Why SHH? Pure cash furniture manufacturing company that yet to fully benefit from USD appreciation

itjustabouttheprofit

Publish date: Mon, 07 Dec 2015, 05:24 PM

EPS estimation : 7.52+6.96+9.4(estimated)

+9.4(estimated) = 33.28sen

PE ratio : 10

Target price : RM3.33 (6 months)

Number of shares: 49,997,500 shares

I am here to ANSWER a simple question.

Why SHH?

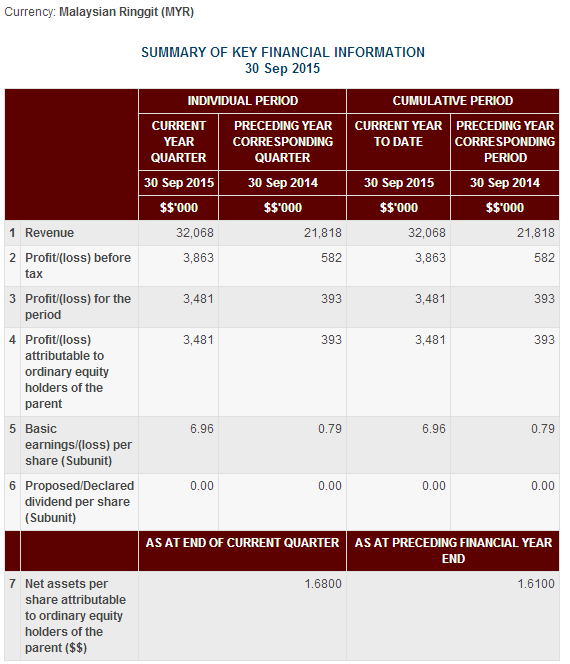

1) Explosive result of 6.98sen last quarter

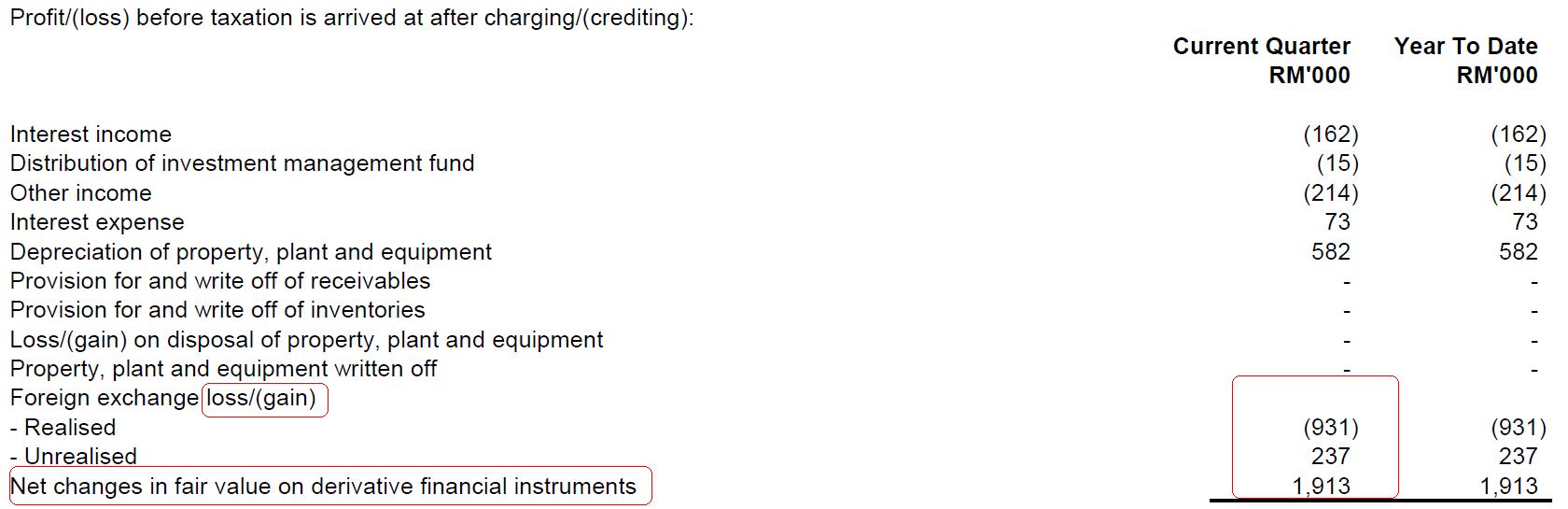

which inclusive of fair value loss of RM1.9mil

on derivatives and RM0.7mil of forex gain

(net effect of RM1.2mil loss or 2.4sen)

