Peter Lynch Style: Mastering the Cyclicals! (Comments by Calvin Tan Research) Peter Lynch beats Warren Buffet on Cyclicals

calvintaneng

Publish date: Tue, 12 Nov 2019, 03:52 AM

Hi guys,

The important details & comments are highlighted in yellow

Have you ever been on a roller coaster ride in an amusement park? Travelling on these rides is so terrifying sometimes: at one moment you are up and upside down, and the next, you’re flying downwards so fast that you can hear your every heartbeat! If you have not been there, then don’t worry, we will take you through the roller coasters of stock markets: Cyclicals, in which there is no end to ups and downs.

What are Cyclicals?

‘Cyclicals’, according to Peter Lynch are the companies whose revenues and profits are in tandem with the state of the economy with their performance being tied to the business cycle.

They can be classified under two categories:

Rate sensitive sectors – These are the businesses which are primarily affected by the interest rates prevailing in the economy and thus any contraction or expansion in economy consequently affects them. Auto companies, banks and capital goods fall under this category.

Commodity based sectors – Earnings and cash flow of these businesses are dependent on the demand –supply of their products/raw materials leading to the final price of the product. During expansion, there is increase in demand, resulting in business expansion; whereas in the times of recession, the demand gets subdued, leading to business contraction. Metals & Mining, sugar and cement companies follow these patterns.

Cyclicals, thus, suffer huge losses during recessions, often finding it hard to survive till the next boom. But, when things do start to change for the better, dramatic swings from losses to profits can often surpass expectations. It is to be noted that rise and fall in profit of cyclicals usually depends on various regulative and administrative policies.

CALVIN COMMENTS: GOVT POLICY AFFECTS F&N WHEN IT TAXED SUGAR

CEMENT COMPANY LIKE LAFARGE WILL BENEFIT WHEN GOVT IMPLEMENT ECRL

& IN SARAWAK CEMENT COMPANY LIKE CMSB WILL BENEFIT WHEN GOVT IMPLEMENT PAN BORNEO HIGHWAY

Why invest in a cyclical company?

“It takes remarkable patience to hold on to a stock in a company that excites you, but which everybody else seems to ignore.” – Warren Buffett

Investing in cyclicals is akin to travelling on a sine wave. One needs to invest in stocks at the trough and get out of investment at the peak of sine wave. Each cycle has a downside, during which prices dip and an upside, during which prices rise to their highest. The depth of the trough and the height of the peak, the duration of downside and the duration of upside may vary for different cycles, but the overall downside, peak and upside are more or less same for most cycles. This downside and upside pattern repeats itself many times for a majority of the cyclical stocks. One has to take advantage of this repetition and buy on the ‘upside’. The approach is quite simple; however, successful cyclical investing requires careful timing.

buy on the ‘upside’.

YES! CALVIN ISSUED BUY CALL AFTER PENERGY GONE LIMIT UP FROM 40 SEN TO 75 SEN. WHILE SO DARING

https://klse.i3investor.com/blogs/www.eaglevisioninvest.com/195879.jsp

IN UP CYCLE PRICES WILL CONTINUE TO GO UP

PENERGY NOW MORE THAN DOUBLED OVER RM1.60

How to invest in Cyclical?

Before selecting a cyclical stock, it makes sense to pick an industry that is due for a revival. Declining interest rates and growing consumer spending signals towards the economic expansion. Then, in that industry, choose companies that look especially attractive.

Before selecting a cyclical stock, it makes sense to pick an industry that is due for a revival.

WELL SAID: PICK AN INDUSTRY THAT IS DUE FOR REVIVAL

CALVIN PICKED CARIMIN, NAIM/DAYANG, PENERGY, VELESTO BECAUSE OF PETRONAS POURING RM30 BILLIONS TO REVIVE O&G INDUSTRIES

NEXT TO DUE FOR REVIVAL IS FIBERISATION THRUST OF RM21.6 BILLIONS CASH INFUSION INTO OPCOM, NETX, REDTONE & OTHERS

Consider an example: In the present economic scenario, where economy is growing at a mere 5% growth, automobile industry is facing a slump in their sales due to higher interest rates and lesser demand. Lower interest rates provide better financing, and thus, stimulate consumer demand. So, one can look for the signals affecting the industry and invest in a company which is able to perform better than its peers.

look for the signals affecting the industry and invest in a company which is able to perform better than its peers.

