HENGYUAN - FUEL CONSUMPTION TO RISE WHEN ECONOMY REOPEN !!! THIS STOCK WILL BENEFIT !!!

BURSAMASTER

Publish date: Sat, 02 May 2020, 02:56 PM

FUEL CONSUMPTION TO RISE WHEN ECONOMY REOPEN !!! THIS STOCK WILL BENEFIT !!!

Hello to all readers out there. Yesterday on 1st May 2020 (Labour Day), our Prime Minister announced that selective business which do not involve physical contact, will be allowed to reopen on 4th May 2020 (coming Monday). This includes also public transport:

https://www.theedgemarkets.com/article/public-transport-services-back-normal-may-4

Having said the above, the stock which I'd like to talk about today is Hengyuan Refining Company Berhad (Hengyuan - Stock Code 4324, Main Market, Energy - Oil & Gas Producers)

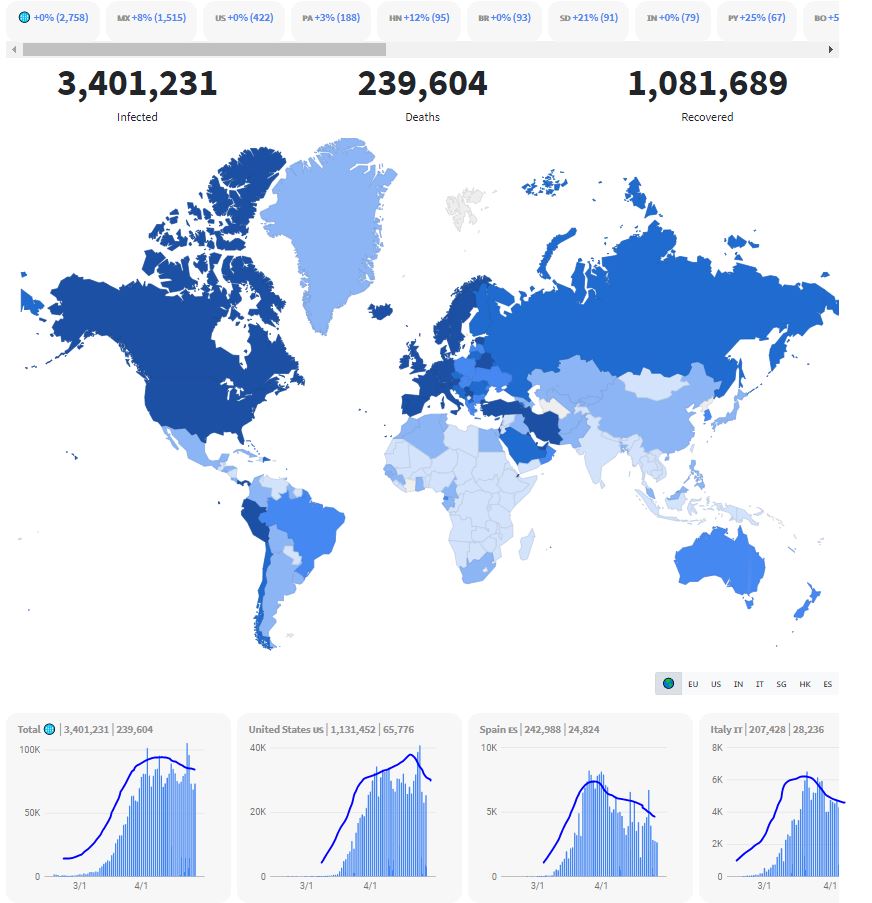

Recent slump in oil consumption was mainly caused by stay-at-home orders all over the world. However, looking at the trend of COVID19 cases across the world (refer below image), it seems that the amount of new infections has either flattended our or started to reduce in many countries.

Some countries have allowed partial re-opening of businesses, but with strict procedures to be followed. With this trend in mind, fuel consumption will generally be improving in the coming future months.

Source: https://coronavirus.thebaselab.com/

BASIC INFORMATION ABOUT PCCS

HENGYUAN (formerly known as SHELL REFINING COMPANY) was incorporated in 1960 and was listed on the Main Board of KLSE in 1962, is an oil refining company operating in Port Dickson.

The total share float of this company is 300 million, which translates to a market cap of RM 936 million.

WHY INVEST IN HENGYUAN ???

Currently, there are a few factors which make the investment at current price look attractive. I will explain below.

