Hengyuan - what next II

teoct

Publish date: Thu, 21 Dec 2017, 10:21 PM

Hengyuan - What next II?

In the first part, the conclusions are:

a) World oil demand for 2018 is forecasted to increase to 99 mbd by IEA, OPEC and EIA

b) Refining capacity in the world currently is 97 mbd and utilization is at 85%.

c) Refining margins (crack spread) is a function of demand (of refined products) and available refining capacity. Any outage of capacity (see b) above) will cause the crack spread to spike like that caused by hurricane Harvey in September this year.

d) It is expected, with capacity just meeting demand for the next few years, crack spread should remain high.

Please note the highlighted – refined products and refining capacity, this is slightly different from crude oil and upstream oil production.

Saudi Arabia and generally OPEC producers plus Russia can easily open their taps and any sudden surge in oil demand will be met. But refineries (700+ worldwide) cannot open any tap to increase refined products. New refineries are required, and this means huge amount of money, land, infrastructure (pipelines, jetties and the likes) and most of all, time and foresight.

Petronas’ new refinery (300,000 bpd) at Pengerang is expected to start-up in 2019. From planning to production it took at least 8 years (from public available info – announced during 2011 “transformation”). So it is safe to conclude that refining capacities will remain tight for the coming 3 to 5 years (assuming some authorities in other part of the world – think China, work faster than 8 years)

Is fear of Red chip justified? Let’s have a look:

Shandong Hengyuan Petrochemical Group Company Limited (SHPGC) is a state owned enterprise (SOE) based in Linyi County, Shandong Province, China. Shandong province is one of 5 provinces that produce oil.

From 2016 Annual Report (AR) – all in italic

SHPGC is the ultimate controlling shareholder of Shandong Hengyuan Petrochemical Company Limited (SHPC), which in turn is the indirect parent company of Malaysia Hengyuan International Limited (MHIL), the majority shareholder of Hengyuan Refining Company Berhad (HRC)

SHPC, incorporated in 1997, operates an independent oil refinery in Linyi County situated in the Shandong Province. Ranked No. 7 among refining companies in that province, it has a production capacity of 12 million tons per year (86 million barrels per year – 236,000 bpd) – emphasis mine.

Also from AR, SHPC’s representative, Chairman of HRC mentioned that HRC has adopted a “Policy of No Change”, that is:

1) No change in culture

2) No change in leadership team

3) No change in salary and benefits

Board of Directors

Wang, YouDe (China)

Chairman

Non-Independent Non-Executive Director

Martinus Joseph Marinus Aloysius Stals (Dutch – Shell secondee)

Managing Director and Executive Director

Dato’ Seri Talaat bin Haji Husain (Malaysian)

DDSA,SPMP, DPCM, DPMP, JSD, PJK, PJM

Senior Independent Non-Executive Director

Datuk Yvonne Chia (Malaysian)

DPMW

Independent Non-Executive Director

Datuk Zainun Aishah binti Ahmad (Malaysian)

KMN, PMP, DPMP, JSM, PJN

Independent Non-Executive Director

Heng Heyok Chiang @ Heng Hock Cheng (Malaysian –Shell retiree)

Independent Non-Executive Director

David Lau Nai Pek (Malaysian – Shell retiree)

Independent Non-Executive Director

Wang, ZongQuan (China)

Non-Independent Non-Executive Director

Sun, JianYun (China)

Non-Independent Non-Executive Director

Out of 9 directors, 3 from China, 6 Malaysians (1 secondee from Shell, 2 Shell retirees)

The Malaysian out vote the China (men) anytime, so running away with the money should be out of the question.

One of the conditions in the sale is that SHPC must refinance the outstanding loans (RM 1.42 billion) in the book at 2016. Two loans – US 200 million (Loan 1) and US 150 million (Loan 2) were obtained and existing loan paid off only in December 2016 (after S&P announced in Feb 2016).