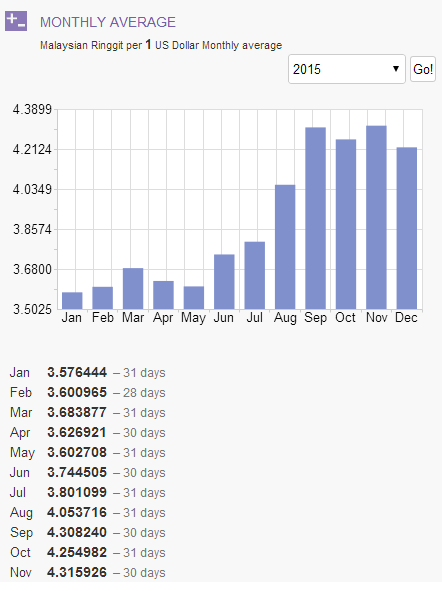

2) Average rate of US dollar exchange rate

higher than Jul 2015 to Sep 2015

3) Net cash company of RM25.1mil (or

50sen per shares) and dividend yield of

4.76percent which ex-date on 21 Dec 2015

4) Expansion program and keen to acquire

smaller peer to expand business

5) Other informations

1) Explosive result of 6.98sen last quarter

which inclusive of fair value loss of RM1.9mil

on derivatives and RM0.7mil of forex gain

(net effect of RM1.2mil loss or 2.4sen)

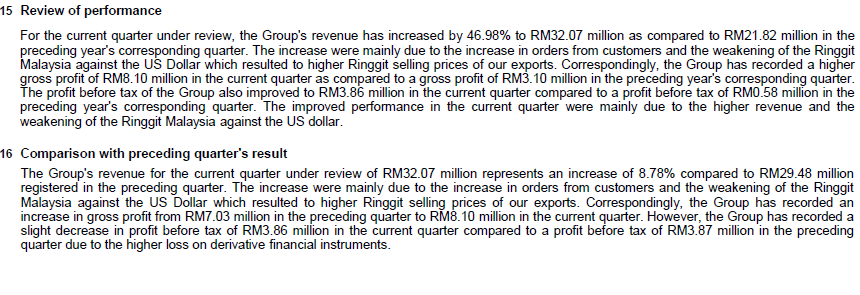

From the bursa announcement above, we notice that profit of the company have surged near to 10times from previous quarter. Also, the revenue have also increased by 47%.

As per disclosure above, the improvement in revenue and profit mainly due to weakening of Ringgit Malaysia against US dollar and increased in order from customers.

As per dislosure above, profit after taxation are inclusive of RM1.9mil of fair value on derivative financial instruments and RM0.7mil of foreign exchange gain.

Conclusion: As the fair value on derivate financial instruments and foreign exchange gain are determined by currency rate,if we did not including the effect of foreign exchange gain and changes in fair value on derivative financial instruments, the profit will be stood at EPS9.4sen for quarter ended 30/9/2015.

Calculation = (RM3.481mil + RM1.913mil +RM0.237mil - RM0.931mil) / 50mil (number of shares) = EPS9.4sen

As the currency rate as per today stood at RM4.2, fair value loss on derivate financial instruments will not incurred in the coming quarter. Hence i expected EPS 9.4sen will be remained or more for the next 2 quarter.

2) Average rate of US dollar exchange rate

higher than Jul 2015 to Sep 2015

sources: http://www.x-rates.com/average/?from=USD&to=MYR&amount=1&year=2015

As per schedule above, the average rate for Oct to Nov 2015 is stood at RM4.28, which is 5percents higher than Jul to Sep 2015 (USD1= RM4.05)

Calculation as below:

Jul, Aug, Sep 2015 = (3.901099+4.053716+4.308240) / 3 =RM4.054352

Nov and Dec 2015 = (4.254982+4.315926) / 2 = RM4.285454

As all of the sales of the company using US dollar in trading (refer trade debtor notes in latest annual report), the increase in average exchange rate will surely bring the profit margin of the company to the next level.

3) Net cash company of RM25.1mil (or

50sen per shares) and dividend yield of

4.76 percent which ex-date on 21 Dec 2015

| Quarter | EPS (sen) | Cash (mil) | Borrowing (mil) | Net (mil) | Net (sen) |

| Mar-15 | 3.07 | 22.08 | (12.21) | 9.87 | 0.20 |

| Jun-15 | 7.52 | 24.08 | (8.85) | 15.23 | 0.30 |

| Sep-15 | 6.96 | 32.46 | (7.37) | 25.09 | 0.50 |

As per table above, the company's net cash position have been improved significantly since Mar 2015. As per Sep 2015, the company's net cash position have been increased to RM0.50 per shares.

Also, the company have declared first and final dividend of 10sen to be ex-date on 21 Dec 2015, which translate to dividend yield of 4.76%

4) Expansion program and keen to acquire

smaller peer to expand business

sources: http://www.bursamalaysia.com/market/listed-companies/company-announcements/4909993

Refer to the annoucement on 2 Nov 2015 (reply to queries for unusual market activity), the company management deny that there is no any corporate development, any rumour or report concerning the business and affairs and no other possible explanation to account.