1. FUEL CONSUMPTION BOOST CAUSED BY PARTIAL RE-OPEN OF ECONOMY

With businesses re-opening on 4th May 2020, fuel consumption will be spiking up as normal people and businesses start to resume operations. Among those fuel consumption include:

i. premises such as factories, warehouses, facilities, etc

ii. transportations - aircraft, buses, trains, lorries, vans, cars, etc

This surge in demand for oil, will demand refiners such as HENGYUAN to be on standby to drive up oil processing in order to be able to timely deliver to the local market demand.

2. HENGYUAN HAVING A HEALTHY CASH PILE ON STANDBY IN CASE OF NEED TO RAMP UP VOLUME

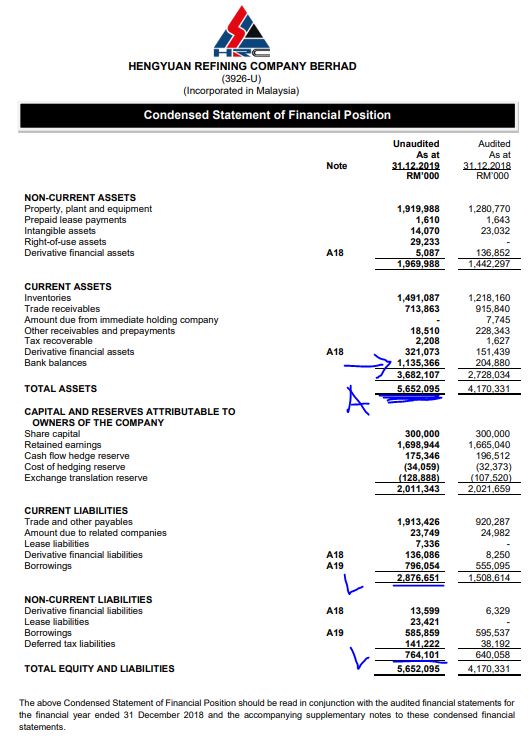

Refer to latest HENGYUAN book as of FEB2020 QR. We can see from the arrow that HENGYUAN has about RM 1.135 billion in cash (which translates to RM 3.78 cash per share). This value is higher than the current market cap of HENGYUAN at RM 936 million. Also, note that, the CASH PER SHARE itself is already higher than the latest closing price of RM 3.12.

This healthy cash pile, would be very important in the case of HENGYUAN being required to ramp up its processing as required by the market demand, to pay for the increased operating expenditures (manpower, utilities, vendors, etc) and also higher product intake (crude oil) to produce more output (finished oil goods)

Also worth to note that total assets stood at RM 5.652 billion versus liabilities of RM 3.64 billion.

3. STOCK HOLDING GAINS IMPROVE AS OIL PRICE RECOVERS

Stockholding gain is referring to gain in the crude oil barrels being kept as inventory, as the price of crude oil moves up.

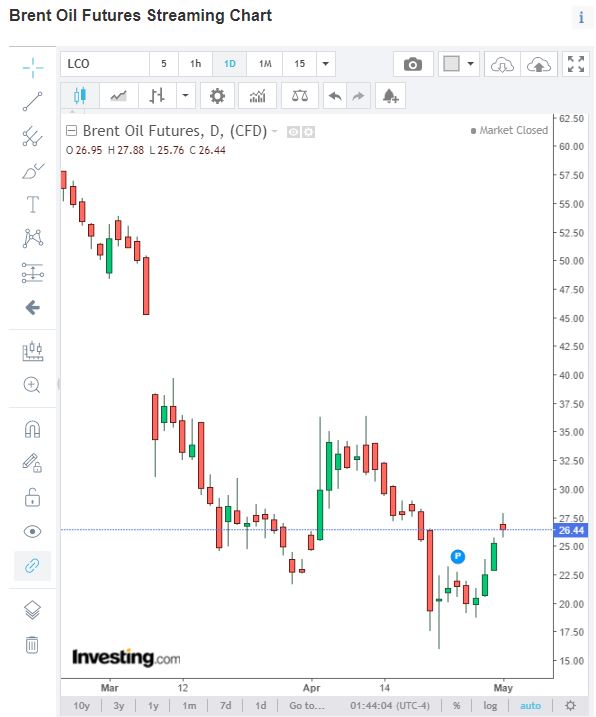

Let's see the recent daily chart of Brent Oil, where it had bottomed at USd 15.98 on 22nd April 2020, and since then rebounded to close at USD 26.61. As oil prices gradually recover, HENGYUAN will be able to make gains on its stock holding as it processes the oil products.