Loan 1 is secured by:

• A corporate guarantee by Shandong Hengyuan Petrochemical Company Limited, an intermediate holding company;

• A first legal charge over the shares of MHIL in the Company;

• A first legal charge under the National Land Code 1965 over all the real estate of the Company;

• A debenture creating first fixed and floating charges over all present and future assets and undertakings of the Company;

• A first legal charge and absolute assignment over all the present and future rights, interests and benefits of the Company in and to the Product Offtake Agreement with two customers and the Joint Facilities Operating Agreement with another party and all project accounts including revenue accounts and debt service accrual account;

• A legal charge over the hydrocarbon assets and receivables of the Company; and

• A first legal charge and absolute assignment over all the present and future rights, interests and benefits of the Company in and to the Crude Oil Supply Agreement with a vendor.

Still have doubts in this China SOE?

YES?!? gees, its like “I have already made up my mind, do not confuse me with facts”, go read something else then.

For investors, large and small who do NOT adhere to the above, read on.

I think Shell is more worry than you (potential minority shareholders), why, because they need the supply for their petrol stations around Malaysia. Shell refinery in Singapore is already fully committed to supply their stations all over Asia-Pacific. Supply is TIGHT (remember).

Electric Vehicles (EV)

EV will soon replace ICE (internal combustion engine) vehicles. This is a MYTH. Please visit the following:

https://www.theglobalist.com/electric-cars-oil-climate-change-sustainability/

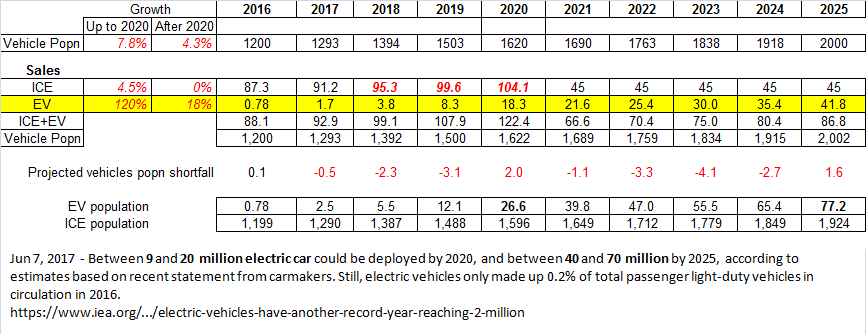

Also a simple projection below:

One can play around with the growth rates until the cow comes home, EV population will not displace the 1.6 billion ICE expected by 2020. Even by 2025, ICE vehicles would grow to 1,924,000,000 (the 0s to emphasis the high numbers).

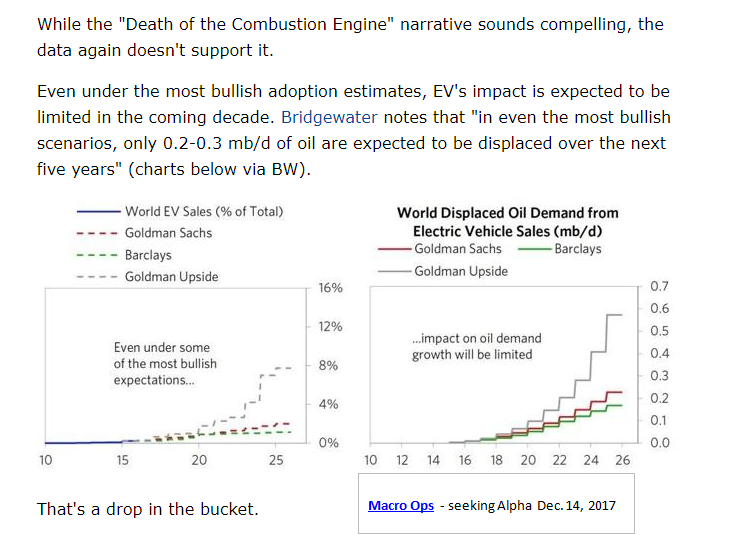

From another analyst;

So demand for refined products will continue to rise in the coming years, no need to worry about EV.

Demand is good, supply is tight, crack spread should remain high and HRC should be profitable going forward. YES? NO? Most likely, yes. (I am being conservative)

BUT, at what rate?

To answer this, the production capacity of HRC need to be reviewed.

Fundamentally there are few things to remember about (oil) refinery versus other manufacturing businesses:

a) Once refinery built, the capacity remain largely static

b) Refined products are “liquid”, i.e. easily sold (That is why Shell is worried that they put in a Joint Operating Agreement – secondee MD, Offtake Agreement)

From HRC website, the licensed production capacity is 156,000 bpd – 56.94 mb per year; but only rated at 120,000 bpd – 43.8 mb per year.