Following points should be considered while investing in Cyclicals:

- Keep a close watch on inventories and the supply-demand relationship. Watch for new entrants into the market, which is usually a dangerous development.

- Anticipate a shrinking P/E multiple over the time as business recovers and investors begin to look ahead to the end of the cycle, when peak earnings are achieved.

- Prices at a discount to the book value offer an encouraging sign.(NETX IS 2 SEN WITH 3 SEN NTA)

- The lower the percentage of institutional ownership, the better the company is.

- Both, insiders and the company buying back its own shares, are positive signs.(NETX BOSS BOUGHT 103 MILLIONS NETX SHARES THRU ASIABIO)

- Are the earnings sporadic or consistent?

- Check whether the company has a comfortable debt to equity ratio of around 1:1.(NETX HAS ZERO DEBT)

Have you found your cyclical?

We will now discuss the sugar industry, which is famous for its cyclical nature. Any thoughts, why?

The reason for cyclicity in sugar industry is the demand & supply mismatch. When demand is more than the supply, it results in a profit for the industry whereas when supply is in excess of demand, sugar industry faces tough times.

GOVT TAX SUGAR HIT F&N BADLY, F&N DIVERSIFY INTO MILK HIT DUTCHLADY

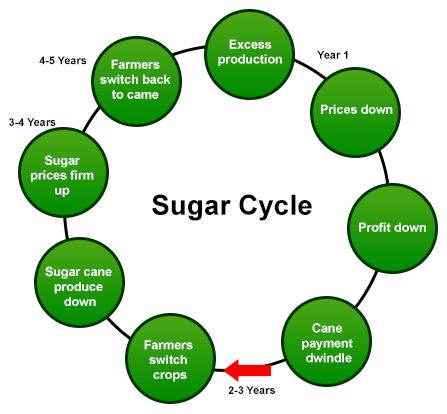

Sugar Cycle

The uptrend is characterised by a decline in sugarcane cultivation. This is due to increased cane arrears as payments are delayed by manufacturers led by losses in the sugar business. Increase in cane arrears leads to a decline in sugarcane harvesting, and thus, lower sugarcane availability. Lower sugarcane crushing followed by lower sugar production results in higher sugar price and increased profitability for manufacturers. Due to increased profitability, manufacturers make prompt payments to farmers, who again increase sugarcane production. This increment leads to a surplus of sugar in markets, affecting prices and profitability of manufacturers adversely. Sugarcane arrears are increased again, prompting farmers to grow less sugarcane and triggering an uptrend.

This could be easily explained with the help of the following illustrations:

When is the best time to sell a Cyclical?

The best time to sell is towards the end of the cycle. To identify the trend; look for signals like an increase in interest rates and a decrease in consumer spending. Excluding the end of the cycle, the best time to sell cyclical companies is, when:

- It has been hit by a regulation issue.

- It is not able to generate positive cash flows.

- Costs have started to rise.

- Existing plants are operating at full capacity, and the company has begun to spend money to increase its capacity.

- Commodity prices are falling and competiting businesses are increasing.

- (OGSE SUPPORT DESTINI & T7 GLOBAL NOW COMPETE WITH TIER ONE OGSE FOR JOBS)

- Inventories building up with company being unable to get rid of them signalling lower prices and lower profits down the road.(NETX HAS NO INVENTORIES)

Conclusion:

If you can’t convince yourself ‘When I’m down 25 per cent, I’m a buyer’ and banish forever the fatal thought ‘When I’m down 25 per cent, I’m a seller,’ then you’ll never make a decent profit in stocks.

These are the words of Peter Lynch which are very apt for Cyclicals. Cyclicals may be low-risk and high-gain or high-risk and low-gain, depending on how adept one is at anticipating business cycles. Thus, if you have the courage to go for a risky investment, then try your hand at Cyclicals!

More articles on THE INVESTMENT APPROACH OF CALVIN TAN

Created by calvintaneng | Aug 23, 2024

Created by calvintaneng | Aug 22, 2024

Created by calvintaneng | Aug 03, 2024

Discussions

It is amusing to see calvin proudly declaring his prowess in cyclicals when Buffett and Peter Lynch, who are proven masters in investing advocate avoidance and/or caution.