Also, recently I read a very interesting article where Goldman Sachs had mentioned 5 reasons why traders should load up on energy stocks following oil's historic price plunge. The article below:

The reasons, in summary are:

i. Oil prices are at/below CASH COSTS

ii. Shut-in announcements are becoming material

iii. Demand appears to be at trough

iv. Valuation near 25-year lows on EV/gross cash invested basis

v. Stocks on average have stopped falling on recent bad micro news

4. TECHNICAL ANALYSIS - CUP AND HANDLE FORMATION, PENDING BREAKOUT

Refer below a simple price and volume chart, with EMAs 14, 43, 200 and 365.

We can see that the candles had formed a cup and handle formation, which recent high being at RM 3.29 area pending for breakout (refer Circle 2).

On Thursday, 30th April 2020, the price managed to break-out above EMA14 of RM 2.98 and EMA43 of RM 3.03, which indicates short term bullish momentum. This rise was accompanied by larger than usual volumes (Circle 3).

The next EMA to be tested is EMA200 at RM 3.96 and EMA365 at RM 4.64.

CONCLUSION

Considering all the above, I opine that current price for HENGYUAN is attractive due to below:

i) Fuel consumption to rise following economy re-open on 4th May 2020

ii) Healthy cash pile of RM 1.135 billion on standby in case the need to ramp up production as required by demand

iii) Improved stock holding gains as crude oil prices recover

iv) Pending cup and handle pattern breakout, with short term EMA broken out with significant volume

LET’S SEE HOW THE SHARE PRICE MOVEMENT IN THE NEAR FUTURE FORBEARING ANY GOOD CORPORATE NEWS.

Disclaimer : The above opinion is never intended to be a BUY CALL whatsoever. I am sharing my observations ONLY based on fundamental; past history; current trading pattern; charts etc. Please make your own informed decision before buying this share or whatever share for that matter.

BURSAMASTER

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Bursa Master

Created by BURSAMASTER | Sep 22, 2023

Created by BURSAMASTER | Aug 20, 2023

DISCLAIMER: This post serves as an educational analysis and is never meant/ intended to be a buy/sell call or recomendation, whatsoever.

Investors / punters must always do their own due deligence bef

Created by BURSAMASTER | Dec 25, 2022

Created by BURSAMASTER | Oct 23, 2021

Discussions

Just go Lctitan mah....!!

Posted by probability > May 2, 2020 4:52 PM | Report Abuse

Bursa sifu, please let go of Hengyuan, migrate to Serbadk if you need to invest on O&G...

HY will suffer huge stock loss on coming qtr results...refinery margin is like shit..

2020-05-02 18:34

the increase in cash accompanied by huge jump in trade and other payables, so net-net no cash at all , i think

2020-05-02 21:34

if you add up short-term and long-term borrowings, the amount is higher than cash

2020-05-02 21:43

also our market has been on an uptrend for a while now since mid-March , almost all counters rebounded from lows , some more than others but now may not be a good time to be bullish - i think the recent market rise has lulled many market players into a sense of positive complacency - Btw , DJIA dropped 600+ points while Nikkei future also dropped heavily on Friday - chart-wise look like pennant breakdown signalling resumption of the earlier downtrend - Monday could see our market follow suit - bears waking up from the short nap - just my two cents to advice caution now

2020-05-02 21:54

lol.. author clearly very below Par analyst that dont know how refinery work. lol.

2020-05-03 12:15

if hengyuan was traded between 3-4 before covid, whay make you think the price can go to 5 after covid ended with same demand? oil price below 20, margin spread won't vr better

2020-05-03 12:16

a lot of pseudo-analysis in this site - almost seems written with one purpose to garner support with no risk to money taken into account. in this MCO i have the opportunity to survey the postings - recent and past - a lot of losses seen - some even bragged how much they lost as if it is an honor ! also a lot of marketing of trading/advisory platforms which i avoid - i mean if its so good as claimed why not the founders use it to make lots of money - no need to sell to the public. but all these make for entertaining read nonetheless hahaha

2020-05-03 12:26

Talib is right , if HY was at 3-4 before covid , to go back to 5 needs some sort of magic - demand just not there anymore , also i think refined oil inventory must have build up over the past 2 months

2020-05-03 12:30

Coming Q huge inventory loss. 31st March 2020 oil price is far far below 31st Dec 2019, isn't it?

2020-05-03 15:11

Current world oil storage almost full lor....how to pump more....wait after June to get clearer picture...

2020-05-03 20:23

probability

Bursa sifu, please let go of Hengyuan, migrate to Serbadk if you need to invest on O&G...

HY will suffer huge stock loss on coming qtr results...refinery margin is like shit..

2020-05-02 16:52