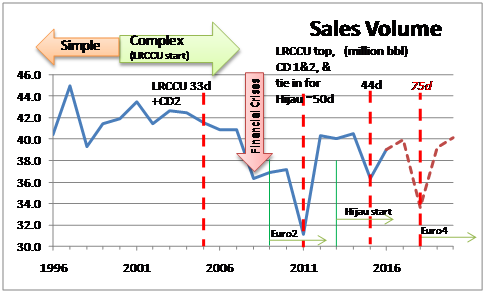

Past ARs shows the actual production as below:

Source: SRC Annual Reports

Shell Refining Company (SRC) became a complex refinery from 2000 onward with the commissioning of the long residue catalytic cracker unit (LRCCU). That is, different types of crude can be accepted as feedstock.

The graph showed that from about 2007 onward, production volume (i.e. Sales volume) had not exceeded 41 million barrels per year. The number of shutdown days is as shown as XXd. For 2018, the announced shutdown is about 75 days with corresponding production indicated in dash lines.

Why the difference between licensed and rated capacity?

Referring back to Part 1, schematic of the refinery, it shows a lot of cylindrical shapes, this is not for ease of drawings but in actuality these equipments are cylinders with cap at both ends – also known as vessel. Once built, cannot simply change (lengthen or enlarge diameter like taking something for you know what……).

Also, one can see that all the crude oil enter the two crude distillers (CD) first before going to the other equipment. These CDs are old and handle hot crude oil, meaning much wear and tear and probably from the many statutory inspections found that wall thickness might have been reduced. Thus, rating had been reduced leading to the differences between licensed and rated. There might be other technical issues.

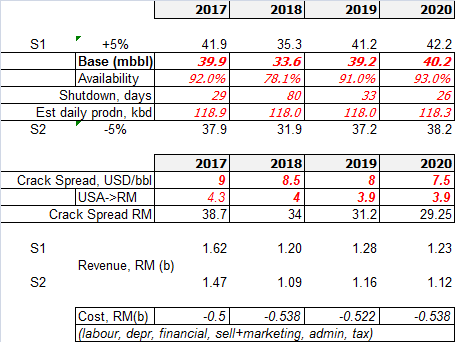

Valuation

Finally all have been waiting for, what would be the profit (in EPS) for the coming years. Hereon, it is almost akin to crystal-ball gazing. There is no right or wrong as there are so many variables, but the best guess is something like this.

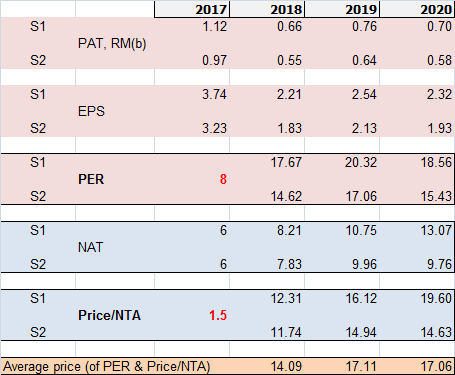

The variables are in red – meaning possible danger for wrong assumption, oil price might spike or drop leading to inventory gain or loss. I am assuming here a rather "calm" business environment going forward. Geo-political risk is excluded here.

Before going into the value, there is the issue of Price Earning Ratio (PER). What is a realistic PER. Or price to net tangible assets (book), another valuation. This is PERCEPTION, Mr. Market decides.

Courtesy of google, some indications of refineries companies around the world:

Europe PER averages 9.5 while US is 20.7. Price to book is 2.8 and 2.1 for Europe and US respectively.

Locally, PetronM and Pet. Dagangan PER are 6.8 and 24.87 respectively.

Considering Hengyuan (HY) products as essential, then comparing to Tenaga maybe closer, PE of 11.66 (5 years average) and 15.62 (10 years average) while price to book is 1.47.

Looking at SRC / HY record since 2006, the average PE (ignoring 2010) is 6.96 while price to book is 1.44 (ignoring 2014).

A PER of 8 seem fair, giving some discount to Europe (for whatever emerging market issues, US too rich valuation), discount to Tenaga (no guarantee from Government). Price to book value of 1.5 is potentially on the lower side but fair. This will result in the following potential prices for the coming years.