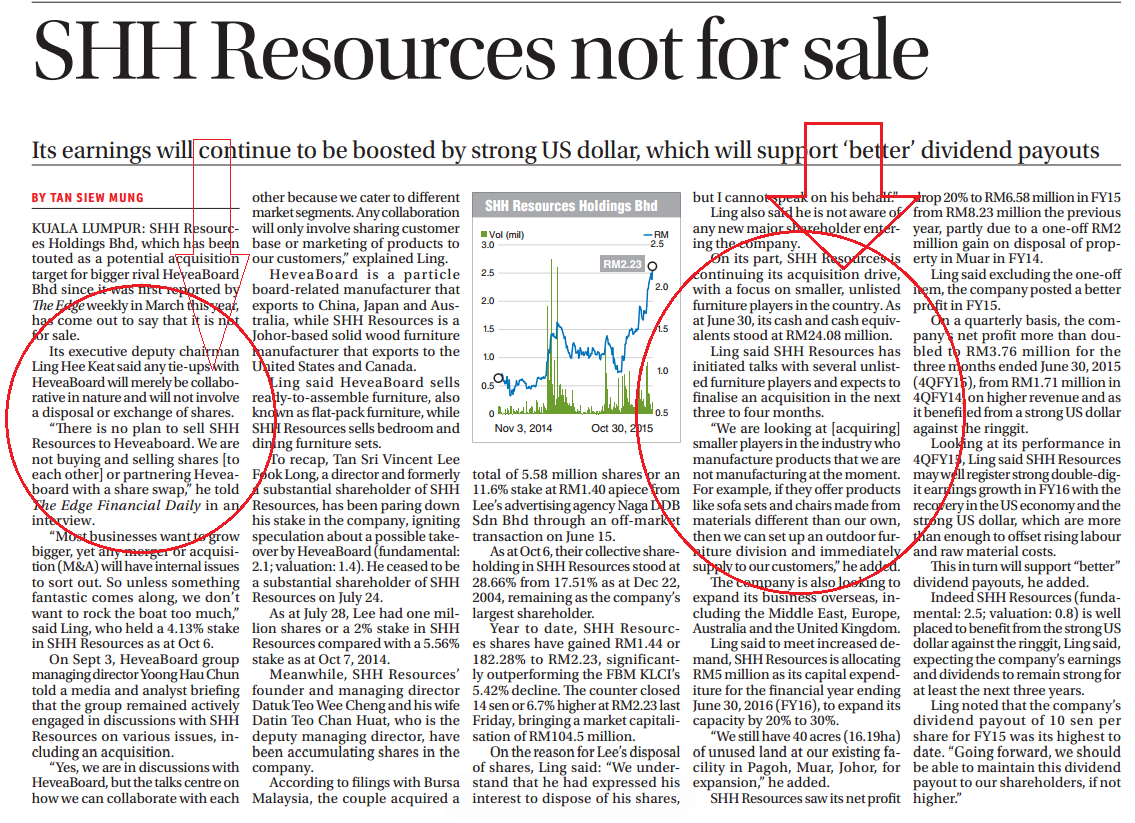

However, they did not deny on the both article below:

1) SHH Resources not for sale

2) SHH Resources keen to acquire smaller peer to expand business

sources: http://www.thesundaily.my/news/1599804

Conclusion after reading both article:

1) Executive deputy chairman, Ling Hee Keat deny that the company did not plan to sell SHH Resources to Heveaboard

2) Executive deputy chairman also mention that SHH Resources have a potential collaboration with Heveaboard Bhd. The negotiations betwen two parties are still on-going and they hope to conclude them next year.

3) SHH has embarked on expansion plans for its manufacturing facilities in Pagoh, Johor with a capital expenditure of RM5million. This will increase the number of containers by 60 and 80 a month from the current 220 to 250 containers, depending on the size of the furniture.

4) The company has a 1,200-strong workforce and this is expected to increase by 150 to 200, in line with the capacity expansion plans.

5) SHH is hoping to continue rewarding its shareholders by at least maintaining its dividend of 10 sen per share for FY16. "We hope we can even increase the dividend payout for the coming years," Ling said.

6) SHH still have 40 acres (16.19ha) of unused land at their facility in Pagoh, Muar to be used as expansion.

5) Other informations

Other useful information:

1) All of the factories for SHH Resources located at Johor, Malaysia. Hence appreciation in US dollar will help SHH Resources improve the profit margin. The company's profit started to go up since Mar 2015 after the average rate of US dollar for the quarter ended Jan to Mar 2015 reached RM3.70.

2) Based on the trade debtor disclosure in annual report, all sales denominated in US dollar.

3) For trade payable, only 20% denominated in US dollar.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Ultimate undervalue club

Created by itjustabouttheprofit | Dec 08, 2020

Created by itjustabouttheprofit | Sep 04, 2018

Created by itjustabouttheprofit | Aug 28, 2016

Created by itjustabouttheprofit | Jun 05, 2016

Created by itjustabouttheprofit | Apr 16, 2016

Discussions

IMHO, land and building revaluation is immaterial. will just translate into higher assets value but wont affect the earnings since their core business is not dealing with properties development. unless they wanna sell off the land and building la, else wont captured as earnings. just my 2 cents

2015-12-08 14:44

Probability

Oh my god...itsjustaboutprofit again..

this time I just want to jump in

I don't need to read and understand your article).

9/10 times your stock selection is giving better return

than any of the gurus here...

Thanks.

Do come rarely...but come only when you are sure of it.

2015-12-07 19:07