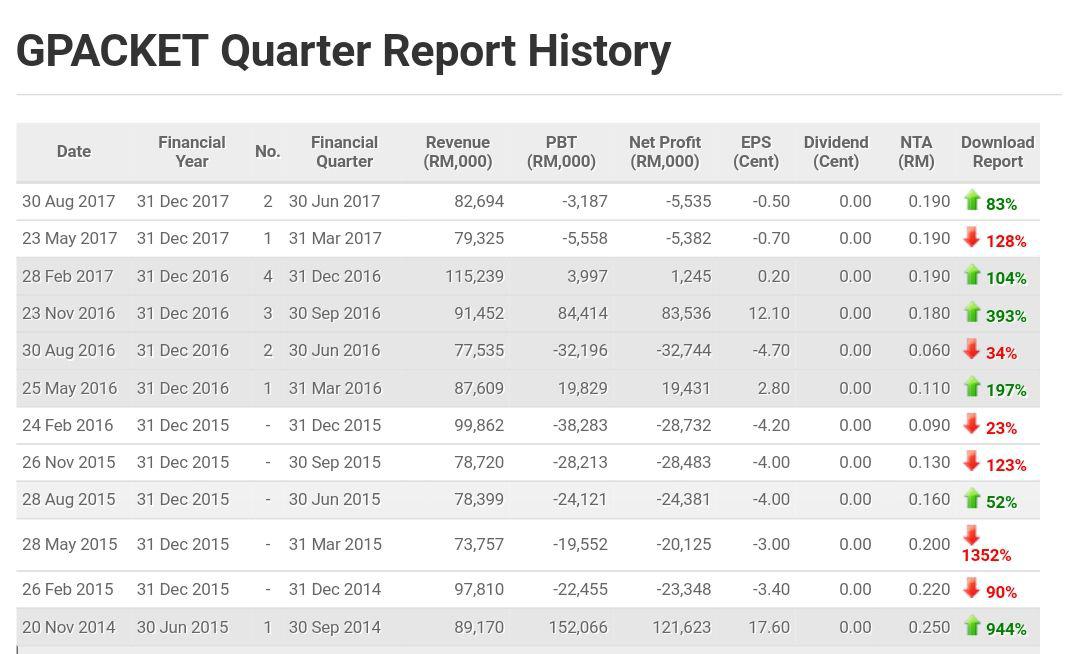

GPACKET - (AUG 2017) - Has narrowed its second quarter net loss to RM5.53mil, compared with RM31.76mil a year ago. The communication and technology services company, posted the second quarter revenue of RM82.69mil, up 7% from RM77.53mil in the corresponding quarter of 2016. Its software and devices business posted a 44% increase in revenue to RM27.38mil against RM19.03mil in the same period last year. The group said its Ebitda for the quarter stood at RM1.77mil, down 59% from RM4.36 a year ago.

GPACKET - (AUG 2017) - They started looking at the mobile payment solutions space since the fourth quarter of 2016. With Webcash, Kiple and Mobiduu, they are integrating the various solutions into one integrated technology platform to offer a complete solution. Eyeing an expansion into a new growth area - the mobile payment solutions segment, an area poised for disruptions through technology.

GPACKET - (JUL 2017) - Announced the proposed acquisition of a 100% stake in Mobiduu Solutions Sdn Bhd for RM4 million. The sellers of the mobile payments solution provider are two individuals, Rashad Khaleel Mousa Bdeiri and Suhaima Abd Hamid. The company said Mobiduu has developed a proven and ready e-services and loyalty platform to launch Green Packet’s mobile payment services.The company has also taken into consideration the opportunity costs in terms of time to market our e-services solutions and investment costs that may be required to develop a similar new software platform.

GPACKET - (MAY 2017) - Green Packet Bhd is expecting an internal rate of return (IRR) of up to 30% over the next four years for its investment in G3 Global Bhd's (formerly Yen Global Bhd) Internet of Things (IoT) business venture, which it is anticipating will break-even by the first quarter of next year. At a press conference after the group's annual general meeting today, chief executive officer cum executive director Tan Kay Yen said he is expecting the IoT business to break-even by the first quarter of next year. The management is expecting a revenue growth of up to 15% for its financial year ending Dec 31, 2017 (FY17). The improvement will continue to be driven by their core businesses, solutions and communications, their solution business is already quite geographically diversified currently. It grew from Asia towards the Middle East and Europe, before moving to the North and Latin Americas.