Now for 2018, there is the potential to reverse the impairment of RM 461 million (from 2014) to cover the lower volume of products during the mandatory shutdown. This will increase 2018 EPS by RM 1.53 per share, resulting in potential share price as per following:

2017 is a super profitable year. This does not meant that 2018 and subsequent years will be similar.

Another reason why Shell sold to SHPC is that SHPC promised to implement Euro4 and Euro5 upgrade to the refinery. This upgrade is mandated by Malaysian Government to take place by October 2018 (Euro4) 2020 (Euro5 diesel) and 2025 (Euro5 petrol). The upgrade will cost US 150 m (RM 615 m) for Euro4 and potential RM 500 m for Euro5. While doing the upgrade for Euro4, a change out of LRCCU top dome will also take place costing US 27.5 m (RM 113 m) in 2018. In total RM 728 or thereabout (depending on exchange rate) is required CAPEX in 2018.

The current cash and cash equivalent of RM 900 m will be used given a balance of RM 172 million that is, assuming everything goes smoothly. Of course during the course of 2018, new free cash flow should come in, boosting the cash reserve to what? Your guess is as good as mine. But that cash reserve will need to be use for Euro5 upgrade in 2020 for diesel and 2025 for petrol.

Depending on loan repayment, the bank(s) that provided Loan 1 may approve dividend payment from 2019 onward, this is my personal opinion.

Hopefully this gives a better understanding of the business, risks involved, how profit is controlled by outside factors and the potential profit for the coming years. To increase capacity to cash in the higher demand is out of the question. Spiking of crack spread due to unforseen circumtances reducing refining capacities would bring higher profit.

Happy investing.

Declaration: I hold HY shares.

Disclaimer: This is for sharing only, not a buy / sell call. You buy / sell at your own risk. All effort made to ensure accuracy. Please accept my apology for any omission and errors.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on TeoCT

Created by teoct | Jul 23, 2020

Discussions

Nice one. Although I will never buy hengyuan due to the China parent company is the pollution king of the universe.

2017-12-21 23:04

This stock even cheaper and undervalued! https://klse.i3investor.com/blogs/huathuathuat/142046.jsp

2017-12-21 23:56

Well written. Hopefully HRC will not disappoint many. Present scenario is, how much it will fall, before climbing back. Will it be below 14 rgt ?

2017-12-22 00:03

RAIDER ALREADY EXPLAIN MANY TIME HENGYUAN IS UNDERVALUE AND GREAT GROWTH PROSPECT LOH....!!

IN FACT HENGYUAN IS IN A PHASE OR CYCLE THAT U CAN MAKE THE MOST U CAN EVER IMAGINE WHY ?

1. THE SHAREHOLDING OF HENG HAS BEEN SHIFTING FROM INDIVIDUAL INVESTOR TO FOREIGN & LOCAL FUND INVESTORS WHO HAVE MORE FIRING & HOLDING POWER LOH....!!

2. HENGYUAN WITH EPS RM 3.10 STILL REMAIN THE MOST PROFITABLE CO IN KLSE.

3. HENGYUAN EPS EXPECTED TO RERATE TO RM 3.40 TO RM 3.60 IN Q4 RESULT.

4. HENGYUAN PE 5X IS STILL EXTREMELY UNDERVALUE COMPARE PETDAG 20X, PETRON 8.5X AND NESTLE 40X.

5.THE CRACK SPREAD STILL ABOVE USD 9 PER BARREL, WHICH IS VERY PROFITABLE.

6. THE CASHFLOW OF HENGYUAN VERY STRONG, GENERATING POSITIVE CASH EXCEEDING RM 1.0 BILLION.

7. ROE OF HENGYUAN 70% IS VERY ATTRACTIVE LOH...!!

JUST HANG ON HENGYUAN FOR ANOTHER 6 TO 12 MTHS....SHARE PRICE SHOULD EXCEED RM 20.00 LOH...!!

2017-12-22 00:28

Be careful if counters were purchased heavily with margin accounts. External shock, for example, the general election, which may cause the overall market to fall can result in margin calls and margin selling. If the margin accounts got no more buying limits, the price of shares purchased on margin may drop sharply.

2017-12-22 08:57

Yu_and_Mee

Hengyuan better than Petronm?

2017-12-21 22:24