No wonder calvin's track record of 2 out of his 3 stock selections lost money is unsurprising. While Buffett and Peter Lynch choose to jump of 1 foot high hurdles, deluded calvin chooses to jump over 7 feet hurdles because calvin was so much smarter.

2019-11-12 07:25

By avoiding cyclicals, (except for the few occasions: please ask raider how I made hundred % gains in the occasional cyclicals) and staying with high quality growth companies (mainly non cyclicals), patience, discipline and compounding over the LONG TERM have delivered amazing portfolio incremental value.

The incremental value delivered in a single year often exceeds by hundred folds those of short term players, making it almost impossible for them to challenge this record in the short or long term.

Time in the market is proven more rewarding than timing the market.

2019-11-12 07:44

Time in the market is proven more rewarding than timing the market

That is, if you know the market direction

Like Calvin called all not to time the job award for Opcom by going in and out as Job Award suddenly announced will be too late to get back in

Because Govt already allocated Rm10. 8 billions to Telekom for the disbursement to The purchase and installation of fiber optic networks

On the other hand Calvin issued buy call for Padini at Rm1. 60 and took profit when Padini crosses Rm4. 80 as the time cycle for Padini uptrend is turning down

3iii who cannot see cyclical behavior in economy stayed on to see gains given back

That is why Calvin called all to sell into peaks to lock in gains

Peter Lynch MAGELLAN fund did beat Warren Buffet at 39% compared to Warren at 25% by buying into CYCLICALS

Another expert is Howard Marks who wrote

Mastering the CYCLICALS. Putting the odds on our side.

2019-11-12 08:45

Calvin got Howard Marks writing chun chun on target

Bought carimin at 39 sen

Bought Naim at 48 sen

Bought Penergy at 68 sen

Bought Uzma at 55 sen

Bought Velesto at 27 sen

Bought Redtone at 45 sen

Bought Opcom at 63.5 sen

Bought netx at 1 sen, 1. 5 sen and 2 sen

Bought T7 global at 45 sen

Bought destini at 20 sen

All chun chun ones

Thks to great Sifu Howard Marks and Peter Lynch

2019-11-12 11:26

>>>>>

calvintaneng Calvin got Howard Marks writing chun chun on target

Bought carimin at 39 sen

Bought Naim at 48 sen

Bought Penergy at 68 sen

Bought Uzma at 55 sen

Bought Velesto at 27 sen

Bought Redtone at 45 sen

Bought Opcom at 63.5 sen

Bought netx at 1 sen, 1. 5 sen and 2 sen

Bought T7 global at 45 sen

Bought destini at 20 sen

All chun chun ones

Thks to great Sifu Howard Marks and Peter Lynch

>>>>>

I think deluded calvin should re-read Howard Mark's book.

Now that calvin has shown his winners, he may wish to show his bigger list of losers. (Refer Philip's monitoring of calvin's portfolio. For every 3, 2 lost money!)

2019-11-12 12:22

RM30 BILLIONS FOR OGSE FROM PETRONAS POWERED UP OIL & GAS STOCKS BY 100% TO 400%

FOR YEARS 2014 To 2018 OGSE WERE SUFFERING BECAUSE AFTER CRUDE OIL CRASHED TO USD27 THERE WERE FEW JOBS FROM PETRONAS

AFTER BRENT CRUDE REBOUNDED TO USD70 PER BARREL PETRONAS GAVE OUT RM30 BILLIONS FOR UPSTREAM - THAT STARTED A BULL RUN

SO BY SAME PATTERN GOVT POURING RM50.3 BILLIONS INTO NCFP FIBERISATION WILL POWER UP ALL DIGITAL ECONOMY STOCKS

AS IT WAS IT IS: AS IT IS IT SHALL BE

THE CYCLE OF BOOM AND BURST GO ON AND ON

THE WISE IN HEART KNOWS THIS AND INVEST ACCORDINGLY

2019-11-16 17:50

.png)

3iii

Once again, calvin is deluded.

Buffett has avoided cyclicals and has outbeat Peter Lynch in wealth accumulation.

Peter Lynch's good performance in Magellan funds were mainly delivered by the multibaggers from fast growing small caps stocks.

2019-11-12 07:20