GPACKET - (APR 2017) - The company, which returned to the black in the third quarter of the financial year ended Dec 31, 2016 (FY16) after years of bleeding red ink, had two years ago refocused its efforts on beefing up its original operations, namely, the solutions and communications segments. At about the same time, it sold off to Telekom Malaysia Bhdits controlling stake in Packet One Networks (M) Sdn Bhd (now rebranded as webe) where its broadband business was parked.

GPACKET - (MAR 2017) - Green Packet Bhd has raised about RM18.09 million in gross proceeds following the completion of its placement of up to 10% of its issued and paid-up share capital, through the subscription and allocation of 68. 27 million new shares of 20 sen each at an issue price of 26.5 sen. The company said the issue price was at a discount of approximately 7.83% to the 5-day weighted average market price up to March 9 of 28.75 sen per shares in Green Packet.

GPACKET - (FEB 2017) - Green Packet Bhd registered revenue and net profit of RM115.24mil and RM1.25mil for the fourth quarter ended December 31, 2016, bringing their full year revenue and net profit to RM371.84mil and RM71.47mil, respectively. The revenue and net profit for FY16 was mainly due continued improvement in core business earnings of RM 13.97mil, cessation of equity accounting of share of losses in associated company, Webe Digital Sdn Bhd and fair value gains on reclassification from interest in associate to long term investment of RM98.2mil.

GPACKET - (JAN 2017) - Green Packet Bhd said it will take up its full entitlement in the two-for-one rights issue by Yen Global Bhd in support of the growth of the company in which it has a 22% stake. The group said it will subscribe for the 60.5 million rights shares together with 45.4 million warrants for a total consideration of RM12.1 million.

GPACKET - (JAN 2017) - Yen Global Bhd, in which Green Packet Bhd has bought a 22% stake last year, proposed to change its name to G3 Global Bhd. Yen Global said a circular to shareholders containing the details of the proposed change of name will be despatched to the shareholders in due course. This proposal came after new substantial shareholders emerged in Yen Global and the loss-making jeans wear manufacturer revealed its interest to diversify into Internet of Things (IoT) business.

GPACKET - (JAN 2017) - Has completed the acquisition of an 80% stake in e-payment firm WebOnline Dot Com Sdn Bhd for RM9 million. Green Packet said PISB completed the purchase of 1.15 million WebOnline shares at RM5.22 per share for RM6 million in total. Simultaneously with the purchase, PISB also completed the subscription of 450,000 new shares in WebOnline for RM3 million, or RM6.66 per share. Green Packet funded the acquisition via internal funds.

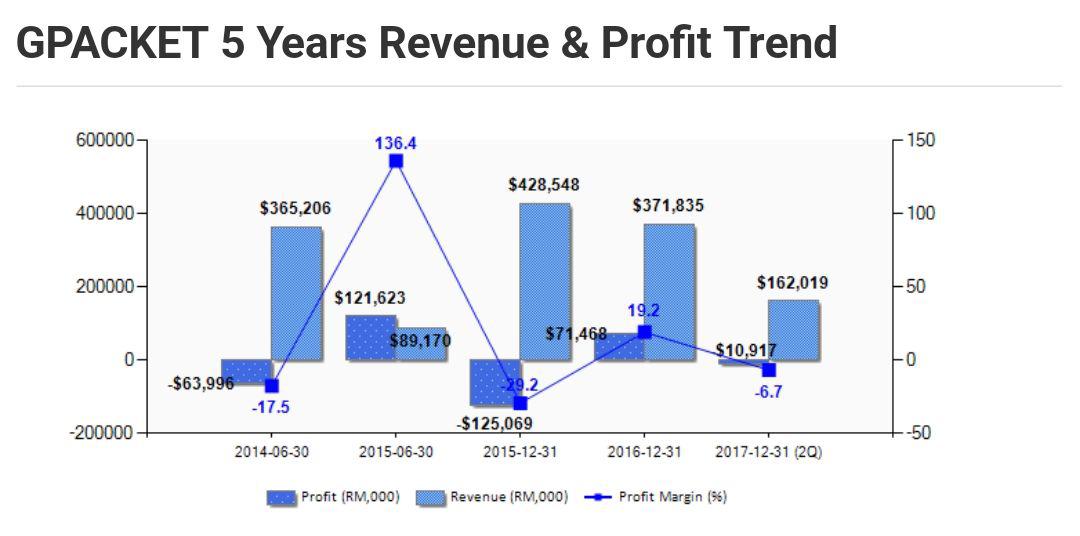

THE FINANCE

THE SUMMARY

"The company's good and I agreed what RHB claimed as their Jewel. But I am forsees more into play as title of Budget 2017 beneficiaries". - Kim Spartan

Regards,

Kim Stockwatch

Or Join Elite Spartan Group Traders (SGT) by contact via phone number.