Positioning your portfolio to hit new all time highs - Lessons from HLIND vs BAT

DividendGuy67

Publish date: Mon, 20 May 2024, 08:26 PM

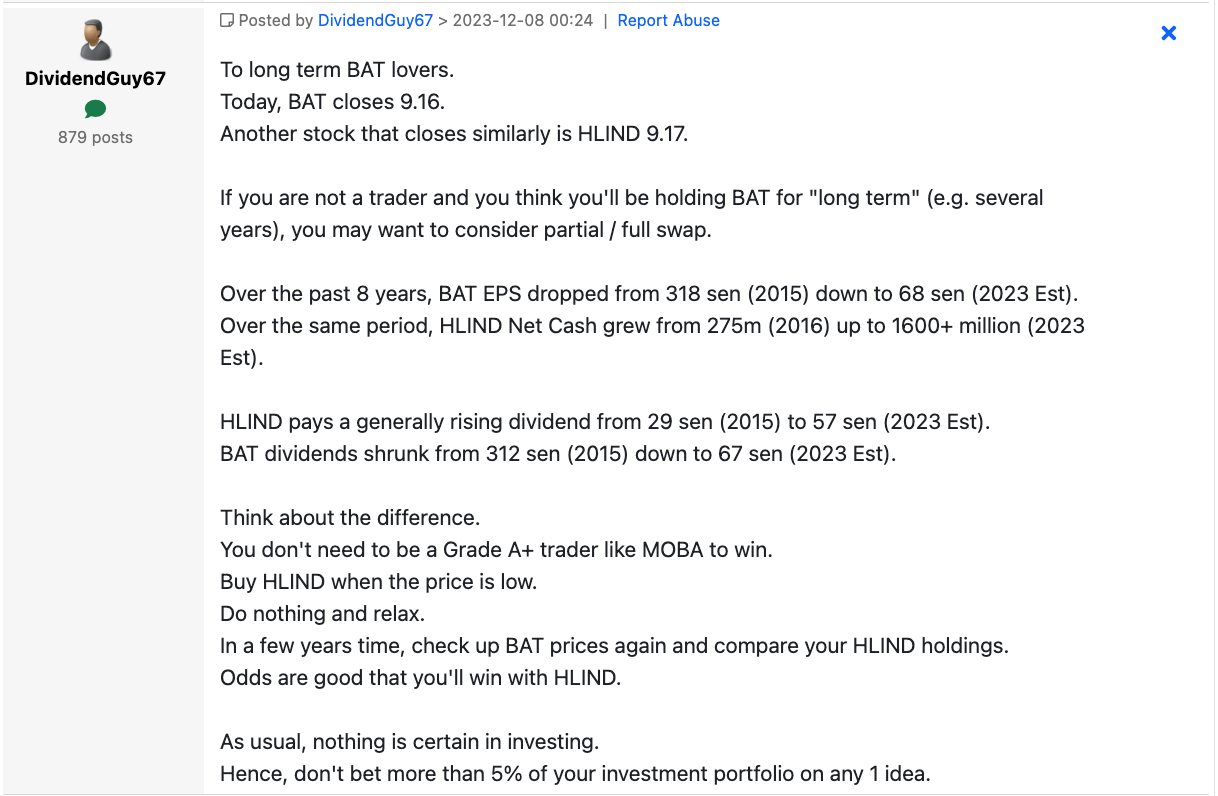

Months ago, I put forward an interesting swap idea at BAT forum, to swap BAT into HLIND. At the time, BAT closed at 9.16 and HLIND at 9.17. Two stocks having the same price, but it was clear to me that it should be swapped.

Why swap? It would take too long to explain the huge differences in the fundamentals between the two businesses. Buffet explained it best (Chairman's Letter, 1996):

Your goal as an investor should simply be to purchase, at a rational price, a part interest in an easily-understandable business whose earnings are virtually certain to be materially higher five, ten and twenty years from now. Over time, you will find only a few companies that meet these standards - so when you see one that qualifies, you should buy a meaningful amount of stock. You must also resist the temptation to stray from your guidelines: If you aren't willing to own a stock for ten years, don't even think about owning it for ten minutes. Put together a portfolio of companies whose aggregate earnings march upward over the years, and so also will the portfolio's market value.

So, 5 months (not a few years) have elapsed, what do we see?

Since 7 Dec 2023:

- BAT dropped, formed a double bottom and start to rise. It is currently yielding -1.31% i.e. portfolio still not yet made new high.

- HLIND was steady, then, gapped up, and then declared a special 50 sen dividend payable ex-div 27 March, gapped down, and then went on to rise again hugely (this is the mark of a superior business). As of today, it is +25.74% gain, excluding that special 50 sen dividend. Including the dividend, it is at least 31% gain. All else equal, portfolio should be hitting new highs quite regularly.

To summarize Buffet's advise in his Chairman's Letter of 1996.

- Select stocks where you are "virtually certain", that its "earnings will be materially higher in 5, 10, 20 years time".

- Avoid stocks where you suspect its earnings may not be materially higher in 5, 10, 20 years time.

- If you swap them when the prices for both are fairly ignored by the market (say 8 Dec 2023), you are more likely to do well in a stock like HLIND than BAT.

Then, odds are good that you have positioned your portfolio, to hit new all time highs.

For future reference and noting only. Nothing is guaranteed, but I believe Mr Buffet has some really good points there. Come back to this comparison again next time.